Recording The Notice Of Default

When a mortgage is in default and the mortgage holder has chosen to foreclose, the mortgage holder hands a to the trustee.

The declaration contains instructions directing the trustee to initiate foreclosure on the mortgaged property as authorized under the power-of-sale provision contained in the mortgage.

Even though the trustee may have received the mortgage holders declaration of default, the trustees foreclosure process and the periods imposing rights and obligations do not begin until the trustee or mortgage holder records a notice of default .

Once the NOD is recorded, the trustee is required to strictly comply with statutory notice requirements. To be assured the required notices are served on all the proper persons, the trustee orders a trustees sale guarantee from a title company before or at the time the NOD is recorded.

The trustees sale guarantee provides coverage to the trustee for failure to serve notices on any party due to an omission of that persons identity in the guarantee.

The trustees sale guarantee contains:

Avoid Foreclosure With A Short Sale

In certain cases, the home being listed will be worth less than the mortgage amount owed against it. This situation requires the mortgage lender’s approval of a short sale. Homeowners must contact their mortgage lender immediately if the home in foreclosure being listed is worth less than the mortgage debt. The lender must agree to accept the net sale proceeds of a purchase offer as full satisfaction of the homeowner’s mortgage debt. When a purchase offer is received, the mortgage lender reviews financial information from the homeowners and may also need to have the short sale approved by a mortgage insurer or investor. Follow up with the lender weekly. If the foreclosure sale is scheduled, ask the mortgage lender to postpone it until the short sale can be completed and the foreclosure cancelled.

References

Foreclosure Notices And Registrations

The Office administers , a web-based application for submission of those foreclosure-related notices and registrations that are mandated by Maryland law. Specifically, the system allows authorized users to submit and/or search the following foreclosure-related notices and registrations:

Specific notice and registration information in the Foreclosure Registration System is generally confidential and not public information. and Local Government Officials may be authorized in their official capacity to view Notices of Foreclosure or Foreclosed Property Registrations by establishing a Government User account in the Foreclosure Registration System. Additionally, a homeowners association or condominium, or if a person owns property on the same block as an address in question, may request from the Office or local jurisdiction specific information related to a Notice of Foreclosure or Foreclosed Property Registration. See Md. Code Ann., Real Prop. §§ 7-105.2 & 7-105.14.

For assistance regarding the Foreclosure Registration System, contact Office staff by email at or by phone at 410-230-6245.

Additional Information and Documents

You May Like: How Much Debt Can I Afford

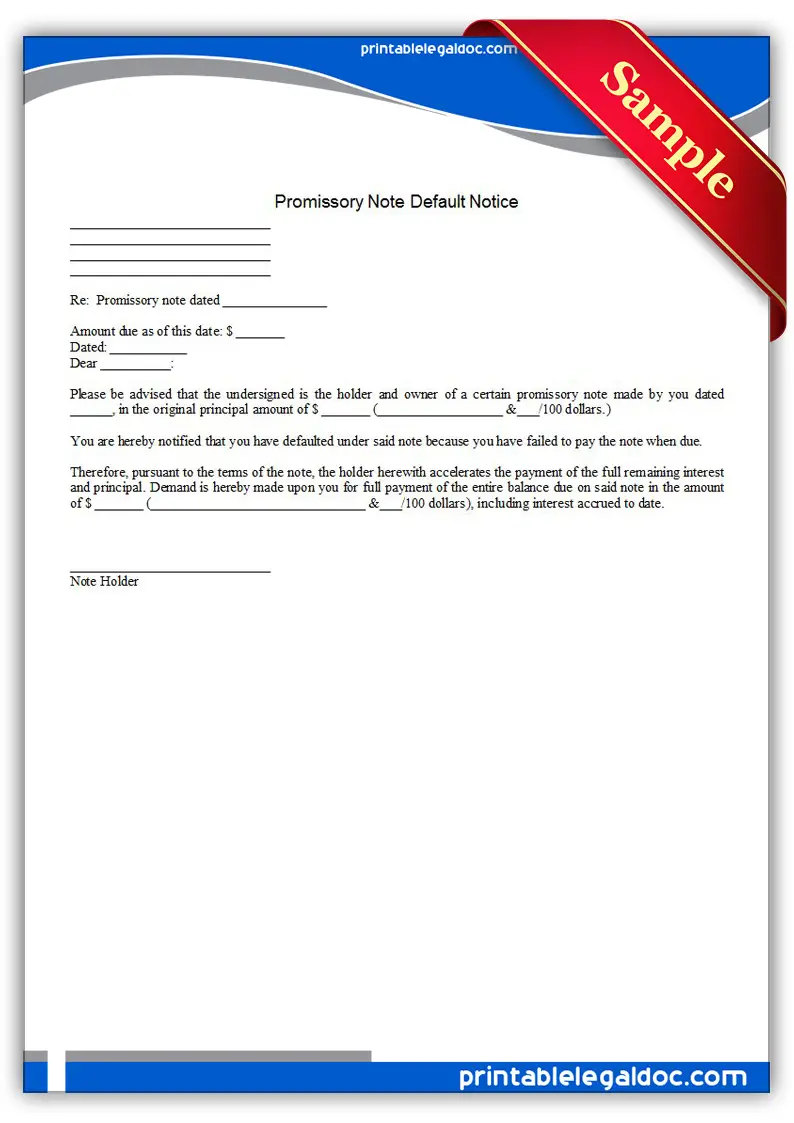

Contents Of A Notice Of Default

The foreclosure process starts when a lender files a notice of default with the court. The main contents of a notice of default include:

- Name and address of the borrower

- Name and address of the lender

- Name and address of the trustee

- Legal description and address of the mortgaged property

- Terms of the mortgage agreement that have been broken

- Description of the default and the remedy required to bring the account up to date

- Actions that the lender will take if the borrower does not comply

- The grace period within which the borrower is allowed to respond to the notice

- A statement that if the default is not cured before the allowed duration, the lender will sell the mortgaged property at a public auction

Nationwide Preforeclosure Listings Including Notice Of Default Lis Pendens And Notice Of Trustee Sales

Pre-foreclosure homes present an excellent opportunity for both home buyers and pre foreclosure investors. These properties can provide investors with the opportunity to buy properties at below market prices.

Through Default Researchs affiliate program, you have access to the nations leading provider of preforeclosure information at preforeclosure.com.

Pre-foreclosure listings include aerial photographs. You can evened receive daily property alerts and updates to notify you of any changes to the status of the property.

Advanced search feature makes looking for preforeclosure properties easy. Simply choose the criteria you want, and filter your properties.

Top U.S. PreForeclosure States:

Don’t Miss: How Long Does Bankruptcy Stay On Public Record Australia

How To Find Pre

Purchasing a home thats in the process of foreclosure is a smart way to find a good deal on an investment property. But you have to know where to look to find that diamond in the rough before it gets snatched up by another investor. While there are a variety of paid resources that can help you find pre-foreclosure listings, there are also plenty of ways you can find these properties for free. Here is a look at a few common ways to find pre-closure listings for free.

What If You Request Hardship Assistance

If you make a request for hardship assistance a credit provider isnt allowed to list a default on your credit report:

- while they are in the process of deciding the hardship request

- until 14 days after they have told you of their decision to refuse your request

However, the credit provider may list a default if they reasonably believe that you made the hardship request on the same basis as a hardship request you made during the previous 4 months.

If you’ve entered into a financial hardship arrangement with your credit provider this information is handled differently. For more information, see financial hardship information.

To find out whats on your credit report, ask for a copy of it

You May Like: Bankrupt Houses For Sale

Notice Of Default Listing

Hi BP Family,

I’m looking for advice. Every week the title company my firm uses sends me a listing of every notice of default sent out in the four counties around me from the week before last. For example, yesterday, I was sent the NOD’s for July 13-17. I am provided the owner’s name, mailing address, property address, original loan amount, the lender and the loan type .

My question is: How would you use this information? I am thinking that I should send a postcard and see if I can meet with them and maybe either work a deal to list the property or see if I can buy the property fast using private money and then flip. The market here is hot and properties are moving fast. We are back to pre-bubble conditions because of local economic development . A fast flip is certainly doable as we have situations where housing prices are being bid up over asking.

I would love to hear what folks here would do in this situation. Would you jump on this, ignore it or what. Any and all advice and/or stories about similar situations are appreciated!

Jennifer

Listing A Home During Foreclosure

Homeowners retain title to their homes until the property is sold at a foreclosure sale or the title reverts to the mortgage lender after a foreclosure sale that has no buyers. Listing a home for sale between filing the Notice of Default and the foreclosure sale can resolve a foreclosure if sale of the home is completed before the foreclosure sale date or the mortgage lender agrees to postpone the foreclosure sale. Legal proceedings such as a bankruptcy can restrict a homeowner’s right to list and sell the property.

Recommended Reading: How To Declare Bankruptcy In Ohio

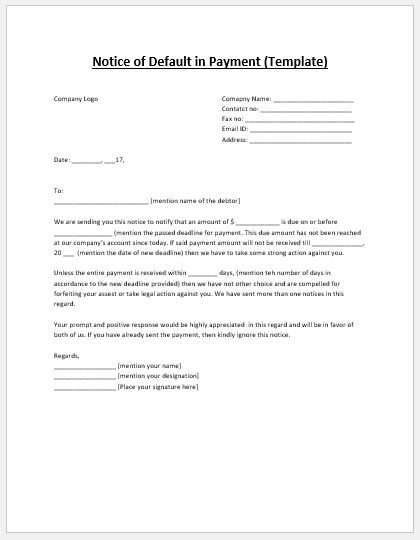

Prospecting Letters For Preforeclosure Listings

In the digital communication world, there are endless ways to contact investment leads and homeowners in foreclosure. Writing letters can seem like a boring, tedious, or old-fashioned way to make contact, but it can actually be a particularly effective strategy for foreclosures. Since the recipients are not in their situation by choice, they should be approached with sensitivity and compassion, which is very difficult to do through online ads or messages.

Sample preforeclosure letter

Letters, on the other hand, can be personalized and handwritten in order to make the biggest impact. Write your prospecting letter from a template, but include personalized details about their neighborhood, local hot spots, or their interests if you are familiar with them. Keep the focus on communicating how you can benefit the owners as much as possible.

Read more information about how to create and distribute real estate prospecting letters, and download a free preforeclosure template from our article: 9 Real Estate Prospecting Letter Templates for Lead Outreach.

To further simplify the process, consider using a direct mail service like ProspectsPLUS! for the execution of your prospecting letters, like designing, printing, and even mailing. ProspectsPLUS! offers multiple resources and strategies for distributing your letters and direct mail, including EDDM and the Market Dominator direct mail strategy. Start looking through ProspectsPLUS! templates and mailing options for free.

California Notice Of Default Listings

What is a pre foreclosure?Most people buy a home by borrowing part of the purchase price usually from a bank or a mortgage company. Other times, a homeowner borrows money against the equity in the property after the home is purchased, and this is called a home equity loan. Sometimes people refinance their mortgage loan and combine it with a home equity loan. In all these situations, the lender usually has a lien against the home to secure repayment of the loan. When a buyer fails to make the payments due on the loan the lender can foreclose, which means that the lender can force a sale of the home to pay for the outstanding loan.

For more information about California foreclosure laws:

The law on foreclosure is changing often. Make sure you read the most updated laws.

Types of foreclosures in CaliforniaLenders can foreclose on deeds of trust or mortgages using a nonjudicial foreclosure process or a judicial foreclosure process . The nonjudicial foreclosure process is used most commonly in our state.

The lender MUST contact the homeowner and anyone else on the mortgage loan to assess their financial situation and explore your options to avoid foreclosure . The lender:Cannot start the foreclosure process until at least 30 days after contacting you to make this assessment andMust advise the homeowner during that first contact that you have the right to request another meeting about how to avoid foreclosure. That meeting must be scheduled to take place within 14 days.

Also Check: Do You Have To File For Bankruptcy After A Foreclosure

Provincial Offences Act Forms

The forms located in the table below are for informational purposes only. They cannot be filled in electronically, and you should not bring them to court.

WARNING: Any forms shaded in grey in the table below have not yet come into force. Do not use them prior to their effective date, which is listed in the table below. Until the effective date, only use the current version of the form, which appears unshaded in the table below.

To view PDF files, you will require Adobe Acrobat® Reader version 5.0 . You can download this free software from Adobe’s web site.

If you do not have Microsoft Word installed on your computer, you can download the MS-Word Viewer. It will allow you to view the fillable forms. You can download this free software from Microsoft’s web site.

Provincial Offences Act formsBakersfield’s Notice Of Default List

Bakersfield is spoiled. The reason I say that is because our Kern County Assessor and Recorder office is the best Ive seen in all of California – and Ive been to lots of other counties. If I want a Patent that recorded in the 1800s – BOOM – they have it. If I need to find who owns the mineral rights on a parcel adjacent to one pumping loads of oil – BADA BING – Im in. Its public record, and you are able to view it all for free. It costs to print I dont need to print unless you want to pay me to print, then Ill print. I like trees.

In the real estate business, loads of investors and real estate agents target Notice of Default and Notice of Trustee Sale recordings. There are a variety of distressed property types, these are just a couple of them – they seem to be the most popular. Others include death, divorce, medical, and a whole bunch of situations that people need to liquidate real property assets because they need the cash – like now.

Thanks to the rise in home-flipping programs on household TV programs, many people have considered getting into this market. The demand for defaulted property is high because there is an added pressure for the homeowner to act before time runs out. Sometimes there is equity, sometimes there is not. When there is no equity, and the borrower is unable to get their mortgage payment current or work something out with their lender, the property will likely foreclose and be offered at auction.

Read Also: How To File Bankruptcy Without Money

How A Notice Of Default Works

When a borrower receives a notice of default, it does not mean that the lender has initiated the foreclosure process on the mortgaged property. Lenders serve the notice as a formal warning to the borrower that they risk losing the mortgaged property if they do not settle the delinquent mortgage payments. However, some lenders may serve the notice as the final notification to the borrower before the lender initiates the foreclosure process to seize the property.

Most lenders use the notice of default in non-judicial foreclosure, where the lender goes through an out-of-court process to auction the property. In such a case, the lender is required to file the notice of default at the county recorders office.

A notice of default will affect a borrowers credit history since the information is reported to , which record the information in an individuals credit report. Lenders will shy away from extending credit facilities to a borrower with a damaged credit score and a history of defaults. Foreclosure proceedings adversely affect a borrowers credit score, and they will face difficulties in accessing loans from other lenders.

Q& a: How To Easily Find Defaulted Properties

Q: Is notice of default public record?A: Yes, notice of default is public record. NODs are filed with local county/jurisdiction through the recorders office.

Q: Is lis pendens in the public record?A: Yes. Even though lis pendens is the initiation of a lawsuit, lis pendens are also filed in the local recorders office and are public record.

Q: Are pre-foreclosures public record?A: Yes. NOD and lis pendens are pre-foreclosures and information is available as part of the public record.

Q: Can you buy a house that is in pre foreclosure?A: Yes. Since the bank has not yet foreclosed, it is possible to negotiate a purchase with the owner of the property.

Q: Where can I find notice of default and lis pendens properties ?A: One source is the local recorders office where you can search files and pull relevant information. In some areas, basic information is available through the Register of Deeds office, but typically is not enough to begin the process of connecting with a potential home seller.

Tap Here to Learn More about Using Real Estate Investing Data to Find Bargain Properties

Q: Where can I find foreclosure listings for free?A: You can scour the records at the local recorders office you can attempt to find them using the local recorders website, but both strategies can be time consuming and difficult to manage.

You May Like: How Much Will Credit Score Increase When Bankruptcy Falls Off

Additional Ways To Find Pre

A big part of how you make your money as a real estate investor is your ability to bring in leads. So its vital to get creative and develop your own unique strategy for finding pre-foreclosures and other potential properties. An additional way you can locate pre-foreclosure properties is to network with other real estate professionals in your area.

Aside from wholesalers, real estate agents, attorneys, and mortgage brokers can be a good resource for finding homes in the process of pre-foreclosure. Even just mentioning your real estate business to friends and colleagues in your personal network can be a good way to hear about preforeclosure properties before they are listed online.

Plus, local newspapers are another good resource you can use to locate properties in the process of pre-foreclosure. Lis Pendens or notice of foreclosure are often published in the legal section of the local newspaper. The best way to find the best deal possible is to develop a few different lead pipelines and keep your eyes and ears open for any opportunities that come your way.

Selling A Home In Foreclosure

Ideally, homeowners facing foreclosure will have discussed alternatives to foreclosure with their mortgage lenders. If a Notice of Default has been filed, there may be only a few months to list and sell the home before the lender forecloses and takes title to the home or title passes to a third-party buyer at the foreclosure sale. Advise the mortgage lender that the property is listed for sale. This may not delay foreclosure but lets the lender know that the mortgage delinquency may be resolved with a sale of the property.

Read Also: How Long To Keep Bankruptcy Papers

Purchase Online Preforeclosure Leads

One of the most direct paths to buying a house in foreclosure is simply buying preforeclosure leads online. Some lead sources automatically send new leads to your inbox every day, which allows you to start marketing to leads immediately instead of spending hours or even days finding the lead before making contact.

Purchasing leads is an optimal choice for buyers or investors who have a significant amount of competition in their area. By using a lead source like REDX or Landvoice, new leads are delivered directly to your inbox on a daily basis, and you can immediately utilize the power dialer to make contact more quickly. Other platforms, like foreclosure.com and ArchAgent, have filtering capabilities and lead managers to sort through potential leads and follow up effectively.

Take a closer look at a few of the top preforeclosure lead sources:

| Key Features |

| Visit Landvoice |