How To Calculate Debt

Lenders value low DTI, not high income. Your DTI compares your total monthly debt payments to your before-tax income.

Calculating your DTI ratio is done by adding your monthly debt obligations together and then dividing that figure by your gross monthly income.

DTI does not include monthly bills for basic household expenses like utilities, health insurance premiums, food, or entertainment.

Instead, your DTI ratio includes the type of debt from lines of credit or housing expenses such as monthly mortgage payments, homeowners insurance premiums, HOA fees, car loans, personal loans, student loans, and credit card debt.

Total monthly debt includes housing-related expenses such as

- Proposed monthly mortgage payment

When adding up debt, do not include the entire loan amount just the monthly minimum payments.

Your monthly gross income is the total amount of pre-tax income you earn each month.

A Credit Score In The Mid

Exact vary by lender, but you generally need a score in the mid-to-high 600s to qualify for a home equity loan or HELOC. A high score typically makes for the easiest qualification process and gives you access to the lowest interest rates.

If your score is in the low 600s or below, you may have trouble securing a home equity product, though its not impossible. If youre less risky in other areas you have a low LTV or DTI, for example then you may still be able to qualify. Just be sure to shop around and consider a number of lenders if you fall into this low-score category.

Why it matters:

Learn More:

Have Home Equity Cash

If youve been in your home for several years or more, chances are you have what is known as home equity, which means youve paid off a substantial part of your mortgage loan. You can turn your home equity into cash with a cash-out refinance or a home equity loan. Refinancing your mortgage may also allow you to lock in a lower interest rate, helping you save money in the years to come.

You May Like: Will A Bankruptcy Affect A Top Secret Clearance

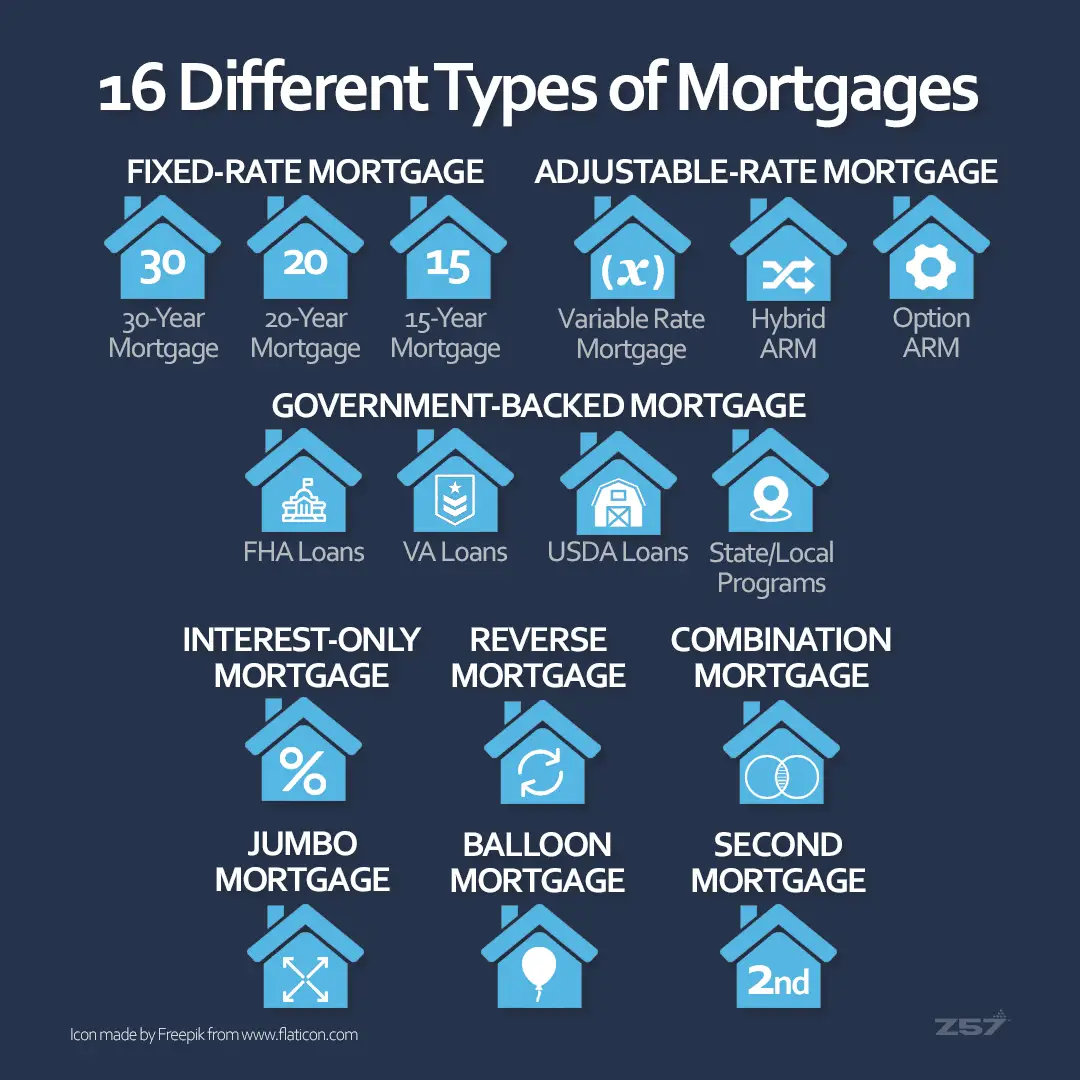

Which Dti Ratio Matters More

While mortgage lenders typically look at both types of DTI, the back-end ratio often holds more sway because it takes into account your entire debt load.

Lenders tend to focus on the back-end ratio for conventional mortgages loans that are not backed by the federal government.

For government-backed mortgages, such as FHA loans, lenders will look at both ratios and may consider DTIs that are higher than those required for a conventional mortgage.

Recommended Reading: Is Debt Consolidation The Same As Bankruptcy

Spring Cleaning With The Help Of A Home Equity Line Of Credit

Spring is right around the corner, and that means its time to get your home in shape. Spring cleaning is a time for cleaning, organizing and improving your living space. From adding a new deck to renovating your kitchen, there are so many projects to consider. However, spring cleaning home improvements can be costly. Depending on the size and scope of your project, you might need to borrow money. You can use a HELOC to help finance your spring cleaning plans. Learn more about how to use a HELOC to improve your home.

Recommended Reading: How To Get A Mortgage After Bankruptcy And Foreclosure

Recommended Reading: How Long To File Bankruptcy Petition

It Works In Tandem With Your Credit Score

Though your DTI does not directly impact your credit score, it is closely associated with your credit utilization. If your DTI ratio and your ratio are both low, youll have a better chance of being approved for loans. Keep in mind: most lenders do not advertise maximum debt-to-income ratios, but instead provide guidelines that offer some flexibility. For example, a common guideline is the 28/36 rule used by some lenders to assess borrowing capacity. According to this rule, a household should only spend 27% of its gross monthly income on housing expenses, and no more than 36% on debt expenseslike car payments and credit cards.

Paying Down The Right Accounts

If you are able to pay down an installment loan so that there are less than 10 payments remaining, mortgage lenders usually drop that payment from your ratios. Alternatively, you can reduce your credit card balances to lower the monthly minimum.

However, you want to enjoy the greatest reduction for your buck. Fortunately, it is possible to do this by taking each credit card balance, dividing it by its monthly payment, and then paying off the ones whose payment-to-balance ratio is the highest.

Suppose you have $1,000 available to pay down the following debts:

| Balance | |

| $150 | 5% |

The first account has a payment thats 9% of the balance, which is the highest of the 4 accounts, which means that it should be the first one to go.

The first $500 eliminates a payment of $45 from your ratios. You would use the remaining $500 to pay down the balance on the fourth account to $2,500, reducing its payment by $25. The total monthly payment reduction is $70, which is sometimes enough to turn your loan denial into an approval.

Recommended Reading: Does Bankruptcy Affect Income Tax Returns

How Do The Big Four Banks Use Your Debt

When it comes to the big four banks, each financial institution offers and accepts different debt-to-income ratios depending on their unique processes. See below for a breakdown, as at the time of writing:

- ANZ wont accept applications where the debt-to-income ratio is greater than 9 for any home loans

- CommBanks credit department needs to manually approve applications with a debt-to-income ratio higher than 7

- National Australia Bank has a debt-to-income ratio cap of 9 for all home loan applications

- Westpac has a policy for debt-to-income ratios of 7 or greater, whereby your application will be referred to its credit department for further review.

What Income And Debts Are Used To Calculate Your Dti

The sorts of income used to calculate your debt-to-income ratio can include:

- Your gross income

- Buy Now Pay Later loans

Letâs look at an example of how to calculate a debt-to-income ratio:

Ash is applying for a $300,000 home loan and has a gross income of $60,000 per annum. They currently have a car loan worth $10,000 and a with a limit of $2,000.

If Ash adds up all their debts , they end up with $312,000. Divide that number by their income of $60,000, and we find their debt-to-income ratio is 5.20.

A DTI ratio of 5.2 will generally place Ash in the âgood, but not greatâ category in a lenderâs eyes. This means that the amount Ash can borrow might be more than someone with a bad DTI.

You May Like: Customer Return Pallets For Sale

Calculate Monthly Debt Burden

Next you need to add up your monthly debt payments. These can be things like:

- Mortgage payments

- Groceries or other living expenses

So your monthly expenses might look something like this:

- $800 per month mortgage on primary residence

- $600 per month for mortgage on investment property

- $500 per month for mortgage on second investment property

- $400 per month for student loan

Your total monthly debt burden would be $2,300 .

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

Don’t Miss: What Is Us Debt

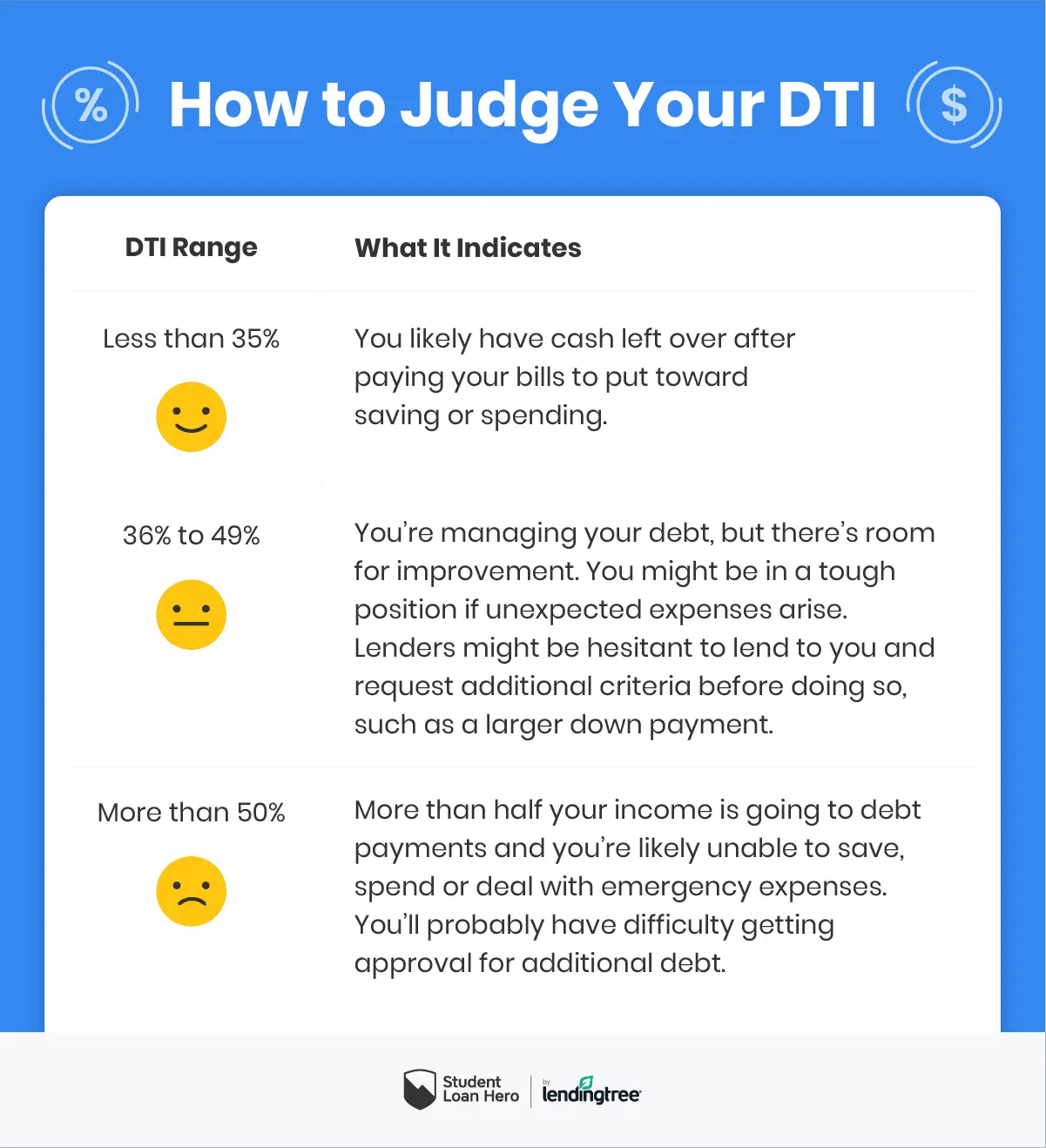

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%: This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

Debt-to-income ratio, or DTI, divides your total monthly debt payments by your gross monthly income. The resulting percentage is used by lenders to assess your ability to repay a loan.

To calculate debt-to-income ratio, divide your total monthly debt obligations by your gross monthly income.

Low Fees And Additional Costs

Interest rates are not the only costs you will incur when taking out a personal loan. Various fees may apply, including:

- application fee

- late payment fee

- payment protection insurance

These also vary considerably from lender to lender. For example, some lenders charge no application fee whatsoever, while others charge up to $50. Origination fees can range from zero to 8%, depending on the loan provider.

Analyze all the different fees charged by each provider. Some may be less noticeable at first and require you to read the terms and conditions carefully. Get a full overview of the total borrowing cost for each personal loan provider before choosing the right one.

You May Like: When You File Bankruptcy Who Pays The Debt

What Is The Dti Ratio

When home buyers apply for a mortgage, lenders want to be sure that they dont take on more debt than they are able to afford. The DTI tells lenders how much money you spend relative to the income you earn. It helps them determine how large a mortgage payment you are able to comfortably make. The DTI ratio is expressed as a percentage thats calculated by dividing monthly minimum debt payments with the gross monthly income before taxes.

For instance, if you earn $10,000 per month and you owe $2,000 per month on student loans and minimum credit card payments, then your DTI is 20% .

Lenders look at 2 types of DTI when applying for a home loan.

What If My Dti Ratio Is Too High

Remember, requirements for DTI arent set in stone. Lenders will also look at your credit score, assets you have like money in savings and checking accounts and what youre willing to put down on a home loan or auto loan. Certain types of loans, like first-time homebuyer mortgages backed by the federal government or low down payment programs, can accept a DTI that is higher than the normal maximum.

Recommended Reading: How To Claim Bankruptcy In Texas

Don’t Miss: Hud Homes For Sale Oregon

How To Lower Your High Debt

You can lower your DTI a few ways:

- Temporarily increase DTI to drop it in the long run. In other words, making payments for a short period so you dont have to later on. Your DTI has reduced, and your chances of receiving a loan increase.

- Target your high-interest loans first. The higher the interest rate, the more it raises your DTI.

- Take on part-time work or temporarily increase your income. Use your part-time money to pay down high-interest debt.

- Utilize credit card promotions. Sometimes you can transfer a balance for six months with no interest.

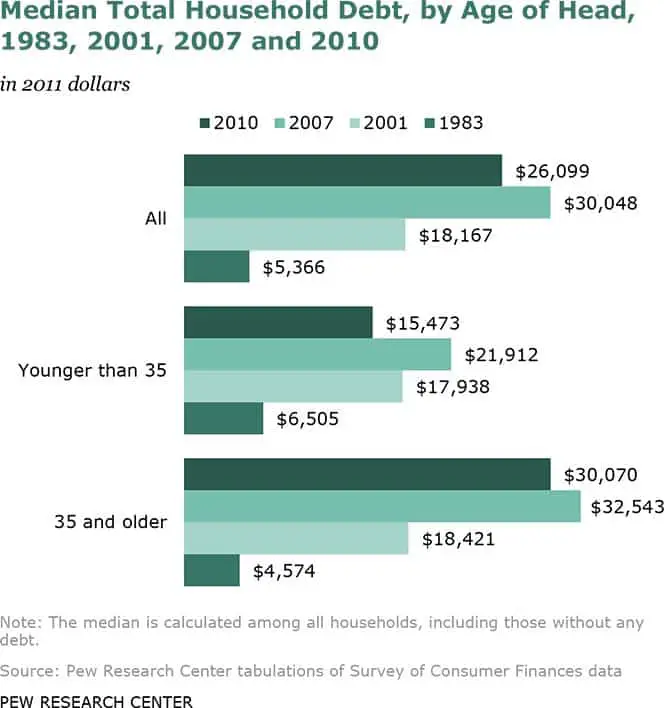

Who Is Affected By Debt

On face value, it makes sense that lenders would want to limit how much they allow you to borrow based on your income-to-debt ratio.

For example, if you earn $100,000, you generally cannot borrow more than $600,000.

For standard homeowners, this is a responsible lending practice, but for an investor, its not always reasonable when you consider their long-term plans.

For example, they may be making for the first 3 years so they can maintain their for further investment opportunities.

Alternatively, they may be pursuing a negative gearing strategy.

The bottom line is that LTI caps dont make sense for property investors because they can simply sell one of their investment properties if they are unable to afford their mortgage repayments.

You May Like: How To Tell If Someone Filed Bankruptcy

Use A Balancer Transfer To Lower The Interest Rates

High interest rates can quickly result in an increase of your overall debt, so reducing these interest rates should be a top priority. One of the most effective ways to do this is to utilize a balance transfer. Debt consolidation with high DTI will be made easier if you transfer your debt balances on various credit cards to a single card with a single interest rate. Learn more about this effective strategy here.

How Debt Consolidation Works

Debt consolidation loans provide money to pay off other loans. Why borrow money to retire your debts? Several reasons:

You May Like: What Makes You Eligible For Bankruptcy

What Constitutes A High Dti

Your debt to income ratio is calculated by dividing your monthly debt payments by your monthly gross income. If your is between 37 and 49 percent, some lenders may consider you a risky borrower but still approve you for a loan with less-than-ideal terms. If your DTI is 50 percent or higher, it could indicate you may not have the money to pay back a loan and youll likely have difficulty getting approved by a lender.

Getting consolidation loans for high debt to income ratio isnt impossible, but requires some diligence and patience. If you want to qualify for a loan with good terms, its a good idea to keep your DTI below 36 percent.

Your DTI.

What Types Of Payments Are Included In Dti

A front-end DTI ratio only includes housing-related costs such as rent, mortgage payments , home insurance payments, property taxes, or HOA fees. This ratio is typically only used by mortgage lenders when you buy a home. A back-end ratio includes all financial obligations like car payments or student loans and is used by most lenders. The DTI calculation does not include expenses such as food, utilities, insurance, or cellphone bills even if they are recurring.

An easy way to determine which types of debt payments are included in DTI is to consider the types of payments that affect your credit score. A missed credit card payment would definitely be noted on your credit score. Forgetting to pay your cell phone service provider, however, wouldnt carry the same credit penalties. That phone payment wouldnt be immediately reported to a credit bureau and therefore doesnt need to be included in your debt-to-income calculation.

Other types of payments to include in a DTI calculation are:

- Any other monthly installment loans

Recommended Reading: Can You File Bankruptcy On Back Taxes

Proof Of Steady Income

Based on stats published by the Bureau of Labour Statistics , the median annual wage for healthcare professionals is $75,040. This is above the national average of $45,760. Of course, this number tends to change based on the specific profession. Here is the average annual salary for some positions, based on the same BLS report:

- physicians and surgeons: $208,000

- licenses vocational nurses: $48,070

- opticians: $37,570

In most cases, many healthcare workers have the necessary income to qualify for a personal loan. Those with higher income levels may have access to lower interest rates and a higher maximum loan amount.

Lower Debt To Income Ratio

So, knowing that a lower debt to income ratio is looked upon favourably by lenders when it comes to getting a home loan, you might reasonably ask: How do I lower my debt to income ratio?

Its not rocket science, and theres no silver bullet or easy way out.

Your two options to lower your debt to income ratio are:

You May Like: How Long Does Bankruptcy Last Uk

How High Dti Affects Debt Consolidation

Mortgage lenders generally offer the best terms to borrowers with a DTI below 43%. You can still get a mortgage with up to a 50% DTI, but the interest and other costs will likely be higher.

Unsecured personal debt consolidation loans have tighter DTI limits. It generally takes a DTI of 36% or less to get the best interest rates and other terms. Many lenders wonât loan to borrowers whose DTIs are over 43% at all.

Even if approved, a high-DTI borrower may have to pay more interest on a debt consolidation loan than for the loans being consolidated. This can make a debt consolidation loan a much less attractive tool for managing debt.