How Does Us Debt Compare To That Of Other Countries

The United States debt-to-GDP ratio is among the highest in the developed world. Among other major industrialized countries, the United States is behind only Japan.

The pandemic has sharply increased borrowing around the world, according to the International Monetary Fund. Among advanced economies, debt as a percentage of GDP has increased from around 75 percent to nearly 95 percent, driven by double-digit increases in the debt of the United States, Canada, France, Italy, Japan, Spain, and the United Kingdom .

The United States has long been the worlds largest economy, with no record of defaulting on its debt. Moreover, since the 1940s it has been the worlds reserve-currency country. As a result, the U.S. dollar is considered the most desirable currency in the world.

High demand for the dollar has helped the United States finance its debt, as many investors put a premium on holding low-risk, dollar-denominated assets such as U.S. Treasury bills, notes, and bonds. Steady demand from foreign creditorslargely central banks adding to their dollar reserves, rather than market investorsis one factor that has helped the United States to borrow money at relatively low interest rates. This puts the United States in a more secure position for a fiscal fight against COVID-19 compared to other countries.

Who Decides How Much Interest The Us Pays On Its Debt

Supply and demand. In other words, the marketplace. When the government needs to raise debt financing, it sells debt securities in an auction. Bidders offer to buy the debt for a specific rate, yield, or discount margin, and all successful bidders receive the highest yield or discount the Treasury accepts. Government debt buyers may include central banks, though their goal is typically to foster sustainable economic growth rather than to finance deficit spending.

How The National Debt Affects You

When the national debt is below the tipping point, government spending continues and contributes to a growing economy, which means more funding for programs that you can take advantage of.

But when the debt exceeds the tipping point, your standard of living could be impacted. Interest rates may increase and that could slow the economy. The stock market could react to a lack of investor confidence, which could mean lower returns on your investments. And a recession may even be possible.

This also puts downward pressure on a countrys currency because its value is tied to the value of the countrys bonds. As the currencys value declines, foreign bond holders’ repayments are worth less. That further decreases demand and drives up interest rates. As the currencys value declines, goods and services may become more expensive and that contributes to inflation.

You May Like: Will Filing Bankruptcy Remove Student Loans

Risks To Economic Growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 34% when debt was relatively moderate or low , but it dips to just 1.6% when debt was high . In April 2013, the conclusions of Rogoff and Reinhart’s study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that “Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

What Causes The National Debt

The national debt is caused by government spending. This causes a budget deficit, but its necessary to help expand the economy. This is known as expansionary fiscal policy. The government expands the money supply in the economy and uses budgetary tools to either increase spending or cut taxes. This provides consumers and businesses with more money to spend, which, in turn, boosts economic growth over the short term.

The federal government pays for things like defense equipment, health care, and construction. It contracts with private firms that then hire new employees or the government hires employees directly. Those employees then spend their paychecks on gasoline, groceries, and new clothes. That consumer spending boosts the economy.

But in order to boost the economy, the government must spend money, which adds to the national debt.

Recommended Reading: When Does Bankruptcy Fall Off Credit Report

Solutions To Reduce The National Debt

76% of voters believe that the President and Congress should allocate more time and energy towards addressing the national debt. Americans care about the national debt, and some work has been done in order to address this issue. Solutions include raising revenue , cutting spending, and growing the countrys GDP.

Policy options such as the Simpson-Bowles plan and the Domenici-Rivlin Task Force have made efforts to create plans to reduce the national debt. Centers and institutes such as the American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, and Economic Policy Institute all proposed things ranging from slow growth to reduction in benefits for high-income individuals.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nations fiscal future, or get involved by learning about how you can make a difference in your own community.

A Brief History Of Us Debt

Investopedia / Sabrina Jiang

Nearly all national governments borrow money. The U.S. has carried national debt throughout its history, dating back to the borrowing that financed the Revolutionary War. Since then the debt has grown alongside the economy, as a result of increased government responsibilities, and in response to economic developments.

Recommended Reading: What Is Chapter 7 Bankruptcy Mean

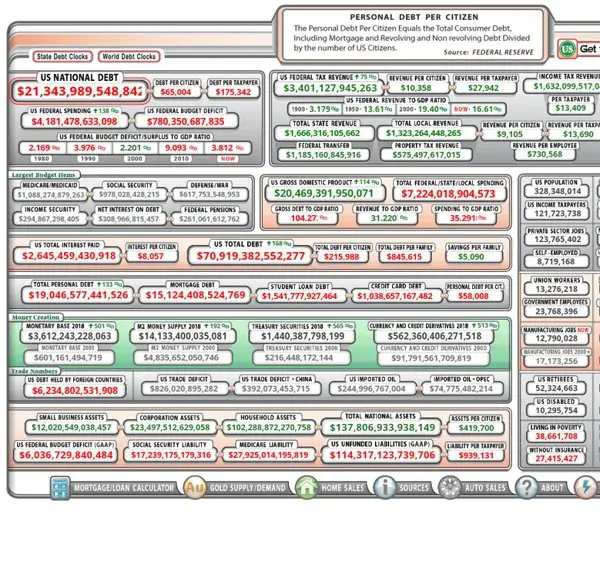

United States Total Debt: % Of Gdp

Key information about United States Total Debt: % of GDP

- United States Total Debt accounted for 791.3 % of the country’s GDP in 2022, compared with the ratio of 809.8 % in the previous quarter.

- US Total Debt: % of GDP data is updated quarterly, available from Dec 1951 to Jun 2022.

- The data reached an all-time high of 856.7 % in Mar 2021 and a record low of 291.9 % in Mar 1952.

View United States’s Total Debt: % of GDP from Dec 1951 to Jun 2022 in the chart:

National Debt And Budget Deficit

The federal government creates an annual budget that allocates funding towards services and programs for the country. This is made up of mandatory spending on government-funded programs, discretionary spending on areas such as defense and education, and interest on the debt. The budget deficit can be thought of as the annual difference between government spending and revenue. When the government spends more money on programs than it makes, the budget is in deficit.

Recommended Reading: Listing Of Foreclosed Homes

How Much Do Other Countries Owe The Us

Public debt makes up three-quarters of the national debt, and foreign governments and investors make up one-third of public debt. As of , the countries with the most debt owed to the U.S. are Japan, China, the United Kingdom, Luxembourg, and Ireland.

Though China had been the long-standing top placeholder for the country with the most debt owed to the United States, Japan currently holds $1.3 trillion worth of U.S. debt. The second place holder, China, currently holds $1.1 trillion in Treasury holdings. Together, they hold 31% of all foreign-owned U.S. debt.

National Debt By President

The National Debt has always been an area of interest for the United States President George Washington appointed future President Alexander Hamilton to understand and solve the $80 million debtthat had accrued due to the Revolutionary War. Hamilton came up with the plan to pay off the debt through taxes and the creation of the national bank. Since then the United States has steadily increased its budget deficit, and the national debt has continued to rise.The first time that the national debt hit the $1 billion mark was in 1863 while the Civil War was occurring it hit the $2 billion was two years later when the civil war ended in 1865. As the country went to battle during World War I and World War II, the national debt hit the $10 billion mark and $100 billion marks respectively. By 1982 after the Vietnam War and the Cold War, the national debt hit the $1 trillion mark for the first time in history. By the 21st Century, the national debt got to $20 trillion after major events such as the War on Terror and the Great Recession. Today , the national debt stands at $30.2 trillion and public debt is roughly 100% of the country’s GDP.

You May Like: Bankruptcy Friendly Auto Loans

Who Owns The Us National Debt

Who Owns The Us National Debt? The public holds over $22 trillion of the national debt. 1 Foreign governments hold a large portion of the public debt, while the rest is owned by U.S. banks and investors, the Federal Reserve, state and local governments, mutual funds, pensions funds, insurance companies, and savings bonds. Oct 8, 2021. Who does the US owe money to 2020?

Interest Expense On The Debt Outstanding

As of June 6, 2022, this data moved permanently to FiscalData.treasury.gov, where it is available for download in multiple machine-readable formats with complete metadata!

The Interest Expense on the Debt Outstanding includes the monthly interest for:

- State and Local Government series and other special purpose securities.

Amortized discount or premium on bills, notes and bonds is also included in the monthly interest expense.

The fiscal year represents the total interest expense on the Debt Outstanding for a given fiscal year. This includes the months of October through September.

Don’t Miss: How To File For Bankruptcy In Nj

What Are The Primary Drivers Of Future Debt

The main drivers are still mandatory spending programs, namely Social Securitythe largest U.S. government programMedicare, and Medicaid. Their costs, which currently account for nearly half of all federal spending, are expected to surge as a percentage of GDP because of the aging U.S. population and resultant rising health expenses. Yet, corresponding tax revenues are projected to remain stagnant.

Meanwhile, interest payments on the debt, which now account for nearly 10 percent of the budget, are expected to rise, while discretionary spending, including programs such as defense and transportation, is expected to shrink as a proportion of the budget.

President Trump signed off on several pieces of legislation with implications for the debt. The most significant of these is the Tax Cuts and Jobs Act. Signed into law in December 2017, it is the most comprehensive tax reform legislation in three decades. Trump and some Republican lawmakers said the bills tax cuts would boost economic growth enough to increase government revenues and balance the budget, but many economists were skeptical of this claim.

The CBO says the law will boost annual GDP by close to 1 percent over the next ten years, but also increase annual budget shortfalls and add another roughly $1.8 trillion to the debt over the same period. In addition, many of the provisions are set to expire by 2025, but if they are renewed, the debt would increase further.

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

Also Check: Will A Bankruptcy Affect A Top Secret Clearance

How To Look At The National Debt By Year

It’s best to look at a country’s national debt in context. During a recession, expansionary fiscal policy, such as spending and tax cuts, is often used to spur the economy back to health. If it boosts growth enough, it can reduce the debt. A growing economy produces more tax revenues to pay back the debt.

The theory of supply-side economics says the growth from tax cuts is enough to replace the tax revenue lost if the tax rate is above 50% of income. When tax rates are lower, the cuts worsen the national debt without boosting growth enough to replace lost revenue.

Major events, like wars and pandemics, can increase the national debt.

During national threats, the U.S. increases military spending. For example, the U.S. debt grew after the September 11, 2001, attacks as the country increased military spending to launch the War on Terror. Between fiscal years 2001 and 2020, those efforts cost $6.4 trillion, including increases to the Department of Defense and the Veterans Administration.

The national debt by year should be compared to the size of the economy as measured by the gross domestic product. That gives you the debt-to-GDP ratio. That ratio is important because investors worry about default when the debt-to-GDP ratio is greater than 77%that’s the tipping point.

You can also use the debt-to-GDP ratio to compare the national debt to other countries. It gives you an idea of how likely the country is to pay back its debt.

Current Foreign Ownership Of Us Debt

Japan owned $1.23 trillion in U.S. Treasurys in June 2022, making it the largest foreign holder of the national debt. The second-largest holder is China, which owns $967.8 billion of U.S. debt. Both Japan and China want to keep the value of the dollar higher than the value of their own currencies. This helps to keep their exports to the U.S. affordable, which helps their economies grow.

China replaced the U.K. as the second-largest foreign holder in 2006 when it increased its holdings to $699 billion.

The U.K. is the third-largest holder with $615.4 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. Luxembourg is next, holding $306.8 billion. The Cayman Islands, Switzerland, Ireland, Belgium, France, and Taiwan round out the top 10.

Don’t Miss: Cheap Foreclosure Homes For Sale

Who Owns The National Debt Held By The Public

Of the $23.6 trillion of debt held by the public, we estimate about 34 percent is owned by foreign entities, 43 percent by private and public domestic entities, and 23 percent by the Federal Reserve Bank. The Federal Reserve has significantly expanded its Treasury holdings since the COVID-19 public health and economic crisis began in 2020.

Foreign holdings come from a mixture of foreign individuals, businesses, banks, and governments. Of the roughly $7.9 trillion of foreign-held debt, 17 percent is held by Japan and 14 percent is held by China. The next largest holders are the United Kingdom, Ireland, and Luxembourg, who each hold between $320 billion and $560 billion of U.S. debt. On a combined basis, the Eurozone holds about $1.3 trillion, and Organization of Petroleum Exporting Country member nations together hold about $250 billion.

What School Was Like In The 13 Colonies

During the Civil War, the national debt ballooned to some $2.76 billion by 1866. Economic growth in the late 19th century, accompanied by inflation, helped make debt a smaller percentage of economic output. But after World War I, the debt-to-GDP ratio hit a record high 33 percent, with a debt of more than $25 billion .

World War I also saw a major shift in control over the national debt, as Congress agreed to give the Treasury Department more flexibility in raising money through sales of its bonds. Though it ceded its right to approve or disapprove of each individual sale, Congress would set an overall limit to that borrowing, known as the debt ceiling.

Congress has since raised or lowered the debt ceiling, or the maximum amount of outstanding debt that the federal government can legally incur, numerous times.

Read Also: Will My Spouse’s Bankruptcy Affect Me

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

|

|

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.