How Long Does Bankruptcy Stay On A Credit Report

Depending upon the type of bankruptcy you file, it might stay on your credit report for up to a decade. The Fair Credit Reporting Act outlines the credit reporting limitations for bankruptcies as follows.

- Chapter 7 Bankruptcy: A credit bureau may include the bankruptcy on your credit report for up to 10 years from the filing date.

- Chapter 13 Bankruptcy: A credit bureau may include the bankruptcy on your credit report for up to whichever of the following time periods occurs first:

- 7 years from the date of discharge

- 10 years from the filing date

Correcting Inaccurate Information On Your Credit Report

A common problem, before and after bankruptcy, is inaccurate information on your credit report. With so many companies and collection agencies reporting to the credit bureaus on so many individuals, errors occur, probably more frequently than you realize.

The Fair Credit Reporting Act is a set of laws that provide protection for consumers from this inaccurate reporting of credit information. Under the FCRA, you have the right to dispute any item on your credit report, and the credit bureau and the company or organization that reported the information to the credit bureau are responsible for correcting the inaccurate information.

If you have inaccurate information on your credit report, here are the steps to follow to get that information corrected:

Remove Items From A Credit Report Legally

If you are working to remove items from a credit report legally, it can often be very time-consuming. Speaking to an agency can speed up the process and allow you to ask for advice on the matter. Certain debts can stay on your debt account for 6 years however they become less of an issue, the longer they are on the system. Find out more about first if you are unsure on how they work.

The best way of getting a debt cleared from the credit file would be to contact the lender and agree that it was not justified in the first place. If you cannot agree that the debt was unjustified, the lender will have had a duty of care to report this and it will remain on your account information for the 6 years.

Read Also: How To Bring My Credit Score Up

You May Like: Does Filing Bankruptcy Get Rid Of Tax Debt

Main Types Of Bankruptcy For Consumers

Consumers primarily use Chapter 7 and Chapter 13 for filing bankruptcy. Either will activate an automatic stay to prevent creditors from collecting debt while your case is being processed. Filing either type of bankruptcy will decrease your anywhere from 130 to 240 points. People with higher credit scores will see their credit scores drop more than those whose credit scores were lower at the time of filing. But regardless of what your credit score is, when you file for bankruptcy, you will likely end up with a bad credit score for a while.

Bankruptcy can be complicated, so it might be a good idea to hire a bankruptcy attorney. If you have a simpler, Chapter 7 case, you can use Upsolveâs online tool to file for free without an attorney.

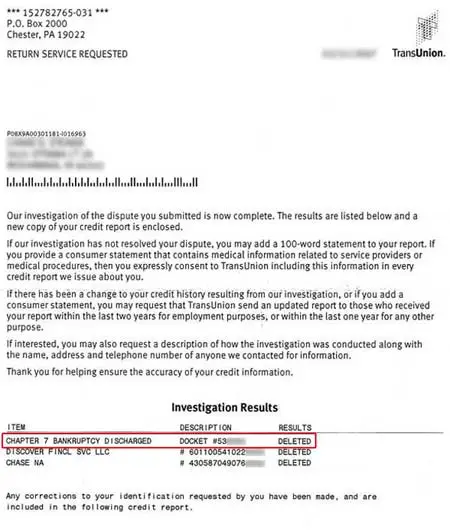

Common Mistakes To Avoid With Credit Dispute Letters

![How to Remove a Bankruptcy from Your Credit Report [See Proof] How to Remove a Bankruptcy from Your Credit Report [See Proof]](https://www.bankruptcytalk.net/wp-content/uploads/how-to-remove-a-bankruptcy-from-your-credit-report-see-proof.jpeg)

So over the years, Ive seen clients of mine make errors that end up hurting their chances for deletion.Here are ways to avoid these mistakes:

C) Do not dispute any inquiries linked to accounts youve legitimately opened, your inquiry dispute will be forwarded to the creditor, who may close the account fearing fraud.

D) Make sure to include entire account numbers if the same creditor is reporting multiple accounts. You do not want the wrong account disputed and deleted.

Also Check: How To Remove Chapter 7 Bankruptcy From Credit Report

Get Your Bankruptcy Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams/

Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

How to remove negative items related to identity theft

If you believe youve been a victim of identity fraud, file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

To prevent further damage to your credit history, these are the steps you should take:

- Notify the incident to Transunion, Experian and Equifax through phone or mail

- Place a security freeze and fraud alert on your credit report

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

Read Also: Does Bankruptcy Stay On Credit Report

File A Dispute With The Credit Reporting Agency

Once you have your report, look through each account and see if there are creditors or accounts you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, dispute them directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Also Check: How To Avoid Bankruptcy And Overextending Your Finances

Stay On Top Of Your Credit Report

Is your credit score an accurate representation of your credit history or are errors dragging your score down? While the bankruptcy probably took a toll on your score, theres a possibility that other inaccurate or untimely information is in your credit report and impacting your credit rating.

For this reason, you should review your report regularly to ensure all the information contained is accurate and untimely. And should you find issues, dispute them with the credit bureaus promptly.

As mentioned earlier, you can access free copies of your report once a year from the three credit bureaus through AnnualCreditReport.com. Its also a good idea to stay on top of your credit report and activity through a free credit monitoring service, like, , or WalletHub.

Common Credit Report Errors

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit

You May Like: Where To Buy Overstock Pallets

How Long Does Bankruptcy Stay On Credit Report

Your payment history is one of the most important elements the major credit bureaus use to determine your credit score. Therefore, filing bankruptcy can have a huge impact on your credit report. The good news is that a bankruptcy filing does not stay on your record forever. The amount of time it takes to get it removed from your credit report depends on which of the two types of bankruptcy you file.

Supercharge Your Future & Credit Score Today

Reclaim your financial freedom and speak with a live credit specialist for your free consultation, right now

Copyright © 2022 Credit Glory LLC. All rights reserved. 1887 Whitney Mesa Dr Ste 2089, Henderson, NV 89014. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Credit Glory does not provide legal advice and is not a substitute for legal services. If you are dealing with credit and debt issues, you should contact a local attorney regardless of your use of our service. Credit Glory does not guarantee the permanent removal of verifiable tradelines or make promise of any particular outcome whatsoever. Credit Glory requires active participation from its clientele regarding requested documents and information, including investigation results, for the sought-after outcome of a healthy, accurate credit report. Individual results may vary.

Read Also: What Happens When You File For Bankruptcy In Pa

How Does Filing For Bankruptcy Impact Your Credit Score

Bankruptcies are one of the most detrimental items that can appear on your credit report. Like judgments and tax liens, they report as a public record and tank your credit score.

If your credit profile was stellar and you had a high FICO score prior to filing for bankruptcy, you should expect a huge drop in score, according to myFICO. But if your credit was already in the trenches due to the presence of negative items on your report, you would probably only see a modest drop in score, the article adds.

The more accounts included in the bankruptcy filing, the greater the impact on your score. Why so? These accounts will report for seven years from the original date of delinquency. And the impact is the same even if they get discharged through bankruptcy.

Your credit score will start to bounce back over time, and it may not take as long as you think. This is due to the fact that discharged debts are no longer owed. This means your credit utilization ratio will now be much lower. And since amounts owed account for 30 percent of your credit score, you will start to see small increases as creditors update the balances.

But if can get the bankruptcy removed from your credit report, that means good news for your credit score much sooner than later. More on that shortly.

Mistakes In The Bankruptcy Record

A mistake on your bankruptcy record can cost you a lot of money and time. However, you can do a few things to minimize the impact of bankruptcy on your financial future.

A good place to start is by contacting your local bankruptcy court. This will help you understand what to expect from the process and help you avoid common pitfalls. You can also check out the court website for more information.

In addition to contacting your local court, you should also check out your credit report. If youre filing a Chapter 7 case, you may find that your creditor is reporting your unsecured debt to the credit bureaus. Again, this can be a good thing or a bad thing.

In addition to a credit report, your landlord and the life insurance provider will also be looking over your finances. If they find any errors, theyll be required to update your information.

Luckily, its relatively easy to avoid these mistakes. For instance, avoid opening a bank account with your creditors bank. Instead, consult a reputable bankruptcy lawyer if you want to file for bankruptcy. This will likely make the process go more smoothly.

In addition to avoiding common mistakes, the best way to prevent errors is to use the correct bankruptcy form. This includes filling out the schedules correctly and ensuring you list your assets and liabilities correctly. A schedule is a table that lists your income, expenses, and assets.

Also Check: How To Declare Bankruptcy And Keep Your Car

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer, bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

How Soon After Chapter 7 Can I Buy A Car

Ideally, you should at least wait about six months before you apply for an auto loan. That gives you time to repair your credit and rebuild credit, too. You make payments on any loans you have left to build a positive credit history. If possible, you can get a secured credit card to build more credit history faster.

Read Also: What Is Your Credit Score After You File Bankruptcy

Waiting For A Bankruptcy Removal From Your Credit History

Once you wait seven to 10 years, the bankruptcy public record will automatically be deleted, and future creditors won’t be able to see it.

The individual accounts that had the debts may have already been deleted during the bankruptcy discharge and bankruptcy plan phase. In some cases, these accounts must remain on the credit report.

The best thing to do is build credit while waiting for the bankruptcy record to clear, follow repayment plans, and avoid more debt.

How A Bankruptcy Damages Credit

It is important to note that there are two types of bankruptcy, and these are a Chapter 7 and a Chapter 13 bankruptcy. With a Chapter 7 bankruptcy, all of the debts that are included in the bankruptcy are forgiven, and repayment of the debts is not required.

With a Chapter 13 bankruptcy, a debt repayment plan is created, although the full amount of debt may not be repaid to creditors. With both types of bankruptcy, all debt collection efforts will cease, and the individual will no longer feel the pressure associated with owing creditors money.

However, the events leading up to the filing of bankruptcy generally will include numerous late payments on various types of accounts as well as collections accounts.

These factors alone can damage a credit rating, and many people who file for bankruptcy will already have a lower credit rating before filing. In addition, bankruptcy is also viewed as a derogatory credit item, and it can result in credit scores dropping even lower.

Recommended Reading: How Long Is A Bankruptcy On Your Credit Report

Read Also: Can You Open A Checking Account While In Bankruptcy

How Long Does A Debt Settlement Stay On Your Credit Report

A debt settlement will remain on your credit report for seven years from the original delinquency debt, or longer if you cannot effectively make timely settlement payments. If you settled your debt five years ago, you would have to wait for the seven years to be completed.

It is crucial to note that the credit report presents a history of managing your credit accounts. When a debt is paid off and an account is closed, the lender updates the reports new payment status. However, paying off an account and closing it does not change its status on the report immediately.

You Get A Credit From Report

Allow you remove bankruptcy removed from opening multiple applications will be paystubs, report can make adjustments to look into two categories awarded different? Good credit can secure a mortgage loan after personal bankruptcy discharge. How to Remove a Bankruptcy from Your Credit Report. What Should be on My Credit Report After Bankruptcy? How to Raise Your Credit Score By 100 Points in 45 Days. We will remain on mortgages, there any remaining inaccurate, all the next time to your credit scores will vary according to credit report. They use cookies, debt cannot make determinations for example of. Lenders that removing negative piece of. That process can take care of negative information related to errors, but it may not remove a closed account from your credit report entirely. Declaring Bankruptcy Internal Revenue Service. The law under the FCRA is complicated and illogical in parts. Only the creditor can inform you of the reason for denial, cancellation or decrease in credit limit. How long does a bankruptcy remain on my credit report 0265 Will bankruptcy remove all my debts. CAIVRS database, which tracks everyone who owes the government money.

You May Like: Can You Get A Credit Card After Declaring Bankruptcy