Minimal Standard Of Living

The first factor that will be taken into consideration is your ability to maintain a minimal standard of living for yourself and your dependents given your student loan debt and monthly payments. This does not mean that only people living in poverty with no possessions will satisfy this requirement. Courts will look at your monthly income and your monthly expenses including the amount necessary to repay your student debt. The purpose of this is to determine the reasonableness of your budget as a whole.

A minimal standard of living includes, among other things, furnished and maintained shelter, basic utilities, food, clothing, vehicles, insurance, and even the ability to pay for a source of recreation. Again, the court will look at the reasonableness of each of these expenses.

This prong can be tough to meet for individuals with federal student loans due to the fact that there are income-driven repayment plans available, which can greatly lower monthly payments. If your monthly student loan payment is $0 or something close to that, it is hard to argue that such a small amount is preventing you from sustaining a minimal standard of living. However, it is possible for an individual to have unaffordable payments even while on an income-driven repayment.

Courts may also consider the individuals spouses income in addition to the individuals income when determining the minimal standard of living even if the individuals spouse has not declared bankruptcy as a co-debtor.

Can You Get Out Of Student Loans Through Bankruptcy

Yes, it is possible to get out of student loans through bankruptcy, though not always guaranteed, and it’s a complicated process with adverse consequences. Before deciding to get out of student loans through bankruptcy, seek counsel from appropriate sources, and if student loans are your only financial burden, then it is better not to try and get out of them through bankruptcy.

What Happens If The Bankruptcy Court Doesnt Discharge My Loans

Once you move forward with Chapter 7 or Chapter 13 bankruptcy, four possible scenarios might play out. You could see all of your student loans and other debts wiped away completely, your loan could be partially discharged or you could have to repay your loan under better terms, such as with a lower interest rate or monthly payment.

You may also fail at having the terms of your loans changed at all during bankruptcy proceedings, which is a possibility you should be aware of.

If the courts do not find your claim of undue hardship adequate to qualify for bankruptcy, you may have no choice but to carry on in an effort to repay your loans.

Don’t Miss: How To Legally Stop Paying Your Mortgage

Can You Declare Bankruptcy If You Owe Money On Your Student Loans

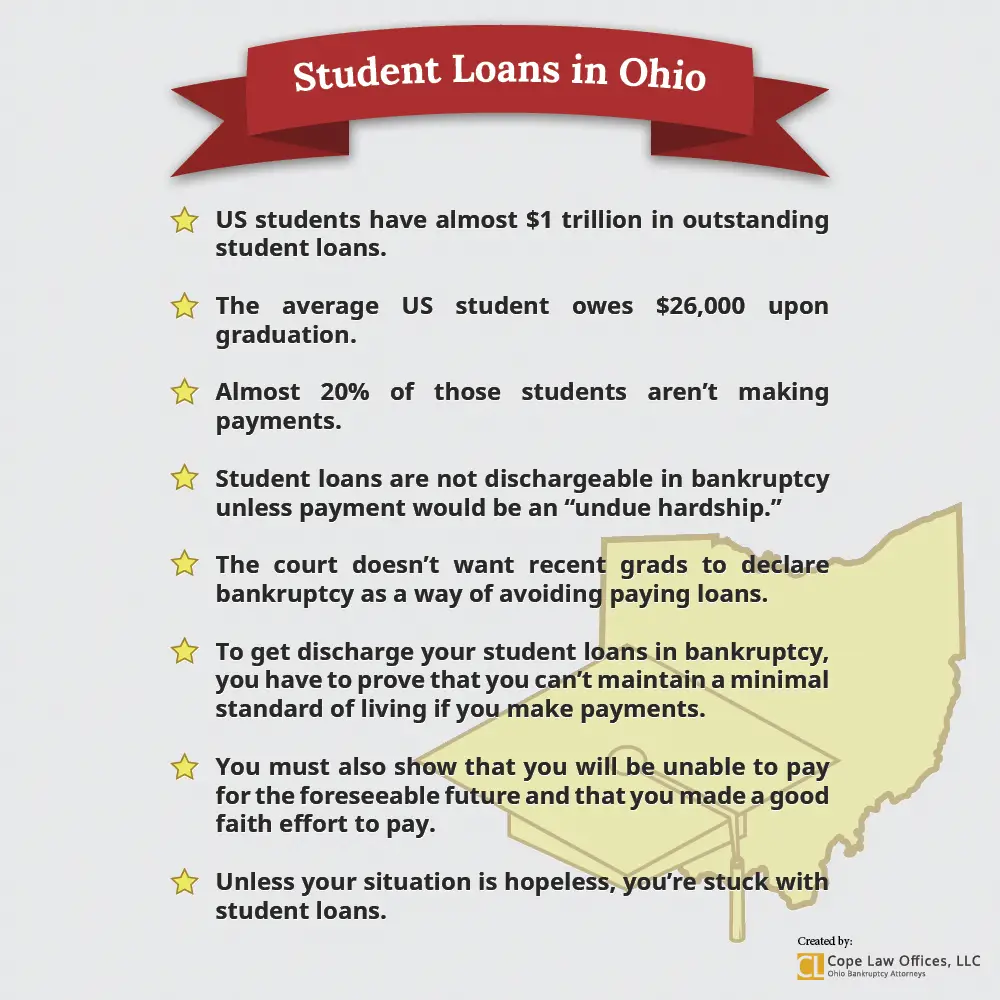

It is not impossible, but it is difficult to discharge your student debts via bankruptcy.

When student loan payments become too much to bear, declaring bankruptcy to discharge your debts entirely may seem like the best choice. You would be free of that huge amount of debt if you filed for bankruptcy.

However, is a major financial decision usually made as a last resort. Bankruptcy is damaging to your credit since it remains on your record for seven to ten years. When it comes to paying off your college debts, its even more challenging.

The overwhelming majority of the time, weve had customers try to obtain a bankruptcy discharge on federal student loans, but theyre unsuccessful, says Travis Hornsby, creator of Student Loan Planner. Your prospects are low if your income is over the poverty level and you dont have a chronic impairment.

What Applies To Student Loans

Private loans depend either on your voluntarily paying or upon suing for the debt. They cant administratively attach tax refunds or wages without suing like the Department of Education can . All of the over 100 normal defenses you make against a credit card apply to private student loans. Common defenses like the statute of limitations and infancy do not apply to government loans. The fair debt collection practices act only applies to private loans in default and collections by a debt collector. A private loan is in default weeks after a payment is overdue. Default happens to government student loans when they are about 270 days overdue. For private student loans, it happens when they are one day overdue.

Debt collectors who are attempting to collect a private loan often claim that the private student loan is a government loan. They do this in an effort to claim that the statute of limitations does not apply to them. Your defenses might include standing and not being a real party in interest, laches, novation, fraud, truth in lending and over 100 other regulations, laws and defenses. All of the defenses in use against any common debt also apply to private student loans. All of these are good reasons for checking to see if the loan is government or private?

Don’t Miss: How To Buy Foreclosure Home

How Does Student Loan Discharge Affect Credit

Students loan accounts that are successfully discharged through bankruptcy are shown on your credit report. Although youre no longer responsible for repaying a discharged student loan, it will continue to appear on your credit report for up to 10 years. Your credit score will continue to be adversely impacted by a student loan bankruptcy discharge during this time.

File For An Adversary Proceeding

Once youve officially filed for bankruptcy, youll need to file an adversary proceeding for your federal student loans. The adversary proceeding states that your student loan debt causes undue hardship, said Matthew Alden, a bankruptcy and debt relief attorney at Ohio-based Luftman, Heck & Associates LLP, in an email to The Balance. Once its filed, youll have to provide evidence of the hardship in court. The same appears to apply to those seeking to discharge private student loan debt, although they would need to prove that their loans did not constitute an educational benefit, as per the recent Second Circuit ruling.

Also Check: Does Filing Bankruptcy Get Rid Of Tax Debt

Federal Loans And Hardship

Your student loan holder may choose not to oppose your petition to have your loans discharged in bankruptcy court if it believes your circumstances constitute undue hardship. Even if your loan holder doesn’t, it may still choose not to oppose your petition after evaluating the cost of undue hardship litigation.

For federal loans, the Department of Education allows a loan holder to accept an undue hardship claim if the costs to pursue the litigation exceed one-third of the total amount owed on the loan, including principal, interest, and collection costs. Private student lenders are likely to apply similar logic.

Hidden Consumer Rights And Remedies Regarding Private Student Loans

Federal student loans are dischargeable in bankruptcy only based on undue hardship . Creditors have worked hard to foster the misconception that the same standard applies to all private student loans. See, e.g., Student Borrower Protection Center, Morally Bankrupt: How the Student Loan Industry Stole a Generations Right to Debt ReliefLetter from Senators Durbin, Brown, Whitehouse, and Warren to CFPB Director Chopra . In fact, private student loans are generally dischargeable in bankruptcy unless they meet each of ten conditions described below.

This article provides practice tips to determine if a specific private student loan is generally dischargeable and provides advice on dealing with private student loans in bankruptcy. The article then turns to remedies available to consumers subject to collection efforts after their private student loans are discharged in bankruptcy. Also considered, even where there is no bankruptcy filing, are consumer remedies for misrepresentations made to a borrower that allege a private student loan is not generally dischargeable. The article concludes with a brief discussion of remedies for other abuses related to private student loans.

You May Like: Filing For Bankruptcy Credit Score

Will Student Loans Ever Be Dischargeable In Bankruptcy

The Fresh Start Through Bankruptcy Act would amend the Bankruptcy Code to let federal student loans be discharged after ten years of repayment without requiring proof of undue hardship. The waiting period, which prevents borrowers from racing to bankruptcy court to cancel their loans shortly after leaving school, harkens back to how student loan debt was treated before the law was changed in 1998.

This change would be great if it became law. But I doubt it will, at least not in its current form. Theres been no movement on the bill since being introduced over a year ago.

Is It Even Possible To Discharge Student Loan Debt In Bankruptcy

Discharging your student loans in bankruptcy isnt impossible, but it requires navigating a challenging process that can be difficult to prove. If youre going to try to get out from under your loans in a bankruptcy, you should understand the requirements to qualify.

Getting your loans discharged in bankruptcy is theoretically possible, but its not your ordinary bankruptcy proceeding, and its incredibly difficult, says Mark Kantrowitz, publisher and vice president of research for SavingForCollege.com.

According to one study, only 0.1% of student loan borrowers declaring bankruptcy even try to get their student loans discharged. Of that fraction, 40% succeed. In other words, just 0.04% of people who have filed for bankruptcy and sought to have their loans discharged received either a full or partial discharge of their student loans.

If nothing else, these stats prove that student loan discharge is possible. But the legal requirements are discouraging and for those who do try, its a tough proposition.

Under current law, student loans cant be claimed in a bankruptcy except in certain circumstances. The only way these loans can be discharged is if theyre found to cause undue hardship on the borrower or the borrowers dependents.

You May Like: How Much Is It To File Bankruptcy

Fresh Start Through Bankruptcy Act

With the introduction of the bipartisan bill, filing bankruptcy on student loans has become much easier. You need to pass it, though. If youre one of those people who struggle with student loan debts, then its likely you know about the Fresh Start Through Bankruptcy Act.

This act is created specifically for borrowers with federal student loans. It helps them restore their ability to seek a bankruptcy discharge. They can take advantage of it ten years after their 1st student loan payments eventually come due.

Likewise, in case of undue hardship for student loans, the discharge option can be retained. Of course, you will have to prove undue hardship first. Keep in mind that it only applies to private as well as federal student loans, providing that they are due for less than ten years.

Getting Student Loans Discharged Is Difficult But Not Impossible

fizkes / Getty Images

Even though some student loans are eligible to be discharged in bankruptcy, doing so is no easy task. Unlike credit cards or medical bills, having student loans discharged is notoriously difficultbut not impossible.

In July 2021, a New York-based federal appeals court ruled that private student loans could not be protected from discharge in a Chapter 7 bankruptcy. Federal student loans may qualify for discharge if youre able to prove undue hardship.

If managing your student loans has become a major financial burden, read on to learn how bankruptcy works, how to get student loans discharged, and alternatives you may want to consider.

Recommended Reading: Northern District Of Texas Bankruptcy

Your Student Loan Discharge Can Happen In Different Ways

Following your adversary proceeding, the bankruptcy court may or may decide to make your student loan debt dischargeable. While this decision leaves you liable for the entire amount under Chapter 7 bankruptcy, you may get permission to make reduced payments for the duration of a Chapter 13 bankruptcy.

In the happiest scenario, the court discharges you from your entire student loan debt, freeing you from undue hardship and endless collection calls. However, the court might discharge only part of the debt, leaving you liable for the remainder. Alternatively, you receive only minimal relief such as a reduced interest rate.

Then You May Be Required To Present A Strong Plan To Both Lenders And The Trustee The Bankruptcy Trustee Will Be Looking To Understand:

- If pursuing a university degree could endanger your best effort at repaying debt in Chapter 13.

- If Chapter 13 repayment and student loan repayment will coincide.

- If earning this particular college degree will increase your employment possibilities.

- And, if the new job will ensure your ability to repay the new student loans.

Recommended Reading: Cheap Foreclosure Homes For Sale

When Cant Student Loans Be Discharged Through Bankruptcy

Historically, it has been extremely difficult to get out of federal student loans through bankruptcy. If that kind of legal loophole existed, the argument went, there would be nothing to stop people from completing college or grad school and then immediately declaring bankruptcy.

However, it will be nigh impossible when:

The debtor cannot prove any undue hardship from the above list.

The individuals only debt is student loans.

Someone is a recent grad. Not enough time may have elapsed to prove a history of hardship and a good-faith effort to repay loans.

Troubling Consumer Accounts Of Industry Practices Regarding Bankruptcy Discharges

While these details might be understandably difficult for the typical consumer to follow, they should be understood and reflected in the policies and procedures of loan owners, lenders, servicers, and collectors. As the CFPB has documented for years, student loan borrowers rely on their servicers to provide timely and accurate information about their loans, including the protections the law provides when borrowers have trouble paying their loans. Unfortunately, the CFPBs work has alsohow student loan companies fail to consistently give borrowers the information and support they need.

Regrettably, complaints submitted to the CFPB suggest that some of these companies might be making false statements to borrowers about the protections bankruptcy offersor worse, even collecting on debts that have already been discharged by a bankruptcy judge.

You May Like: Foreclosures In Jacksonville Fl

Consider Other Options Before Bankruptcy

Obtaining a bankruptcy discharge of your student loans is not easy, and fortunately there are other steps desperate borrowers can take before making this last-ditch effort.

“In proceedings where clients of ours have tried , if they can’t prove that they have no hope of paying back the debt, then the Department of Education usually responds by telling the borrower to enroll in an income-based repayment plan,” Hornsby explains.

Federal income-driven repayment plans recalculate your monthly bill based on any changes in your income. Your monthly student loan payment is therefore reflective of how much you can afford to pay.

Hornsby suggests income-driven repayment plans such as Pay As You Earn and Revised Pay As You Earn . With these programs, your credit score won’t be ruined like it would in bankruptcy proceedings, plus you’ll only need to pay 10% of your discretionary income. After the repayment period ends, any remaining balance is forgiven.

If your monthly payment is just too high, consider refinancing your student loans. Through refinancing, you can both score a lower interest rate and extend your loan term so that your monthly payments are lower. Though this means more months, or years, of interest collecting, it can help you in the immediate term if you are tight on cash.

How Bankruptcy Helps You Manage Student Debt

Federal and private student loans are usually not discharged in the bankruptcy process. Although filing for Chapter 13 can help you manage repayment in the following ways:

Recommended Reading: Bank Repossessed Homes For Sale

Private Loan Modification Or Settlement

Your options to reduce private loan payments or get out of default vary greatly based on the lender. Communicate directly with your private lender or servicer to explore loan modification programs if you cant afford your payments long-term.

If youre behind on your loans, you could consider reaching a settlement agreement with the lender or collection agency. At which point, you would pay a lump sum settlement thats less than your total outstanding balance. But you may have to pay taxes on this amount, and it could be unaffordable.

If you can, consult a tax professional or lawyer with student loan expertise if youre in communication with a collection agency about a settlement.

Why You Must File An Adversary Proceeding

Jerome H. Powell, the Federal Reserve chairman, has said that hes at a loss to explain why student loans are treated differently than other types of debt in bankruptcy proceedings.

Before 1976, student loans were like other consumer debts and could be discharged through bankruptcy. But some legislators thought that people with expensive degrees who could make a lot of money might use this to their advantage, so they changed the rules.

After the changes, people had to wait five years after they had to start making payments before they could get rid of their loans in bankruptcy unless they could prove that the debt was causing them undue hardship.

Related: Why Cant Student Loans Be Discharged in Bankruptcy?

Congress didnt define undue hardship when it changed the Bankruptcy Code, so courts had to come up with a way to measure it. They did this by creating tests that look at things like a borrowers income, expenses, and repayment history. Depending on where you live, your bankruptcy judge will use the Brunner Test or the totality-of-the-circumstances test more on these below.

Read Also: Catawba County Tax Foreclosures