How To Calculate The Back

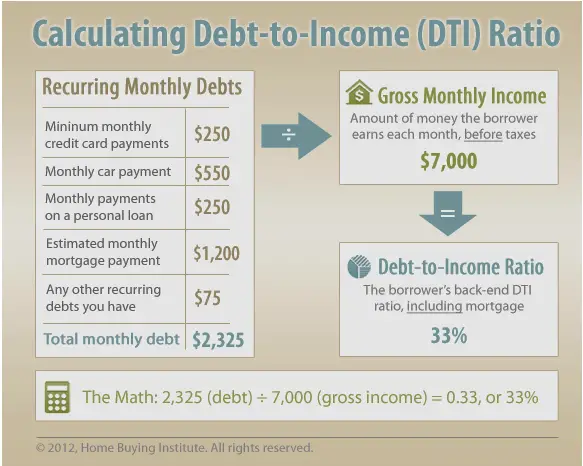

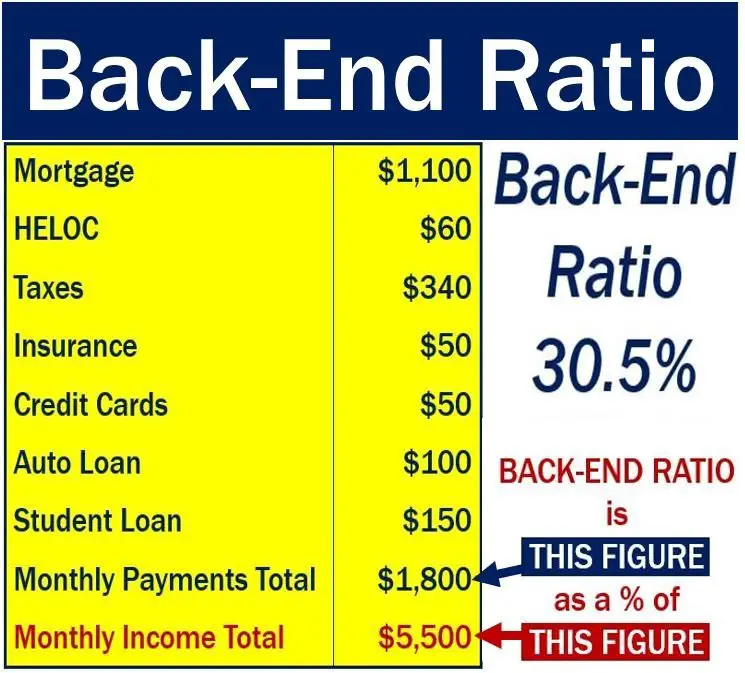

The back-end ratio can be calculated by summing the borrowers total monthly debt expenses and dividing it by their monthly gross income.

The formula is shown below:

Calculation steps:

Total monthly debt expenses include but are not exclusive to:

How To Improve My Debt

One thing is sure, theres no ideal debt-to-income ratio. Theres always room for improvement. It always makes sense to lower your DTI.

You have two ways: first to reduce your monthly debt, and second to increase your income. The latter is often easier said than done. Although, if you could have a higher salary, why would you bother about your DTI?

So, one possible way to improve your debt-to-income ratio is to reduce your monthly payments. Sure, some loans such as student or mortgage loans are not something you can change on one, two, three. It will take months to reduce your monthly liabilities but result in a lower DTI ratio.

It takes time and effort to pay down the debt you already have, but the end result is worth the battle.

Lower Your Monthly Debt

The DTI ratios are usually driven up by large monthly payments. If you are going to lower your debt, then it is important that you target the debt that has the biggest monthly payment requirement.

One of the most important steps that you can take to lower your debt is to eliminate the monthly payments from all of your credit accounts. If you have $5,000 available to spend on debt, then you should use it to pay off as many of these accounts as possible. However, you should not apply the $5,000 against a debt that has a large balance.

Read Also: Did Toys R Us File Bankruptcy

Can A Debt Ratio Be Negative

If a company has a negative debt ratio, this would mean that the company has negative shareholder equity. In other words, the company’s liabilities outnumber its assets. In most cases, this is considered a very risky sign, indicating that the company may be at risk of bankruptcy.

Accounting Tools. “Debt ratios.” Accessed Nov. 2, 2021.

Can I Still Get A Loan If I Break The 28/36 Rule

If you did the math and discovered that your housing payments came to more than 28 percent of your gross income, or you realized that the alimony payments tipped you over the 36 percent mark, dont despair. Youre not out of the housing market yet. Even if you present a higher lending risk, a lender could still approve your application if you shine in other parts of your financial profile. For instance, do you have a sky-high credit score? Maybe you can scare up some extra cash for a larger down payment. Or you could simply pay a higher interest rate. First, however, you should always assess your financial situation prudently, keeping your long-term comfort level in mind.

Don’t Miss: How Long Do Bankruptcy Restrictions Last

Why Is Your Debt

Once your debt-to-income ratio is calculated, the lender sees a big picture of your financial health. If youre not about to apply for a loan yet, knowing your DTI ratio is still important.

For you, that means the possibility to keep an eye on important numbers. For example, after some calculations, youve found that your debt is 60% of your income. Not a nice surprise. You understand that in case of any emergency, youll have a harder time keeping up with your debt liabilities.

For lenders, your DTI ratio means nothing but the level of risk to deal with. The number of 43% is acceptable debt to income ratio that will make you qualify for a loan. A higher DTI ratio means that you are more likely to default on a loan.

How To Calculate Debt

You can calculate your DTI ratio before you apply for a mortgage, regardless of which kind of loan youre looking to get.

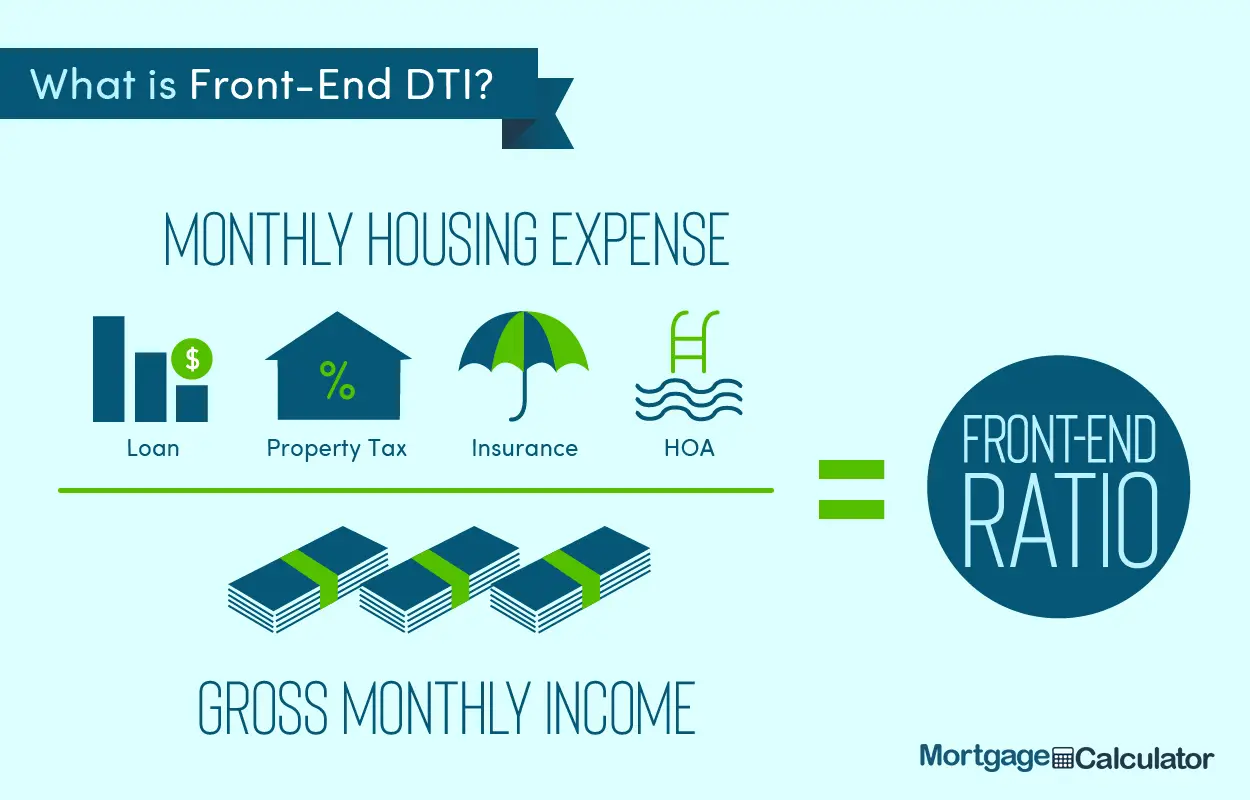

First, there are two types of ratios lenders evaluate:

- Front-end ratio: Also called the housing ratio, this shows what percentage of your income would go toward housing expenses. This includes your monthly mortgage payment, property taxes, homeowners insurance and homeowners association fees, if applicable.

- Back-end ratio: This shows how much of your income would be needed to cover all monthly debt obligations. This includes the mortgage and other housing expenses, plus credit cards, auto loan, child support, student loans and other debts. Living expenses, such as utilities and groceries, are not included in this ratio.

The back-end ratio may be referred to as the debt-to-income ratio, but both ratios are usually factored in when a lender says theyre considering a borrowers DTI.

Also Check: How To Select A Bankruptcy Attorney

What Is The Highest Debt To Income Ratio For A Personal Loan

The highest DTI ratio for a personal loan is 43 percent while many crediting services and finance-related service providers require it to be below 36 percent. If your debt to income ratio is lower than 18 percent its considered perfect.

There are many online calculators to define your debt to income ratio. Its necessary to define this percent before you apply for various lending options or a mortgage so that you know what interest rates you will be offered in advance. Its considered that a DTI ratio below 36 percent is better for borrowers who want to purchase a house or take out a loan to fund their needs. If you are a student who wants to obtain a student loan you should have your DTI ratio below 10 percent.

In some cases, crediting institutions may ask for a ratio of 28 percent and less. This figure is calculated by dividing the overall recurring monthly debt by monthly gross income. If your DTI is higher than the stated percent, you may be offered a high-interest loan. Sometimes, lenders even deny the borrowers application if the ratio is too high. So, if you want to qualify for better terms and loan conditions and pay less in interest, try your best to keep your DTI ratio below 36 percent.

High Point North Carolina

Housing prices are on the rise in High Point. The market is less competitive in High Point than some larger cities, but some homes still receive multiple offers, and the typical house sells for 2% above the asking price.

Content on this site is not intended to create, and does not constitute, an attorney-client relationship between the user or any other person. The information provided should not be used as a substitute for competent legal advice from a lawyer whom user has retained. No content provided any User is intended to provide, and in no event shall it be treated as providing, legal advice.

Company

Recommended Reading: Can You File Bankruptcy On Income Taxes Owed

What Is Considered A Good Dti Ratio

Most people who purchase a home will have some type of debt. With that said, its essential to understand what is considered a good DTI ratio before moving forward with a mortgage application.

Be sure to know the requirements of all prospective lenders before starting an application. As a general rule of thumb, a borrower should aim to have no more than 43% DTI. If you can, its better to aim for a DTI of around 36%, with no more than 28% going towards your new mortgage. Keep in mind that the requirements for DTI vary from lender to lender. Some lenders are more lenient, but others have more rigid requirements.

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Also Check: How Does Bankruptcy Affect My Job

Which Dti Ratio Matters More

While mortgage lenders typically look at both types of DTI, the back-end ratio often holds more sway because it takes into account your entire debt load.

Lenders tend to focus on the back-end ratio for conventional mortgages loans that are not backed by the federal government.

For government-backed mortgages, such as FHA loans, lenders will look at both ratios and may consider DTIs that are higher than those required for a conventional mortgage.

Does Dti Ratio Affect Your Credit Scores

Your DTI ratio may not directly impact your credit scores. But there are some indirect ways that your DTI or income can impact your credit scores.

For example, your credit utilization ratio may account for nearly 30% of your credit scores. And it looks at outstanding balances on your credit cards relative to your total available credit. Reducing your credit utilization ratio will also reduce your DTI ratio and could improve your credit scores.

But a loss of income could make it difficult to pay your bills on time. And late or missed payments could affect your credit scores. Thatâs because a loss of income can change your DTI ratio.

You May Like: How Long Does Bankruptcy Last In Ontario

Limitations Of The Back

It is important to recognize that the back-end ratio is simply one of many metrics that can be used to understand the borrowers ability to settle their debt. Lenders can analyze the borrowers credit history and to make a decision on whether extending or raising credit is worthwhile.

The back-end ratio does not recognize the different types of debt and service costs of debt. For example, although credit cards yield a higher interest rate than student loans, they are added together in the numerator within the ratio.

If the borrower transfers balances from a low-interest credit card to a higher one, evidently, the monthly debt payments will be higher. Thus, the back-end ratio should be higher as well. However, as the ratio sums all debt in one package, the total debt outstanding remains the same.

How To Lower Your Dti

If your DTI is not within the recommended range, you can attempt to lower your DTI through a number of techniques. The preferred option is to pay off as much of your debt as you can manage, but you can also try restructuring your loans. Seek out options for lowering the interest rate on your debt or attempt to lengthen the duration of the loan through refinancing options. Look into loan forgiveness programs that may help to eliminate some of your debt entirely.

If youre unable to refinance your loans, focus on paying off the high-interest ones first. These carry a heavier weight in your DTI calculation, so paying them off first will improve the ratio.

If you can, seek out an additional source of income. This additional stream of income will help to improve your DTI ratio.

Also Check: Why You Should File For Bankruptcy

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Also Check: What Does Bankruptcy Discharge Date Mean

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How The 28/36 Rule Helps You As A Buyer

The 28/36 rule gives you a sense of how much you can afford to spend without stretching your finances to the breaking point. Whether you’ve purchased a dozen homes over your lifetime or you’re working with a lender that specializes in mortgages for first-time home buyers, the ratio helps protect both you and the lender.

Forget thinking about where you want to live — focus on how you want to live. Do you want your mortgage payment to eat up a huge chunk of your monthly income, or do you want extra funds to do the things you enjoy? If you’re wondering “How much house can I afford?” the 28/36 rule can help.

You May Like: How Do You Declare Bankruptcy In England

How Lenders Use Front

Lenders use both front-end and back-end debt-to-income ratios to determine your ability to repay a home mortgage loan. A higher DTI can signal to lenders that you might be stretched thin financially, while a lower DTI suggests that you have more disposable income each month that isn’t going to debt repayment.

Debt-to-income ratio is just one part of the puzzle, however. Lenders can also look at your income, assets, and employment history to gauge your ability to repay a mortgage loan. Debt-to-income ratios can play a part in decision-making for purchase loans as well as mortgage refinancing.

How To Improve Your Debt

The goal is usually 43% or less, and lenders often recommend taking remedial steps if your ratio exceeds 35%. There are two options to improving your debt-to-income ratio:

Neither one is easy for many people, but there are strategies to consider that might work for you.

You May Like: What Does The Bankruptcy Trustee Investigate

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

How To Lower Your Dti Ratio

There are two key ways to lower your DTI ratio: reducing your debt and increasing your income.

Here are some tips for decreasing your DTI ratio.

- Ask for a raise at work to boost your income

- Take on a part-time job or freelance work on the side

- Make extra payments to your credit card to lower the balance

- Reduce your day-to-day expenses so you can make a bigger dent in your debts, such as your student loan or auto loan balances

- Avoid making large purchases on credit that arent absolutely necessary

- Avoid taking out any new loans or lines of credit

Recommended Reading: What’s The Difference Between Chapter 7 And Chapter 11 Bankruptcy