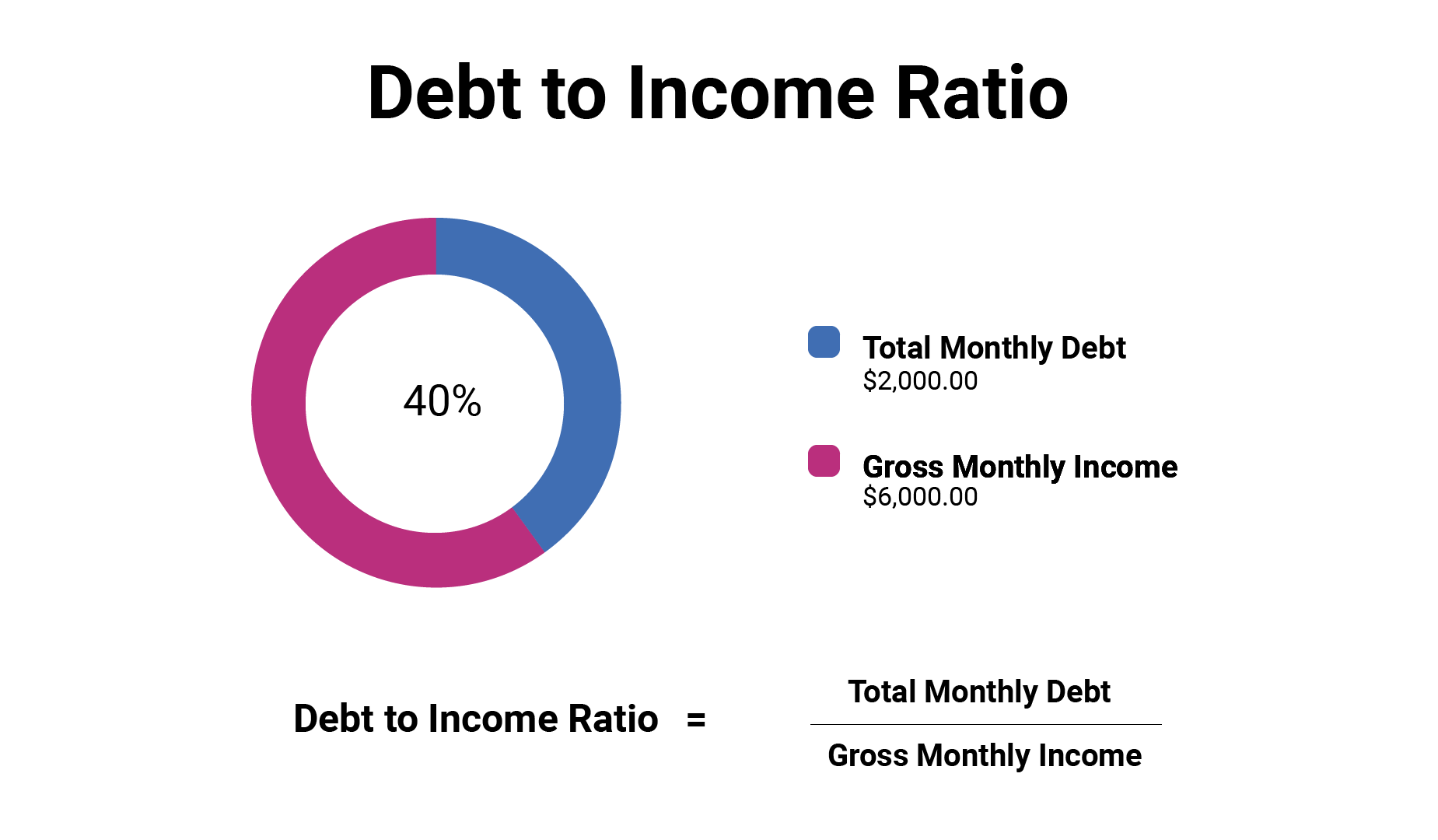

What Your Debt To Income Ratio Means

Your final result will fall into one of these categories.

- 36% or less is the healthiest debt load for the majority of people. If your debt-to-income ratio falls within this range, avoid incurring more debt to maintain a good ratio. You may have trouble getting approved for a mortgage with a ratio above this amount.

- 37% to 42% isn’t a bad ratio to have, but it could be better. If your ratio falls in this range, you should start reducing your debts.

- 43% to 49% is a ratio that indicates likely financial trouble. You should start aggressively paying your debts to prevent an overloaded debt situation.

- 50% or more is an extremely dangerous ratio. This means that more than half of your income goes toward debt payments each month. You should be aggressively paying off your debts. Don’t hesitate to seek professional help.

Should I Include My Spouses Debt

In states where you have the option to do so, this depends on how beneficial it is for you. Having two incomes available means that you could qualify for larger loans. Combined debt and income could give a lower, stronger DTI ratio.

Applying as a couple would be ideal in such a case. However, if a couples combined credit score and debt-to-income ratio severely affect the prospects of qualifying for a good mortgage, it might be better to apply as an individual.

- Categories

Read Also: Fha Limits In Texas

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Recommended Reading: Amazon Liquidation Pallets Houston

How To Improve Your Debt

Now that you are able to calculate your DTI ratio you are likely in one of two camps. Either you have a fairly low or manageable DTI ratio and are feeling pretty good about yourself or you have a high DTI ratio and are starting to worry and stress. Either way, there is no reason to worry, as its a fairly simple process to lower your DTI ratio.

Basically, there are three different ways to lower and improve your debt-to-income ratio and they are to eliminate or reduce the monthly recurring debt you have, increase the income you make per month, or a combination of the two. While this sounds simple and easy, it is not always simple to go out and make more money or to reduce your debt. You need to make specific lifestyle changes and be conscious of these things going forward. It is easy in principle, especially when compared to raising your credit score, which can take a while and can be hard to predict. However, it does indeed take some considerable lifestyle changes for most people.

Want to know why your credit score dropped? Read this.

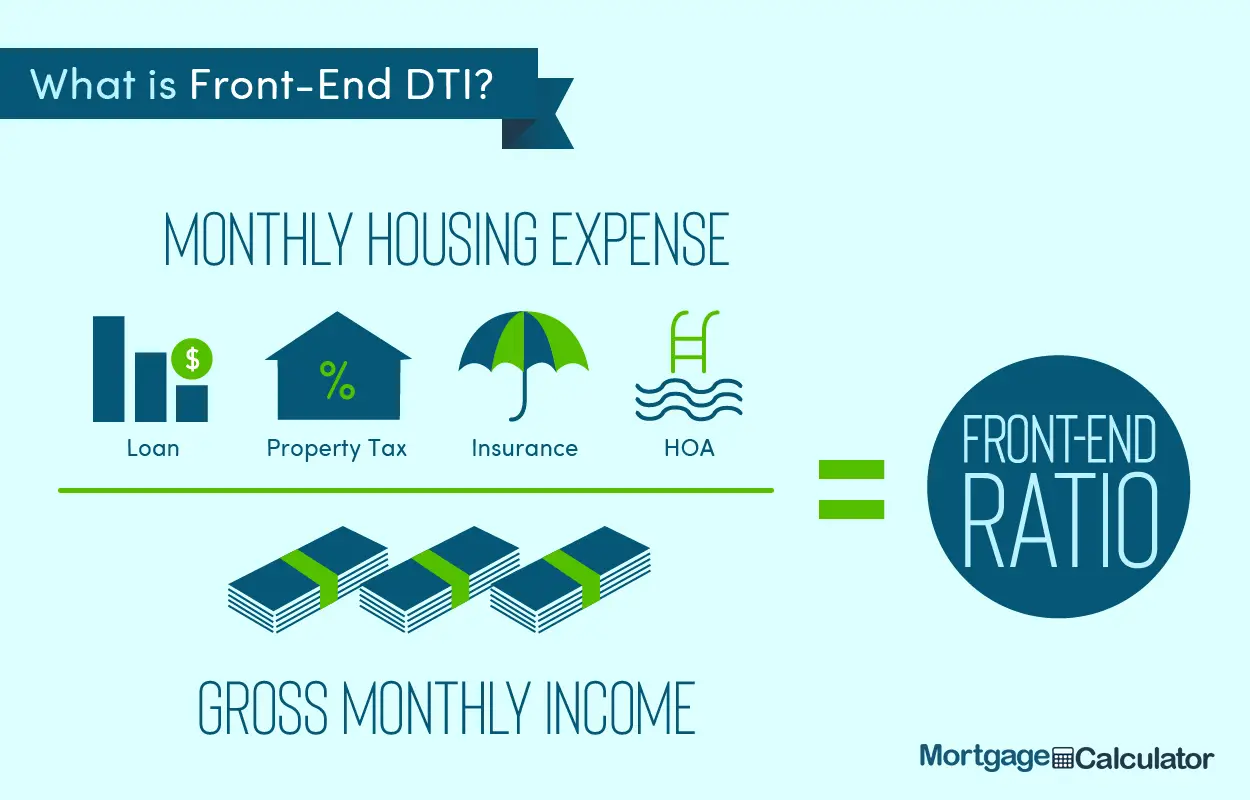

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Don’t Miss: How Does Bankruptcy Affect Your Credit Rating

What Happens If My Debt

If your debt-to-income ratio is higher than the widely accepted standard of 43%, your financial life can be affected in multiple waysnone of them positive:

- Less flexibility in your budget. If a significant portion of your income is going towards paying off debt, you have less left over to save, invest or spend.

- Limited eligibility for home loans. A debt-to-income ratio over 43% may prevent you from getting a Qualified Mortgage possibly limiting you to approval for home loans that are more restrictive or expensive.

- Less favorable terms when you borrow or seek credit. If you have a high debt-to-income ratio, you will be seen as a more risky borrowing prospect. When lenders approve loans or credit for risky borrowers, they may assign higher interest rates, steeper penalties for missed or late payments, and stricter terms.

Personal Loans And Auto Loans

With personal loans and car loans, you might be able to qualify for financing with a DTI ratio higher than the typical 43% cap for a qualified mortgage. But you should pay close attention to your interest rate and monthly payment to make sure its affordable for you.

Wells Fargo, for example, says that if you have a DTI of 35% or less, youre probably in pretty good shape.

Don’t Miss: Do It Yourself Bankruptcy Chapter 7

What Is A Good Dti

Lending Tree reports that most lenders want to see a DTI ratio of 36% or less, but it can vary. To break it down for you, here are the tiers of DTI ratios:

- DTI of 0% to 35%: The amount of debt is manageable.

- DTI of 36% to 49%: The debt amount is manageable, but giving you a loan could cause issues.

- DTI above 50%: The debt amount could be managed through some counseling or a debt relief program.

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

Also Check: How Many Points Does A Bankruptcy Lower Your Credit Score

Personal Loans For High Debt

The following six loan matching services work with networks that will lend to consumers with bad credit and/or high DTI ratios. All six can link you to one or more lenders that promise quick decisions and rapid funding, often on the next business day.

None of these services collect fees from borrowers. Rather, network lenders pay finders fees to the matching services.

Eligible borrowers usually must be a U.S. citizen or resident, age 18 or older, have a checking account, valid email address, and work and/or home phone numbers.

| Varies |

See representative example |

The CashAdvance.com network will consider you for a short-term loan of $100 to $999 without checking your DTI ratio. To be eligible, you must have at least three months on the job and a monthly income of at least $1,000.

CashAdvance.com, a member of the Online Lenders Alliance, has been helping borrowers get loans since 1997. Its large lender network welcomes borrowers with bad or thin credit. Expect funding of approved loans by the next business day.

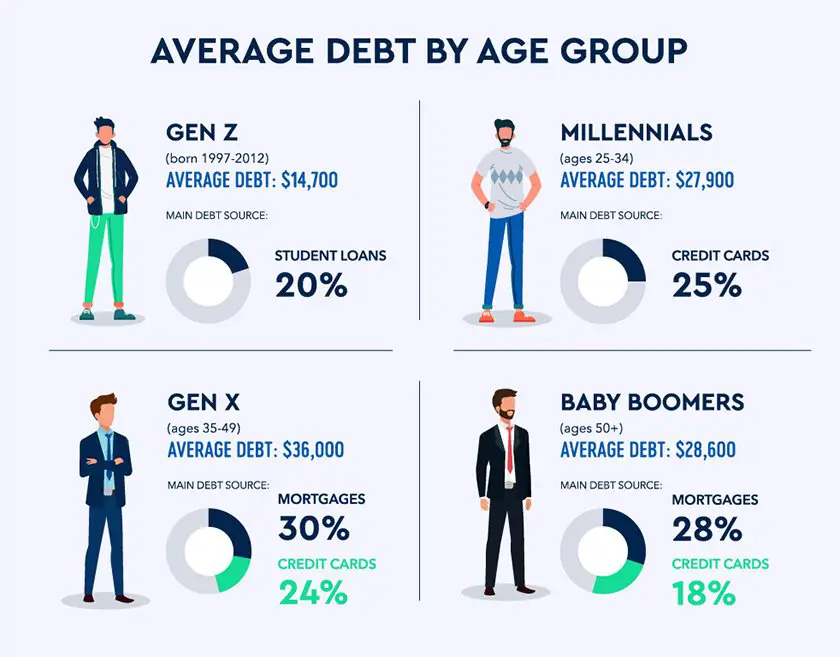

How Much Debt Does The Average 50 Year Old Have

50 years or older = $96,984 Baby boomers have an average debt of $96,984, according to Experian. Mortgages, credit card bills, and auto loans are the three main debt sources for those in this age group. Although this is less than the average debt of those 3549, it could still spell trouble for two primary reasons.

Also Check: Bankrupt Houses For Sale

How To Get A Car Loan With A High Debt

There are two sets of ways to get a car loan with a high debt-to-income ratio because fractions have a numerator and denominator.

Lenders use the DTI ratio to determine if you can afford a specific vehicle and set a maximum ranging from 35% to 55%.

You can improve your DTI by lowering the numerator , increasing the denominator , or both.

You can reduce your monthly debt installments by extending the term, making a down payment, improving your credit score, or choosing a cheaper vehicle.

Or, you might boost your earnings by reporting on all income sources or picking up a side gig to increase your wages.

What Can I Do When My Mortgage Is Declined Due To Affordability

When lenders decline your loan due to affordability, it could mean that your debt-to-income ratio is too high. Have a look at your credit report and see if youre using more than 30% to 35% of your revolving credit. Another way to improve affordability is to put down a higher deposit. You may also need to increase your income or decrease your non-essential expenditure.

Recommended Reading: How Soon Can You Refinance After Bankruptcy

How Can You Lower Your Debt

Since the formula for your debt-to-income ratio uses two different numbers, there are a couple of different ways to lower your DTI ratio. The first is to lower the amount of debt that you owe.

You can do this by paying off your credit cards or loan balances ahead of schedule. Even if youre having trouble paying beyond your minimums, look at refinancing options to lower your monthly debt payments with a lower interest rate.

What Are The Other Expenses To Consider When Buying A Car

Owning a car goes beyond the monthly loan payments. Youll have to consider other expenses, which include the following:

- Regular insurance premiums

- Auto maintenance and repair costs

- Taxes and registration

- Parking fees

You will find several car repayment calculators online to help in your calculation of how much mortgage youre going to be paying every month for the amount of money that would like to borrow.

How much can I borrow for a car? Thats a fairly common question for car buyers. You can also find free car loan calculators that could give you an estimate on how much fund you can get from lenders based on your credit, gross income a month, and debt factors.

Recommended Reading: Can A Va Loan Be Used For An Investment Property

Also Check: How To Boost Credit After Bankruptcy

How To Improve Your Dti

To improve your DTI, you could:

- Pay down your debts.

- Increase your income.

- Do both.

There are many ways to pay down debts, including the snowball method. This involves paying off the debt with the smallest balance, then taking the amount you were putting toward that debt on the next biggest balance and so on and so on.

Another way to better your DTI ratio is to decrease your housing cost. Maybe a roommate or a smaller apartment would help you meet your goals.

To increase your income, you could make money with your car. There are potential opportunities for both passive and active earnings. You could also consider a side job.

Ideal Dti For Auto Loans

Your DTI represents your monthly income that goes toward paying the debt you owe, expressed as a percentage. Auto lenders routinely use the DTI to figure out the amount of loan you can handle after all your other monthly debts are paid. Typically, lenders want your DTI to be no more than 36 percent, inclusive of your monthly obligation for the auto loan you are seeking.

Don’t Miss: Where To Pay Collections

Max Dti Ratio For An Auto Loan

As a general rule, auto lenders cap your DTI ratio to 45% to 50%. This means that with the projected car payment and auto insurance payment that youre applying for factored in, at least half of your income should be still available.

Even if you make decent money each month, lenders want to know how much of that income is going to feasibly be available to afford the car payment. If you make $2,000 of income a month but your credit card payments, rent, and student loan payments are $1,500 a month, that means your DTI ratio is already at 75%. If you factor in a car loan payment and insurance premium, its likely to push your budget to the max which an auto lender wants to avoid doing.

A high DTI ratio can be risky for you because if you do get approved for a car loan and you dont have much wiggle room in your monthly budget, it could lead to missed payments on the car loan if unexpected expenses crop up.

When it comes to the DTI ratio, the lower it is, the better. Ideally, you want your DTI ratio to be under 45% with the projected car payment and insurance premium included. The more income you have available, the higher your odds are for meeting a lender’s requirements.

Can I Get A Personal Loan With A High Debt

Personal loans are available from private networks of lenders, such as the six reviewed above. All serve a wide swath of consumers, including folks with bad credit and/or high DTI ratios.

In other words, whether you have too much debt or a low credit score, your less-than-perfect handling of debt is not automatically disqualifying.

That being said, you should understand how debt affects your credit scores. You may be surprised to learn that your income isnt part of your credit report, and, therefore, doesnt figure into your credit score.

Income is not one of the factors used to determine your credit score.

Indeed, you can have a high credit score and a high DTI ratio, or a low score and ratio. However, the most likely scenario for consumers with low credit scores is to have an uncomfortably high DTI ratio.

Otherwise, you would be in a position to increase your score by paying down your debts and reducing your , which is the total amount you owe on all your revolving accounts compared with your total credit available. Since CUR makes up 30% of your FICO score, reducing it can have a major impact on your credit.

If your DTI is so high that lenders wont approve your loan applications, you can consider a secured loan in which your home or car serves as collateral. Secured loans are much easier to obtain, as they put the lender at much less risk.

Also Check: How Many Times Can You File Bankruptcy In Tn

How Can I Improve My Debt

There are a number of ways you can try to improve your debt-to-income ratio. The basic idea is lowering your debt or increasing your income. Here are some ideas.

- Pay down debt early. If you have room in your finances, make more than the minimum payments on your debts each month so that you pay them down faster. For example, pay more than your minimum credit card payment every month.

- Cut monthly expenses to pay off more debt. Look at your budget and consider ways you can adjust your spending so that you have more money to use toward debt repayment.

- Consider a debt-consolidation loan. If you cant make extra payments on your debt or trim your budget, a debt-consolidation loan could be a good option. This may help you reduce the amount of interest you pay while you work to pay down your debts.

- Get a side hustle or ask for a raise. Extra income from side jobs can count toward your income when you calculate your debt-to-income ratio. The boost in salary youd get from a raise could also help to lower your DTI.

What Are Good Debt

The next time you want to get an auto loan, be prepared to be asked for your most recent pay stub. Although the lender also will pull your credit score, your debt-to-income ratio will play a significant role in the loan decision. This establishes whether you can comfortably meet your monthly expenses when the auto loan is added to your monthly debt obligations. DTI should not be confused with debt-to-credit ratio, which is a credit utilization parameter on your credit report that indicates the amount of debt you carry in relation to your credit limits.

Tips

-

Typically, a good debt-to-income ratio is 36 percent or less.

You May Like: Is It Better To File Bankruptcy

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyouâre applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If youâre new to building credit

- If youâve had financial problems in the past like a bankruptcy or foreclosure

- If youâre taking out ajumbo loan

Also Check: Usaa Auto Loan Refinance Rates

Don’t Miss: Can You Declare Bankruptcy On Credit Cards

What If My Debt

What happens if my debt-to-income ratio is too high? Borrowers with a higher DTI will have difficulty getting approved for a home loan. Lenders want to know that you can afford your monthly mortgage payments, and having too much debt can be a sign that you might miss a payment or default on the loan.