What Is The Debt Ratio

The term debt ratio refers to a financial ratio that measures the extent of a companys leverage. The debt ratio is defined as the ratio of total debt to total assets, expressed as a decimal or percentage. It can be interpreted as the proportion of a companys assets that are financed by debt. A ratio greater than 1 shows that a considerable amount of a company’s assets are funded by debt, which means the company has more liabilities than assets. A high ratio indicates that a company may be at risk of default on its loans if interest rates suddenly rise. A ratio below 1 means that a greater portion of a company’s assets is funded by equity.

Relevance And Uses Of Debt To Equity Ratio Formula

From the perspective of lenders and credit analyst, it is important to understand the concept of debt to equity ratio because it is used to assess the degree to which an entity is leveraged. Typically, a relatively high debt to equity ratio signifies that the company unable to make adequate cash vis-à-vis the debt obligations. On the other hand, a low value of debt to equity ratio can be indicative of the fact that the company is not taking advantage of financial leverage. Inherently, debt-to-equity ratios are higher for capital intensive as compared to low capital industries because the capital intensive companies are required to incur regular capital expenditure in the form of new plants and equipment to operate efficiently. As such, it is always advisable to compare debt to equity ratios of companies in the same industry.

Debt Ratio Excel Calculator

Well now move to a modeling exercise, which you can access by filling out the form below.

Suppose we have three companies with different debt and asset balances.

- Company A: Debt = $50 million Assets = $50 million

- Company B: Debt = $25 million Assets = $50 million

- Company C: Debt = $50 million Assets = $25 million

Given those assumptions, we can input them into our debt ratio formula.

- Company A = $50 million ÷ $50 million = 1.0x

- Company B = $25 million ÷ $50 million = 0.5x

- Company C = $50 million ÷ $25 million = 2.0x

From the calculated debt ratios above, Company B appears to be the least risky considering it has the lowest ratio of the three.

On the opposite end, Company C seems to be the riskiest, as its debt balance is double the value of its assets.

Also Check: Can You Get A Credit Card After Declaring Bankruptcy

What Does A Debt

A debt-to-equity ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million. Since equity is equal to assets minus liabilities, the companys equity would be $800,000. Its debt-to-equity ratio would therefore be $1.2 million divided by $800,000, or 1.5.

What Does A D/e Ratio Of 15 Indicate

A D/E ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million. Because equity is equal to assets minus liabilities, the companys equity would be $800,000. Its D/E ratio would therefore be $1.2 million divided by $800,000, or 1.5.

Recommended Reading: How Does Bankruptcy Chapter 7 Work

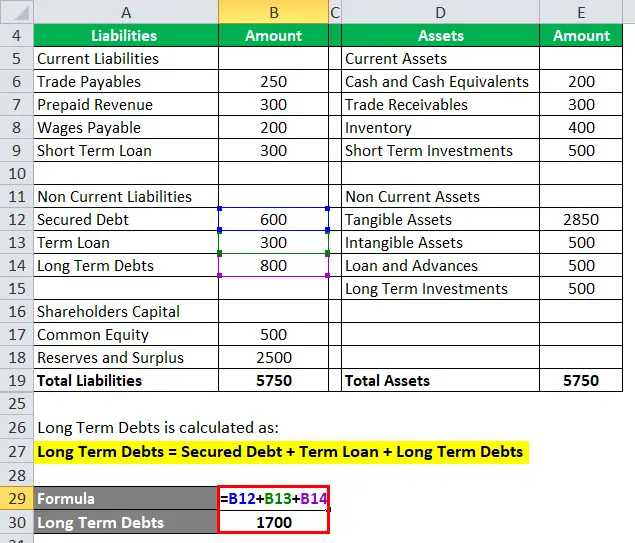

Determine Your Total Liabilities

Your company’s total liabilities are the sum of its debts and other financial obligations. It’s a combination of both current and long-term liabilities. Find this number to begin the debt ratio calculation process. You can find this amount listed on your company’s financial statements. Examples of total liabilities include utility bills, credit card debt, wages payable or notes payable. For the most part, it’s the money your company owes at a certain point in time.

Debt Ratio: Types And How To Calculate

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

If you own a business, it’s important to calculate and analyze the amount of money your company owes in relation to its total assets. In essence, your debt ratio allows you to determine whether or not your company will be able to pay off its liabilities with its assets. Determining your debt ratio is especially important if you’re hoping to catch the attention of lenders or investors because many prefer to work with companies that have lower levels of liabilities. In this article, we define debt ratio, list examples and outline how to calculate it for your business.

Read Also: Repo Houses For Sale

What Is A Short

Short-term debt is anything you expect to pay in full within 12 months. Some examples of short-term liabilities or current liabilities include:

-

Short-term loans

Tally Technologies, Inc. . Lines of credit issued by Cross River Bank, Member FDIC, or Tally Technologies, Inc. , as noted in your line of credit agreement. Lines of credit not available in all states.

Loans made by Tally pursuant to California FLL license or other state laws.

*To get the benefits of a Tally line of credit, you must qualify for and accept a Tally line of credit. Based on your credit history, the APR will be between 7.90% – 29.99% per year. The APR will vary with the market based on the Prime Rate. Annual fees range from $0 – $300.

Privacy Policy Terms & Conditions Accessibility

3 Individual Savings Claims We calculated each customers interest savings based on payments Tally made on their behalf to their credit cards with a higher APR than their Tally line of credit. We compared the total daily interest that would have accrued with and without Tally based on the difference between their credit card APR and the APR for their Tally line of credit. We excluded payments made to cover minimum payments to cards with a lower APR than Tally or to cards that were in a grace period at the time of payment.

6The portion of your credit line that can be paid to your cards will be reduced by the amount of the annual fee.

Example Of How To Use Debt

As an example, assume a firm has $100 million in liabilities comprised of the following:

- Notes payable $5 million

- Long-term liabilities $55 million

- Other long-term liabilities $1 million

Of these, only notes payable, bonds payable, and long-term liabilities are interest-bearing securities, the sum of which total $5 million + $20 million + $55 million = $80 million.

As for equity, the company has $20 million worth of preferred stock and $3 million of minority interest listed on the books. The company has 10 million shares of common stock outstanding, which is currently trading at $20 per share. Total equity is $20 million + $3 million + = $223 million. Using these numbers, the calculation for the company’s debt-to-capital ratio is:

- Debt-to-capital= $80 million / = $80 million / $303 million = 26.4%

Assume this company is being considered as an investment by a portfolio manager. If the portfolio manager looks at another company that had a debt-to-capital ratio of 40%, all else equal, the referenced company is a safer choice since its financial leverage is approximately half that of the compared company’s.

As a real-life example, consider Caterpillar , which has $36.6 billion in total debt as of December 2018. Its shareholders equity for the same quarter was $14 billion. Thus, its debt-to-capital ratio is 73%, or $36.6 billion / .

Also Check: Buy By The Pallet Merchandise

How Do You Analyze The Debt

The debt-to-asset ratio is primarily used by financial institutions to assess a companys ability to make payments on its current debt and its ability to raise cash from new debt. This ratio is also very similar to the debt-to-equity ratio, which shows that most of the assets are financed by debt when the ratio is greater than 1.0.

A company that has a high debt-to-equity ratio is said to be highly leveraged. Highly leveraged companies are often in good shape in growth markets, but are likely to have difficulty repaying debt during market downturns. Its also more difficult for them to raise new debt to ensure their survival or to take advantage of market opportunities.

Not only is it normal for a company to be in debt, this can even be a positive thing.

Leveraging can be an interesting option for a company that can use the debt to generate additional resources, explains Bessette. For example, to increase its productivity, a company can buy a commercial building for a space that is larger and better adapted to its needs. Next, it can purchase state-of-the-art equipment that will enable it to fulfil more contracts, more quickly, for its customers. Using debt allows the company to keep its liquidity for its working capital.

Its also important to know that a company with high debt will get a higher interest rate on future loans because the risk to lenders is higher, says Bessette.

How To Interpret Debt Ratio Results

As it relates to risk for lenders and investors, a debt ratio at or below 0.4 or 40% is considered low. This indicates minimal risk, potential longevity and strong financial health for a company. Conversely, a debt ratio above 0.6 or 0.7 is considered a higher risk and may discourage investment. The highest possible ratio is 1.0, which indicates that a company would have to sell all of its assets to cover its debts.

In addition to the raw score, lenders and investors consider a company’s credit and payment history when making investment decisions. Specifically, a strong credit and payment history might offset the perceived risk for a prospective lender. The industry context for a given company is also a factor. Certain industries are considered capital intensive, meaning they require substantial front-end spending to produce a good or service and thus maintain high debt ratios. This includes airlines, telecommunications and utility companies. Comparing a specific company’s ratio to that of comparable competitors provides more complete context for a prospective lender or investor.

Related:Learn About Being a Loan Officer

Don’t Miss: How Long Does Bankruptcy Chapter 7 Last

What Does D/e Ratio Tell You

D/E ratio measures how much debt a company has taken on relative to the value of its assets net of liabilities. Debt must be repaid or refinanced, imposes interest expense that typically cant be deferred, and could impair or destroy the value of equity in the event of a default. As a result, a high D/E ratio is often associated with high investment risk it means that a company relies primarily on debt financing.

Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit. However, if the additional cost of debt financing outweighs the additional income that it generates, then the share price may drop. The cost of debt and a companys ability to service it can vary with market conditions. As a result, borrowing that seemed prudent at first can prove unprofitable later under different circumstances.

Changes in long-term debt and assets tend to affect D/E ratio the most because the numbers involved tend to be larger than for short-term debt and short-term assets. If investors want to evaluate a companys short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios.

For example, cash ratio evaluates a companys near-term liquidity:

Cash Ratio

\begin \text = \frac = 1.80 \\ \end Debt-to-equity=$134,000,000$241,000,000=1.80

What Is The Debt To Asset Ratio

The Debt to Asset Ratio, also known as the debt ratio, is a leverage ratio that indicates the percentage of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risk.

The debt to asset ratio is commonly used by creditors to determine the amount of debt in a company, the ability to repay its debt, and whether additional loans will be extended to the company. On the other hand, investors use the ratio to make sure the company is solvent, is able to meet current and future obligations, and can generate a return on their investment.

Read Also: Pallets Of Items For Sale

What A D/e Ratios Means

A high debt-to-equity ratio generally means that in the case of a business downturn, a company could have difficulty paying off its debts. The higher the D/E, the riskier the business. Startups or companies looking to grow quickly may have a higher D/E naturally, but also could have more upside if everything goes according to plan. Investors use the D/E ratio as a benchmark to determine the risk of investing in a business. D/E is especially relevant when a business uses creditor financing.

However, there are industries where a high D/E ratio is typical, such as in capital-intensive businesses that routinely invest in property, plant, and equipment as part of their operations. On the other hand, lifestyle or service businesses without a need for heavy machinery and workspace will more likely have a low D/E. Holding short-term debt is a reality of many businesses, and a D/E ratio helps put that short-term debt in perspective compared to other company assets.

While lenders and investors generally prefer that a company maintain a low D/E ratio, a low debt-to-equity ratio can also suggest that the company may not be leveraging its assets well, limiting its profitability.

Significance And Use Of Debt Ratio Formula

The debt Ratio formula can be used majorly by the Top Management of a company or the investors:

The debt ratio formula can be used by the top management of the company to take the top-level decision of the company related to its capital structure and future funding. By using the Debt ratio, the top management can take a decision for raising funds. Whether they want to raise funds from external sources like loan or debts or through equity. If the company have enough capitals to repay its obligations, then they can raise fund from external sources.

The debt Ratio formula can be used by the investors who want to invest in the company. This formula shows whether the firm has enough assets or capital to repay the debts and other obligations as the company pays dividends to shareholders after paying all the debts and obligations of the company.

The debt ratio can be used as a measure of financial leverage. If a company have a Debt Ratio greater than 0.50, then the company is called a Leveraged Company. This shows the company has more debt funding in its capital structure. If the company have a lower debt ratio, then the company is called a Conservative company.

| 0 |

Don’t Miss: Chapter 7 Bankruptcy Forms

D/e Ratio Vs Gearing Ratio

Gearing ratios constitute a broad category of financial ratios, of which the D/E ratio is the best known. Gearing is a term for financial leverage.

Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis. The underlying principle generally assumes that some leverage is good, but that too much places an organization at risk.

Debt-to-equity ratio is most useful when used to compare direct competitors. If a companys D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky.

How To Calculate Total Debt Ratio

The total debt ratio, more often called debt ratio, is a measure of a company’s debt leverage and helps you indicate much a company funds itself with debt. If your company needs to borrow some additional money, this ratio is useful as an indicator of how risky lenders will see your company, since lenders use the debt ratio along with other company financial information to determine if lending money makes financial sense. To calculate the figure, you simply use the debt ratio equation where you divide the total liabilities for the business at a given moment by the total assets.

How to calculate debt ratio- divide total liabilities by total assets . a company should maintain a debt ratio no higher than 60 to 70 percent.

Also Check: How Long Does Chapter 13 Bankruptcy Stay On Your Credit

Cautions & Further Explanation

The most important thing to remember is that long term debt does not account for all debt.

Long term debt includes things like mortgages and securities.

But companies also have short term debt obligations like rent and utilities.

Paying off these short term obligations could interfere with their ability to meet their long term obligations so you cant afford to ignore them.

This ratio is a good predictor of their long term burden.

Youll need to get the total debt to total assets ratio in order to see the bigger picture of how the company is doing right now.

About the Author

Wealthy Education

We have been producing top-notch, comprehensive, and affordable courses on financial trading and value investing for 250,000+ students all over the world since 2014.With the best trading courses, expert instructors, and a modern E-learning platform, we’re here to help you achieve your financial goals and make your dreams a reality.

Example Of The Total Debt Service Ratio

To see how your TDS ratio will be determined, just add up monthly debt obligations and divide them by gross monthly income. Here’s a hypothetical example: an individual with a gross monthly income of $11,000 and monthly debt obligations of $4,225 .

Divide the total debt obligation of $4,225 by income of $11,000 to get a TDS ratio of 38.4%, which is not much higher than the low benchmark and well below the max . This individual would most likely get a mortgage.

Don’t Miss: Amazon Liquidation Pallets San Antonio