States With Highest And Lowest Debt

Quick Answer

Debt and income rates vary state-by-state based on housing prices, cost of living and the local economy. To put that in perspective, Experian compared income levels with the amount of debt individuals carry in different states.

Americans collectively owe more than $15.3 trillion in personal debt, accrued by financing homes and cars, taking out loans to attend college or simply by using credit cards. Debt isn’t necessarily a sign of borrowers living beyond their means or buying irresponsibly, though. It’s often used as a tool to achieve financial goals that can have long-term benefits such as buying a home to build equity over many years. Debt and income profiles of every state vary significantly when factors such as housing prices, cost of living and economic opportunities are considered.

While not a factor in credit scores, lenders may consider the balance between an applicant’s debt and personal income when deciding to approve applications for credit and when setting terms on the account, like interest rates. The more of your income used to pay off debt, the more difficult it might be to get approved.

There are many factors at play when discussing debt profiles, however, and not all of them can be included in this analysis. For instance, the ratio between personal debt and income levels fails to capture the complete financial picture of the 49 million Americans with little or no creditas well as systemic disparities in lending practices.

What Is Your Debt

Your debt-to-income ratio refers to the total amount of debt payments you owe every month divided by the total amount of money you earn each month. A DTI ratio is usually expressed as a percentage.

This ratio includes all of your total recurring monthly debt credit card balances, rent or mortgage payments, vehicle loans and more.

Average American Debt By Age

Youve probably heard the saying You have to spend money to make money. Economists debate that, but theres little doubt that people spend more when theyre making more.

The average American has $90,460 in debt, according to a 2021 CNBC report. That included all types of consumer debt products, from credit cards to personal loans, mortgages and student debt.

The average amount of debt by generation in 2020:

- Gen Z : $16,043

- Millennials : $87,448

- Gen X : $140,643

- Baby boomers : $97,290

- Silent generation : $41,281

Don’t Miss: What Happens When You Claim Bankruptcy

How Is The Debt

At What Age Should You Have No Debt

Kevin O’Leary, an investor on Shark Tank and personal finance author, said in 2018 that the ideal age to be debt-free is 45. It’s at this age, said O’Leary, that you enter the last half of your career and should therefore ramp up your retirement savings in order to ensure a comfortable life in your elderly years.

Recommended Reading: What Does Chapter 13 Bankruptcy Do To Your Credit

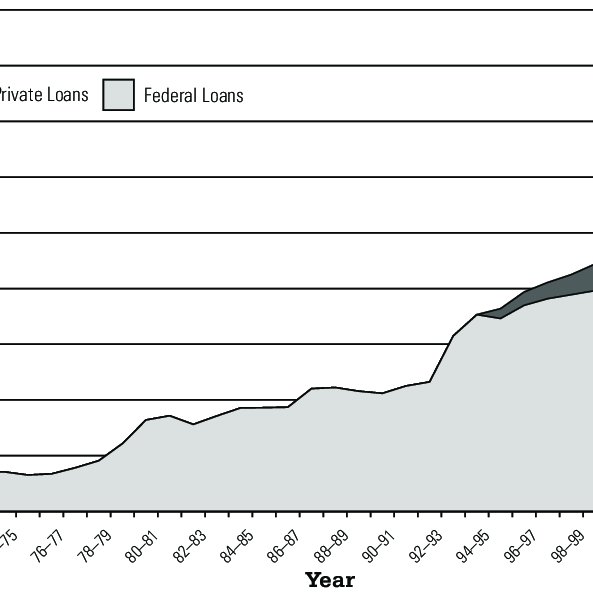

How Much Student Loan Debt Does The Average 30 Year Old Have

Similarly in 2016, 60.4% of students ages 24 to 29 accumulated an average of $ 11,030 in an academic loan. 62.3% of students 30 years of age or older have accumulated an average of $ 10,940 in loans. Adults between the ages of 30 and 45 owe almost half of all student loans.

How much student loan debt does the average person have?

The average college debt among student creditors in the United States is $ 32,731, according to the Federal Reserve. This is an increase of almost 20 percent from 2015-2016. Most lenders have between $ 25,000 and $ 50,000 in student loans.

At what age do most pay off student loans?

The average student loan takes 20 years to pay off their student loans.

- Some undergraduate graduates take over 45 years to repay their student loans.

- 21% of lenders see a student loan amount increase in the first 5 years of their loan.

Average American Debt Payments In : 869% Of Income

The St. Louis Federal Reserve tracks the nation’s household debt payments as a percentage of household income. The most recent number, from the second quarter of 2020, is 8.69%.

That means the average American spends less than 9% of their monthly income on debt payments. That’s a big drop from 9.69% in Q2 2019. This drop could be related to debt relief programs and other allowances made for coronavirus-related income loss — though it could also indicate that consumers have paid off their high-interest debts.

Read Also: Middle District Bankruptcy Florida

Dti Isn’t A Full Measure Of Affordability

Although your DTI ratio is important when getting a mortgage, the number doesn’t tell the whole story about what you can afford.

DTIs don’t take into account expenses such as food, health insurance, utilities, gas and entertainment, and they count your income before taxes, not what you take home each month.

Youll want to budget beyond what your DTI labels as affordable, and consider all your expenses compared with your actual take-home income.

» MORE: How much house can you afford?

How Much Debt Is Normal

While the average American has $ 90,460 in debt, this includes all types of consumer loan products, from credit cards to personal loans, mortgages and student loans.

How much debt is the average 25 year old in?

24-year-old federal borrowers owe an average of $ 14,434. Federal debt among 24-year-old borrowers has fallen 3.6% since 2017. Federal borrowers aged 25 to 34 owe an average debt of $ 33,570. Debt between the ages of 25 and 34 has increased by 6.1% since 2017.

Is 15000 debt a lot?

If you have a large credit card debt of $ 15,000 or more, you are not alone. The average household debt and credit card debt incurred from one month to the next is estimated at more than $ 7,000 in 2019. This is the average.

Don’t Miss: What Happens When You File For Bankruptcy In Texas

Use A Balance Transfer Card

If you carry a high average credit card debt, consider using a balance transfer card. A balance transfer card typically offers 0% for the introductory period. You can transfer your balances from your high-interest credit card onto the balance transfer card with a 0% interest rate.

Even if you continue to make minimum monthly payments on your balance transfer card, you won’t have to worry about collecting interest during the intro period. A balance transfer card provides breathing room, giving you time to pay down high-interest credit card debt.

Household Debt Statistics By Country

1. Total household debt in the European Union is over $7 trillion.

The latest CEIC data shows that the EU recorded household indebtedness was $7.2 trillion in March 2021. This figure is still under the all-time high of $7.71 trillion seen in July 2008. In December 2020, the total household debt represented about 54.1% of the Unions GDP. The total EU household debt is fueled by the family indebtedness of some of Europes leading economies like France and Germany, according to household debt statistics by country shown below.

2. The US, China, and Japan are the countries with the highest total debt for households in the world.

The United States is by far the leader here with its total owed balances of $14.6 trillion. The second in line China doesnt even come close with their $10.2 trillion. Japan rounds up the top three with total owed balances of $3.4 trillion. These figures show the shocking difference in total debt of Americans compared to other nations.

3. The United Kingdom, Germany, and France are among the countries whose households owe over $2 trillion in debt.

The households of several other leading economies owed balances of over $1 trillion, according to the global household debt stats. The United Kingdom leads the way with $2.7 trillion. Germany and France follow with $2.3 trillion and $2.2 trillion, respectively.

4. Canada, Australia, and South Korea all owe over $1 trillion in household debt each.

Also Check: Which Of The Following Phrases Best Summarizes Chapter 13 Bankruptcy

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Average Mortgage Rate In : 278%

2020 was a record year for mortgage rates, with the average 30-year fixed rate at 2.78% on Nov. 5. That’s the lowest it’s been since the St. Louis Fed started compiling this data in 1971.

These low rates have also led to a rush on refinances, especially before the new 0.5% refinance fee kicks in on Dec. 1.

You May Like: Which Is Better Chapter 7 Or 13 Bankruptcy

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

Also Check: Houses For Sale By Bank

How Much Debt Is Ok

The rule used by lenders and the general public is that your total monthly debt should not exceed 36% of your monthly income.

What does debt look like? The amount of debt-to-income ratio is the amount of your monthly debt compared to the gross monthly income , which is expressed as a percentage. A good credit-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43 percent is heavily indebted.

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

You May Like: When Does A Bankruptcy Get Discharged

Average Credit Card Debt In 2020

| Figure | |

|---|---|

| Delinquency rate of all credit card loans from commercial banks, Q2 2020 | 2.42% |

According to the latest Household Debt and Credit survey results from the New York Fed, Americans owe $807 billion in credit card debt as of Q3 2020. That’s down from $881 billion in Q3 2019 and $817 billion in the second quarter of 2020.

This could be because Americans are spending a bit more conservatively with their than they were before the pandemic.

“Consumers tightened their belts in 2020, leading them to carry less revolving debt and focus on paying their credit card bills on time every month,” says Melinda Opperman, President of , a nonprofit HUD-approved housing and nationwide consumer credit counseling organization headquartered in Riverside, California.

“But those encouraging numbers are ironically a sign of financial instability struggling families are cutting back wherever they can as we all brace for the fallout when foreclosure and eviction moratoriums end.”

So what does that mean for individual credit card holders?

According to Experian’s Oct. 20 report, Americans have an average of $5,897 in credit card debt spread over three cards. Americans also have 2.4 store credit cards, on average, with a total balance of $2,044.

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

You May Like: How To Be A Bankruptcy Lawyer

What Happens If My Debt

If your debt-to-income ratio is higher than the widely accepted standard of 43%, your financial life can be affected in multiple waysnone of them positive:

- Less flexibility in your budget. If a significant portion of your income is going towards paying off debt, you have less left over to save, invest or spend.

- Limited eligibility for home loans. A debt-to-income ratio over 43% may prevent you from getting a Qualified Mortgage possibly limiting you to approval for home loans that are more restrictive or expensive.

- Less favorable terms when you borrow or seek credit. If you have a high debt-to-income ratio, you will be seen as a more risky borrowing prospect. When lenders approve loans or credit for risky borrowers, they may assign higher interest rates, steeper penalties for missed or late payments, and stricter terms.

How Much Debt Is The Average Millennial In

Consumer debt in the United States currently stands at about $ 14.88 trillion, representing an average individual debt of nearly $ 93,000, according to data from consumer debt analysis.

How much credit card debt does the average millennial have?

The millennial average is over $ 4,000 in credit card debtâ some generations are extra.

How much debt does the average Gen Z have?

Gen Zers, aged between 18 and 23, holds an average of $ 16,043 in debt, according to data from consumer credit analysis.

Recommended Reading: How Often Can You File Bankruptcy In Ga

How Does A High Or Low Debt

A high debt-to-income ratio directly affects a consumers ability to secure a loan. A debt-to-income ratio of around 6 is generally considered high. Different institutions have different rules around what they consider, but if you have a debt-to-income ratio of 9 or above you likely wont be considered for a loan with the major institutions.

A low debt-to-income ratio is generally under 3.6, and is often viewed favourably by lenders. Having a low debt-to-income ratio can help show an ability to successfully manage debt. Consumers with a low debt-to-income ratio may be more likely to be offered lower fees and rates by prospective lenders and may also have more loan options to choose from.

Related article: Interest rate ranges: How is your rate determined?

What Can You Do If You Find Yourself In Debt

If you have debt, youre likely wondering how you can reduce the amount you owe. And if you carry more than the average debt for your age group, it may be time to work toward reducing that number now. Below are some tips to help lower your debt, including how to improve your credit score and save money.

Also Check: How Do You Qualify For Chapter 7 Bankruptcy

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: Do You Need An Attorney To File Bankruptcy

How Do Lenders Use Your Debt

While there are variations between the different types of debt-to-income ratios that lenders will accept when assessing prospective borrowers, banks and financial institutions generally apply the debt-to-income ratio as part of the credit analysis process.

This process determines the amount of credit risk a borrower has which the lender can use to decide whether to accept or decline their loan request and to pinpoint the amount they will allow the customer to borrow. If a customer has a low debt-to-income ratio, this means that a bank will be more likely to accept their request as they have the income and ability to successfully make the repayment.

Some lenders, particularly non-banks, have their own ways to measure whether a customer will be able to make repayments, such as the Net Service Ratio which assesses serviceability. To calculate the Net Service Ratio, lenders take into account a prospective borrowers after-tax income, and then subtract expenses and other liabilities to work out the loan amount the customer may be able to repay.