How Does Chapter 7 Bankruptcy Work

When you file for Chapter 7 bankruptcy, the court places an automatic temporary stay on your current debts. This stops creditors from collecting payments, garnishing your wages, foreclosing on your home, repossessing property, evicting you or turning off your utilities. The court will take legal possession of your property and appoint a bankruptcy trustee to your case.

The trustee’s job is to review your finances and assets and oversee your Chapter 7 bankruptcy. They will sell certain property the bankruptcy won’t let you keep and use the proceeds to repay your creditors. The trustee will also arrange and run a meeting between you and your creditorscalled a creditor meetingwhere you’ll go to a courthouse and answer questions about your filing.

The list of property you don’t have to sell or turn over to creditors , and the total value that you can exempt, varies by state. Some states let you choose between their exemption list and the federal exemptions. But most Chapter 7 bankruptcy cases are “no asset” cases, meaning all of the person’s property is either exempt or there’s a valid lien against the property.

At the end of the process, approximately four to six months from your initial filing, the court will discharge your remaining debts . However, some types of debts generally aren’t dischargeable through bankruptcy, including child support, alimony, court fees, some tax debts and most student loans.

Start Here To Learn About Protecting Property In Chapter 7 Bankruptcy

When considering Chapter 7 bankruptcy, most people want to know if they can keep their property. The short answer is maybe. Chapter 7 bankruptcy wipes out many qualifying debts, but there is a catchif you own too much property, the bankruptcy trustee can sell some of it and pay the proceeds to your creditors.

So how much property can you keep? The answer depends on “exemptions”state laws that tell you what you’re allowed to protect in Chapter 7 and 13 bankruptcy.

Chapter 7 Bankruptcy For Sole Proprietors

NYC bankruptcy attorney at the Law Office of William Waldner whose sole focus is in the areas of chapter 7 and chapter 13 bankruptcy cases.

getty

Though most lawyers and accountants recommend against sole proprietorships and with good reason they are far and away the most common type of small business in America, with more than 25 million sole proprietors operating a business of some kind, according to 2016 IRS data.

True, many of those might only earn a tiny fraction of their income from their sole proprietorship and may view their side hustle as more of a hobby that earns them enough to get Uncle Sam’s attention. When you file that Schedule C and you don’t have a separate business entity, you’re a sole proprietor, whether or not you think of yourself as owning or running a full-fledged business. For some, a sole proprietorship may be advantageous, but in general they’re best avoided.

But you’re an entrepreneur: a risk taker. Maybe you’ve thrown caution to the wind and grown your business from a small garage enterprise to six figures per year and you never stopped to form a separate business entity along the way. Or, maybe things just grew faster than you expected and you never got around to taking that important step.

Either way, if your business hits hard times before you’ve moved away from a sole proprietorship, you may be confronted with additional complications that legally separate business entities don’t have to face.

What are your other bankruptcy options?

Recommended Reading: How Long To Refinance After Bankruptcy

Why Its Called A Liquidation Bankruptcy

A Chapter 7 bankruptcy provides the filer with lasting debt relief in the form of a discharge, which can be granted within 3 months of filing their case in the bankruptcy court. In exchange, the filer gives up those possessions that are not protected by an exemption.

A trustee takes those so-called non-exempt assets and sells them, using the proceeds to pay creditors. More than 95% of Chapter 7 cases are no-asset cases that donât result in a payout to creditors.

When Should You File For Chapter 7 Bankruptcy

Bankruptcy is a last resort for those who are struggling financially and cant afford to repay their debts. Bankruptcy may be a good option for you if:

- Your debt-to-income ratio is 50% or higher

- Youre struggling to pay your bills

- Youre dipping into accounts like your 401 in order to keep up with your bills

You May Like: How Long Can A Bankruptcy Remain On A Credit Report

Houses Cars And Property Encumbered By A Secured Loan

If you own a house, car, or expensive household furnishings, chances are you had to take out a loan to purchase them. Your lender typically has a security interest in the property . This security interest is not affected by bankruptcy in most cases. Since bankruptcy does not erase security interests, the bankruptcy trustee is only concerned with how much equity you have in the property.

Each state allows you to exempt a certain amount of equity in your personal property and your house. So whether a trustee will sell your property depends on the amount of equity you have in the property and your state’s exemption laws. If you have no equity in your house or personal property, you don’t have to worry about the trustee taking them. However, if you wish to keep them, you must continue making regular payments to your lender. Your lender may also require you to “reaffirm” your debt to keep the property after bankruptcy.

What Can You Not Do Before A Chapter 7 Bankruptcy Filing

The bankruptcy court will examine past transactions made within a specified period before you file. The “look back” period is usually one to two years but can be up to ten years. Many mistakes can be avoided simply by delaying your bankruptcy filing until these periods have expired. But that’s not always the case, so it’s important to talk with a bankruptcy lawyer to avoid potential allegations of bankruptcy fraud.

Read Also: What Does Chapter 13 Mean On Bankruptcies

Chapter 13 Bankruptcy: Modification Of An Individuals Debts As Per Regular Income

Chapter 13 Bankruptcy is made for persons who possess a steady income source and wish to pay off all their debts however, it is incapable of doing so. The Bankruptcy Chapter 13 might be desirable to Chapter 7 science Chapter 13 typically lets the debtor hold on to a precious asset, for example, an individuals house. The debtor is empowered to place and suggest a key strategy in front of the court under Bankruptcy Chapter 13. The strategy describes how the debtor would reimburse creditors with time over a period ranging from three to five years. Finally, the Court should later approve of this strategy.

Suppose the Court accepts the strategy, the debtor would need to pay the creditors via a trustee. Any outstanding debt would be discharged upon the successful plan completion. Hence, the debtor gets protected from all the actions taken by creditors that include an actual agreement with that debtor for the entire strategys life, wage garnishments, and lawsuits.

Chapter 13 Bankruptcy Eligibility:

- Overall debt should not be extremely high.

- The Bankruptcy filing candidate must be current on their income tax reporting.

Chapter 13 Bankruptcy Example

Under this situation, since Josh successfully meets all the conditions of filing a Chapter 13 petition, he subsequently decides to hire a lawyer and file a Chapter 13 Bankruptcy petition to get some financial respite.

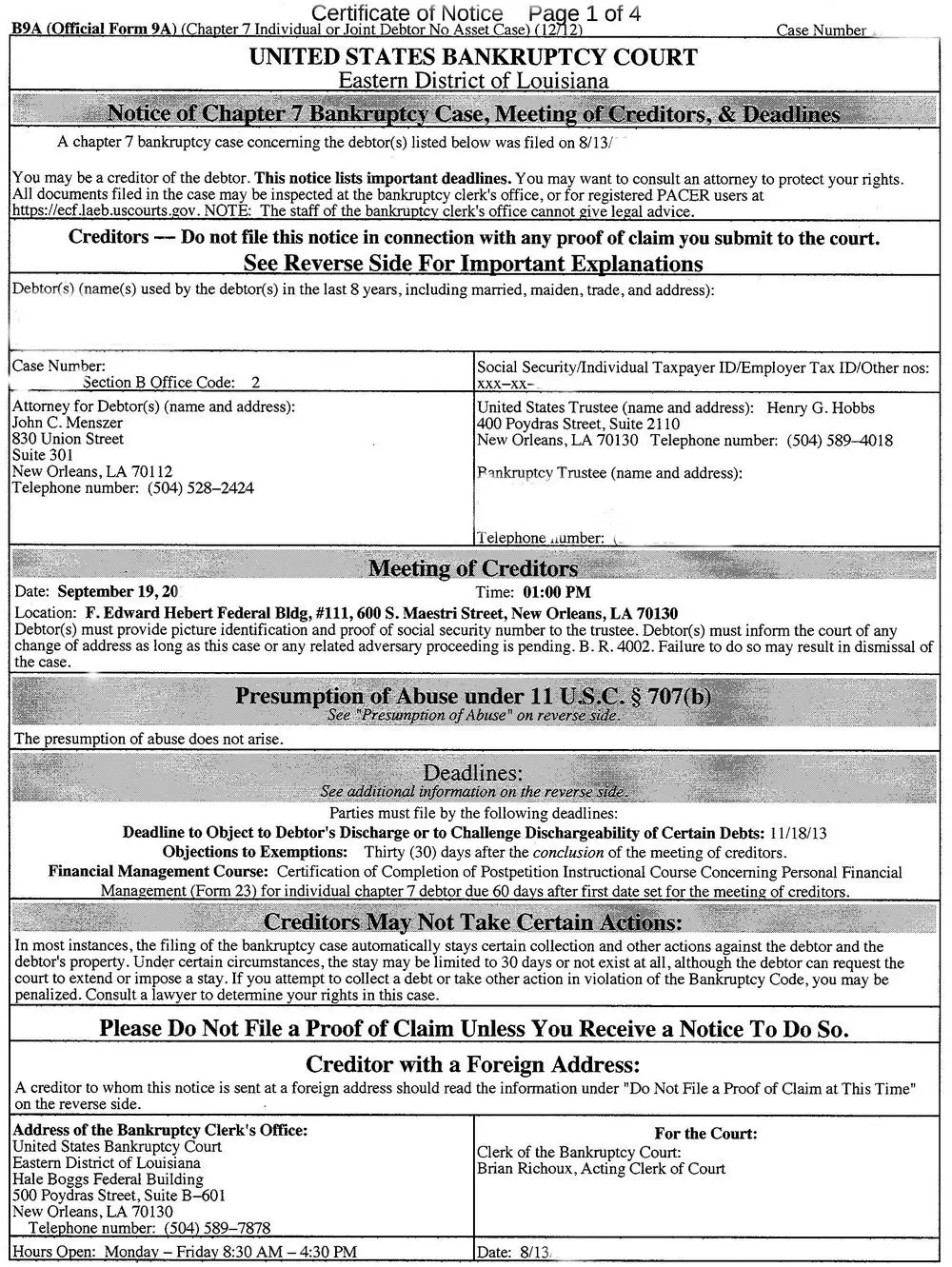

The Meeting Of Creditors

The court will issue notice of a debtor’s “meeting of creditors” when a Chapter 7 bankruptcy is filed. This is often referred to as the “341 meeting” after the bankruptcy code number that provides for it. The notice is sent to all of the creditors that are listed in your bankruptcy documents.

Any creditor can appear at the meeting and ask the debtor questions about their bankruptcy and their finances. The most common creditors that typically appear are auto lenders that want to know what you intend to do about your car payment if you have one.

Also Check: What Will Bankruptcy Do To My Credit Score

Bankruptcy Doesn’t Clear Most Liens On Your Property

Bankruptcy clears you of the responsibility to pay a mortgage, car loan, or another secured debt automatically. Bankruptcy doesn’t remove a lien giving the creditor the right to take property if you don’t pay.

For instance, you’ll lose your car if you don’t continue paying your car payment informally or sign a reaffirmation agreement. The lender can use its lien rights to repossess it during the Chapter 7 case after asking the court to lift the “automatic stay” order preventing collection efforts, or wait until the Chapter 7 case ends.

Overview Of Bankruptcy Chapters

The Bankruptcy Code appears in title 11 of the United States Code, beginning at 11 U.S.C. 101. Its principal chapters are briefly outlined below:

Chapter 7 bankruptcy is a liquidation proceeding available to consumers and businesses. Those assets of a debtor that are not exempt from creditors are collected and liquidated , and the proceeds are distributed to creditors. A consumer debtor receives a complete discharge from debt under Chapter 7, except for certain debts that are prohibited from discharge by the Bankruptcy Code.

Chapter 11 bankruptcy provides a procedure by which an individual or a business can reorganize its debts while continuing to operate. The vast majority of Chapter 11 cases are filed by businesses. The debtor, often with participation from creditors, creates a plan of reorganization under which to repay part or all of its debts.

Also Check: Can You Discharge Private Student Loans In Bankruptcy

Business Use Of Chapter 11 And Chapter 7

Businesses frequently use both types of these bankruptcies. Choosing between these two chapters comes down to what business owners hope to achieve with their business in the long run. If the business is not profitable or worth keeping, Chapter 7 bankruptcy is a reasonable choice. If the business is profitable, Chapter 11 may be a good option. It is worth noting, however, that few small businesses survive the costs of Chapter 11 bankruptcy.

Bankruptcy Debt Repayment And Discharge

When a company is being liquidated in a chapter 7 bankruptcy, there is an order of priority in which debts are paid off. The assets are liquidated and the funds are used to repay the debt according to that priority. If there are assets remaining once debts are repaid, they can be distributed to shareholders, but if debts are greater than available assets, shareholders may get nothing at all.

You May Like: How To Find Bankruptcy Filings In Texas

Don’t File For Bankruptcy If You’ll Receive Future Payments

Funds you don’t have yet but expect to get in the future are part of your bankruptcy estate. If you are filing for Chapter 7 bankruptcy, the Chapter 7 trustee can take this money and use it to repay your unsecured creditors.

Examples include agreeing to accept a future bonus at work, getting an inheritance you’ll receive in the future, or filing tax returns that entitle you to a refund. If you anticipate receiving any payments or money in the future, talk to a bankruptcy attorney.

Don’t Deposit Unusual Amounts Before Filing Bankruptcy

You won’t want to deposit money that isn’t considered salary or payment to you into your bank account. Examples would be depositing money in your account as a favor to others or which is not your money.

Consumers with small businesses should refrain from conducting transactions for the company using personal accounts. You’ll likely have difficulty proving that the funds weren’t yours, and it might cause a problem with your ability to pass the means test and qualify for Chapter 7 bankruptcy. Learn more about bank accounts in bankruptcy.

You May Like: Why Did Pg& e File For Bankruptcy

The Chapter 7 Trustee

The Chapter 7 bankruptcy trustee assigned to the case is in charge of making sure the creditors get what theyâre due under the bankruptcy laws. They donât represent the filer or any specific creditor. But, just like the filer and the creditors, they want to make sure the case proceeds as smoothly as possible.

The trusteeâs duties include reviewing the filerâs tax returns and recent pay stubs and determining whether any property can be sold for the benefit of creditors. To ensure the fair treatment of all unsecured creditors, bankruptcy trustees have wide-ranging powers that include the ability to undo payments to creditors and property transfers where the filer received less than fair market value for the property. So, if someone transfers a piece of property to someone else so it doesnât come into the bankruptcy estate, the trustee can and will undo that transfer and sell the property.

The Trusteeâs Role In A No-asset Case

Once a trustee fulfills their duties and after determining that there are no assets that can be sold for the benefit of creditors, the trustee notifies the bankruptcy court and asks to be relieved from the case. This can happen as soon as the meeting of creditors has been completed. Once a trustee files the no-asset report, the case is essentially on auto-pilot until the discharge is entered. Chapter 7 cases where a report of no distribution has been filed are closed by the court once the discharge has been entered.

Pros And Cons Of Chapter 7 Bankruptcy

Filing for bankruptcy is serious business, so its important that you understand the benefits and risks before beginning the process.

| Pros | Cons |

|---|---|

|

Can offer a fresh financial start and your credit score may start to go up after your debt is discharged You may be able to keep certain exempt assets Collection efforts by your creditors must stop as soon as you file |

May impact your ability to get credit, buy a home or car and rent an apartment for some time Can remain on your credit report for up to 10 years You may lose some of your assets, such as vehicles, jewelry and real estate |

In order to file Chapter 7, you must be able to pass a means test, which is designed to determine whether you have the means to repay a portion of your debts. The process requires you to provide information about your income, expenses and debt, and if you dont pass, your case may be converted to Chapter 13 or be dismissed altogether. Additional information on means testing is available through the U.S. Department of Justice.

But just because youre eligible doesnt mean filing for bankruptcy is the right choice for your financial situation. Chapter 7 bankruptcy may make sense for people who:

Don’t Miss: Can You Keep Your House And Car In Bankruptcy

Which Debts Will Chapter 7 Bankruptcy Discharge

Chapter 7 filers discharge all of the following debts :

- collection agency accounts

- old tax penalties and unpaid taxes

- most attorneys’ fees

- government program overpayments, including welfare, Social Security, and veterans assistance programs.

You can use our list to get a general feel for whether you’re a potential Chapter 7 candidate, but it’s best to review your particular debts with a bankruptcy lawyer. Why? Because you might have dischargeable debts that don’t appear above.

As much as we’d like to, we can’t create a list that includes all dischargeable debts because bankruptcy law doesn’t tell us the debts you can discharge. Instead, the law tells us the debts you can’t erase in bankruptcy, which we cover in “Chapter 7 Bankruptcy Doesn’t Clear All Debts” below.

Note about fraud and utility deposits. Any debt-related misconduct or fraud can turn a dischargeable obligation into a nondischargeable debt. Also, a utility provider can’t refuse to provide service because of a bankruptcy filing but can charge a reasonable deposit to ensure future payment.

Find out about utility shut-offs and Chapter 7 bankruptcy.

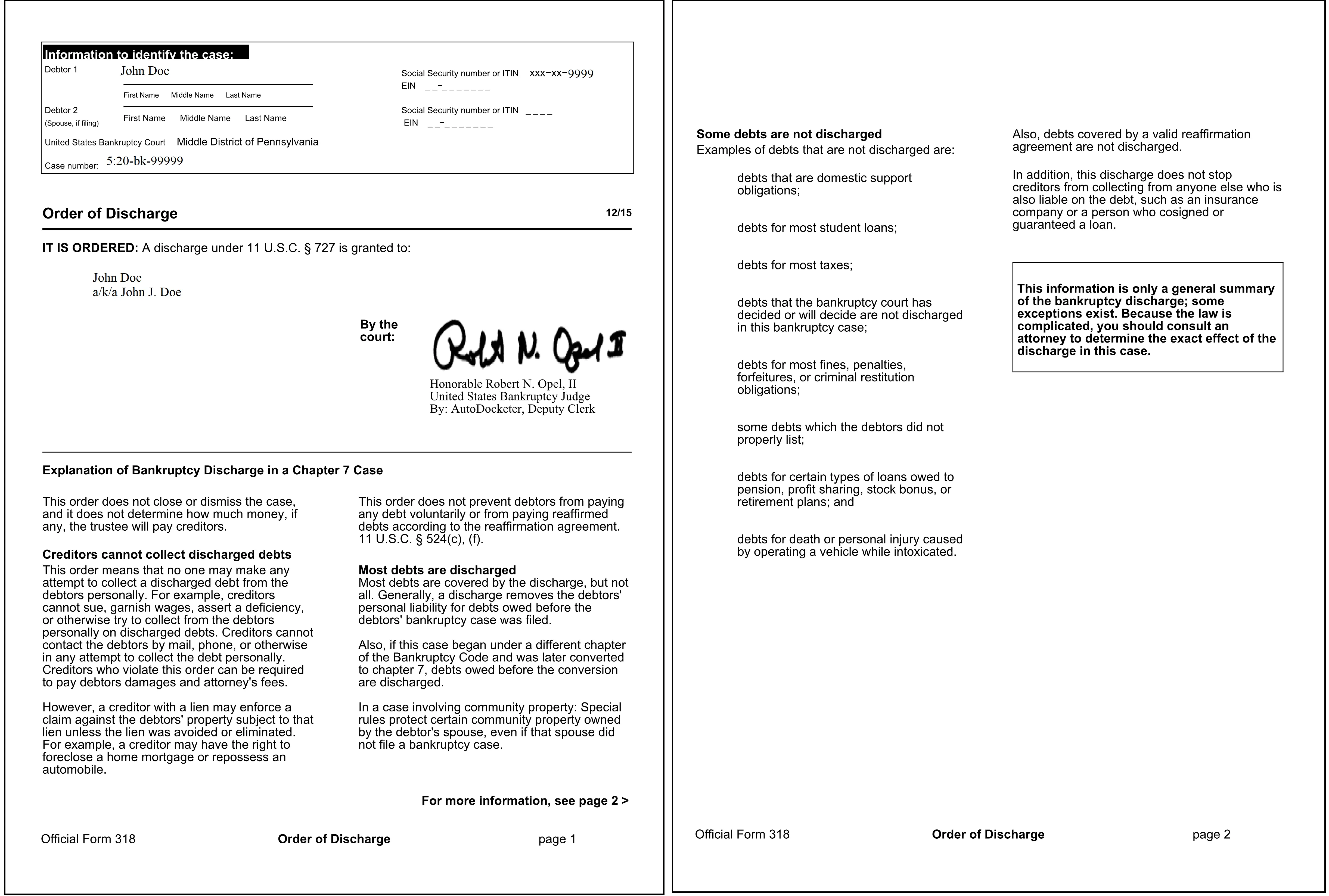

Discharging Debts In Bankruptcy

A bankruptcy discharge releases a debtor from being personally responsible for certain types of debts. So, after a bankruptcy discharge, the debtor is no longer legally required to pay any debts that are discharged.

The discharge prohibits the creditors of the debtor from collecting on the debts that have been discharged. This means that creditors have to stop all legal action, telephone calls, letters, and other type of contact with the debtor. This prohibition is permanent for the debts that have been discharged by the bankruptcy court.

You cannot discharge all debts in bankruptcy. Some of the most common debts that you cannot get rid of in bankruptcy are debts from child or spousal support, most student loans, most tax debts, wages you owe people who worked for you, damages for personal injury you caused when driving while intoxicated, debts to government agencies for fines or penalties, and more.

Recommended Reading: Can You Get A Usda Loan With A Bankruptcy

Consequences Of Chapter 7 Bankruptcy

The consequences of a chapter 7 bankruptcy are simple: the company goes out of business and all remaining debts that cannot be paid are discharged. As the company is dissolved, it will likely cease to meet the listing requirements necessary to continue to trade on a major exchange. It may continue to trade over the counter or not at all.

Executory Contracts During Chapter 7 Bankruptcy

An executory contract is a legal term referring to a contractual agreement that both parties are obligated to perform in consideration for a benefit . Executory contracts do not include at-will contracts such as employment agreements or personal service contracts.

Chapter 7 bankruptcy permits the debtor, or the trustee, to assume or reject an executory contract. A debtor must decide if they want to remain bound by their executory contracts prior to the courts issuance of a bankruptcy discharge which usually happens about 90 days after filing.

A car lease is an example of an executory contract. If the debtor rejects a car lease, they surrender the car to the leasing company and have no further personal liability. If the debtor wants to assume the lease they can keep the property provided they make the lease payments. The leasing company can take back the car if the debtor subsequently defaults on lease payments.

Assumption of an executory contract is not the same as a reaffirmation of the lease, and the leasing company may not sue the debtor for the balance of payments due under the lease following default.

Recommended Reading: How Does Bankruptcy Work In Indiana