Why Is The Us In Debt To China

The U.S. doesn’t restrict who may buy its securities. China invests in U.S. debt because of the positive effect these low-risk, stable investments can have on its economy. By investing in dollar-denominated securities, the value of the dollar increases relative to the value of China’s currency, the yuan. This, in turn, makes Chinese goods cheaper and more attractive than U.S. goods to buyers. That increases sales and strengthens the economy.

Paks Economic Crisis Is Well Known Lanka Also Just Saw A Dramatic Change In Govt Followed By Massive Revolt By Public Over Sky

After Pakistan and Sri Lanka falling under severe debts of Chinese loans, Bangladesh has now sounded an alert, warning developing countries to think twice over taking more loans through Chinas Belt and Road Initiative as global inflation and slowing growth add to the strains on indebted and vulnerable emerging markets.

Pakistans economic crisis is well known and Sri Lanka also just saw a dramatic change in government followed by massive revolt its public over deep financial burdens, sky-rocketing inflation triggered by depleting foreign reserves. Nepal, too, is said to be foreseeing an economic crisis and earlier this year banned the import of vehicles and other luxury items, due to declining foreign exchange reserves.

ALSO READ:How Rajapaksa Clan And Chinese Loans Put Sri Lanka on Expressway of Economic Collapse

One factor common between these countries is that they are all part of Chinas BRI global infrastructure development strategy aimed at investment by Beijing in nearly 70 countries. The Chinese government, through BRI, invests in building ports, roads, bridges, dams, power stations, railroads, etc. China is known to have BRI deals with all three countries, two of which are already reeling under a massive economic crisis and the remaining foreseeing one.

China is one of the biggest owners of U.S. debt.

China Us Lead Rise In Global Debt To Record High $305 Trillion

A view of the city skyline in Shanghai, China February 24, 2022. Picture taken February 24, 2022. REUTERS/Aly Song

Register now for FREE unlimited access to Reuters.com

NEW YORK, May 18 – The world’s two largest economies borrowed the most in the first quarter as global debt rose to a record above $305 trillion, while the overall debt-to-output ratio declined, data from the Institute of International Finance showed on Wednesday.

China’s debt increased by $2.5 trillion over the first quarter and the United States added $1.5 trillion, the data showed, while total debt in the euro zone declined for a third consecutive quarter.

The analysis showed many countries, both emerging and developed, are entering a monetary tightening cycle -led by the U.S. Federal Reserve- with high levels of dollar denominated debt.

Register now for FREE unlimited access to Reuters.com

“As central banks move ahead with policy tightening to curb inflationary pressures, higher borrowing costs will exacerbate debt vulnerabilities,” the IIF report said.

“The impact could be more severe for those emerging market borrowers that have a less diversified investor base.”

The yield on the benchmark 10-year Treasury note has risen some 150 basis points so far this year and earlier this month hit its highest since 2018.

Also Check: What Happens When You File For Bankruptcy In Ny

Concerns Over Chinese Holdings Of Us Debt

According to a 2013 Forbes article, many American and other economic analysts have expressed concerns on account of the Peoples Republic of Chinas extensive holdings of United States government debt as part of their reserves. The National Defense Authorization Act of FY2012 included a provision requiring the Secretary of Defense to conduct a national security risk assessment of U.S. federal debt held by China. The department issued its report in July 2012, stating that attempting to use U.S. Treasury securities as a coercive tool would have limited effect and likely would do more harm to China than to the United States. An August 19, 2013 Congressional Research Service report said that the threat is not credible and the effect would be limited even if carried out. The report said that the threat would not offer China deterrence options, whether in the diplomatic, military, or economic realms, and this would remain true both in peacetime and in scenarios of crisis or war.

Breaking Down The Us Debt And Who Owns It

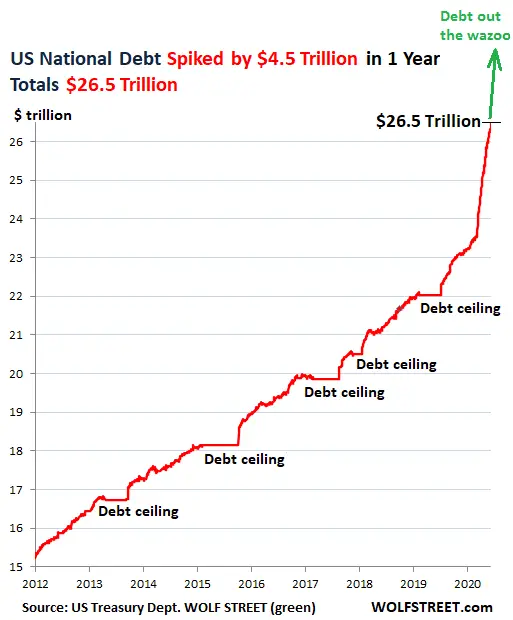

In 2011, the total U.S. debt stood at $14.3 trillion. By June 2017, the debt had grown to $19.8 trillion and was projected to top $20 trillion by January 2018. In addition, many economists contend that the reported U.S. debt should include at least another $120 trillion in unfunded future liabilitiesmoney the government does not currently have but is legally obligated to pay people in the future.

The government itself actually holds just under one-third, about $5 trillion, of the $19.8 trillion government debt in the form of trust funds dedicated to legislatively-mandated programs like Social Security, Medicare, and Medicaid and veterans benefits. Yes, this means that the government actually borrows money from itself to fund these and other entitlement programs. Financing for these huge annual IOUs comes from the Department of the Treasury and the Federal Reserve.

Most of the rest of the U.S. debt is owned by individual investors, corporations and other public entitiesincluding foreign creditors like the Chinese government.

Among all of those foreign creditors to which America owes money, China led the way at $1.17 trillion, followed by Japan, at $1.07 trillion as of January 2018.

Also Check: How To File Bankruptcy In Mn

Consequences Of Owing Debt To The Chinese

It’s politically popular to say that the Chinese “own the United States” because they are such a huge . The reality is very different than the rhetoric.

If China called in all of its U.S. holdings, the U.S. dollar would depreciate, whereas the yuan would appreciate, making Chinese goods more expensive.

While around 3.2% of the national debt isn’t exactly insignificant, the Treasury Department has had no problems finding buyers for its products even after a rating downgrade.

If the Chinese suddenly decided to call in all of the federal government’s obligations , others would likely step in to service the market. This includes the Federal Reserve, which already owns six times as much debt as China.

A Conversation With Scott Miller

Skip to another question

- 0:12 Can China use its creditor position as an instrument of power or leverage against the U.S?

- 2:09 Why do countries buy each others debt?

- 3:40 If China sells its U.S. Treasury Bonds, what would happen? How would the economies of both countries be affected?

- 5:43 Would countries still eagerly buy US Treasury Bonds if the US dollar was no longer the world economys reserve currency?

Despite U.S. debts attractive qualities, continued U.S. debt financing has concerned economists, who worry that a sudden stop in capital flows to the United States could spark a domestic crisis.1 Thus, U.S. reliance on debt financing would present challengesnot if demand from China were halted, but if demand from all financial actors suddenly halted.2

From a regional perspective, Asian countries hold an unusually large amount of U.S. debt in response to the 1997 Asian Financial Crisis. During the Asian Financial Crisis, Indonesia, Korea, Malaysia, the Philippines, and Thailand saw incoming investments crash to an estimated -$12.1 billion from $93 billion, or 11 percent of their combined pre-crisis GDP.3 In response, China, Japan, Korea, and Southeast Asian nations maintain large precautionary rainy-day funds of foreign exchange reserves, whichfor safety and convenienceinclude U.S. debt. These policies were vindicated post-2008, when Asian economies boasted a relatively speedy recovery.

Also Check: Can You Buy A House With Bankruptcy On Your Record

Pboc Strategy And Chinese Inflation

Though other labor-intensive, export-driven countries such as India carry out similar measures, they do so only to a limited extent. One of the major challenges resulting from the approach that’s been outlined is that it leads to high inflation.

China has tight, state-dominated control on its economy and is able to manage inflation through other measures like subsidies and price controls. Other countries dont have such a high level of control and have to give in to the market pressures of a free or partially free economy.

Who Owns The Most Us Debt

Around 70 percent of U.S. debt is held by domestic financial actors and institutions in the United States. U.S. Treasuries represent a convenient, liquid, low-risk store of value. These qualities make it attractive to diverse financial actors, from central banks looking to hold money in reserve to private investors seeking a low-risk asset in a portfolio.

Of all U.S. domestic public actors, intragovernmental holdings, including Social Security, hold over a third of U.S. Treasury securities. The secretary of the treasury is legally required to invest Social Security tax revenues in U.S.-issued or guaranteed securities, stored in trust funds managed by the Treasury Department.

The Federal Reserve holds the second-largest share of U.S. Treasuries, about 13 percent of total U.S. Treasury bills. Why would a country buy its own debt? As the U.S. central bank, the Federal Reserve must adjust the amount of money in circulation to suit the economic environment. The central bank performs this function via open market operationsbuying and selling financial assets, like Treasury bills, to add or remove money from the economy. By buying assets from banks, the Federal Reserve places new money in circulation in order to allow banks to lend more, spur business, and help economic recovery.

The biggest effect of a broad scale dump of US Treasuries by China would be that China would actually export fewer goods to the United States.

Scott Miller

You May Like: How Long Will Bankruptcy Be On My Credit Report

Interest And Debt Service Costs

Despite rising debt levels, interest costs have remained at approximately 2008 levels because of lower than long-term interest rates paid on government debt in recent years. The federal debt at the end of the 2018/19 fiscal year was $22.7 trillion. The portion that is held by the public was $16.8 trillion. Neither figure includes approximately $2.5 trillion owed to the government. Interest on the debt was $404 billion.

The cost of servicing the U.S. national debt can be measured in various ways. The CBO analyzes net interest as a percentage of GDP, with a higher percentage indicating a higher interest payment burden. During 2015, this was 1.3% GDP, close to the record low 1.2% of the 19661968 era. The average from 1966 to 2015 was 2.0% of GDP. However, the CBO estimated in 2016 that the interest amounts and % GDP will increase significantly over the following decade as both interest rates and debt levels rise: “Interest payments on that debt represent a large and rapidly growing expense of the federal government. CBO’s baseline shows net interest payments more than tripling under current law, climbing from $231 billion in 2014, or 1.3% of GDP, to $799 billion in 2024, or 3.0% of GDPthe highest ratio since 1996.”

According to a study by the Committee for a Responsible Federal Budget , the U.S. government will spend more on servicing their debts than they do for their national defense budget by 2024.

How The Ownership Of Us Debt Works

By mid-2017, the total amount of official debt owed by the federal, state, and local governments was more than $19.8 trillion. That figure was $30.5 trillion as of June 30, 2022. Some experts insist on adding hundreds of trillions in unfunded future liabilities on the federal government balance sheet.

Of the $30.5 trillion in government debts, more than $6 trillion is owned by the federal government in trust funds. These are accounts dedicated to Social Security, Medicare, and other entitlements.

In simpler terms, the government wrote itself a really big IOU and bankrupted one account to finance another activity. IOUs are formed and financed through joint efforts of the U.S. Department of the Treasury and the Federal Reserve.

Much of the rest of the debt is owned by individual investors, corporations, and other public entities. This includes everyone from retirees who purchase individual U.S. Treasurys to the Chinese government.

From May 2021 to May 2022, the debt to Japan and China decreased by 4% and 9%, respectively.

Japan commands the top spot among foreign creditors with $1.2 trillion4% of total U.S. debtowed by the U.S. government. China holds the number two position, holding $980.8 billion of U.S. Treasurys3.2% of the total U.S. debt.

Japanese-owned debt doesn’t receive nearly as much negative attention as Chinese-owned debt, ostensibly because Japan is seen as a friendlier nation and the Japanese economy hasn’t grown as fast as China’s year after year.

Recommended Reading: Credit Card Debt Relief Government Program

The Countries Most In Debt To China

Countries heavily in debt to China are mostly located in Africa, but can also be found in Central Asia, Southeast Asia and the Pacific, data from The World Bank shows. China is currently the preferred lender to the worlds low-income countries, which owe 37% of their debt to China in 2022, compared to just 24% in bilateral debt to the rest of the world.

The Chinese “New Silk Road” project, a program to finance the construction of port, rail and land infrastructure across the globe, has been a major source of debt to China for participating countries. At the end of 2020, of the 97 countries for which data was available, those with the highest external debt to China were all involved in the project, namely Pakistan , Angola , Ethiopia , Kenya and Sri Lanka .

This chart shows external debt to China as a percentage of gross national income .

Statista

The countries with the biggest debt burdens in relative terms were Djibouti and Angola, where debt to China exceeded 40% of gross national income, an indicator similar to GDP but also including income from overseas sources. The equivalent of 30% of GNI or more in Chinese debt affect the Maldives and Laos, with the latter just having opened a railway line to China which is already causing debt issues for the country.

Debt forgiveness from China?

Why Do Countries Accumulate Foreign Exchange Reserves

Any country that trades openly with other countries is likely to buy foreign sovereign debt. In terms of economic policy, a country can have any two but not three of the following: a fixed exchange rate, an independent monetary policy, and free capital flows. Foreign sovereign debt provide countries with a means to pursue their economic objectives.

The first two functions are monetary policy choices performed by a countrys central bank. First, sovereign debt frequently comprises part of other countries foreign exchange reserves. Second, central banks buy sovereign debt as part of monetary policy to maintain the exchange rate or forestall economic instability. Third, as a low-risk store of value, sovereign debt is attractive to central banks and other financial actors alike. Each of these functions will be discussed briefly.

You May Like: Can You File Bankruptcy And Still Keep Your Home

Public Debt And Intragovernmental Holdings

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The Social Security Trust Fund owns a significant portion of U.S. national debt, but how does that work and what does it mean? Below, we’ll dive into who actually owns the U.S. national debt and how that impacts you.

How Bad Is It

Chinaâs debt is more than 250 percent of GDP, higher than the United States. It remains lower than Japan, the worldâs most indebted leading economy, but some experts say the concern is that Chinaâs debt has surged at the sort of pace that usually leads to a financial bust and economic slump.

Total debt to GDP

Recommended Reading: How To Write A Bankruptcy Letter

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

Usd As A Reserve Currency

Effectively, China is buying the present-day reserve currency. Until the 19th century, gold was the global standard for reserves. It was replaced by the British pound sterling. Today, it is the U.S. Treasurys that are considered virtually the safest.

Apart from the long history of the use of gold by multiple nations, history also provides instances where many countries had huge reserves of pounds sterling in the post-World-War-II era. These countries did not intend to spend their GBP reserves or to invest in the U.K. but were retaining the pounds sterling purely as safe reserves.

When those reserves were sold off, however, the U.K. faced a currency crisis. Its economy deteriorated due to the excess supply of its currency, leading to high-interest rates. Will the same happen to the U.S. if China decides to offload its U.S. debt holdings?

It’s worth noting that the prevailing economic system after the WW-II era required the U.K. to maintain a fixed exchange rate. Due to those restraints and the absence of a flexible exchange rate system, the selling off of the GBP reserves by other countries caused severe economic consequences for the U.K.

Since the U.S. dollar has a variable exchange rate, however, any sale by any nation holding huge U.S. debt or dollar reserves will trigger the adjustment of trade balance at the international level. The offloaded U.S. reserves by China will either end up with another nation or will return back to the U.S.

Read Also: Breakdown Of Us Debt