How Does Filing Bankruptcy Impact Credit

Your credit may not be in tip-top shape by the time you consider filing for bankruptcy, since high balances and missed payments are the top factors affecting your credit score. Still, the presence of a bankruptcy on your credit report will severely impact your credit scores and creditworthiness the entire time it is on your report. That impact will lessen as time passes, however. Chapter 7 bankruptcy remains on your report for up to 10 years, and Chapter 13 stays there for up to seven years.

It’s not an ideal credit situation, of course, but you can use the time to manage your debts wisely and make consistent on-time payments. Like with any damage to your creditworthiness, it’s possible to rebuild your credit with some focus and patiencealong with using the debt relief provided by the bankruptcy to get back on track financially.

How Do I Apply For Bankruptcy

The unfortunate reality of bankruptcy is that it will cost some moneymore if you hire legal help, which you probably should . All filings have to go through U.S. bankruptcy courts, where the cost to file is $335 for Chapter 7 and $310 for Chapter 13. However, you can ask the court to either waive your fee or let you pay with monthly installments. You’ll also have to take debtor education courses if you file on your own.

And that’s just the beginning. There’s a list of documents you’ll need to take care of, as well as the specific repayment proposal you need to submit for Chapter 13. That proposal gets reviewed by a court-appointed trustee, who contacts your creditors before approving your submission. Overall, neither filing is an easy process to handle on your own, and even minor mistakes on your end could be a setback for your case.

So, whether you file for Chapter 7 or Chapter 13 bankruptcy, it’s typically a good idea to hire a lawyer to help you petition. A bankruptcy attorney’s price depends on the nature and complexity of your filing, with Chapter 13 filings on the pricier end, but the price tag doesn’t necessarily mean a lawyer is out of the question for you. Discuss payment plans with potential attorneys, check out local pro-bono lawyers and legal aid offices, or use an online tool like Upsolve to cover your bases when it comes to bankruptcy.

Three Types Of Bankruptcy

There are three types of bankruptcy, personal, small business and corporate. But despite being designated as their own type, personal and small business bankruptcies are essentially the same thing. Note that this is only true if the small business is set up as partnership or sole proprietorship, not if it is incorporated.

Before you can declare any type of bankruptcy in Canada, you need to work with a Licensed Insolvency Trustee, who will assess your financial situation and recommend which type of bankruptcy you may qualify for.

There are some basic, general qualifiers that set the parameters for whether or not youll be able to declare bankruptcy, including:

- You must be a Canadian resident

- You must owe more than $1000 to creditors

- Your debts are greater than the value of your assets and/or you are not be able to pay your bills when they are due

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

A Note On Eliminating Tax Debt

It is vital to know that very few tax debts get discharged. You are still liable for most tax debt after bankruptcy â particularly federal taxes.

However, bankruptcy law allows the discharge of tax debt only in some very limited circumstances. As a rule of thumb, a debtor is more likely to have tax debt discharged in Chapter 7 than in a Chapter 13 bankruptcy.

Chapter 1: Small Business Repayment Plan

Customarily reserved for individuals, Chapter 13 can be used for small business bankruptcy by sole proprietorships because the sole proprietor and the individual are indistinguishable; in the eyes of the law, they exist as one.

The small business that wants to reorganize rather than liquidate files Chapter 13, including a repayment plan that details how debts will be repaid.

The amount that must be repaid hinges on how much you earn, how much is owed, and the value of the property owned.

Why not file Chapter 7 liquidation bankruptcy and be done with it? Chapter 13 protects personal assets, such as a home, which would be exposed to seizure if a sole proprietor filed Chapter 7.

Recommended Reading: How To File Bankruptcy In Wisconsin

Types Of Business Bankruptcies

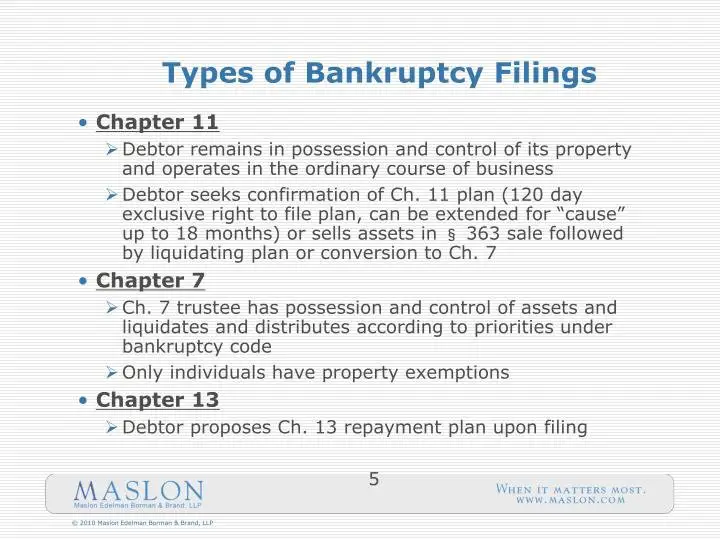

Business bankruptcies typically fall into one of three categories. Two Chapter 7 and Chapter 13 are variations on the personal bankruptcy theme. Chapter 11 bankruptcy is generally for businesses that have hit a bad patch and might be able to survive if their operations, along with their debt, can be reorganized.

Business bankruptcies involve legal entities ranging from sole proprietorships and LLCs to partnerships, professional associations, and corporations.

Getting A Lawyer To Help You With Your Bankruptcy

Bankruptcy is a specialized area of law that is very complex. And the issues are not always apparent or simple. The bankruptcy laws changed in October 2005 to discourage many people from filing for bankruptcy. So the law became more complicated. And there are more situations where a mistake can result in your case getting dismissed. If your case is dismissed, the bankruptcy court often imposes a penalty of 180 days before you can refile, and in this time period a lot can happen. This is why it is so important to have a lawyer advise you and help you with your bankruptcy.

Find a lawyer who can help you work through the issues, alternatives you may have, and consequences of your choices.

- Pick a lawyer with whom you are comfortable, one who will allow you to ask questions and give you responses that you can understand.

- Pick a lawyer who either specializes in bankruptcy or does a large part of his or her practice in the field.

- Ask questions until you understand what your choices are.

- Don’t be afraid to interview a lawyer and leave without hiring him or her.

If you decide to represent yourself in bankruptcy court, read a guide for Filing for Bankruptcy Without an Attorney.

To find a good bankruptcy lawyer:

- Check state bar groups and specialization/certification programs for bankruptcy lawyers in your community.

- Ask other lawyers or tax preparers you know for recommendations.

Read Also: Can You Rent An Apartment After Bankruptcy

Chapter 1: For Foreign Creditors

A fairly recent addition to the federal Bankruptcy Code, Chapter 15 was adopted to enhance cooperation in international insolvencies. Such filings are rare, but they are useful to parties representing debtors, creditors, and assets involving more than one country seeking efficient and reasonable bankruptcy processes.

A Chapter 15 filing typically is not central to a bankruptcy involving a foreign individual or entity. Instead, it is considered ancillary, the main event unfolding in the foreigners home nation.

Alternatives To Chapter 7

Debtors should be aware that there are several alternatives to chapter 7 relief. For example, debtors who are engaged in business, including corporations, partnerships, and sole proprietorships, may prefer to remain in business and avoid liquidation. Such debtors should consider filing a petition under chapter 11 of the Bankruptcy Code. Under chapter 11, the debtor may seek an adjustment of debts, either by reducing the debt or by extending the time for repayment, or may seek a more comprehensive reorganization. Sole proprietorships may also be eligible for relief under chapter 13 of the Bankruptcy Code.

In addition, individual debtors who have regular income may seek an adjustment of debts under chapter 13 of the Bankruptcy Code. A particular advantage of chapter 13 is that it provides individual debtors with an opportunity to save their homes from foreclosure by allowing them to “catch up” past due payments through a payment plan. Moreover, the court may dismiss a chapter 7 case filed by an individual whose debts are primarily consumer rather than business debts if the court finds that the granting of relief would be an abuse of chapter 7. 11 U.S.C. §;707.

Debtors should also be aware that out-of-court agreements with creditors or debt counseling services may provide an alternative to a bankruptcy filing.

Also Check: Bankruptcy Petition Preparer Fee

Chapter 1: For Family Farmers And Fishermen

Similar in design and intent to Chapter 13, Chapter 12 provides family farmers and family fishermen who meet certain criteria to propose a repayment plan lasting from three to five years.

However, anticipating the seasonal nature of many small farming and fishing operations, Chapter 12 allows more flexibility in structuring periodic payments.

Chapter 12 helps multigenerational families involved in the business in which the parents have guaranteed debt.

Family farmers or fishermen considering Chapter 12 should be aware of several changes that came about in 2019 regarding the sale of assets. Its a good idea to review these changes with an attorney or an accountant trained in bankruptcy law.

Chapter 11 And Chapter 12

Chapter 11 and Chapter 12 are similar to Chapter 13 repayment bankruptcy but designed for specific debtors.

Chapter 11 bankruptcy is another form of reorganization bankruptcy that is most often used by large businesses and corporations. Individuals can use Chapter 11 too, but it rarely makes sense for them to do so.

Chapter 12 bankruptcy is designed for farmers and fishermen. Chapter 12 repayment plans can be more flexible in Chapter 13. In addition, Chapter 12 has higher debt limits and more options for lien stripping and cramdowns on unsecured portions of secured loans.

Don’t Miss: Can You Get A Personal Loan After Bankruptcy

What Are The Types Of Bankruptcies

Even though the general goal of bankruptcy is to clear debt, not all bankruptcies are created equal. In fact, there are six different types of bankruptcies:

-

Chapter 7: Liquidation

-

Chapter 15: Used in Foreign Cases

-

Chapter 9: Municipalities

You may have just taken one look at this list and zoned out for second. Thats okay. More than likely, you would only be dealing with the two most common types of bankruptcies for individuals: Chapter 7 and Chapter 13. But well take a look at each type so youre familiar with the options.

Are There Different Types Of Bankruptcy

There are many forms or types of bankruptcy. Were going to share the two most common types – a Chapter 7 and a Chapter 13.

But its important to know that whatever type you file, they all move forward in bankruptcy court.

A Chapter 7 bankruptcy helps you get rid of most debt. It is designed to give you a fresh start. But it doesnt get rid of those secured debts you may have, such as homes or vehicles. You will need to decide whether to pay for or give up that property.

A Chapter 13 bankruptcy is a bit different. Instead of wiping out your debt, it can help you lower it, and will also put in place a plan for you to pay back the rest of the debt within 3 to 5 years.

There are two main reasons why you may need to file a Chapter 13 bankruptcy, instead of Chapter 7:

If you have regular income and have a secured debt, such as a home mortgage, and you want to keep that property but are behind on payments, or

If you make too much money to qualify for a Chapter 7

To figure out which type of bankruptcy is right for you, you should talk to a bankruptcy lawyer.

Don’t Miss: Can You Be Fired For Filing Bankruptcy

What Are The Different Types Of Bankruptcies

11 Minute Read | September 03, 2021

Youre sitting at the kitchen table, staring down collection notices and wondering how youre going to make things work. Maybe youve recently lost your job and the debt is piling up to an overwhelming amount. And then you think itthat word you never thought youd have to consider: bankruptcy.

Sometimes your situation seems so hopeless that bankruptcy looks like your only option. We know you might feel scared and backed into a corner, but bankruptcy isnt a decision to make lightly. Its important to know exactly what bankruptcy is and what the different types of bankruptcies are so you can make the best decision for your situation.

Four Types Of Bankruptcy

ByAndrew Stratton;;|;;Submitted On November 04, 2010

There are four types of bankruptcy to know about if you or your business is considering filing. Chapter seven, chapter eleven, chapter twelve, and chapter thirteen bankruptcies have some specific differences, and knowing the specifics of each will help you decide which the best option for you is. If you have exhausted all other possibilities for getting your finances under control, seeing a bankruptcy attorney may be your next first step to financial freedom. Learn the ins and outs of all four options, and be prepared to disclose all of your financial business.

Chapter seven is the most commonly filed in the United States, and is also commonly known as liquidation. The person filing sells off all non-exempt assets and applies the profit to his/her debt. Though this is available to both individuals and businesses, it is usually avoided by businesses or partnerships because normal business function will be interrupted. For individuals, however, income made after filing does not have to go toward debt, so the individual is free to begin starting over once assets have been sold and applied to existing debts.

Chapter thirteen is also similar to the aforementioned eleven, but it is accommodates individuals only. Those filing this type are able to keep their assets while they work for three to five years to pay off debt, and because only a certain amount of debt can be claimed, it is possible that some debt will be forgiven.

Don’t Miss: Has Mark Cuban Ever Filed For Bankruptcy

When Chapter 13 Might Meet Your Needs

Chapter 7 bankruptcy isn’t the best choice for everyone. Chapter 7 won’t help people whose debts won’t get wiped out , like certain income tax debt, student loans, and domestic support obligations. High-income filers find it hard to qualify. It’s also not a good fit for people who would lose substantial equity in a home or other property if they filed for Chapter 7 bankruptcy, or those facing foreclosure or repossession. For those individuals, Chapter 13 bankruptcy would likely be a better choice.

What Different Types Of Bankruptcies Are There

There are two main types of bankruptcies for consumers:

Chapter 7 – is a liquidation of assets followed by a discharge of debt. It is perhaps what you normally think of when you think of bankruptcy. Upon filing the bankruptcy, the Court assigns, through the US Department of Justice, an attorney called the “Trustee”. The Trustee’s job is to examine what you own and see if anything can be sold to pay any of your debt back, even if it is not the full amount. In exchange for a selling of your assets, you receive a total discharge of your debt, meaning that creditor can never take any action to collect on that debt you owe him or her ever again.

Chapter 13 – is essentially a consolidation payment plan. Rather than selling any of your property, you are promising to pay some or all of your debt back over the course of time . You would file a Chapter 13 rather than a Chapter 7 when you have some property that you consider too valuable to lose in a liquidation, when you make too much money to qualify for a Chapter 7, or when you want a payment plan to help pay the arrears on a secured debt, like when you fall behind on your mortgage payments. In order to file a Chapter 13, you need to have enough income to make the plan work, so you need enough income for your normal expenses plus whatever the plan payments may be.

Other types of bankruptcies not necessarily for consumers that you may have heard of include Chapter 11 or Chapter 12 .

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Bankruptcy And Your Credit

No matter which Chapter you file for, your credit score is going to take a hit. If you submit for a Chapter 7, then the three major credit bureaus will leave that black mark on your record for ten years. If you opted for Chapter 13, then the credit bureaus will normally remove it after seven years, even though they can legally leave it on there for ten.

Your credit report is an overview of your financial habits. If you maintain good credit utilization, make payments on time, and dont exceed your credit limit, your score will reflect it. However, activities such as late or missed payments might lower your score, and bankruptcy can be devastating to it. It is possible to rebuild your credit score after bankruptcy, but its a long process.;

Until you rebuild your credit, you may find it more difficult to obtain a loan, get a job, or even rent an apartment, since the people behind these will request a copy of your credit report.

What To Do If You Have Too Much Debt

If your debt feels overwhelming, there are a few options you might have. Some of these paths include:

- Negotiating directly with creditors. Creditors would rather get some of the money you owe, rather than risk getting nothing . Be transparent about your financial situation, and see if theyre willing to work with you on a payment plan, debt amount reduction or other solution.

- If you feel like you need more guidance, a nonprofit agency can help. Theyll help stop collection calls and create a debt management plan thats sustainable for your financial situation. You can find out more from the National Foundation for Credit Counseling.

- Bankruptcy. Filing for bankruptcy is an option if youve tried all other ways to address your debt. This path has long-lasting effects on your credit record, and can adversely affect your credit anywhere from seven to 10 years.

Read Also: Can You File Bankruptcy On Unemployment Overpayment