How Does Bankruptcy Affect My Credit Score

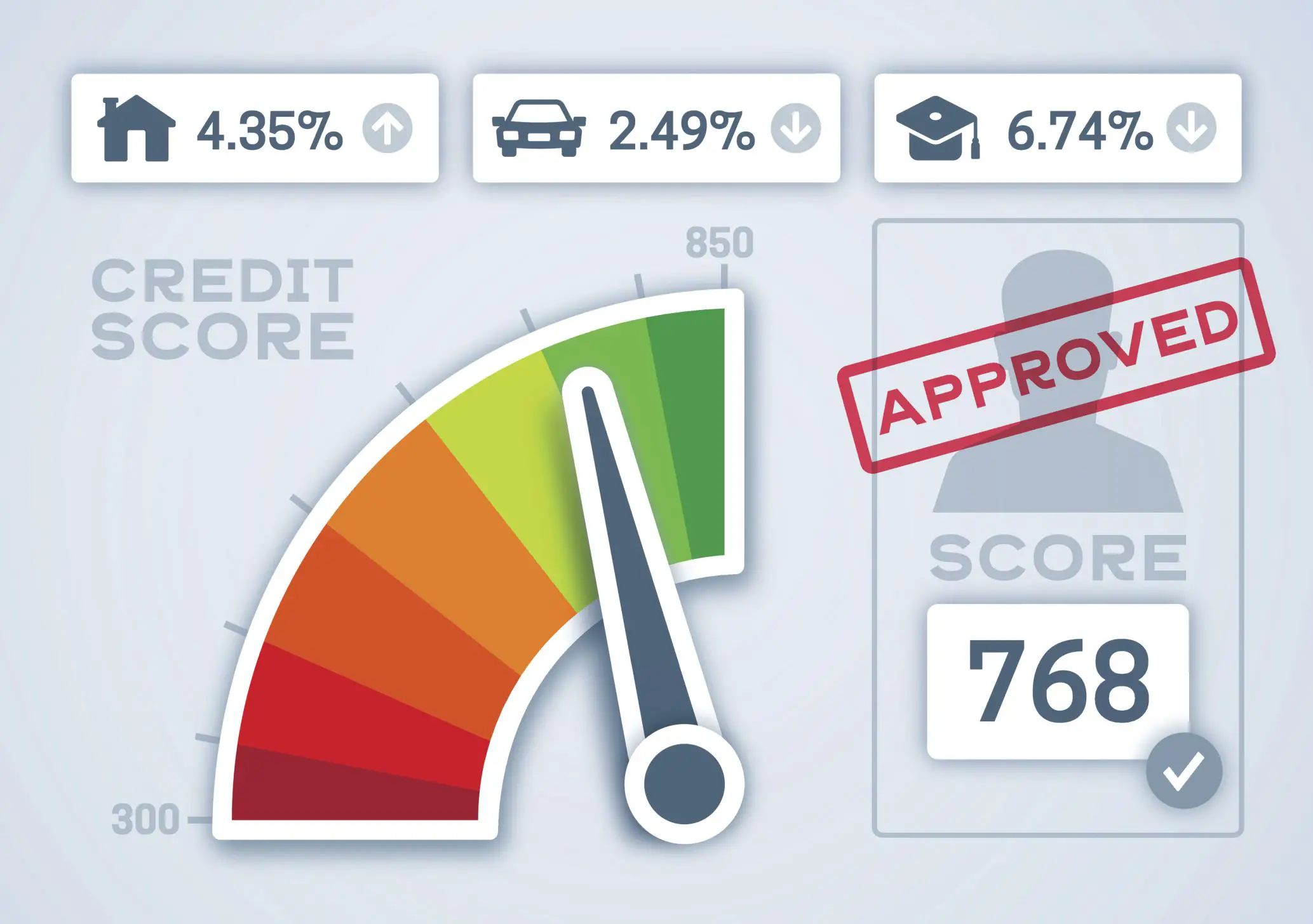

The impact of bankruptcy on a credit report can be devastating and entirely depends on your credit score prior to filing.

According to FICOs published Damage Points guidelines, the effects range from 130 to a 240 point drop. For example:

- A person with a 680 credit score would drop between 130 and 150 points.

- A person with a 780 credit score would drop between 220 and 240 points.

So, if your credit score was high, a bankruptcy would drop it instantly to the poor category. Starting with a good score, you likewise end up with a poor score, but your score does not plummet nearly as far.

The end result is still negative your and it will keep you from getting approved for new credit. The lower your initial score, the less drastic the impact.

Buying A Car Or House After Chapter 7 Bankruptcy

Many people are surprised to learn that filing bankruptcy won’t derail a car purchase or homeownership for long. If the bankruptcy helps clean up your credit faster than you’d be able to do on your ownas it does for many without the means to pay off outstanding debtsyour dream might be closer than you imagine. Specifically, if you take steps to rebuild your credit, it’s possible to get relatively reasonable interest rates when buying a new car within one to two years after bankruptcy. Securing a home loan within four years is well within reachand some people start the home purchasing process in as few as two.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

What Happens To Your Credit Report When You File Bankruptcy

Whenever certain financial things happen in your life, the credit bureau is usually notified.

A typical example of this is when you apply for money the bureau becomes aware of this and gets added to your credit report.

The same happens when you file bankruptcy.

The credit bureau is notified of this by the Office of the Superintendent of Bankruptcy Canada.

All of the creditors you owed money will also inform the bureau if your debts to them were included in the bankruptcy.

Both of these have an impact, but for different reasons.

Firstly, notifying the credit bureau of bankruptcy allows them to add this to your report.

Secondly, creditors informing the bureau of your debts allows them to remove the debts from your report.

This can be important when it comes to rebuilding your credit.

Read Also: What Is Epiq Bankruptcy Solutions Llc

Check Your Credit Score

Its important for everyone to check their credit report regularly, but its most essential for those who have recently filed bankruptcy. Maintain a list of the debts included in your bankruptcy and check their status a few months after your debts are discharged. If you filed Chapter 7, these debts should show a balance of $0 and no longer be listed as delinquent. If something isnt being reported correctly, ask the credit report issuer to make the change and check with the original lender.

Buying A Home After Chapter 7 11 Or 13 Bankruptcy

After filing for bankruptcy, youll need to consistently work on your credit score. As you rebuild, you can start to think about securing a mortgage for your next home purchase. However, you need to keep waiting periods in mind.

For FHA home loans you may need to wait up to 2 years after filing for bankruptcy before applying for a mortgage. However, VA loan applicants who filed for Chapter 13 just have a 1-year waiting period. Check into the bankruptcy restrictions surrounding your desired home loan before you submit your application.

Don’t Miss: How To File For Bankruptcy In Nh

Keep Your Credit Utilization Ratio Low

Another key credit score factor is your it accounts for 30% of your FICO Score. Your credit utilization ratio measures how much of your credit you use versus how much you have available. For example, if your available credit is $10,000 and you use $2,000, your credit ratio is 20% .

Although its often recommended that you keep your ratio below 30%, you may be able to rebuild your credit faster by keeping it closer to 0%.

What Can I Do To Improve My Credit Score After Filing For Bankruptcy In New York

Fortunately, there are several things you can do to improve your credit score after filing for bankruptcy. To start, you should ensure that you do not simply apply for multiple credit cards at once, as this can imply that you are frantic for money and will quickly go into debt once again. You should also ensure that from here on out, you pay all of your bills on time, every time. You should also continuously work to pay off any outstanding debt you may have. These are just some of the tactics you can use to rebuild your credit score after filing for bankruptcy. To learn more about rebuilding credit, or if you have any additional questions regarding bankruptcy in New York State, please do not hesitate to speak with our knowledgeable Rockland County bankruptcy attorney today.

Recommended Reading: Did Donald Trump Ever File For Bankruptcy

How Do Chapter 7 And 13 Bankruptcy Affect My Credit

Its a question we hear often: How long does a Chapter 7 bankruptcy stay on a credit report?

A Chapter 7 bankruptcy will remain on your credit report for 10 years, but the real impact of a bankruptcy on your credit is not as simple or as harsh as one Q& A tells you. There are factors pertaining to your financial situation that need to be weighed and considered to determine whether bankruptcy is right for you and how a bankruptcy filing will affect your credit going forward.

Sasser Law Firm can provide you with knowledgeable advice about your legal options if you are considering bankruptcy. We proudly represent clients in the Triangle and across North Carolina. Contact us today to learn about your options for getting out of debt.

How Long Does A Bankruptcy Stay On My Credit Report

There are differences in severity between a Chapter 7 and a Chapter 13 bankruptcy. According to the Fair Credit Reporting Act , a Chapter 7 bankruptcy can remain on your credit history for up to 10 years from the filing date and a Chapter 13 bankruptcy can remain for a maximum of 7 years.

The FCRA states only the legal maximum amount of time bankruptcies can appear on your report and not the minimum. This means a bankruptcy can be removed earlier than the legal maximum, but it must be proven that it is misreported, unsubstantiated or otherwise found inaccurate. A bankruptcy cannot be removed simply because you do not want it there.

Read Also: Can You Rent An Apartment While In Chapter 13

Keep Your Oldest Accounts Active

Since many people who declare bankruptcy previously had good credit, older items on their report can help their credit scores even if they later declare bankruptcy. The length of credit history factor, which makes up about 15% of your score, is generally not affected by declaring bankruptcy. In other words, keep these older accounts active and in tact whenever possible to maintain the length of your credit history.

Bankruptcy Information Can Be Wrong

You may want to hire a credit repair attorney if your record shows inaccurate financial or bankruptcy information. They can speak with credit reporting agencies, credit card companies, or credit card issuers if you are having personal finance trouble. An attorney can also step in if a company does not discharge your debt correctly or you fall into a credit counseling scam.

Remember: A bankruptcy discharge legally stops creditors from harassing you. You have rights if a company is not following the process or respecting your bankruptcy filing.

Thank you for subscribing!

Recommended Reading: How To File Bankruptcy In Iowa

Consider Applying For A Secured Credit Card

After filing for bankruptcy, its unlikely that you will qualify for a traditional credit card. However, you may qualify for a secured credit card. A secured credit card is a credit card that requires a security depositthis deposit establishes your credit limit.

As you repay your balance, the credit card issuer usually reports your payments to the three credit bureaus. Repaying your balance on time can help you build credit. Once you cancel the card, a credit card provider typically issues you a refund for your deposit.

When shopping for secured credit cards, compare annual fees, minimum deposit amounts and interest rates to secure the best deal.

How Does Bankruptcy Work

When you’re declared bankrupt, the value of your possessions is usually shared out among those you owe money to. This can include your house, car, leisure equipment and jewellery â everything except the essentials. Depending on your income, you’ll also be asked to make payments towards your debt for up to three years.

Sounds gloomy, but there’s a silver lining. Once you’re declared bankrupt, you won’t have the pressure of dealing with creditors anymore. Lenders will also have to stop most types of court action against you. And, most relieving of all, you will usually be ‘discharged’ â in other words, freed from your debts â after one year.

Read Also: How Many Bankruptcies Has Donald Trump Filed

Obtaining Credit After Bankruptcy

It is true that a Chapter 13 bankruptcy filing can remain on a credit report for seven from date of filing. Some Chapter 13 filers have been able to obtain new lines of credit within one to three years from the date of filing. For instance, filers interested in purchasing a new home can qualify for a Fair Housing Administration mortgage after having made at least twelve on-time payments under a Chapter 13 bankruptcy plan. This is known as a seasoning requirement. Fannie Mae, the nations largest mortgage lender, has a two-year seasoning requirement. While many people believe that filing bankruptcy dooms a person to never qualifying for credit again, this is simply untrue.

Exceptions That Might Affect Your Credit

In a few instances, interest in an LLC, corporation, or limited partnership bankruptcy might affect your individual .

- Personal guarantee. Often a creditor will require the owners or officers of a small business to sign a personal guarantee before they will extend credit to the business. By signing, you agree to be responsible for the payment of the business debt. If the business files for bankruptcy you’ll need to pay the debt, or it could get reported to the credit bureaus as an unpaid obligation. If it is, it will most certainly affect your credit.

- Certain types of business taxes. If unpaid, some tax could become your responsibility. A tax that you withhold from employees’ salaries or that you collect from others, such as sales tax, is often referred to as trust fund taxesand these taxes aren’t usually discharged in bankruptcy. Although it is the responsibility of the business to transmit these taxes to the government, the money used to pay the tax belonged to the employee or the customer. You’re charged with personal responsibility if you collect these taxes but fail to transmit them to the taxing authority. This debt will affect your credit, especially if a tax lien is filed against you and recorded in the public records.

You May Like: How Many Bankruptcies Has Donald Trump

How Long Does It Take To Rebuild Credit After Chapter 13

Chern also says that most Chapter 13 petitioners will see a reduction in debt-to-income ratio, but this wont occur as quickly.

After three to five years of living on a strict budget, Chapter 13 debtors should be much more equipped to manage their money efficiently, he says. In many cases, after 18 months of regular Chapter 13 payments, a debtor can refinance out of a Chapter 13, especially if the debtor has any equity in a home.

Advantages And Disadvantages Of Chapter 7 Bankruptcy

By FindLaw Staff | Reviewed by Maddy Teka, Esq. | Last updated April 27, 2021

There’s no question that deciding whether to declare bankruptcy is very difficult. It affects your future credit, your reputation, and your self-image.

It can also improve your short-term quality of life considerably, as the . Taken as a whole, it’s a difficult process with both advantages and disadvantages.

Chapter 7 bankruptcy, in particular, will damage your credit for a little while but also may provide much-needed relief and a roadmap for getting your financial house back in order.

Also Check: What Is Epiq Bankruptcy Solutions Llc

How Long Does A Chapter 7 Bankruptcy Affect Your Credit Score

For those struggling with debt, filing for bankruptcy is necessary to achieve much-needed financial relief. One of the biggest concerns people often have, however, is the impact a Chapter 7 bankruptcy will have on their credit score. The fact is that although a bankruptcy will affect your credit, your score is likely already in bad shape given that you cannot pay off your debts. Filing for a Chapter 7 bankruptcy gives you the opportunity to start anew, wiping out most of your unsecured debts, so you can begin rebuilding your credit score without an insurmountable sum of debt looming over you.

Become An Authorized User On A Credit Card

If you dont want to take out a secured credit card, you can ask a family member or friend who has good credit to add you as an on one of their credit cards. You may see an increase in your credit score if the issuer reports the cards positive payment history to the three main credit bureaus. However, your score could take a dip if the primary cardholder makes a late payment or maxes out their credit limit.

Also Check: Does Bankruptcy Affect Renting An Apartment

Options For Dealing With Debt

If youre struggling with debt, its already reflected in your credit score. Maxing out credit cards and making late payments will lower your score. So will foreclosures and repossessions. However you deal with debt will also affect your score.

The first line of defense when youre struggling with debt is to reach out to your lender. They may be willing to work with you to lower your monthly payments or your interest rate. Those agreements may or may not affect your credit score. Youll have a more manageable monthly payment, but your overall debt load wont change.

You may also seek help through a debt consolidation company. Debt consolidation can either lower or raise your credit, depending on your other finances and the vagaries of the score calculation by each agency. Youll still have your debt, but consolidation may help you catch up on back payments and then stay current, which will improve your score.

If that doesnt work or isnt enough to help you, you may seek a debt settlement. In a debt settlement, you pay one lump sum of less than you owe to your lender in satisfaction of the debt. A debt settlement will cost you 45-65 points if your score was 680 prior to the settlement.

Does Bankruptcy Create Bad Credit

One of the reasons bankruptcy hurts your credit is because youre not making payments like you normally would outside of an active bankruptcy. Payment history is the biggest determining factor of your credit score. Once you declare bankruptcy, youre saying you cant repay your loans in the way you originally agreed to or that you can only pay a portion of what you owe to your creditors through bankruptcy.

Another reason why bankruptcy hurts your credit is that filing for bankruptcy and attempting to wipe away your debts tells the credit scoring models that you were unable to handle the debt you took on. However, there are many reasons why someone may need to file bankruptcy such as a sudden job loss, medical emergency, divorce, or other unexpected life events. No matter the underlying reason you decide to file bankruptcy, it can still cause a lot of damage.

And, it should be considered a last resort if you cant repay your debts.

The damage that happens to your credit score after you file for bankruptcy depends on the state of your credit before you file. If your credit score wasnt great before filing, then you may only see a modest drop in points. But if your credit score was in good shape, then you may see a steeper drop in your credit score.

Read Also: How Many Bankruptcies Has Donald Trump Filed

Whats The Difference Between Bankruptcy And Debt Management Plans

If you are unable to pay your bills, you may start to receive mail or phone calls from companies offering debt management plans.

Debt management plans are privately negotiated agreements between creditors, lenders, and the debt management company.

The goal of a debt management plan is for creditors to be repaid, and for debtors to avoid bankruptcy.

The key difference between bankruptcy and a debt management plan is that bankruptcy is a legal process, overseen by a judge and administered by a bankruptcy trustee, with the goal of discharging debts that a debtor is unable to repay, while a debt management plan is a privately negotiated agreement, sometimes administered by a for-profit company, with the goal of repaying creditors and avoiding bankruptcy.

Unlike bankruptcy, a debt management plan wont discharge your debts or give you the legal right to stop calls from debt collectors.

A debt management plan may be right for you if you have fallen behind on repaying your debts, but you think you will have enough income to repay your debts in the next 3-5 years.

Under a debt management plan, lenders may agree to reduce or eliminate late fees and penalties your accounts have incurred in order to receive full repayment.

Lenders may also agree to a lower interest rate on the remaining debt.

Secured debts cant be brought into a debt management plan, so if you only have secured debts like car loans or home mortgages, a debt management plan wont help you get caught up.