Between Bankruptcy And Discharge

The bankrupt must:

A bankrupt must also remit to the trustee the amount of his income that is determined to be surplus to his needs, for the benefit of the estate.

Determination of property in the bankruptcy estate

Contributions made to Registered Retirement Savings Plans , Registered Retirement Income Funds , and Deferred Profit Sharing Plans in the twelve months prior to the date of bankruptcy will be recovered for the benefit of the bankruptcy estate in provinces other than British Columbia, Alberta, Ontario, New Brunswick, and Nova Scotia . The court can extend the one-year recovery period where it is considered appropriate.

Bankruptcy Exemptions For Joint Owners

It may be the case that you are the joint-owner of a particular asset, like a vehicle or your principal residence. If this is the case, how would these exemptions apply? It depends partly on your percentage of ownership. A Licensed Insolvency Trustee can provide more information and help you determine how the exemptions will apply in your specific case.

What Are Exempt Assets In Bankruptcy Summary

I hope that you found this what are exempt assets in bankruptcy Brandon Blog helpful in describing the personal exemptions in Ontario and whether bankruptcy and death can change that. Problems will arise when you are cash-starved and in debt. There are several insolvency processes available to a person or company with too much debt. You may not need to file for bankruptcy.

If you are concerned because you or your business are dealing with substantial debt challenges, you need debt help and you assume bankruptcy is your only option, call me.

It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties with debt relief options as analternative to bankruptcy. We can get you the relief you need and so deserve. Our professional advice will create for you a personalized debt-free plan for you or your company during our no-cost initial consultation.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

what are exempt assets in bankruptcy

Recommended Reading: Can You Rent An Apartment After Filing For Bankruptcy

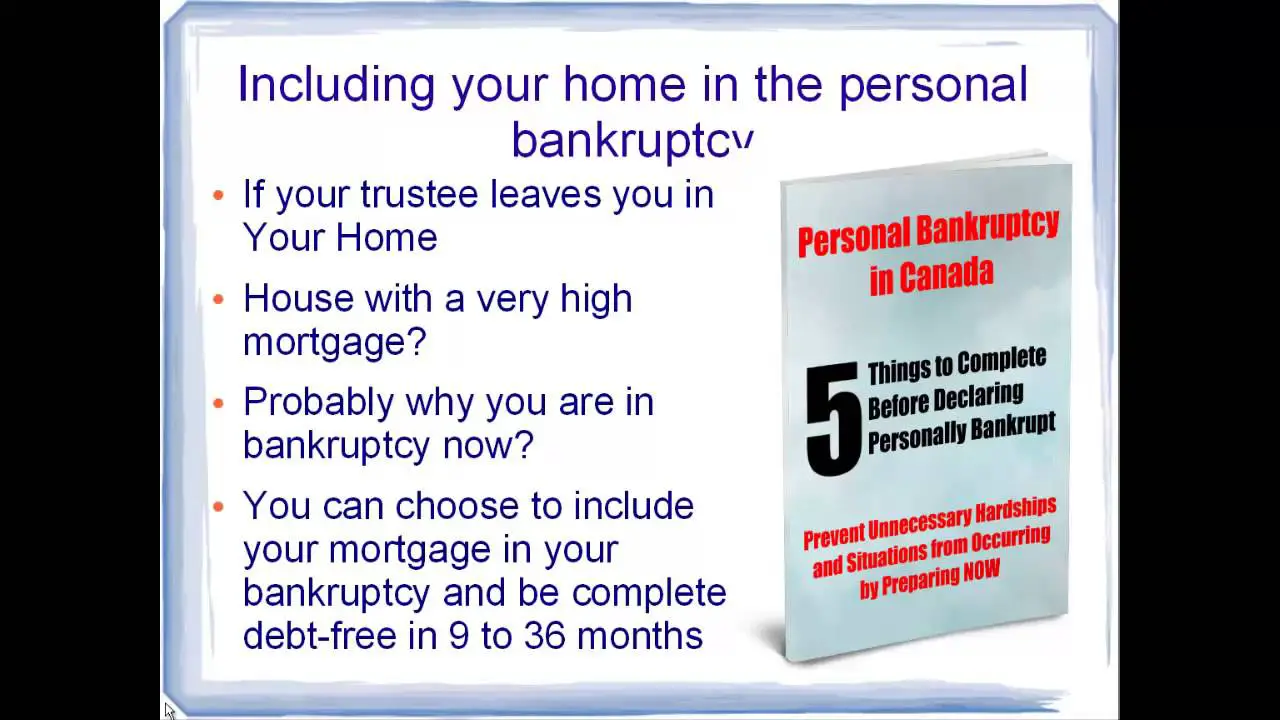

So Will I Lose My House In Bankruptcy

This brings us back to the original question, which is one that we get all the time. The Ontario Execution Act states that your primary residence is exempt from bankruptcy proceedings with a maximum value of $10,000. This means that you are only allowed to maintain $10,000 of equity in your home during bankruptcy. If you have more than $10,000 worth of equity, then there are ultimately two options:

Option A: Your house can be surrendered and/or sold, with the resulting funds being added to the bankruptcy estate. In this case, you would not be keeping your home, but sometimes it makes the most sense.

Option B: You can pay the difference in equity to the Trustee and keep the house. With this option, you would consider the total amount of equity you have in your home and pay that amount to the Trustee, minus $10,000, which is exempt. The Trustee adds these funds to the bankruptcy estate for distribution to your creditors in accordance with the Bankruptcy and Insolvency Act.

If you are hoping to keep your home, your Trustee will work with you to find an acceptable solution that makes sense in your situation. . It is common for people in bankruptcy to keep their homes.

Exemptions In British Columbia:

- No limit on clothing for you or your dependents all clothing is exempt from bankruptcy

- Household furnishings and appliances up to $4,000

- One motor vehicle up to $5,000 unless you are behind on child support payments, in which case the limit is $2,000

- Work tools and work-related property up to $10,000

- No limit on medical and dental aids for you or your dependents

You May Like: Has Donald Trump Filed Personal Bankruptcy

What Are Exempt Assets In Bankruptcy: Are They Rev1ewed Upon The Sad Death Of The Bankrupt

- Post author

what are exempt assets in bankruptcy

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

If you would like to listen to the audio version of this Brandon Blog, please scroll to the very bottom and click play on the podcast.

Exempt Assets In Bankruptcy: What Can I Keep

When you file for bankruptcy, you must sell some of your assets to cover a portion of the debt that is owed.

However, not all of your assets are eligible to be seized and some of them are considered exempt, so you will be allowed to keep them.

But many people are unsure about the rules around exempt assets in bankruptcy and they dont know what they will be able to keep and what they wont.

When you file for bankruptcy, all of your assets will be vested with a bankruptcy trustee, but certain assets are exempt.

Although the rules differ slightly depending on where you live, the exempt assets in bankruptcy remain the same, in most cases.

Need Help Reviewing Your Financial Situation?Contact a Licensed Trustee for a Free Debt Relief Evaluation

Furniture and personal effects are exempt in most places, up to a certain value.

For example, in Ontario, you are allowed to keep any furniture up to the value of $11, 300 and any other personal effects up to the value of $5,650.

The trustee will assess the value of these assets and if they are worth less than the specified amount, you will be allowed to keep them.

The value limits vary depending on location, but you will always be allowed to keep some furniture and personal effects.

Cars are always exempt assets in bankruptcy, but there are limitations.

You will be allowed to retain one vehicle, up to the value of $5,650.

If you want to keep the car, you will have to pay the difference.

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

I Cannot Include The Taxes I Owe In Bankruptcy

Absolutely untrue. All taxes owing are unsecured debts fully dischargeable by bankruptcy . This includes not just personal income tax but HST and, in the case of a business, payroll tax, which is a director liability and would trail you personally. The myth about taxes not being dischargeable in bankruptcy likely derives from the U.S. Bankruptcy Code, in which only certain tax debt for specific periods are dischargeable and only in certain situations. Canadian bankruptcy law discharges all tax debt universally, unless the Canada Revenue Agency has taken steps to secure it or in the case of fraud or tax evasion.

Gifts Transfers Of Property Or Special Treatment

Any gifts or transfers of property youve made in the year prior to filing for bankruptcy will need to be reviewed by your LITand could be reversed by the court. You will also need to advise your LIT of any payments or preferential treatment to your creditors in the three months prior to declaring bankruptcy .

For more information about bankruptcy exemptions, you can click the button below to book a free initial consultation with a Licensed Insolvency Trustee.

Recommended Reading: Can Restitution Be Discharged In Bankruptcy

What Assets Can I Keep In Bankruptcy In Northwest Territories

- Household goods not exceeding $5,000 in value

- Necessary and ordinary clothing of the debtor and the family of the debtor

- Food, fuel and other necessaries of life required by the debtor and the family of the debtor for the next 12 months

- Tools of the trade not exceeding $12,000 in value and tools used for hunting not exceeding $15,000 in value

- Principal residence if it has $50,000 or less in equity

- Motor vehicle not exceeding $6,000 in value

- Necessary medical and dental aids

- Registered Retirement Savings Plans are exempt from seizure with the exception of any contributions made to RRSPs during the 12 month period prior to the date of bankruptcy

For further details on what you can keep, book a free consultation with a Licensed Insolvency Trustee.

Northwest Territories Bankruptcy Exemptions

In the Northwest Territories, property exempt from seizure in bankruptcy is set out in the Exemptions Act and applies to the equity in an asset. Equity is the difference between the value of the asset and what you owe on the asset.

Example: If you have household furniture and equipment in your home worth $5,000 and you do not owe any outstanding loans on these items, the equity you have is $5,000. In the Northwest Territories, the exemption for the total of these items is $5,000. In this case, you would be entitled to keep these possessions and your creditors cannot take them from you.

Read Also: Bankruptcy Petition Preparer Services

Newfoundland & Labrador Bankruptcy Exemptions

In Newfoundland and Labrador, property exempt from seizure in bankruptcy is set by the provincial government and applies to the equity in an asset. Equity is the difference between the value of the asset and what you owe on the asset.

Example: If you have a car worth $6,000 and you still owe $4,000 on the loan, the equity you have in the car is $2,000. In Newfoundland and Labrador, the exemption for a car is $2,000. In this case, you would be entitled to keep the car and your unsecured creditors cannot take this from you when you file for bankruptcy.

Common Bankruptcy Exemptions In Canada

Canadas provinces and territories may all set their own bankruptcy exemptions, but some exemption types are common to most, if not all, of Canada. For example, federal law since 2008 has made Registered Retirement Savings Plans exempt from bankruptcy in every province and territory. What you have saved for retirement in these plans is exempt from bankruptcy, just as your retirement savings are exempt from seizure in debt settlement and other legal debt solutions. However, the contributions you made to these retirement plans in the twelve months before your bankruptcy are not exempt. Still, this excludes most of your retirement savings from having to be surrendered in the process of bankruptcy. In most of the provinces and territories of Canada, the following types of assets are exempt from bankruptcy based on a total worth up to a certain limit that is established by the province. So, for example, a province might exempt one motor vehicle from bankruptcy up to a total worth of $15,000 while another might set the limit at $10,000.

Don’t Miss: How To Get Bankruptcy Court Documents

What Assets Are Exempt From Bankruptcy In Ontario

When a person considers filing an assignment in bankruptcy, they are typically concerned with what assets they will lose. They need a fresh start from their debt, but they also may need their vehicle to be able to earn a living and provide for their family.

In order for a debtor to retain the basic necessities of life, there are certain assets that are exempt from seizure under the Ontario Executions Act. A creditor is unable to seize, and a bankrupt may keep the following assets:

In addition to the above exempt assets under the Execution Act in Ontario, other legislation provides for exemptions for RRSPs and RRIFs . Life insurance policies with a designated beneficiary of a parent, spouse, child, or sibling are also exempt from seizure in a bankruptcy.

Please contact Taylor Leibow Inc., Fresh Start Now, with any specific questions you may have on how a bankruptcy will affect your assets or for a free initial consultation on debt solutions.

Purpose Ofbankruptcy Exemptions Of Canada

Even though assets are sold by the LIT when you declare bankruptcy in Canada, there are some assets that you can still retain after such declaration.

These assets are referred to as Bankruptcy Exemptions, in Canada.

The purpose of the existence of such exemptions is goodwill.

The Canadian Law wants to ensure that an honest debtor has a reasonable foundation to rebuild his or her life after bankruptcy.

Therefore, certain assets, usually those required to rebuild ones life and financial future, are exempted under the Canadian law.

This enables the unfortunate debtor to have access to reasonable means to restart a new life.

With bankruptcy exemptions in Canada, it is possible for an honest debtor to resume a life of dignity even after bankruptcy, and build a life for oneself and dependents.

Read Also: Can You Be Fired For Filing Bankruptcy

What Property Is Exempt In A Bankruptcy

Bankruptcy is not meant to be punitive which means you do not lose everything even if you declare bankruptcy. Both federal bankruptcy law and provincial exemption laws provide a list of certain assets that are exempt from seizure by a Licensed Insolvency Trustee.

Federal exemptions are those specifically mentioned in Section 67 of the Bankruptcy & Insolvency Act . The BIA says that assets not available to satisfy your creditors include:

- Property held in trust for another person

- Property that is exempt by provincial laws

- GST / HST tax credit payments

- RRSP, RRIF

- The courts have ruled RDSP savings are also exempt under the Act

- Prescribed payments relating to special needs of individuals which the Office of the Superintendent of Bankruptcy has ruled to include CERB, CRB, Child Tax Benefit and HST cheques are not considered income for the purposes of calculating surplus income.

As mentioned, the limitations amounts are based on equity, after any amount owing. Value is also based on resale or liquidation value, what you could reasonably get in a garage sale for example for home furnishings. The result of this is that in most bankruptcies across Canada, people keep their personal belongings and household furnishings.

You Dont Lose Everything

The most important thing to realize is that you do not lose all your assets if you file bankruptcy in Canada. If you do have assets that must be surrendered to the trustee, you still have options like a consumer proposal to keep those assets.

To discuss your specific situation, contact us to talk to a Licensed Insolvency Trustee about how your assets may be treated in a bankruptcy and if a consumer proposal is a better way to preserve any assets you may wish to keep.

You May Like: Can Restitution Be Included In Bankruptcy

How Does The Treatment Of Non

A consumer proposal is the most common alternative to personal bankruptcy in Canada. In fact, it is the solution most Canadians use to deal with their debts.

Just like in the case of bankruptcy, a consumer proposal offers debt relief and provides legal protection from creditors. A consumer proposal can stop collection calls, a wage garnishment and lawsuits.

The main difference between the two is that you can keep all your assets with a consumer proposal, including non-exempt assets.

A consumer proposal is a legal agreement to settle your debts for less than you owe, in exchange for which you agree to make pre-arranged payments to pay off the settlement amount. While you do not lose assets in a proposal, the value of your non-exempt assets will affect how much you will need to offer your creditors.

Consumer proposals are much simpler than bankruptcies, and the terms are determined upfront. Your payments can be spread out over a period of up to five years, making your monthly payments more affordable than a bankruptcy if you have significant non-exempt assets you wish to keep.

The goal of filing for bankruptcy, or making a proposal to creditors, is to get debt relief when you reach a point where you cant pay off what you owe on your own. Bankruptcy is not punitive, but instead it eliminates almost all your unsecured debts and allows you to start fresh

Can I Keep My Bank Account If Im Bankrupt

We strongly advise anyone considering bankruptcy to open a new bank account at a different bank prior to declaring bankruptcy. This will avoid the risk of your bank seizing funds for unpaid debts once you file.

While any funds in your bank account are not exempt assets, typically you are allowed to keep a small amount of cash on hand in your new bank account to cover living expenses like rent, food, etc. for a short period of time.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

I Will Lose My Possessions

Personal effects, furniture and household goods are exempt in bankruptcy. Exceptions would be made if you had items of extraordinary value such as fine art, which you would be asked to declare on your sworn Statement of Affairs to the creditors. You can exempt one car with a net value of $6,600 or less. So if you have a fully encumbered car , keep it if you wish, provided you continue to make the payments in the normal course of business. Keep your stuff.

Bankruptcy Exemptions Allowable Assets

When people hear about or think about bankruptcy, the first thing that comes to mind is that they will lose everything if they go bankrupt. In most cases, many of a persons personal assets are exempt from seizure in a bankruptcy. What you can or cannot keep depends on the province in which you reside.

Read Also: Will Filing Bankruptcy Clear A Judgement