Property That Is Exempt

Exempt property can include:

- Motor vehicles, up to a certain value

- Reasonably necessary clothing

- Reasonably necessary household goods and furnishings

- Household appliances

- Jewelry, up to a certain value

- A portion of equity in the debtor’s home

- Tools of the debtor’s trade or profession, up to a certain value.

- A portion of unpaid but earned wages

- Public benefits, including public assistance , social security, and unemployment compensation, accumulated in a bank account

- Damages awarded for personal injury

Can A Bankruptcy Trustee Take My Home

Itâs not common, but it is possible if your home equity is greater than the available homestead exemption.

The bankruptcy trusteeâs job is to sell non-exempt property for the benefit of unsecured creditors. That includes personal property and real property. Whether your home is safe from the trustee depends on whether it has any non-exempt equity which in turn depends on its market value.

If the amount of equity is greater than the homestead exemption amount you can claim, the Bankruptcy Code allows the trustee to use that equity to pay unsecured creditors. Subtract the balance of your mortgage and the available homestead exemption from the total value of the property to find out if you have non-exempt equity. Letâs look at a few of examples on what that can look like:

Farming Fishing And Aquaculture Exemptions

- If your primary occupation is farming, personal property used by you to earn income are exempt up to $10,000

- If your primary occupation is fishing, personal property used by you to earn income are exempt up to $10,000

- If your primary occupation is aquaculture, personal property used by you to earn income are exempt up to $10,000

Read Also: What Is Epiq Bankruptcy Solutions Llc

Also Check: How Do Bankruptcy Laws Help Debtors

Bankruptcy Exemptions: What Property Can You Keep In Chapter 7 Bankruptcy

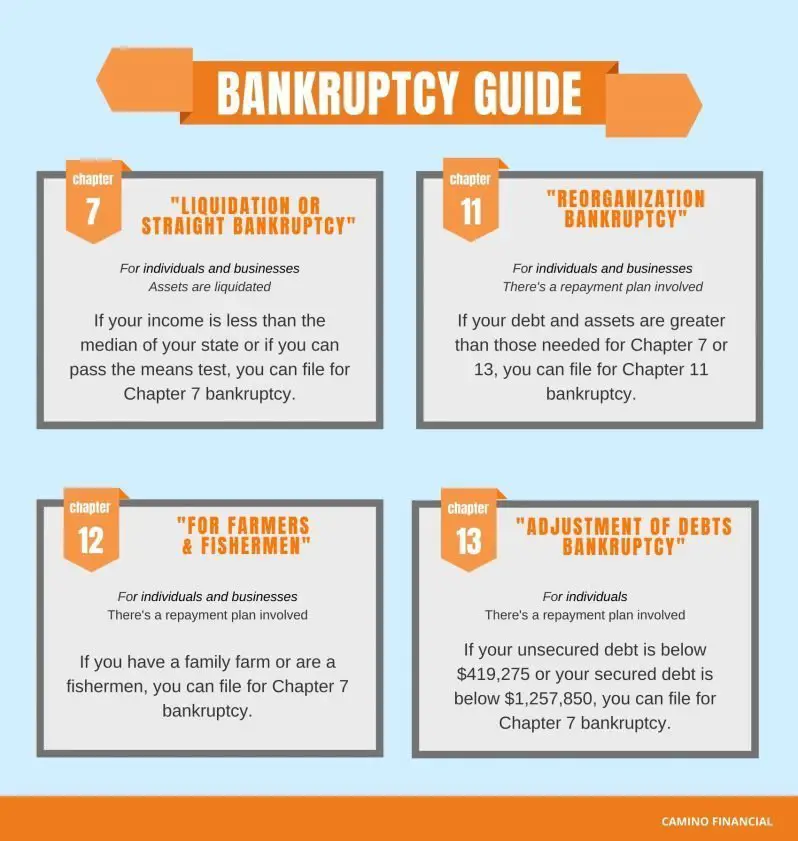

When you file for Chapter 7 bankruptcy, almost all of your property becomes property of the bankruptcy estate. That doesn’t mean you lose everything. The purpose of bankruptcy is to provide people with a fresh startand part of that fresh start is keeping the things you need to hold down a household and job. Bankruptcy exemptions allow you to keep the things you’ll need to work and live, such as furniture, dishes, clothing, and a car.

How much property you can exempt differs depending on which state you live in because each state has a set of exemption laws .

Example. If you own a car worth $5,000 and your state allows a $6,000 car exemption, then you can keep your vehicle. However, if you live in a state that only allows a $2,000 car exemption , then the bankruptcy trustee may take your car and sell it. From the proceeds of the sale, the trustee will pay you the exemption amount of $2,000 and distribute the rest among your creditors.

The Individual Insolvency Register On Annulment

Once notice of the annulment is received your bankruptcy will be removed from the Individual Insolvency Register after:

- 28 days if the bankruptcy order should not have been made

- 3 months if the debts were paid in full or an IVA has been agreed

If an IVA has been agreed, details of this will appear on the register.

Don’t Miss: How Do You Claim Bankruptcy In Canada

Property That Is Not Exempt

Items that the debtor usually has to give up include:

- Expensive musical instruments, unless the debtor is a professional musician

- Collections of stamps, coins, and other valuable items

- Family heirlooms

- Cash, bank accounts, stocks, bonds, and other investments

- A second car or truck

- A second or vacation home

Can Creditors Touch My Retirement & 401k Funds

Most of your retirement funds such as 401ks and other qualified retirement accounts are protected from creditors and untouchable by a bankruptcy trustee. Since these funds are protected by federal bankruptcy laws, it is rarely a good idea to cash in your retirement accounts to pay off your debts.

In aChapter 7 bankruptcy, most retirement accounts are classified as exemptions under the Bankruptcy Code. That means these accounts cannot be liquidated to pay your creditors. UnderChapter 13 bankruptcy, none of your assets are taken from you. The monthly repayment plan amount is determined by your income. Your retirement savings are only included in this amount if you want them to be.

You May Like: When Did Hertz File For Bankruptcy

Can You Keep Up With The Payments

If you have expensive car payments each month, and if those payments are the cause of your financial problems, it may be wise to surrender the car to the lender before you go bankrupt, even if your payments are up to date. Bankruptcy should be a fresh start, and keeping high car payments may not be a fresh start for you.

Your Ontario bankruptcy trustee can help you analyze your situation and help you decide whether or not to keep your car if you file for bankruptcy in Ontario.

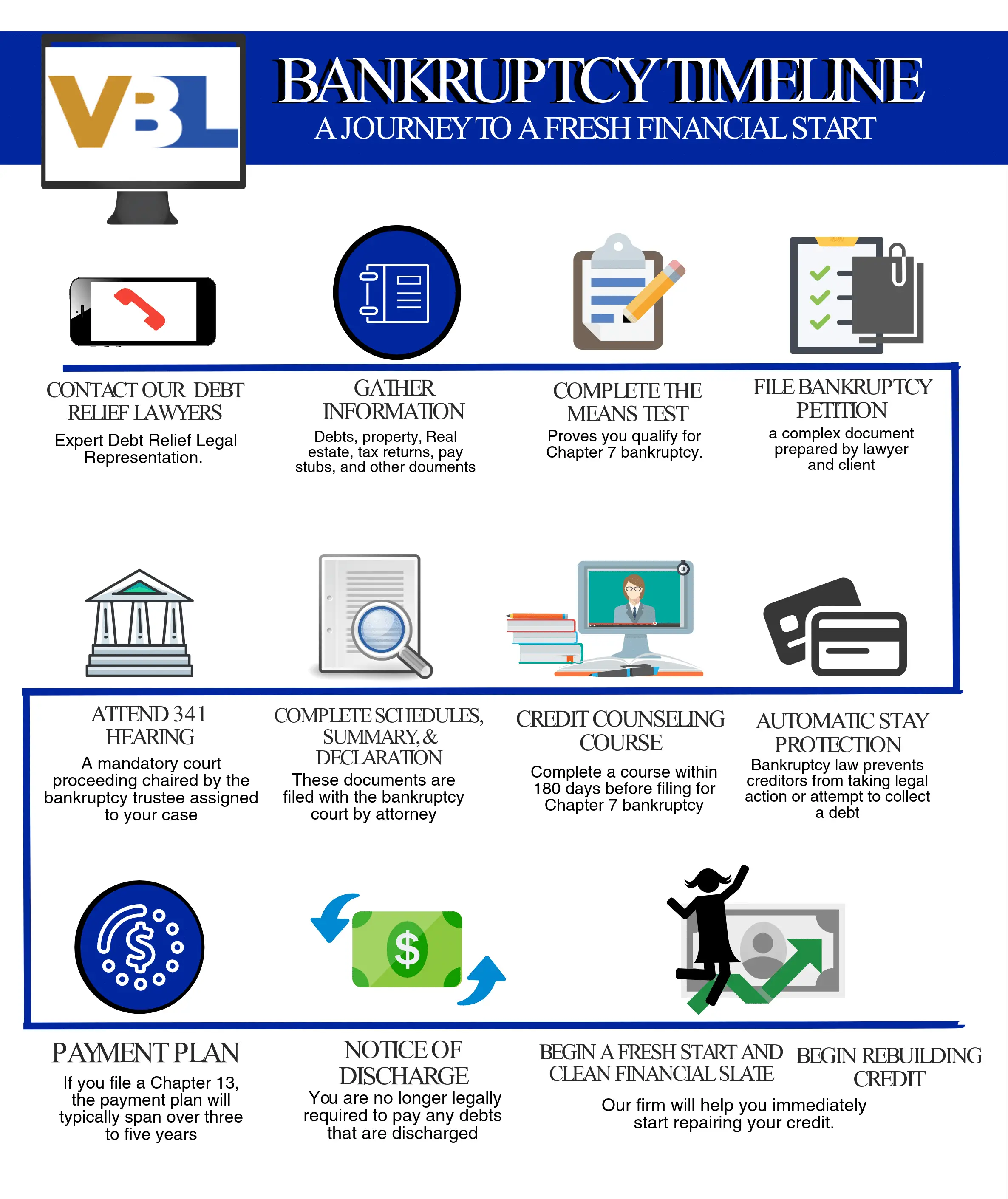

Meeting The Bankruptcy Trustee

The bankruptcy court will schedule a meeting with an appointed Chapter 7 trustee. This meeting is called the or the 341 meeting. The meeting is held in a conference room, not a courtroom. Typically, this meeting will last ten to fifteen minutes.

A representative of the U.S. Trustees office sometimes attends these meetings. The debtor and his bankruptcy attorney are required to attend the creditors meeting . As a practical matter, very few, if any, unsecured creditors attend. The Chapter 7 bankruptcy trustee represents all creditors whether or not unsecured creditors attends the meeting of creditors.

The Chapter 7 bankruptcy trustee asks the debtor questions at the creditors meeting, but they will not interrogate, cross-examine, or threaten the debtor. The trustee may ask the debtor why they filed bankruptcy and ask questions about the debtors assets and sources of income. The trustee often asks about the debtors income and expenses to make sure the debtor qualifies for Chapter 7 bankruptcy and that the bankruptcy is not an abusive filing.

are scheduled by the court based on the trustees schedule. Your bankruptcy attorney is not able to request a meeting date or time. If the debtor or their attorney is unable to attend the scheduled 341 meeting, the trustee usually schedules a make-up meeting approximately two weeks after the first date. If the debtor fails to attend the second meeting, the trustee may move to have the bankruptcy dismissed.

You May Like: Do Private Student Loans Go Away With Bankruptcy

Exceptions To Payment Rules

There are some exceptions to the payment rules. You can make direct payments for:

- secured creditors, like a mortgage lender

- debts which are not included in the bankruptcy , these are called non-provable debts

- money owed after 19 March 2012 to the Department for Work and Pensions for budgeting or crisis loans

You must keep paying rent and any new debts after the bankruptcy. You might not need to pay bills that are unpaid at the date of your bankruptcy order. You may have to pay a deposit for future supplies of gas, electricity or other utilities. Or your utility accounts may be transferred to a spouse or partner.

How Your Creditors Are Paid

The official receiver will take control of your assets unless an insolvency practitioner is appointed. An insolvency practitioner is usually an accountant or solicitor.

The person who takes control of your assets is known as the trustee. The law says you must cooperate fully with them.

The trustee will sell your assets and tell the creditors how the money will be shared. Creditors must then make a formal claim. You cannot make payments directly.

If you have assets, money from the sale of these will be used to pay the costs of the bankruptcy process before creditors are paid. If your case is administered by the official receiver the following fees will all be deducted from the money realised:

- an administration fee of £1,990 if you applied for your own bankruptcy or £2,775 if someone else applied

- a general fee of £6,000

- 15% of the total value of assets realised

- a fee charged at an hourly rate where money is paid to creditors

If there are insufficient assets in your case the official receiver will still process your bankruptcy.

Next, money will be used for:

- certain debts in relation to employees, if you had any

- your other creditors

- interest on all debts

Any money left over will be returned to you. If everyone is paid in full you can apply to have your bankruptcy cancelled .

You May Like: Can You File Bankruptcy Without Your Spouse

What Is Credit Counseling

In your credit-counseling session, the agency will review your budget and discuss your possible options. For example, filing bankruptcy may be one option another option may be to enter into a debt management plan administered by the agency. Under a debt management plan, you repay some or all of your debts by sending the agency a monthly payment. The agency then distributes that money to your creditors. For some people this makes sense. For others bankruptcy may be the best option.

Be very careful in choosing an agency for the required counseling. Some agencies have been known to pressure people into debt management plans as a way of avoiding bankruptcy whether it makes sense for those people or not.

Before choosing an agency, keep these points in mind:

- The agency may charge fees for their services. These fees vary from agency to agency.

- In many cases bankruptcy may actually be the best choice for you.

- Dont sign up for a debt management plan that you cant afford, you may end up in a bankruptcy anyway.

- There are approved credit counseling agencies that do not offer debt management plans.

Agencies provide counseling in various ways. Some do it in person. Others do it by telephone or over the Internet. No matter what method you use, when you complete your counseling, the agency will give you a certificate of completion. The certificate verifies that you received the required counseling. You must file this certificate with your bankruptcy petition.

Difference Between Property Excluded From The Bankruptcy Estate And Exempt Property

When you file for bankruptcy relief, almost all property you own becomes property of the bankruptcy estate. When an asset is property of the estate, the bankruptcy court has the power to administer it in your case.

If an asset is property of the estate, you must be able to protect it with a bankruptcy exemption if you want to keep it. In Chapter 7 bankruptcy, the bankruptcy trustee can take or sell your nonexempt assetthe property that isnât protected by an exemptionand distribute the proceeds to your creditors.

Assets that arenât property of the estate are safe in bankruptcy and canât be administered by the court. Most retirement accounts are protected in bankruptcy because they are either not property of the estate or they are exempt.

Don’t Miss: What Is A 341 Meeting In Bankruptcy

Property In Chapter 7 Bankruptcy

The trustee will liquidate any nonexempt property and distribute the proceeds to your unsecured creditors. An unsecured creditor is different from a secured creditor because it doesnt have the right to take back your propertyyour car or home if you dont pay your debt.

The trustee doesnt treat all unsecured debts the same but instead disperses funds according to the priority of the particular creditor. For instance, a past due support obligation is higher in priority than an overdue tax debt, which in turn has more priority than a credit card debt .

So, if the trustee gets $20,000 from the sale of your sailboat, and you owe $10,000 in child support, $15,000 in taxes, and $50,000 in credit card debt, the trustee will make the following distributions:

- $10,000 towards child support arrearages

- $10,000 for unpaid tax , and

- $0 for credit card debt.

In some cases, you can buy your nonexempt property from the trustee at a discount. For instance, if you own a car free and clear worth $15,000, but your states vehicle exemption is $5,000, you can pay $10,000 to the trustee to keep the vehicle. Its not uncommon for the trustee to reduce the price by the amount it would take to sell the property so you might pay only $8,000.

Keep in mind that your case is unique. A bankruptcy attorney can review your situation and explain what will happen to your property, as well as the cost to file for Chapter 7.

Complete Handling Of Your Case Throughout The Bankruptcy Process

Your lawyer should handle every aspect of filing for bankruptcy from start to finish. Not only does this include step-by-step instructions, but you should also receive valuable advice and guidance about which debts the court will discharge and which will remain.

Explaining which debts are dischargeable and non-dischargeable

Whether you need a Chapter 11 bankruptcy lawyer for your business or a lawyer to handle your personal finances, the goal when filing is to have the court discharge your debts.

When the court discharges your debts, youre no longer liable and dont need to continue paying them. Bankruptcy laws clearly define the types of debts that can and cannot be discharged. The majority of consumer debts, such as credit cards and medical bills, are eligible for debt relief. However, certain types of debt, such as student loans, child support, taxes and alimony, cannot be discharged.

A lawyer will work to identify the debts you can reasonably assume the court will discharge and which you will still need to pay once the filing is complete.

Helping you protect your assets with a bankruptcy exemption

In addition to discharging debts, bankruptcy is designed to help shield certain assets from creditors. Assets fall into one of two categories exempt and non-exempt and your lawyer will help you determine where your assets fit.

Non-exempt assets usually include:

-

Cash, bonds, stocks and investments

-

Valuable possessions like art, antiques and collectibles

-

Secondary vehicles

Recommended Reading: Filing Bankruptcy On Medical Bills

What Debts Cannot Be Discharged In Bankruptcy

The following debts cannot be discharged in either a Chapter 7 or a Chapter 13 bankruptcy case. If you file Chapter 7, you will still owe these debts after your case is over. If you file Chapter 13, these debts will either be paid in full during your plan, or the balance will remain at the end of your case.

Nondischargeable debts include:

- Unlisted debts, unless the creditor had knowledge of your bankruptcy filing.

- Recent income tax debt and other tax debt.

- Fines imposed for violating the law.

- Student loans, unless you can show that it will cause a hardship for you to repay them.

- Debts you owe under a divorce decree or settlement.

In a Chapter 7 and 13 case, a creditor may object, and a judge may agree, to theseadditional debts being discharged:

- Debts incurred by embezzlement, fraud, or larceny.

- Certain credit purchases made within 90 days or cash advances made within 70 days of filing.

- Restitution or damages awarded in a civil action for willful or malicious injury to a person.

What Is An Injunctive Relief Clause

Parties can include an injunctive relief clause in a contract. The injunctive relief clause will prevent either party from taking actions that may harm the other party or entity.

Injunctive relief clauses are helpful when theres no way to stop harm to another through tangible means, like money or property. An injunctive relief clause can make it easier for either party to obtain a judgment or further injunctive relief in court.

Don’t Miss: Can One Spouse File Bankruptcy Without Affecting The Other

Bankruptcy Exemptions By Province

Statute: Read the Civil Enforcement Act.

- Food for a 12 month period.

- Clothing up to $4,000

- Household furniture and appliances up to $4,000

- One motor vehicle up to $5,000

- Equity in your principal residence up to $40,000, reduced to your share if you are a co-owner

- Tools of your trade up to $10,000

- Farm land where your principal source of income is farming, up to 160 acres

- Farm property requirements for 12 months operations

- Social allowance, handicap benefit or a widows pension if the benefits are not intermingled with other funds

To ask about what you can keep if you go bankrupt in Alberta and the rules for bankruptcy exemptions in Alberta, please consult your local Bankruptcy Alberta Trustee.

British Columbia Exempt PropertyStatute: Read the Court Order Enforcement Act and Regulations.

- Clothing for yourself & your depenants, no dollar limit

- Household goods up to $4,000

- One motor vehicle up to $5,000 .

- Tools of your trade up to $10,000.

- Principal residence up to $9,000

To ask about what you can keep if you go bankrupt in British Columbia and the rules for bankruptcy exemptions in British Columbia, please consult your local Bankruptcy British Columbia Trustee.

Manitoba Exempt PropertyStatutes: Read the Executions Act and the Judgments Act.

- Food and fuel for six month supply or cash equivalent

- personal clothing

- Tools of the trade up to $1,000

- Seeds and livestock for domestic use

Ontario Exempt PropertyStatute: Read the Executions Act.

Where To Find Your State’s Bankruptcy Exemptions

Your state’s bankruptcy exemptions are in your state code. If you’re not sure where to find your state’s statutes, we can help. We provide state exemption lists and even links to online statutes in Bankruptcy ExemptionsWhat Do I Keep When I File for Bankruptcy? Scroll down to the middle of the article for the link to your particular state.

But remember, mistakes can be costly. You must read the code section itself to be sure it applies or speak with a knowledgeable bankruptcy lawyer.

Recommended Reading: Bankruptcy Letter Of Explanation

How Exemptions Work In Chapter 7 And Chapter 13 Cases

The type of bankruptcy chapter you file doesnt change the amount of property that you can exempt it remains the same in both a Chapter 7 and Chapter 13 bankruptcy. Whats different, however, is the treatment of your nonexempt property. Understanding these differences will help you determine the appropriate chapter for you.