What Monthly Debt Is Used To Calculate Debt To Income Ratio

Back-end DTI includes all your minimum required monthly debts including the anticipated mortgage payment.

Back-end DTIs also include any required minimum monthly payments that a lender finds on your credit report.

This covers debts such as credit card balances, loan balances from school and auto loans, and personal loan balances.

The majority of lenders place a greater emphasis on the figure that represents your back-end DTI since it provides them with a more comprehensive view of your monthly expenditures.

Do All Lenders Have The Same Dti Requirements On Va Loans

Government and conventional loans have a set maximum DTI cap on their mortgage loan program. Mortgage lenders usually have lower debt-to-income ratio requirements than the agency DTI requirements. The lower the debt-to-income ratio, the better. Low DTI means the borrower has low monthly debts compared to his income. The VA DTI Mortgage Calculator will get you the most accurate estimated housing payment including the VA MIP, PMI, Taxes, Insurance, and HOA if applicable.

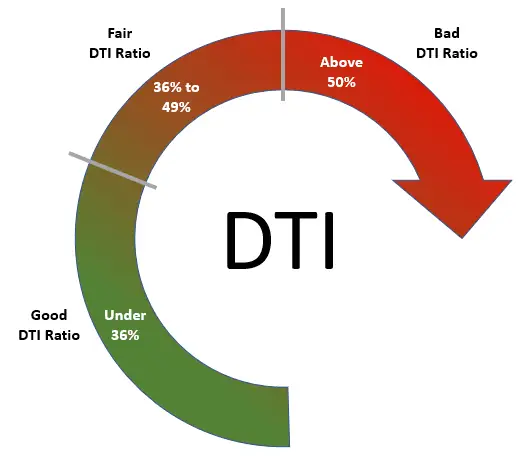

What Should Your Dti Be To Buy A Home

The lower your DTI, the betterthis means less of your income is tied to recurring debt payments, and youll likely be more able to continue making payments on time even if you experience a minor financial setback. Borrowers with higher debt obligations relative to their incomes are less able to absorb those setbacks, and are at greater risk of defaulting on their loan. This is why high DTI is the #1 reason mortgage applications get rejected.

So, whats the magic number when it comes to DTI? Well, it varies slightly based on the type of mortgage, the lender, and other aspects of your financial profile.

Typically, though, most lenders prefer to see a DTI of under 36%. In other words, the total of your monthly debts, including your estimated monthly mortgage payment, will be less than 36% of your monthly gross income. However, it may be possible to get a mortgage with a DTI of up to 50% depending on the lender. If you have a DTI of 50% or higher, then it could be challenging or even impossible to get approved for a mortgage until you lower your debt to income ratio.

Conventional loan DTI requirements

While many lenders require a DTI of no more than 43%, some lenders, including Better Mortgage, can provide mortgages to borrowers with DTIs up to 50%. This means even if your DTI is 49.999%, you could be eligible for a home mortgage loan.

FHA loan DTI requirements

Also Check: Can You File Bankruptcy On Back Taxes

How To Determine How Much House You Can Afford

Ultimately, you will need to work with a lender to figure out exactly how much house you can afford, given your current financial situation. That being said, you can do some preliminary calculations to get a better sense of your budget. Create a mortgage affordability template using these categories to crunch the numbers on what you can afford.

What Dti Is Needed For A Mortgage

- Pay attention to the qualifying rate used by the lender

- Which could differ from the note rate on the loan

- If you apply for an adjustable-rate mortgage

- You might be required to qualify at a higher interest rate to account for future rate adjustments

One important thing to keep in mind is the qualifying rate banks and mortgage lenders use to come up with your debt-to-income ratio.

Many borrowers may think that their start rate or minimum payment is their qualifying rate, but most banks and lenders will always qualify the borrower at a higher interest rate to ensure the borrower can handle a larger amount of debt in the future assuming payments rise.

For example, a borrower may be in an adjustable-rate mortgage with a monthly payment of only $1,000, but their fully-indexed payment could quite a bit higher, say $1,500, after the fixed period ends.

For a bank or lender to effectively gauge the borrowers ability to handle debt, especially once the minimum payment is no longer available for the borrower, the lender must qualify the borrower at the higher of the two payments.

This gives the lender security and prevents under-qualified borrowers from getting their hands on mortgages they cant really afford.

Borrowers should also note that most debt cannot be paid off to qualify. If you have debt on credit cards or other revolving accounts and plan to pay them off with your new loan, the monthly payments will likely still be factored into your DTI.

Don’t Miss: Liquidation Pallets South Carolina

How To Improve Your Dti

If the calculator shows a DTI over 36%, dont be too discouraged: you may still have options. And knowing where you stand before filling out a mortgage application can save you a lot of time, money and heartache.

Achieve a lower debt-to-income ratio by:

-

Avoiding new debt

-

Increasing your income with a side hustle

-

Reducing expenses and using the extra cash to pay off debts

Debt-to-income ratio is different than , which measures how much credit youre using versus how much is available to you. But reducing credit utilization will typically improve your DTI.

How To Calculate Debt

You can calculate your DTI ratio before you apply for a mortgage, regardless of which kind of loan youre looking to get.

First, there are two types of ratios lenders evaluate:

- Front-end ratio: Also called the housing ratio, this shows what percentage of your income would go toward housing expenses. This includes your monthly mortgage payment, property taxes, homeowners insurance and homeowners association fees, if applicable.

- Back-end ratio: This shows how much of your income would be needed to cover all monthly debt obligations. This includes the mortgage and other housing expenses, plus credit cards, auto loan, child support, student loans and other debts. Living expenses, such as utilities and groceries, are not included in this ratio.

The back-end ratio may be referred to as the debt-to-income ratio, but both ratios are usually factored in when a lender says theyre considering a borrowers DTI.

Read Also: Bankruptcy Lawyers In My Area

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Veterans: See What You Can Afford In 2022

One of the key financial metrics for lenders is the debt-to-income ratio when it comes to getting a VA home loan.

The debt-to-income ratio is an underwriting guideline that looks at the relationship between your gross monthly income and your major monthly debts, giving VA lenders an insight into your purchasing power and your ability to repay debt.

Some loan types require a look at two forms of DTI ratio:

- Front-end looks at the relationship between your gross monthly income and your new mortgage payment

- Back-end ratio considers all of your major monthly expenses

For VA loans, lenders consider only the back-end ratio, which offers a more holistic look at your monthly debt-and-income situation.

Read Also: How Long Is A Bankruptcy On Your Credit

Dti Isn’t A Full Measure Of Affordability

Although your DTI ratio is important when getting a mortgage, the number doesn’t tell the whole story about what you can afford.

DTIs don’t take into account expenses such as food, health insurance, utilities, gas and entertainment, and they count your income before taxes, not what you take home each month.

Youll want to budget beyond what your DTI labels as affordable, and consider all your expenses compared with your actual take-home income.

» MORE: How much house can you afford?

Pay Off Debt And Limit Your Spending

Now, for the first lever of your DTI: the debt thats weighing you down.

Look for ways to affordably accelerate debt repayment and start making a plan to reach your target DTI, says the NFCCs McClary. You can adjust your budget to pay more than the minimum payments, but that may take some time to get you to the results you seek.

You might trim unnecessary expenses from your monthly budget, for example, to pay down credit card or other debt at a faster pace. Minimizing your current spending will also allow you to avoid taking on additional debt.

More tips from McClary

-

If youre doing well financially, consider using savings or liquidating assets to lower your debt balances.

-

If youre delinquent on debt, contact a NFCC-approved nonprofit credit counseling agency to get your accounts current and get an affordable repayment plan.

Read Also: Can You File Bankruptcy On A Civil Lawsuit

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyouâre applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If youâre new to building credit

- If youâve had financial problems in the past like a bankruptcy or foreclosure

- If youâre taking out ajumbo loan

Don’t Miss: Is It A Good Idea To File Bankruptcy

What Is Included In Debt

Your DTI ratio should include all revolving and installment debts car loans, personal loans, student loans, mortgage loans, credit card debt, and any other debt that shows up on a credit report. Certain financial obligations like child support and alimony should also be included.

Monthly expenses like health insurance premiums, transportation costs, 401k or IRA contributions, and bills for utilities and services are generally not included. However, if you have long-overdue bills for these types of accounts, they might eventually be passed on to a collection agency. The debt may be included in the calculation if that is the case.

There are two types of DTI ratios that lenders look at when considering a mortgage application: front-end and back-end.

Recommended Reading: Rocket Mortgage Conventional Loan

What Is Considered A Good Dti Ratio

Most people who purchase a home will have some type of debt. With that said, its essential to understand what is considered a good DTI ratio before moving forward with a mortgage application.

Be sure to know the requirements of all prospective lenders before starting an application. As a general rule of thumb, a borrower should aim to have no more than 43% DTI. If you can, its better to aim for a DTI of around 36%, with no more than 28% going towards your new mortgage. Keep in mind that the requirements for DTI vary from lender to lender. Some lenders are more lenient, but others have more rigid requirements.

Recommended Reading: Can You Get An Sba Loan With A Bankruptcy

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

You May Like: What Are The Steps In Filing Bankruptcy

The Ascent’s Best Mortgage Lender Of 2022

Mortgage rates are at their highest level in years and expected to keep rising. It is more important than ever to check your rates with multiple lenders to secure the best rate possible while minimizing fees. Even a small difference in your rate could shave hundreds off your monthly payment.

That is where Better Mortgage comes in.

You can get pre-approved in as little as 3 minutes, with no hard credit check, and lock your rate at any time. Another plus? They dont charge origination or lender fees .

Whats Included In Your Dti Ratio

Our tool calculates your back-end DTI ratio using potential mortgage payments and the following recurring debts:

-

Child support and alimony

-

Personal loan or other monthly debts

Of course, these probably arent your only monthly expenses. Your back-end DTI ratio can also include what you spend on food, utilities, gas, insurance or entertainment, in addition to proposed mortgage payments. Although lenders may not inspect your back-end ratio to this detail, its important to look carefully at these costs so your true monthly financial obligations are represented.

Ideally, your total DTI ratio should be under 36%. Keep this in mind when deciding what affordable means for you.

You May Like: What Are The Pros And Cons Of Bankruptcy

Fha Debt To Income Ratio Chart

This chart will indicate what DTI is acceptable based upon your credit score. This also talks about some compensating factors that may be needed to qualify for the higher DTI levels. Keep in mind this is just a basic guideline and it would be best to discuss your personal scenario because you still may qualify despite what this chart says.

| Minimum Credit Score |

Also Check: How To Figure Out Mortgage Rates

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

You May Like: Loan Ratio To Income

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

What Happens If I Cannot Get An Approve/eligible Per Automated Underwriting System

If the borrower does not get an approve/eligible per the automated underwriting system and gets a refer/eligible per AUS findings, the file can be manually underwritten. Manual underwriting is the process where a human mortgage underwriter is assigned to the file and thoroughly underwrites the file. The mortgage underwriter will be more thorough on manual underwrites when reviewing the borrowers credit, credit history, income history, and the ability to pay the new mortgage loan. Use the VA DTI Calculator to determine what your debt-to-income ratio is on manual underwriting.

QUICK USEFUL LINK: How To Get Refer/Eligible To an Approve/Eligible Per AUS

Also Check: Can You File Bankruptcy On Student Loans In Collections

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.