What Happens When You File Chapter 13

If you can’t file a Chapter 7 bankruptcy, or if you have some money to pay creditors and there are assets that you want to keep, a Chapter 13 bankruptcy may be an option for you. In a Chapter 13 bankruptcy, you will:

- Develop a plan for making payments to your creditors over a three-to-five-year period, depending on your income

- Make all of your payments on time to said creditors

- Complete a budget counseling course

After these milestones are complete, the remainder of your debt that is eligible for discharge will be erased.

Chapter 13 is a good option for someone with a steady income who has some money left over every month to make debt payments but who needs some breathing room and extra time to get caught up.

It May Be Your Only Choice But Know The Consequences Before Deciding

Peope who have racked up more debt than they can repay are sometimes left to ponder whether they should file for bankruptcy. There are several reasons it might make sense to take the plunge and file for Chapter 7 bankruptcy or Chapter 13 bankruptcy. However, making that decision also carries some serious consequences.

What Can I Gain By Filing Bankruptcy

At the end of a successful bankruptcy, you’ll receive a bankruptcy discharge order from a United States bankruptcy court. Bankruptcy laws are clear that creditors can never again try to collect on a debt that’s been discharged. After bankruptcy, you’ll have the fresh start that you need.

Bankruptcy erases most common types of unsecured debts, which are debts not connected to any specific piece of property. Unsecured debts erased by filing bankruptcy include:

-

Deficiency on a car loan after a repossession

-

Other dischargeable debts

While most debts are wiped out when your bankruptcy discharge is granted, some are not. Debts that can’t be erased through bankruptcy are known as non-dischargeable debts. The most common non-dischargeable debts are recent tax debts , child support or alimony payments, and generally student loans. You will have to pay these types of debts back after bankruptcy.

Read Also: What Happens When You File For Bankruptcy

What Not To Do

The biggest mistake people make in bankruptcy filings is trying to game the system. All your assets may be seized in a bankruptcy and failing to disclose all of them can result in criminal charges

Just ask tennis player Boris Becker, currently looking at jail time in the U.K. for hiding assets. Do not transfer property to family or friends before you file. It will be clawed back.

Honest debtors get a fresh start, while dishonest ones can potentially go to jail.David Leibowitzhead of Lakelaw

Also don’t max out your credit resources before you file. The court will not look kindly upon it. Never use funds from retirement accounts to pay off debt.

“Truth and transparency are critical to the bankruptcy process,” said Leibowitz. “Honest debtors get a fresh start, while dishonest ones can potentially go to jail.”

Which Debts Cant Be Discharged In Bankruptcy

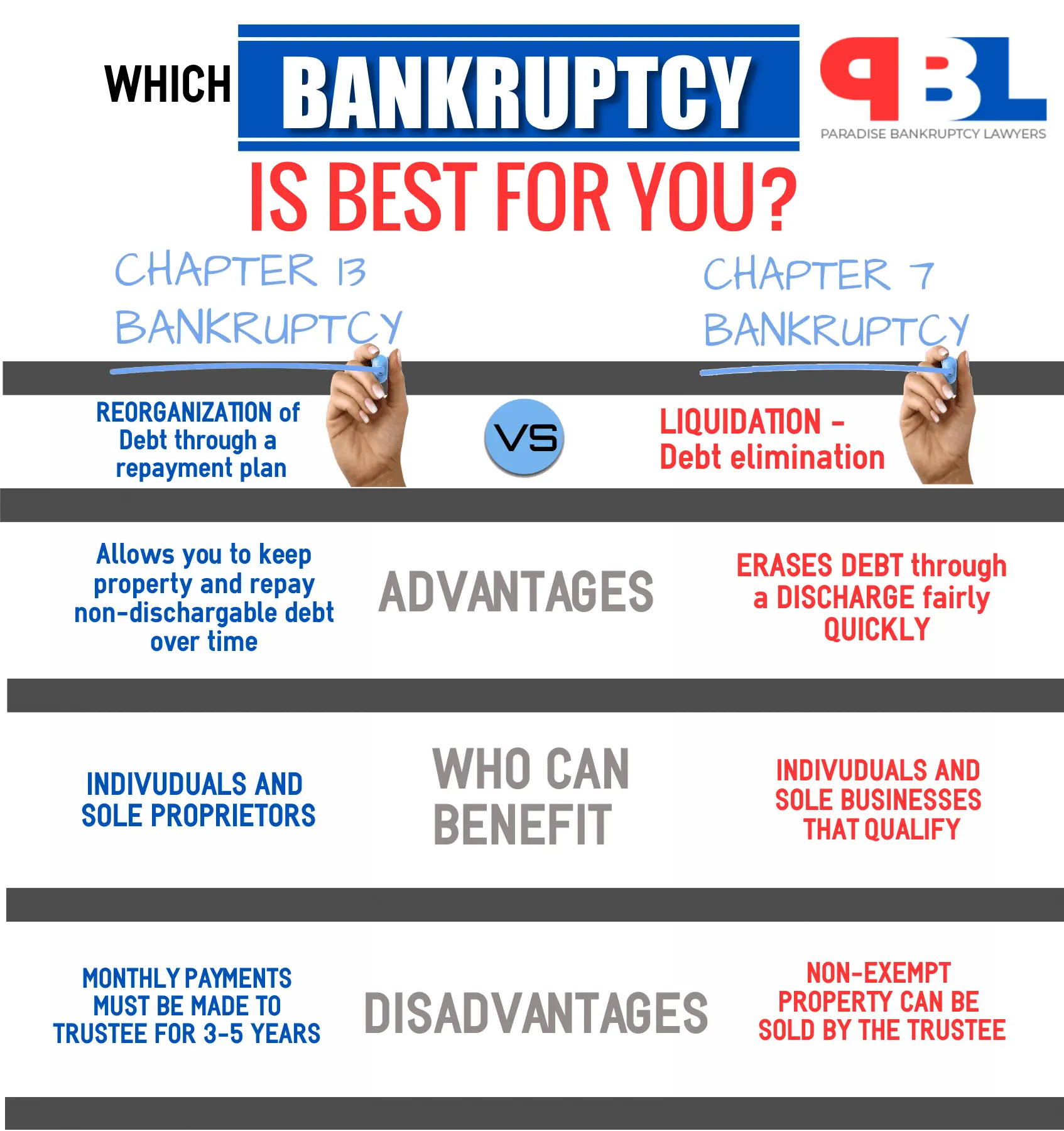

There are several types of bankruptcy, but chapter 7 and chapter 13 are among the most common forms pursued as they apply to individuals. Under chapter 7, an individuals non-exempt assets are liquidated and debts are repaid with the proceeds. Chapter 13 bankruptcy allows for restructuring your debts and paying some creditors back with interest, while others will receive a portion of the outstanding debt. Once your repayment plan is completed, the remaining debts can be discharged.

Also Check: How To Qualify For Home Loan After Bankruptcy

What Are The Types Of Bankruptcies

Even though the general goal of bankruptcy is to clear debt, not all bankruptcies are created equal. In fact, there are six different types of bankruptcies:

-

Chapter 7: Liquidation

-

Chapter 15: Used in Foreign Cases

-

Chapter 9: Municipalities

You may have just taken one look at this list and zoned out for second. Thats okay. More than likely, you would only be dealing with the two most common types of bankruptcies for individuals: Chapter 7 and Chapter 13. But well take a look at each type so youre familiar with the options.

Chapter 7 Vs Chapter 13 Bankruptcy

The main difference between Chapter 7 and Chapter 13 bankruptcy is that in Chapter 13 bankruptcy, you don’t immediately erase any debts. You propose a repayment plan based on your ability to repay certain debts. The bankruptcy trustee and all creditors review the Chapter 13 reorganization plan and, if itâs acceptable to all involved, the court confirms your repayment plan, which lasts three to five years.

Most people file Chapter 13 bankruptcy instead of Chapter 7 for two reasons. First, they fail the means test due to their high income and donât qualify for Chapter 7 bankruptcy. Second, they own a home they want to keep thatâs not covered by the Chapter 7 bankruptcy exemptions.

If you’re considering filing Chapter 13 because you don’t pass the means test, look at the reasons you aren’t passing. The lookback period for the means test is 6 months, so if you recently experienced a drop in household income, you might qualify for Chapter 7 in the near future.

Recommended Reading: How Many Points Does A Bankruptcy Lower Your Credit Score

If You Cant Stick To The Repayment Plan You Could Lose Your Chapter 13 Status And Maybe Even Assets

If youre unable to make your payments under the plan, your bankruptcy case could be dismissed or converted to Chapter 7, which means you could again be in jeopardy of losing assets like your home or car.

Your repayment plan could also be at risk of being dismissed or converted to Chapter 7 by the court if you fail to file required taxes during your case or if you fail to pay domestic support obligations, such as child support and alimony, after filing.

The Impact On Your Credit May Not Be As Severe

Like Chapter 7, Chapter 13 bankruptcy may have a very negative impact on your credit. A completed Chapter 13 bankruptcy can stay on your for up to seven years from the date you file. But some creditors could view a Chapter 13 bankruptcy more favorably than a Chapter 7 bankruptcy. It could be an indication that you repaid more of your debt.

You May Like: Can You File Bankruptcy More Than Once

It Can Provide Relief From Debt Collectors

If you cant afford your unpaid debts, Chapter 7 can be a helpful tool to stop debt collectors from taking action against you. When you file, some of your may be temporarily restricted from

- Collecting money from you

- Continuing wage garnishment

- Starting or continuing lawsuits against you or your property

The Federal Government May Intervene

Under rare situations, the federal government may pass laws that could affect your bankruptcy case during a pandemic. For instance, the federal government passed a stimulus bill in response to the COVID-19 pandemic.

Under this stimulus bill, several temporary changes were made to the bankruptcy code. Some of these changes include:

- Previously, the debt limit to be eligible to file for bankruptcy under the Small Business Reorganization Act was $2,725,625. Under this stimulus bill, the debt limit was increased to $7.5 million for a period of one year.

- The bill also changed the definition of “income” for Chapter 7 and 13 bankruptcy filers. Accordingly, payments received from the federal government that are related to COVID-19 are not considered income for purposes of bankruptcy.

- People with federal student loans can, without penalty, defer their payments for six months through September 30, 2020.

- People who already filed a Chapter 13 and are under a repayment plan can make modifications if they can show “material financial hardship” because of the pandemic. The modifications include an extension of payments for seven years.

Also Check: How Can Filing Bankruptcy Help Me

What Type Of Bankruptcy Should I File

The average American has over $90,000 in debt from credit cards and medical bills to mortgages and student loans. As the COVID-19 moratorium on some loans expires, many people find themselves in more debt than ever. However, bankruptcy can bring some much-needed relief from these debts. Read on to learn about the types of bankruptcy and what option may be best for you.

Choose Your Debt Amount

Home > Bankruptcy > Should I File for Bankruptcy?

If youre considering bankruptcy, it means you have serious debt. Bankruptcy can be an opportunity to rebuild finances, but it comes with a serious long-term hit to your credit worthiness. Before filing , make sure youve looked at all the debt relief options and considered what is right for you.

If you ask friends if you should file for bankruptcy, their likely response will be Only as a last resort! The reality is more complicated than that bankruptcy may be your best option to reach financial stability. Or the consequences, including the hit to your credit for years to come, may not be worth any gains you would make. Everyones situation is different.

The decision to file for bankruptcy isnt a simple matter of weighing pros and cons, but rather a more complicated issue of understanding your finances now, and what you would like your future to be.

Things to consider are:

- What kind of debt you have

- Does that debt qualify for bankruptcy

- Will filing allow you to keep your home and your car

- What financial steps you would like to take in the next 7-10 years when bankruptcy is sitting on your credit report like an albatross

- Is there a less severe debt relief option that will work better for you.

Lets take a look.

Recommended Reading: Does Bankruptcy Cover Private Student Loans

What Happens When I File For Chapter 7 Bankruptcy In Pennsylvania

After you file for bankruptcy, three important and immediate things happen:

Once Chapter 7 bankruptcy is granted, you will see your credit score affected by it. Chapter 7 bankruptcy stays on your credit report for ten years. As you rebuild your credit, bankruptcy will begin to lose its negative effect on your credit score.

Contact A Bankruptcy Lawyer In Bucks County Today

At Law Offices of Jeffrey S. Nowak, we know how debt can impact an individual, a family, or a business. If you have difficulty paying bills because of the debt you or your company have accumulated, speak to a bankruptcy attorney in Bucks County today by filling out our online form or calling us at 215-364-3700. We will schedule a Consultation so that you get the answers you need to all your financial questions.

Contact Our Firm

Thank you for contacting us. We will get back to you shortly.

Please complete all required fields below.

You May Like: How Soon After Bankruptcy Can You Buy A Car

How Much Does Bankruptcy Cost

Another consideration is the cost of filing for bankruptcy. Filing typically costs a couple of hundred dollars, but hiring an attorney to represent you and protect your interests could cost a great deal more. Although individuals can act on their own behalf without an attorney, by going it alone you run the risk of losing certain rights or property. Generally speaking, because of their knowledge of bankruptcy law and experience with the courts, an attorney can be worth the money.

After bankruptcy, you will probably find it difficult to get a credit card, except at a very high interest rate. One alternative is a secured card, where you put some money on deposit with the issuer.

You Can Keep Your House In Bankruptcy But May Have To Sell Other Assets

If you file for bankruptcy, you can usually keep the house and other property you own. In some cases, you may have to sell some of your assets in order to keep them. If you dont have enough money to pay your mortgage, for example, you might have to sell other assets to make the payment, but you wont lose your home. Before filing for bankruptcy, you should understand the law. Learn more about your current bankruptcy situation by speaking with an attorney.

Read Also: Will Filing For Bankruptcy Stop A Judgement

Keep Up With Your Chapter 13 Plan Payments

Woohoo! The hard part is over! Congratulations on getting your Chapter 13 plan approved! Now youâll need to continue making your monthly plan payments for the next 3 to 5 years before your case successfully concludes and your discharge can be entered.

The first payment is due within 30 days after you file your bankruptcy forms. Keep in mind that up until your case is confirmed, your monthly plan payments can increase or decrease. If you fall behind on your payments and are unable to catch up within a reasonable amount of time, your case will be dismissed and you will not receive a discharge.

What Happens When You File For Bankruptcy

There are a lot of misconceptions about what it means to file for bankruptcy, which can lead to unnecessary stigma.

For instance, there is a commonly held belief that those who file for bankruptcy are irresponsible when it comes to managing money. In reality, the high cost of medical expenses is one of the leading causes of bankruptcies.

Other misconceptions are that if you file for bankruptcy, you can lose all of your belongings or never be eligible for credit again. Neither of these statements is true. Your assets are often protected by federal or state exemption laws though you may have to sell some of your belongings in a Chapter 7 case and many bankruptcy filers are able to secure forms of credit again.

There are six types of bankruptcy, but the average consumer will usually file one of two:

- Chapter 7: This is the most common form of bankruptcy for individuals. With this method, valuable assets are liquidated to settle debts. Chapter 7 is typically split into asset cases and no-asset cases if you are determined to be a no-asset filer, you wont have to give up your belongings. Chapter 7 bankruptcy can stay on your credit report for up to 10 years, starting on the filing date.

- Chapter 13: This is the second most common form of bankruptcy that individuals file. With Chapter 13 bankruptcy, a three-to-five-year repayment plan is created. This form of bankruptcy can stay on your credit profile for up to seven years.

Also Check: What Is The Origin Of The Word Bankruptcy

Your Credit Could Take A Hit

The other major consequence of a Chapter 7 bankruptcy is the impact to your credit. A Chapter 7 bankruptcy can stay on your credit reports for up to 10 years from the date you file.

That doesnt mean youll never be able to open a credit card or take out a mortgage again, but it does mean you might have to pay a lot more in interest rates and fees when borrowing.

Which Debts Are Discharged In Bankruptcy

When filing for bankruptcy, the goal is to eliminate as much debt as possible and get a fresh financial start. As part of this process, several types of debts will be discharged immediately or at the end of the bankruptcy process. Once discharged, you will no longer be required to pay the debt. This is a permanent order, and creditors cannot pursue collection.

Also Check: Does Filing For Bankruptcy Eliminate Debt

Overview: What Is Bankruptcy

Bankruptcy is a legal process for individuals or companies that are unable to pay their outstanding debts. You can go bankrupt in one of two main ways. The more common route is to voluntarily file for bankruptcy. The second way is for creditors to ask the court to order a bankruptcy.

If you decide to file for bankruptcy yourself, there are several ways to do so. You may want to consult a lawyer before proceeding so you can figure out the best fit for your circumstances.

If You Cant Make Your Installment Debt Payments

A surprising number of people start thinking about bankruptcy when they fall behind on their credit card payments. Some people who are unfamiliar with our legal system believe they will go to jail if they stop paying. Not true. Furthermore, most creditors, including credit card companies, banks, and medical-care providers, cant go after your wages, bank account, or home unless they first sue you in court and win.

Suing you takes time and money, and not all creditors are willing to take this step. If a creditor does sue you, youll be personally served with a summons and complaint, after which youll typically have 30 days to file a simple response that denies the allegations and makes the creditor prove its case at a trial months or even years down the road.

Because of the potential expense involved in bringing a lawsuit, many creditors instead will declare the debt as “uncollectable” and write it off on their taxes. If you dont own real estate and have few assets that could be seized, or you are unemployed or receiving Social Security, this is likely to happen in your case. In other words, while bankruptcy can get rid of most debts, you may be able to just stop making your payments without any consequences , and save the bankruptcy fees. If a creditor does sue you later and win, and you have assets or income to lose, you can always file bankruptcy to get the debt wiped out.

Don’t Miss: What Happens When You File Bankruptcy On Your Business