How To File Bankruptcy In 2021 For Free: A 10

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Chapter 7 bankruptcy is an important debt relief tool for Americans in severe financial distress from losing a job, getting injured, or getting divorced. Upsolve walks you through the steps on how to file for Chapter 7 bankruptcy and get your fresh start in 10 steps.

Written by Attorney Andrea Wimmer.

Before Starting…

First, you need to determine whether filing bankruptcy will help you. Bankruptcy is a powerful debt relief tool, but only if it makes sense for your financial situation. Filing any type of bankruptcy provides immediate debt relief through the automatic stay. Thatâs the law that prohibits creditors from contacting you as soon as your bankruptcy case has been filed. It also stops a wage garnishment right away.

Chapter 7 bankruptcy is a very effective tool for erasing credit card debt, medical debts, and most other unsecured debt. Although Chapter 7 is a liquidation bankruptcy, filers are able to keep all their property in more than 90% of all consumer bankruptcy cases in the United States. You can file bankruptcy under Chapter 7 once every 8 years.

-

The name of your bankruptcy trustee

-

The date, time, and location of your meeting with your trustee

S In A Chapter 7 Bankruptcy Case

A typical Chapter 7 bankruptcy case is relatively straightforward. You will spend most of your time completing the bankruptcy petition, schedules, and other forms, which will require you to list your debts, assets, financial transactions, and so on. Once you’ve filed your paperwork, the bankruptcy trustee takes over your case. After you attend a brief court hearing and meet a few other requirements, you’ll receive your discharge and your case will be closed, usually, four-to-six months after you file for bankruptcy.

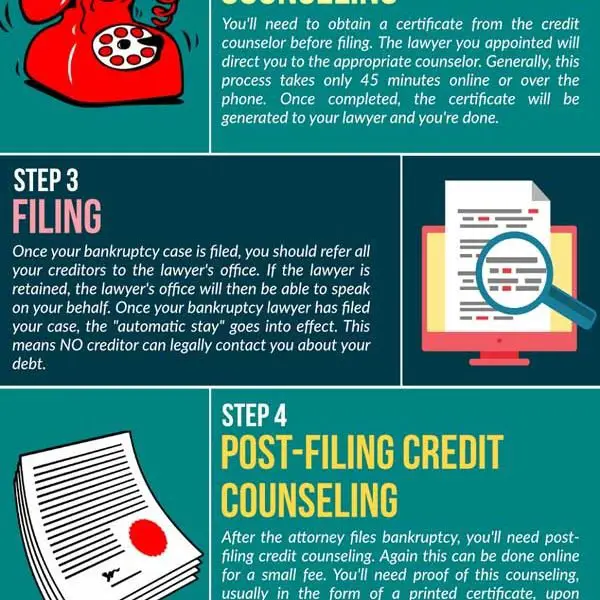

Complete A Debtor Education Course

Next is a required education course. You must complete this education before your debts will be discharged. GreenPath is approved to provide both the pre-filing bankruptcy counseling and the debtor education session. The GreenPath version of debtor education can be completed 100 percent online, or by reading a book and speaking with a counselor.

You May Like: How Many Times Did Donald Trump File For Bankruptcy

The Final Steps Of Your Journey Towards Lasting Debt Relief

Getting all of your bankruptcy forms prepared and filed with the bankruptcy court is usually the most time-intensive process of a Chapter 7 bankruptcy. But that doesnât mean that your job is done. There are a few things everyone filing Chapter 7 bankruptcy has to do to successfully complete their bankruptcy case and receive a discharge. Letâs take a look at what you can expect will happen in your Chapter 7 bankruptcy.

Pay Filing Fee in Installment Payments

If you can’t pay the entire Chapter 7 bankruptcy filing fee and you don’t qualify for a fee waiver, then you can apply to pay the filing fee in installments. You can ask to make four installment payments. The entire fee is due within 120 days after filing.

If the bankruptcy court approves your application, it will grant an Order Approving Payment of Filing Fee in Installments. Your installment payment due dates will be in that order. You must pay all installments on time or your case is at risk of being dismissed.

Take Bankruptcy Course 2

You will complete a credit counseling course before filing bankruptcy. There’s a second course you must take after filing bankruptcy. It covers personal financial management and can help you take advantage of your fresh start after erasing your debts through bankruptcy.

You have to take this course after your case is filed but make sure itâs be completed within 60 days from the date of the meeting of creditors. A certificate of completion must be filed with the court.

Bankruptcy Blunders: Mistakes To Avoid When Filing Bankruptcy

If you are facing a critical financial situation, and if nothing else works to restore your financial health but you have the option of filing bankruptcy, it is okay to go for it. However, remember to take a careful approach and avoid any mistakes that can derail the process of filing bankruptcy. Here are some of the common mistakes one should avoid when filing for bankruptcy. ~ Ed.

Life-changing events such as illness, loss of a job, and divorce can push an individual to their breaking point, especially in terms of finances. In the context of business bankruptcy, wrong turns and unexpected bumps in the road can have similarly dire consequences.If your businesss finances have gone up in flames, retracing your steps and identifying the root cause of this financial fire is an essential step. For some business owners, the weight of external forces like a bearish market, unraveling consumer confidence, shifting customer preferences reaches crushing levels.

In other cases, internal missteps, such as tacking on loads of debt, poor decision-making or questionable management skills will leave entrepreneurs stumbling down the road to bankruptcy.Whatever has sent your bottom line in smoke, remember that financial ruin is much closer than it may appear. While there are many options to turn to when trying to restore your financial health, sometimes bankruptcy is the only way out of sky-high debts.

You May Like: What Is A Bankruptcy Petition Preparer

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

S To Filing Bankruptcy In Canada

Filing bankruptcy in Canada is a ten step process. The steps to claim bankruptcy in Canada are relatively simple. Here is how to file bankruptcy in Canada, step by step:

Read Also: Has Mark Cuban Ever Filed For Bankruptcy

Obtain Discharge From Bankruptcy

Most personal bankruptcies in Canada end in an automatic discharge. How long you will be bankrupt depends on the completion of your duties, how much you make, and if you have filed bankruptcy before. For a first time bankrupt, with no surplus income, a bankruptcy can be finished in as early as 9 months.

Your discharge is the most important step, since your bankruptcy discharge is what eliminates your unsecured debts. You have a fresh start.

After your debts are discharged, you can continue the process of rebuilding your credit and finances. A note of your bankruptcy will be removed from your credit report six years after your date of discharge. Some people are able to obtain a credit card during bankruptcy although we do not recommend taking on new credit while bankrupt.

What Is A Claim In A Bankruptcy Case

In the broadest sense, a claim is any right to payment held by a person or company against you and your bankruptcy estate. A claim does not have to be a past due amount but can include an anticipated sum of money, which will come due in the future. In filling out your Schedules, you should include any past, present or future debts as potential claims.

Read Also: Donald Trump Number Of Bankruptcies

Debts Discharged: Be Careful With New Lines Of Credit

If you filed Chapter 13 bankruptcy, you will need to complete your payment plan to achieve discharge. If you filed Chapter 7, you will simply wait the 60 days after your 341 Meeting of Creditors for your case to be eligible for discharge. Once your case has been discharged, you are no longer legally obligated to pay the debts discharged in your bankruptcy. You will likely be inundated with new credit offers shortly after discharge. While opening new credit cards can be a great way to rebuild your credit after bankruptcy, you should be cautious about the terms of all credit offers, and spend minimally and wisely.

Redeem Or Reaffirm Secured Debts

If you pledged property as collateral for a loan, you’ll need to continue to pay the creditor if you want to keep the property. When you file for bankruptcy, you’ll be asked to decide whether you want to “redeem” the property , “reaffirm” the debt , or “surrender” the property . Depending on where you live, there might be other options as well .

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Filing Chapter 7 And Chapter 13 Bankruptcy In Canada

When US residents file for personal bankruptcy, they do it under Chapter 7, Title 11 of the United States Code. Since this is common practice for personal bankruptcy filings, it has come to be known as Chapter 7 bankruptcy.

Chapter 7 bankruptcy does not exist in Canada. The Bankruptcy and Insolvency Act covers personal bankruptcy, but the process is called filing for personal bankruptcy, not filing for Chapter 7 bankruptcy.

Chapter 13 is a bankruptcy law in the US that allows people to reorganize or settle their debts. The Canadian equivalent of Chapter 13 is called a Consumer Proposal. Consumer proposals allow debtors to reorganize their debt and come up with a settlement plan that would enable them to repay a portion of their debt over a period of up to 5 years.

Consumer proposals are designed to help people repay their debt instead of filing for bankruptcy.

More About Bankruptcy

- 1544 Danforth Avenue, Suite 203 Toronto

- 10 Milner Business Court Ste. 300 Scarborough

- 4711 Yonge St. 10th Floor North York

- 4 Robert Speck Parkway, 15th Floor Mississauga

Virtual appointments are available

How To File For Bankruptcy

Filing for bankruptcy is a legal process that either reduces, restructures or eliminates your debts. Whether you get that opportunity is up to the bankruptcy court. You can file for bankruptcy on your own, or you can find a bankruptcy lawyer, which most experts regard as the prudent avenue to pursue.

Bankruptcy costs include attorney fees and filing fees. If you file on your own, you will still be responsible for filing fees. If you cant afford to hire an attorney, you may have options for free legal services. If you need help finding a lawyer or locating free legal services, check with the American Bar Association for resources and information.

Before you file, you must educate yourself on what happens when you file for bankruptcy. Its not simply a matter of telling a judge Im broke! and throwing yourself at the mercy of the court. There is a process a sometimes confusing, sometimes complicated process that individuals and businesses must follow.

The steps are:

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Withdraw Some Money For Your Living Costs

There may be a delay of several days between your bankruptcy order being made and the official receiver taking control of your money and property. However, your bank or building society accounts may be frozen immediately, meaning you won’t be able to access any money. Therefore, you should take enough money out of your account to cover your costs for the next few weeks, if possible.

Surplus Income Adds To The Cost Of Bankruptcy

In addition to the trustee fee and potential loss of assets, you may be required to pay a portion of your monthly income towards your debts, depending on how much you earn and the size of your household. The principle is that, if you earn more than your household needs to survive, you must pay a portion of the surplus income to your trustee for the creditors. The formula is prescribed by law. The idea is that the more you earn, the more you can presumably afford to repay to your creditors. In general, the greater your level of income, the greater the cost of a bankruptcy and the more attractive the alternatives to bankruptcy become.

You May Like: Can Bankruptcy Wipe Out A Judgement

Meet With Your Trustee To Review Your Options

Now that youve selected your trustee you should contact them and schedule a free initial consultation. You will be asked to bring some specific details of your financial situation, including your income and expenses, assets and debts.

At your first meeting, your trustee will review your financial details, and outline the alternatives to bankruptcy that could be chosen in your case, ranging from debt consolidation through consumer proposals and including the bankruptcy process. Your trustee will provide you with information and advice on each which is best for you but the decision will remain in your hands and you will have as much time as you need.

- If you have enough income, debt consolidation or credit counseling are good debt relief options.

- Consumer proposals allow you to keep your house and other assets, subject to the rights of secured creditors.

Learn More

What Happens After I File Bankruptcy

Your stay of proceedings begins immediately after your bankruptcy is filed with the government. That means collection calls stop and your trustee can notify your employer to stop a wage garnishment if needed.

After filing, you stop making payments to your unsecured creditors and make your bankruptcy payments instead.

Read more: What debts are included in a bankruptcy?

Completion of Duties

Once you are legally bankrupt, you are required to perform the bankruptcy duties as outlined in Appendix I of the Act. The trustee will inform you of these duties but generally, they include making your bankruptcy payments, providing information about your monthly budget, attending two credit counselling sessions, and keeping the trustee notified of any material changes to your situation.

Meeting of Creditors

Generally, a meeting of creditors is not necessary but there may be instances where such a meeting will be held. . Creditors or the Official Receiver may request one after filing bankruptcy. If a meeting of creditors is called, you must attend this meeting. You may also be required to go to the Official Receivers office to answer several questions under oath about your financial affairs.

Examination with the Official Receiver

Don’t Miss: How Many Trump Bankruptcies

Where Bankruptcy Doesnt Help

Bankruptcy does not necessarily erase all financial responsibilities.

It does not discharge the following types of debts and obligations:

- Loans obtained fraudulently

- Debts from personal injury while driving intoxicated

It also does not protect those who co-signed your debts. Your co-signer agreed to pay your loan if you didnt, or couldnt pay. When you declare bankruptcy, your co-signer still may be legally obligated to pay all or part of your loan.

Determine Whether Your Income Meets The Means Test

When considering whether to file bankruptcy without a lawyer, the first step is to conduct a âMeans Test” to determine whether you qualify for Chapter 7 bankruptcy.

The federal government provides a test form. You can also find simplified versions of the test online. You’ll have to answer questions regarding:

- Your monthly income

- Your debts and nonexempt assets

- The number of people in your household

The bankruptcy process may be simple enough to handle on your own if the following are met:

- You own few assets

- Your household income is below your state’s median

- You haven’t been accused of fraud

You May Like: How To File Bankruptcy In Wisconsin

Alternatives To Chapter 7

Debtors should be aware that there are several alternatives to chapter 7 relief. For example, debtors who are engaged in business, including corporations, partnerships, and sole proprietorships, may prefer to remain in business and avoid liquidation. Such debtors should consider filing a petition under chapter 11 of the Bankruptcy Code. Under chapter 11, the debtor may seek an adjustment of debts, either by reducing the debt or by extending the time for repayment, or may seek a more comprehensive reorganization. Sole proprietorships may also be eligible for relief under chapter 13 of the Bankruptcy Code.

In addition, individual debtors who have regular income may seek an adjustment of debts under chapter 13 of the Bankruptcy Code. A particular advantage of chapter 13 is that it provides individual debtors with an opportunity to save their homes from foreclosure by allowing them to “catch up” past due payments through a payment plan. Moreover, the court may dismiss a chapter 7 case filed by an individual whose debts are primarily consumer rather than business debts if the court finds that the granting of relief would be an abuse of chapter 7. 11 U.S.C. § 707.

Debtors should also be aware that out-of-court agreements with creditors or debt counseling services may provide an alternative to a bankruptcy filing.