To Remove A Bankruptcy From Your Credit Report Youll Need To Find Evidence That The Bankruptcy Was Reported Incorrectly Otherwise It Will Only Come Off After Seven Or 10 Years Depending On The Type Of Bankruptcy

Beyond the stress and inconvenience that comes with filing for bankruptcy, it can have a long-standing impact on your credit report and score.

Fortunately, that negative impact can be mitigated with the right help.

Mistakes On Credit Reports After Completion Of A Consumer Proposal

Unfortunately, it is not uncommon to find mistakes on your credit report after youve completed the consumer proposal. Its advisable to get the inaccuracies resolved as soon as you can, so your credit report reflects the correct and most updated picture. After all, upon completion of a consumer proposal, youre looking forward to a fresh and optimistic start and rebuilding your credit. Both Equifax and Transunion have processes in place to correct erroneous information on your credit report in Canada.

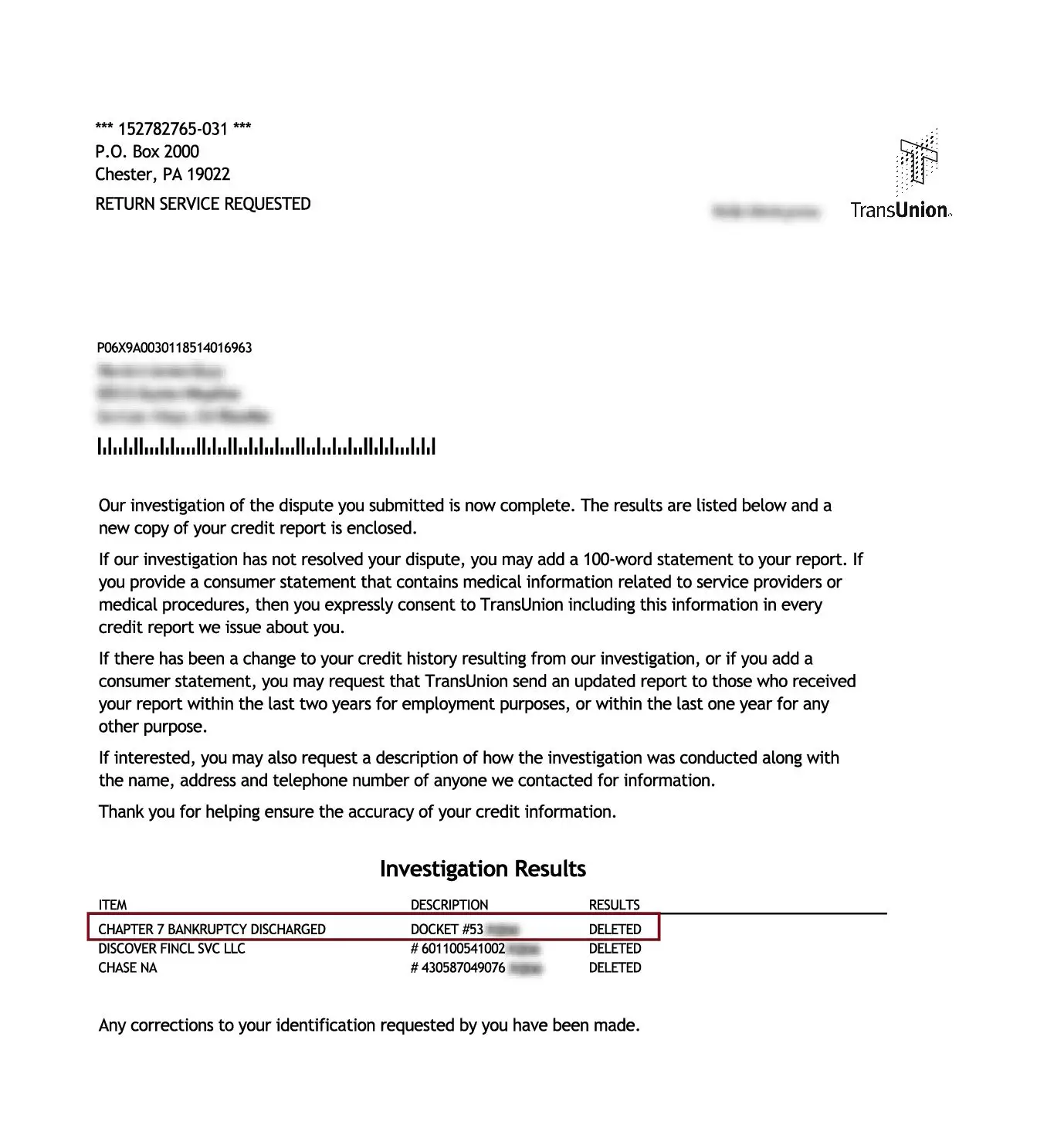

So be sure to examine your credit reports and check whether creditors are reporting any previously owed figures as fulfilled or still pending. If you find any discrepancies, you can initiate a rectification by submitting a correction request to Equifax or TransUnion . The request must include a completed Credit Investigation Request Form along with any pertaining documents as evidence to substantiate your request.

Can I Apply For Credit

After your bankruptcy has ended, there is no restriction on applying for loans or credit. Its up to the credit provider to decide if they will lend you money.

Your credit reportwill continue to show your bankruptcy for either:

- 2 years from when your bankruptcy ends or

- 5 years from the date you became bankrupt .

It can take time to rebuild your credit rating.

For more information regarding your credit report, contact a credit reporting agency. Information about credit reporting agencies is available at ASIC’s MoneySmart.

Also Check: Epiq Bankruptcy Solutions Llc Ditech

Get Your Credit Report Fixed

So, what to do next?

Youve gotten your reports and check them for these errors and youve found one or more of them . No worries, get free help drafting written disputes to your creditors and the bureaus and set your problem up to get fixed as soon as possible!

If it takes a lawsuit to fix it, remember, the law requires that the Credit Bureaus pay the costs and attorneys fees for that .

Youve done the work of going through bankruptcy make sure you get the Fresh Start that you deserve!

More on life after bankruptcy

Check The Credit Reports For Errors

The most important step in removing a bankruptcy from your credit report is to scan your credit reports closely and look for errors. If you find a mistake on a report relating to a bankruptcy, the credit bureau may be willing to remove the bankruptcy altogether.

First, obtain a copy of each of your credit reports from the three credit bureaus. Next, read each report carefully and look for errors. Common errors you may find on a credit report include:

- Identity errors: Errors in personal information, contact information, spelling, etc.

- Balance errors: Errors in the balance amount or credit limit

- Duplication errors: Errors in how many times a creditor reports a debt

- Account errors: Errors regarding your payment history, the status of your accounts, timely payments, charge-offs, etc.

If you find any of these errors relating to your bankruptcy filings, you can present them to the creditor and request that they remove the bankruptcy from your credit report.

Tip: Using a credit monitoring service is an excellent way to stay on top of your credit reports and to identify errors as they occur. If you do not currently work with a monitoring service, you may want to consider doing so as you attempt to rebuild your credit score after a bankruptcy. Many of these services offer a free credit consultation and personalized credit advice.

Read Also: Luftman Heck And Associates Debt Settlement

How Long Does Chapter 11 Bankruptcy Stay On Your Credit Report

4.8/510 years7 years

People also ask, does a bankruptcy automatically come off?

The Two Types of BankruptcyIt takes 10 years for this type of bankruptcy to come off your credit report. The bankruptcy itself will automatically be deleted from your report seven years from its filing date.

Also Know, does Chapter 11 affect personal credit? If you are operating as an LLC or corporation, a business bankruptcy under Chapter 7 or 11 should not affect your personal credit. However, there are exceptions. Pay the debt on time and your will be fine. If it goes unpaid, or you miss payments, however, it can have an impact on your personal credit.

In this manner, how much will credit score increase after bankruptcy falls off?

The Truth: While bankruptcy may help you erase or pay off past debts, those accounts will not disappear from your report. All bankruptcy-related accounts will remain on your report and affect your for seven to ten years, although their impact will lessen over time.

Can Chapter 7 be removed from credit before 10 years?

Chapter 7 bankruptcy is deleted 10 years from the filing date because none of the debt is repaid. Individual accounts included in bankruptcy often are deleted from your history before the bankruptcy public record. Usually, a person declaring bankruptcy already is having serious difficulty paying their debts.

How Long Does A Bankruptcy Stay On My Credit Reports

Depending on the type of reportable credit event, the statutory reporting limit is either two years , seven years , or ten years . Bankruptcies are reported on consumer credit reports because they are credit-related public records. The length of time a bankruptcy remains on a credit report depends on the type of bankruptcy.

A Chapter 7, 11 or 12 bankruptcy is reportable for ten years and a Chapter 13 bankruptcy is reportable for seven years from the date of filing in bankruptcy court. Chapter 13 has a shorter reporting time than other bankruptcy types because it requires at least partial repayment of the debts the filer is attempting to have discharged. In this way, a Chapter 13 bankruptcy is treated like any other non-payment or payment delinquency, which also has a reportable timeframe of seven years.

On the expiration of the reporting period for a specific bankruptcy, the bankruptcy and all discharged accounts should be deleted automatically. An account listed for discharge in the bankruptcy, however, may be removed prior to expiration of the bankruptcy’s reporting period or even prior to filing the bankruptcy altogether. Since the date for removal of delinquent accounts is based on the date of delinquency, the delinquency will fall off a credit report seven years after the delinquency and will not be renewed merely based on its inclusion in the bankruptcy.

Get The Help You Need. Get It Now.

Please complete all required fields below.

Read Also: How Many Times Trump Filed Bankruptcy

Why Consider Opting For A Consumer Proposal

If you have the capacity to make partial payments towards your debts, opting for a consumer proposal is an advantageous option for a number of reasons. It not only helps you avoid bankruptcy but can also relieve you of a significant proportion of your debt without interest. In addition, it consolidates your debts into one reasonable and affordable monthly payment, the terms of which can be negotiated with the guidance of a federally Licensed Insolvency Trustee. Moreover, there is no loss of assets in a consumer proposal,so assets like home equity investments, and secondary motor vehicles can be retainedwhile stopping collection calls and legal action from creditors. Proposals filed by Licensed Insolvency Trustees are the only debt settlement plans sanctioned by the Government of Canada. The Office of the Superintendent of Bankruptcy is the section of the Government of Canada that regulates the bankruptcy and consumer proposal processes in Canada.

It is important to remember that filing a consumer proposal is a positive step, and the effect on your credit rating will be temporary. Questions about consumer proposal or how does a consumer proposal affect your credit score? A Licensed Insolvency Trustee can answer your questions and help you explore your options. Contact a Trustee today for a free consultation.

How A Bankruptcy Filing Affects Your Credit Score

When you file for bankruptcy, your credit score will drop. The range of the drop is usually 130 to 240 points. Typically, people who have a higher credit score of over 700 points lose more points. If you already have a poor credit score, the deduction of these points may not really affect you that much.

When you have a bankruptcy on your credit score, it can be difficult to get approval for new credit and get the best deals people with excellent credit scores enjoy. For example, if you are planning to get a cell phone plan with bad credit, you will not be eligible to get the best deals available that require no deposit or no upfront fees. If you have bad credit due to a bankruptcy, you may have to settle for a no credit check cell phone plan where you have to buy the device in full and prepay your usage.

You May Like: Mark Cuban Bankruptcy

Will The Accounts Included In My Bankruptcy Fall Off At The Same Time

You may see references to your bankruptcy listed under individual accounts that were included in the filing. For example, a credit account that was discharged may have a note in the account details that says Included in Bankruptcy. Like a Chapter 13 bankruptcy, this information should come off of your reports after seven years.

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Don’t Miss: Leasing A Car After Chapter 13

Bankruptcy Information Can Be Wrong

You may want to hire a credit repair attorney if your record shows inaccurate financial or bankruptcy information. They can speak with credit reporting agencies, credit card companies, or credit card issuers if you are having personal finance trouble. An attorney can also step in if a company does not discharge your debt correctly or you fall into a credit counseling scam.

Remember: A bankruptcy discharge legally stops creditors from harassing you. You have rights if a company is not following the process or respecting your bankruptcy filing.

How Long Does A Bankruptcy Stay On A Credit Report

The amount of time that a bankruptcy remains on your credit report depends on the type of bankruptcy you file.

According to the Fair Credit Reporting Act, a Chapter 13 bankruptcy can stay on your credit report for up to seven years from the bankruptcy filing date. Meanwhile, a Chapter 7 bankruptcy can remain for up to ten years. All of the accounts included in your bankruptcy will stay on the report until the bankruptcy clears.

These timelines are the legal maximum that bankruptcies can stay on your credit report. However, you may be able to have a bankruptcy removed from your credit report sooner by following the steps above.

Don’t Miss: Can I Buy A Car After Filing Bankruptcy

Differences Between Chapter 7 And Chapter 13 Bankruptcy

With a Chapter 7 bankruptcy, most of your assets are liquidated, so you will not continue making payments on the accounts once they are included in the filing. Chapter 7 bankruptcies are usually discharged about three months after they are filed, and they remain on credit reports for 10 years from the filing date.

Unlike Chapter 7 bankruptcy, a Chapter 13 bankruptcy is an adjustment of debt plan, which means that you will repay a certain portion of the debts you owe. A Chapter 13 repayment plan usually lasts anywhere from three to five years, and your bankruptcy is not discharged until your repayment plan is complete. Because you do repay a portion of the debt you owe, a Chapter 13 bankruptcy is removed from your credit history sooner: seven years from the file date.

Getting Professional Help For Bankruptcy Disputes

Some people prefer to outsource credit disputes to someone else because theyre busy or feel overwhelmed by the process. If this describes you, you might want to consider hiring a reputable professional to help.

A credit repair specialist can send disputes to the credit bureaus on your behalf and follow up with additional suggestions if the credit bureaus fail to remove inaccurate data from your credit report. Call 1-877-637-2673 to schedule a free credit consultation with a Credit Saint counselor today.

Read Also: Bankruptcy Score Range

The Meaning Of Credit Reports

On Canadian credit reports , each credit account is assigned a credit score on a scale from R1 to R9. R1 is the best credit rating and R9 is the worst. The R stands for revolving credit accounts that can carry a running balance, on which you are required to pay only a portion each month.

Here are the credit score meanings:

- R1 You pay that credit account on time

- R2 Your payments are 30 days late

- R3 Your payments are 60 days late

- R4 Your payments are 90 days late

- R5 Your payments are 120 days late

- R6

- R7 Typically used for consumer proposals, consolidation orders, or debt management plans

- R8 Shows that a secured creditor has taken steps to realize on their security rarely appears on a credit report as after repossession the creditor typically initiates legal or collection action, which is rated R9

- R9 Typically used when an account is placed for collection or considered un-collectible, or if you are bankrupt R9 can also appear in consumer proposal

What Are Other Ways To Improve Your Credit Score

You can build healthy credit over time by starting with these steps:

- Make on-time payments. This is one of the most important factors that impacts your credit scores. If you think you cant afford a payment, reach out to the lender right away. It may be willing to work out a payment plan and keep your account in good standing.

- Check your credit reports. This will help you understand and track your overall financial health. Also look for errors, such as incorrect credit card balances, trade lines that arent yours and accounts that are incorrectly marked as delinquent.

- Dispute and fix errors. About 20 percent of consumers have an error on at least one credit report, according to a Federal Trade Commission study. Getting an error removed may help your credit score improve.

- Consider a debt consolidation loan. A debt consolidation loan unites all your debts into a single balance, often at a lower interest rate that can save you money. A debt consolidation calculator can help you evaluate whether this type of loan is right for you, as debt consolidation can temporarily hurt your credit.

Sign up for a Bankrate account to analyze your debt and get custom product recommendations.

You May Like: Renting After Bankruptcy

If You Discharged Debts In Bankruptcy Heres How They Should Be Listed On Your Credit Report

Updated By Cara ONeill, Attorney

In short, yes. Not only will a bankruptcy filing remain on your credit report for seven to ten years, but you can expect information about the debts discharged in bankruptcy to continue to appear on your credit report, too. In this article, youll learn what shouldand should notshow up on your credit report after you receive a bankruptcy discharge, and what to do if your credit report contains incorrect information.

Read Also: How To Get Out Of Chapter 13 Early

Q Does Adding A Fraud Warning Prevent Information From Updating To My Credit File

A. A fraud flag does not prevent changes from being made to your file without your authorization. In Ontario, the legislation mandates that financial institutions upon receipt of a fraud warning, take reasonable steps to identify the consumer that they are entering into specific transactions with. These reasonable steps may include contacting the consumer by phone or other steps, as determined by each financial institution. If you wish to monitor changes to your credit file, we recommend a visit to our website at www.transunion.ca for more information about our Credit Monitoring product. Please note that there is a fee for enrolling in this service.

Also Check: How Much Does It Cost To File Bankruptcy In Iowa