Rebuilding Your Credit Score

Your ability to borrow is dependent on more than just one item on your credit report. A past bankruptcy is one factor, but a potential lender will review other factors including your income, work history, living situation, and other credit you have re-established.

If you want to rebuild your credit rating after bankruptcy, it is recommended that you do the following:

Get A Small Line Of Credit

When youre ready, you can apply for a small line of credit, such as through a gas credit card or store credit card. Keep this account current and pay it on time, and youll see your rise slowly but steadily.

You can also consider getting a secured line of credit, asking someone to co-sign on a line of credit for you, or becoming an authorized user on another account. Any of these can help you get credit if you cant get it on your own.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Don’t Miss: How Much Debt To File Bankruptcy

How Can I Dispute Inaccurate Bankruptcy Information

It’s always a good idea to look over your credit report a month or two after the discharge to make sure that the bankruptcy and any accounts included in the bankruptcy have been updated and are being reflected accurately. You can get free copies of your credit reports from all three bureaus at AnnualCreditReport.com. You can also request your free credit report and FICO® Score 8 directly through Experian.

If you notice that the bankruptcy listing itself has not been updated to show that it has been discharged, or if there is an account that should be showing discharged but has not been updated, you can dispute the information using Experian’s online Dispute Center. Simply indicate which account you believe is appearing incorrectly and why. If you have documentation, such as the schedule of creditors that were included in your discharge, you can upload a copy of those documents as well.

You can also contact the lender directly to ensure that their records have been updated to reflect your bankruptcy discharge and to request that they update the account with each credit reporting company that they report to.

How Will Bankruptcy Affect My Life

Bankruptcy is an extreme measure and can affect your life in several ways:

- You may lose valuable possessions. However, you can keep basic items needed for living and working . Note that you may need to trade in these items for cheaper versions. While it’s upsetting to lose your belongings, just remember what youâre working towards: a life free of debt.

- Your bankruptcy will be public knowledge. It’ll appear in the London Gazette and on the Insolvency Register. Worrying what the neighbours will think? You probably don’t need to â unless there’s a high level of public concern about your bankruptcy, it’s unlikely to be covered by local or national newspapers.

- Your bank accounts may be closed. This can make day-to-day life difficult, since bank accounts are used for everything from receiving your salary to paying bills. But you may be able to open a basic bank account. These are designed for people with bad credit, and enable you to store and pay money without accessing overdraft facilities.

- The courts may take away your passport. This is called being impounded, but itâs unlikely to happen to you unless the courts believe youâll travel abroad to sell your possessions.

- It can be a stressful experience. From doing the paperwork to telling friends, bankruptcy can be a difficult process emotionally. That said, some people find a weight has been lifted from their shoulders, as bankruptcy lets them turn over a new leaf.

Recommended Reading: How Much Is Bankruptcy Chapter 7 In Ohio

Contact An Experienced North Carolina Bankruptcy Attorney

If you are dealing with overwhelming debt, schedule a free consultation today with our compassionate consumer bankruptcy attorneys to discuss your options. At Sasser Law, youll work directly with a board-certified bankruptcy attorney. We pride ourselves on giving straightforward and honest legal advice.

The Sasser Law Firm serves individuals and businesses throughout North Carolina, including in Wake, Harnett, Johnston, Durham, Orange, Granville, Vance, Franklin, Warren, Nash, Lee, Chatham, and Moore counties.

This post was originally published in October 2019 and has been updated for accuracy and comprehensiveness in August 2021.

Accounts Included In Bankruptcy

The accounts included in your bankruptcy filing will also have status notations for filing.

- During your filing, account statuses will note included in bankruptcy

- After discharge, the status will change to discharged in bankruptcy and the balance show $0

These statuses and accounts remain on your credit report for seven years from the date that each account became delinquent. So, even if the bankruptcy record remains for ten years, the accounts included will drop off your report after seven.

Also Check: How Does Bankruptcy Affect Your Future

Become An Authorized Account User

To become an authorized account user, have a close friend or relative add you to their credit card account. Youre not responsible for repaying any of the money charged to the account. If the account is maintained responsibly, you will get positive marks on your credit report.

On the flip side, if he or she racks up unpaid bills, your score will reflect that. So, choose someone you would trust to make good financial decisions.

But Ive Never Missed A Payment I Just Have No Hope Of Ever Paying Off My Debt

If youâre one of the few that has been able to stay current with all debt payments, but need to reorganize your financial situation through a Chapter 13 bankruptcy, your credit score will go down initially.

But, thatâs not the end of the story. Once your bankruptcy discharge is granted, your debt amount will go down significantly! And guess what helps build and maintain good credit? A low debt-to-income ratio.

Debt-to-income ratio?!

Put differently, the best credit rating is possible only if your total unsecured debt is as low as possible. A bankruptcy discharge eliminates most, if not all of your debt. Itâs the one thing you can do that your current debt management methods canât accomplish.

Doesnât bankruptcy stay on your record for 10 years?

Well, yes, under federal law, the fact that you filed bankruptcy can stay on your credit report for up to 10 years. This is true for all types of bankruptcy. But, Chapter 13 bankruptcy stays on your credit report for only seven years from the filing date.

According to Experian, thatâs because unlike a Chapter 7 bankruptcy, Chapter 13 involves a repayment plan that pays off some amount of debt before a bankruptcy discharge is granted.

Recommended Reading: Can You Get A House After Bankruptcy

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

How Does Bankruptcy Work

When you’re declared bankrupt, the value of your possessions is usually shared out among those you owe money to. This can include your house, car, leisure equipment and jewellery â everything except the essentials. Depending on your income, you’ll also be asked to make payments towards your debt for up to three years.

Sounds gloomy, but there’s a silver lining. Once you’re declared bankrupt, you won’t have the pressure of dealing with creditors anymore. Lenders will also have to stop most types of court action against you. And, most relieving of all, you will usually be ‘discharged’ â in other words, freed from your debts â after one year.

You May Like: Can Only 1 Spouse File For Bankruptcy

Are All Bankruptcies The Same

FICOs example doesnt differentiate between Chapter 7 and Chapter 13 bankruptcy, the two types of bankruptcy available for personal debts.Chapter 7 bankruptcy will be over quickest, with discharge happening a few months after you file . It takes years to complete a Chapter 13 bankruptcy since youd be on a three- to five-year repayment plan.

How Much Will Your Credit Score Drop

A bankruptcy case filing often results in a drop in your credit score. But how much? There is no set formula to answer this question, as many variables come into play. A lot depends on what your score was, to begin with.

Most people who file bankruptcy have already damaged their credit score. A credit score below 580 is considered very poor. If you declare bankruptcy with a 500 credit score, you’re not going to drop too much farther. However, if you’ve managed to keep your credit score above 700 before bankruptcy you can expect a 200 or greater drop.

Regardless of what your score was at the start, most people who file for bankruptcy end up having similarly low FICO scores after filing. After a discharge of debt has been issued by the Court, your credit score will begin to increase, especially if the filer continues to pay on secured debt.

You May Like: How Long Is A Bankruptcy On Your Credit Report

How Credit Scores Work

First, lets take a look at how your credit score is calculated in the first place. You have credit scores from each of the three major credit bureaus: TransUnion, Equifax, and Experian. These bureaus track all of your credit activity. That includes the use of your credit cards and whether you pay them in full, your student loans, mortgages, auto loans, and more. Each item the bureaus track is factored into your credit score, which ranges from 280 to 850.

The exact mechanism by which the bureaus arrive at an individuals credit score is proprietary they keep it secret so that, in theory, no one can game the system. However, FICO recently released some data about how much certain common events will affect your credit score, called damage points.

Your score affects your access to all sorts of things. It will show up when you want to get a credit card or a loan, for example. If you want to rent an apartment or get a cell phone plan, theyll check your credit. Some employers may even check your score when you apply for a job.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Read Also: How To File Bankruptcy In Tennessee

Can I Get Credit While In A Consumer Proposal

You may wish to ask your Trustee about this. While in a consumer proposal, you can apply for a secured credit card through select financial institutions. With a secured card, you make a small security deposit, and then utilize the credit card to make purchases and then promptly pay them off. By doing this, the credit card company will report that you are utilizing the credit and paying as agreed and note the account as an R1. Check the cost of the card, as service charges are greater than with standard cards. Also, do not confuse secured credit cards with pre-paid VISAs and MasterCards prepaid cards have no effect on your credit report and do not help you rebuild.

Using a secured credit card and making regular payments on it while in a consumer proposal can cause a slight improvement in your credit rating, but you will see quicker improvements once your consumer proposal is paid off. Also, you will have access to better interest rates on borrowed money after your consumer proposal is completed. Becoming debt-free by successfully completing your consumer proposal will have a significant impact on your capacity to obtain credit.

How Soon Will My Credit Score Improve After Bankruptcy

By FindLaw Staff | Reviewed by Bridget Molitor, JD | Last updated June 30, 2021

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can’t remove bankruptcy from your credit report unless it is there in error.

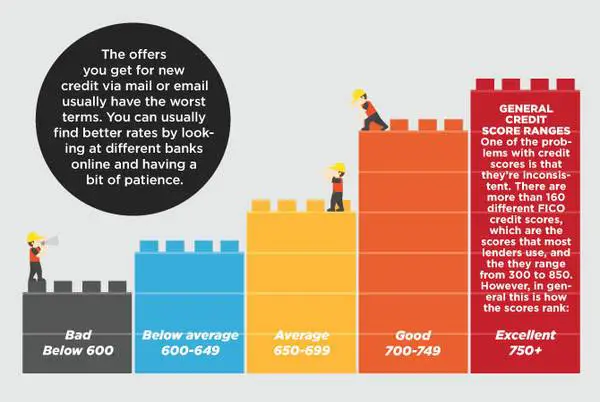

Over this 12-18 month timeframe, your FICO credit report can go from bad credit back to the fair range if you work to rebuild your credit. Achieving a good , very good , or excellent credit score will take much longer.

Many people are afraid of what bankruptcy will do to their credit score. Bankruptcy does hurt credit scores for a time, but so does accumulating debt. In fact, for many, bankruptcy is the only way they can become debt free and allow their credit score to improve. If you are ready to file for bankruptcy, contact a lawyer near you.

You May Like: How Long Does Bankruptcy Stay On Your File

What Does Bankruptcy Do To Your Credit Score

If you had a ton of debt that became unmanageable, you may have filed for bankruptcy for a new start. That said, people often mistakenly believe that they will get a totally clean start after filing for bankruptcy, but when it comes to your credit, the story is more complicated. We will explain what bankruptcy does to your credit in much detail below.

Do You Qualify For Chapter 7 Bankruptcy

To qualify for Chapter 7 bankruptcy you:

-

Must pass the means test, which looks at your income, assets and expenses.

-

Cannot have completed a Chapter 7 in the past eight years or a Chapter 13 bankruptcy within the past six years.

-

Cannot have filed a bankruptcy petition in the previous 180 days that was dismissed because you failed to appear in court or comply with court orders, or you voluntarily dismissed your own filing because creditors sought court relief to recover property they had a lien on.

Don’t Miss: Which Kind Of Bankruptcy Proceeding Is Considered A Liquidation Proceeding

Pay All Your Bills On Time

No matter what else you do, always pay your bills on time. Even paying your cell phone or your car insurance bill on time will help you establish a positive credit history. Paying on time will also keep your balances in check so you do not reach a point where you can no longer manage your debt.

Be consistent in your efforts to rebuild your credit, and you will slowly see your credit improve after your bankruptcy. You will be able to qualify for new lines of credit, including a home loan or a car loan. But the first step to managing your overwhelming debt and getting on that road to financial recovery should be to talk with a Gilbert bankruptcy lawyer about your options for debt relief.

Bankruptcys Effect On Your Credit Score

First of all, what is a FICO credit score? This score is an indicator of your personal credit worthiness that is calculated by one of three credit reporting agencies in the United States. These agencies give you a score the higher, the better based on your past behavior with credit, your likelihood of paying back debt promptly, and your years of experience with handling consumer debt. Typically, banks, mortgage lenders and other financial institutions will pull your credit score when making a decision about whether to lend you money for a house or car or whether to approve you for a credit card. Bankruptcy does affect your credit score.

You are allowed free access to one copy of your credit report every 12 months from each of these three credit reporting agencies.

You May Like: How Long Does A Dismissed Bankruptcy Stay On Credit Report

Can A Bankruptcy Come Off My Credit Report Early

A legitimate bankruptcy record cannot be removed from your credit report, but a bankruptcy can come off your report if it is inaccurately entered or otherwise incorrect.

The FCRA makes provisions for challenging anything on your credit report that is incorrect, has remained on your credit report beyond the maximum time allowed, or cannot be substantiated by the creditor who reported it.

In the case of bankruptcies especially because they remain on the credit report for so many years its not uncommon for errors to creep in.Some of the most common errors we find include:

- Debts that were discharged in the bankruptcy are still showing a balance.

- Individual accounts included in the bankruptcy are still appearing on the report after seven years. In both Chapter 7 and Chapter 13 bankruptcies, the individual affected accounts can only impact your report for seven years starting from original delinquency date, not the filing date of the bankruptcy in which they were discharged.

- The bankruptcy is still showing up on a report more than 10 years after the filing date.

- Any sort of material error in how the bankruptcy was reported, from the spelling of names to accurate addresses, phone numbers, dates, etc.

If any of these or other errors appear on your credit report, you have the right to challenge those errors. The reporting agency must remove them if the reporting agency cannot substantiate the item.