Qualifying For Fha Loans After Chapter 7 Bankruptcy And Chapter 13 Bankruptcy

Under both VA and FHA Chapter Bankruptcy Guidelines, the waiting period to qualify for a FHA Loan after a Chapter 7 Bankruptcy.is two years after the discharge dates of Chapter 7 and Chapter 13 Bankruptcies for an automated underwriting system approval.

However, there is an exemption with qualifying for VA and FHA Loan After Chapter 13 Bankruptcy Discharge date. The exception is there is NO WAITING PERIOD AFTER A CHAPTER 13 BANKRUPTCY DISCHARGED DATE.

Needs to be a manual underwrite. Borrowers will not get an approve/eligible unless the Chapter 13 Bankruptcy discharged date has been seasoned for at least two years. That is why it needs to be manually underwritten.

Remember that all manual underwrites need verification of rent.

Late Payments After Bankruptcy

Another requirement to qualify for a mortgage after bankruptcy is borrowers cannot have any late payments after bankruptcy. Late payments after bankruptcy and/or housing event is not a deal killer. However, it will be tightly scrutinized and reviewed by mortgage underwriters. A good letter of explanation to the mortgage underwriter will be required. Borrowers also need re-established credit after bankruptcy. Many mortgage lenders will require at least three credit tradelines. A credit tradeline is a credit history with at least a 12 months payment history. Home Buyers with a prior bankruptcy or had lower credit scores or issues and were told they do not qualify from another mortgage company, please contact us at Gustan Cho Associates Mortgage Group at 262-716-8151 or text us for faster response. You can also email us at Borrowers can also click this icon, APPLY NOW FOR PRE-APPROVAL to get started.

Why Your Income Is Important In Chapter 13

Although your income won’t preclude you from filing for Chapter 13 bankruptcy, your “disposable income” does play a role in how long your repayment plan will last. If your income is less than your state’s median income, your repayment plan will probably last only three years. If your income is greater than your state’s median income, your repayment plan will probably have to extend to five years — which means you’ll repay a larger portion of your debts.

Read Also: How Many Bankruptcies Trump

What Happens To Your Property When You File For Bankruptcy

Bankruptcy doesnt mean automatically getting rid of all your property or life savings. There are exemptions dictated by both your state and the federal government. In some states, you can choose to use either your specific state exemptions or the federal exemptions. Find more about what your state allows here to compare it to the federal exemptions outlined below.

Chapter 13 Bankruptcy Is A Legal Process That Allows People To Repay Their Debts Over Time While Having The Opportunity To Keep Valuable Assets Like A Home

Chapter 13 bankruptcy is also called the wage earners plan, because those who file need regular income to qualify. Instead of having your debt forgiven, youll restructure your debt with a three- to five-year repayment plan.

The flexibility of the repayment plan can make Chapter 13 the right kind of bankruptcy for those who have a job with steady income and want to hold onto their property.

Heres a rundown of whos eligible for Chapter 13, the general shape of the process, and the pros and cons to consider before filing.

Read Also: What Is A Bankruptcy Petition Preparer

Chapter 13 Bankruptcy In Florida

Chapter 13 bankruptcy is a court-supervised payment plan whereby the bankruptcy debtor pays his secured and unsecured a monthly amount based upon the debtors family income and reasonable expenses. The amount of monthly payments and the amounts paid to various creditors makes up the debtors Chapter 13 plan.

A Florida Chapter 13 has some advantages over a Chapter 7 bankruptcy. The debtor does not have to liquidate assets in Chapter 13 as he does in Chapter 7. Chapter 13 bankruptcy permits debtors to modify or eliminate some secured debts. Chapter 13 is used to stop a mortgage foreclosure and permit the debtor to catch up past due mortgage payments. Also, Chapter 13 permits discharge of some unsecured debts not dischargeable in a Chapter 7.

Benefits Of Filing For Chapter 13 Bankruptcy

Chapter 13 is a recommendable solution for many because it provides a workable three- to five-year payment plan with reduced or no interest and no penalties. This is extremely helpful for someone struggling to pay their bill because interest and late fees add up quickly.

But what are the factors that determine if your application for bankruptcy will be approved?

You May Like: Is Taco Bell Filing For Bankruptcy

Do You Qualify For Chapter 13 Bankruptcy

To qualify for Chapter 13 bankruptcy:

-

You must have regular income.

-

Your unsecured debt cannot exceed $419,275, and your secured debt cannot exceed $1,257,850.

-

You must be current on tax filings.

-

You cannot have filed for Chapter 13 bankruptcy in the past two years or Chapter 7 bankruptcy in the past four years.

-

You cannot have filed a bankruptcy petition in the previous 180 days that was dismissed for certain reasons, such as failing to appear in court or comply with court orders.

Even if you qualify for Chapter 13 bankruptcy, make sure you know the difference between Chapter 7 vs Chapter 13 bankruptcy.

If you dont qualify for Chapter 13, consider looking into other debt relief options.

Look into whether you have too much debt. If you dont qualify for Chapter 13, consider looking into other debt relief options.

I Am Asset Rich But Cash Poor

It happens a lot. We meet with guests who are asset rich but cash poor and the creditors are howling at the door. Is there a way not to lose assets and yet pay the debt according to terms you can afford? You bet there is- its called a chapter 13 bankruptcy, or as I like to refer to it a government sponsored debt consolidation plan. How does this work?

Lets use Rick as an example. Lets say Rick owns 10% of the Marriot hotel worth 3 million dollars. He draws an income from the quarterly distributions from his Marriot stock and this is what he uses to live on. Rick is retired and needs this income to survive. He makes 60k a year on his distributions.

Rick has 50k in credit card debt and he got behind because he was helping out one of his kids who got into some trouble with drugs and needed treatment desperately. His credit cards went delinquent and one big creditor has already gotten a judgment against Rick.

With this judgment, Ricks creditor has discovered his stock ownership in the Marriot and now wants to seize control of the stock to satisfy the debt. The trouble is if the stock is liquidated now Rick will be forced to fire sale his stock and lose a lot of money plus take enormous tax hits not to mention losing his income stream.

It gets better- all collection activity is barred against Rick or his assets while in the plan and Rick will lose no assets in a chapter 13 bankruptcy! POW POW POW!

Also Check: Taco Bell Bankrupsy

Which Debts Are Elgible For A Chapter 13 Discharge

Filing for Chapter 13 bankruptcy entails undergoing a payment period that lasts between three and five years. Depending on your income and other financial obligations, you put your remaining discretionary income towards your outstanding debt.

The payments are then distributed to the qualifying creditors. At the end of the payment period, those debts are considered settled however, you typically cant take on any additional debt and you must live on a fixed budget.

So what types of debts qualify? First, your unsecured debts must not exceed $383,175 and your secured debts may not exceed $1,149,525.

Qualifying debts include general unsecured claims, such as credit card debt, personal loans, medical bills, or overdue utilities. Youll only end up paying a percentage of what you owe these types of creditors the exact amount depends on how much you owe and how much you earn.

There are certain debts that you must pay in full, even when you file for Chapter 13 bankruptcy. Unsecured priority claims must be paid in full and include debts such as income tax debts, overdue child or spousal support, and any relevant legal fees.

Secured debts such as a mortgage dont have to be paid in full during your repayment plan period. However, you do have to keep up with your monthly payments.

Your Debts Can’t Be Too High

You won’t qualify for Chapter 13 bankruptcy if your secured and unsecured debts exceed certain amounts.

A debt is secured if you stand to lose specific property if you don’t make your payments to the creditor. Home loans and car loans are the most common examples of secured debts. But a debt might also be secured if a creditorsuch as the IRShas filed a lien against your property.

An unsecured debt doesn’t give the creditor a right to take a particular piece of property. Most debts are unsecured, including credit card debts, medical and legal bills, back utility bills, and department store charges.

Read Also: Can You Buy A New Car After Filing Chapter 7

Georgia Bankruptcy Attorneys And Informal Qualifications

There are also some preliminary and subsequent informal qualifications. These informal qualifications usually involve the income and expense information in Schedules I and J. These qualifications also vary in different jurisdictions.

Unlike Chapter 7, which offers an almost immediate discharge, Chapter 13 debtors must remit a monthly debt consolidation payment to the trustee . Therefore, Chapter 13 debtors must have sufficient disposable income to make this payment.

Frequently, to meet this informal qualification, a Georgia bankruptcy lawyer works backwards. Experienced attorneys can normally estimate the plan payment amount. So, a lawyer starts with this amount then works out the math. Do not try this at home. Only an experienced attorney should tackle this issue.

As for the subsequent informal qualification, debtors must timely make this payment every month, come hell or high water. A lot can happen in sixty months. Financial circumstances almost always change for better or worse. When these changes happen, a Georgia bankruptcy lawyer could file a motion to modify the payment amount. That motion could lower the payment amount to make it more affordable or raise it and allow the family to perhaps emerge from bankruptcy earlier.

Contact a Reliable Georgia Bankruptcy Attorney Today

Chapter 13 Bankruptcy Allows You To Reorganize Your Debts

Chapter 13 bankruptcy can be a favorable option for people who can still repay a portion of their debts. Individuals who do not make enough income to pay back their debts and need total financial relief may need to file under Chapter 7.

A Chapter 13 bankruptcy typically involves developing a repayment plan lasting for three to five years, and the plan is based on the debtors personal finances and ability to pay. This allows individuals to refinance their debts, meaning that some of their debts may be discharged while they make reasonable payments for the remaining portion.

Don’t Miss: Leasing A Car During Chapter 13

The Process For Filing Chapter 13

People who qualify for Chapter 13 bankruptcy can file a petition with the bankruptcy court in their district to get bankruptcy relief from their debts. A court-appointed trustee will then review the information submitted by the debtor, which includes the debtors:

- Assets, e.g., home equity or vehicle value

- Liabilities, e.g., credit card debts or personal loans

- Current income

- Expenditures, e.g., mortgage payments and other bills

- Certain questions about their financial history

Also, there are certain actions that must be done before an individual can file for Chapter 13 bankruptcy, such as completing a credit counseling course from an approved agency. If you have not begun preparations, our team can guide you so that your case is successful.

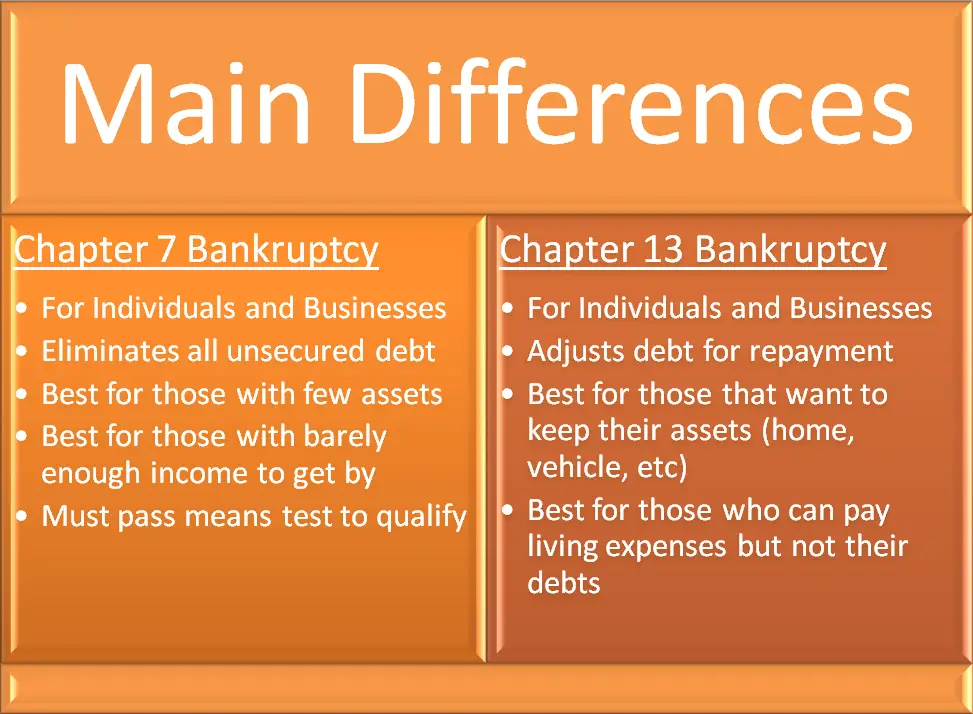

Chapter 13 Vs Chapter 7

Chapter 13 bankruptcy is often called the wage earners bankruptcy. A petitioner must have regular income to enter a Chapter 13 debt repayment plan. This form of bankruptcy is mostly beneficial to consumers with valuable assets and a high source of income.

Chapter 7 bankruptcy is designed for those who truly cant afford to repay their debts. It is, by far the most common type of bankruptcy with 483,988 filings in 2019 compared to 283,413 Chapter 13 filings.

In Chapter 13 bankruptcy, you retain your assets while extending repayment of debts over a 3-5-year period. In Chapter 7, your assets are liquidated except those that are exempt such as your house and car and turned over to a court-appointed bankruptcy trustee, who sells them and uses the proceeds to pay off creditors. The rest of the debt is discharged.

To qualify for Chapter 7, you must earn less than the median income in your state for a family of your size. Filers who dont pass the means test can look to Chapter 13 instead.

Recommended Reading: Trump Filed Bankruptcy How Many Times

Your Paycheck May Make Chapter 13 Bankruptcy The Lifeline You Need

Chapter 13 bankruptcy is not for everyone. Generally, people who choose this form of bankruptcy make more than the income limits for Chapter 7 bankruptcy and simply need more time to pay off their debts. However, there are several other pros and cons to Chapter 7 versus Chapter 13 bankruptcy. That’s why we want to meet with you and review your current financial situation. The more information we know, the better our advice.

The trusted attorneys at Benjamin R. Matthews and Associates, LLC can help you develop a thorough, comprehensive financial plan. Call today at 799-1700 or contact us online for a free initial evaluation to see how you can get your life back on track. Every discussion is confidential. We respect your privacy and value your time.

We are a debt relief agency. We help people understand their financial options and file bankruptcy.

You Are Not A Business Entity

Only individuals and those filing jointly as spouses can file for Chapter 13 bankruptcy. For instance, businesses that are corporations and limited liability companies are ineligible for Chapter 13 and must instead file for Chapter 11 bankruptcy.

While a business owner can’t file in the name of the business, if you own the business as a sole proprietor or with a partner, you can file in your name for the debts you are personally liable for. Stockbrokers and commodity brokers, however, are ineligible for Chapter 13.

You May Like: Donald Trump Files For Bankruptcy

Eligibility Requirements For Chapter 7 And 13 Bankruptcy

Are you presently contending with out of control and crushing debt? If so, you may want to consider filing for bankruptcy or evenalternatives to bankruptcy. For many, bankruptcy can offer an effective and powerful solution to financial troubles however, the first question that most people has is,Do I qualify for bankruptcy?. The answer is, it depends on which chapter you are filing for.

Contact us online or call 325-1181 if you have questions about qualifying for bankruptcy.Our bankruptcy attorney in Chico is ready to give you answer.

Section 341 Meeting Of Creditors And Trustee

The debtor and his attorney are required to attend a meeting with the Chapter 13 bankruptcy trustee or the trustees attorney approximately four weeks after the bankruptcy filing date. The meeting is held in a meeting room not a courtroom and the federal bankruptcy judge is prohibited by law from being there. Typically, this meeting will last about five to ten minutes. Creditors rarely attend.

At the , the Chapter 13 trustee or his attorney will ask the debtor questions, but they will not interrogate, cross-examine, or threaten the debtor. The trustee may give the debtor payment envelopes with the trustees mailing address for future plan payments . The trustee may suggest changes to the debtors initial Chapter 13 plan. Most debtors submit one or more amended plans during the Chapter 13 bankruptcy as creditors file their claims.

Also Check: Toygaroo Failure

You Have Fulfilled The Credit Counseling Requirement

A Chapter 13 debtor must file with the bankruptcy court a certificate of proof showing an approved credit counseling agency provided debt counseling at least 180 days prior to the Chapter 13 filing.

If the credit counseling agency created a debt management plan, the debtor must provide a copy to the court. The debtor must also file the certificate with the initial paperwork or must provide it within 15 days after filing for bankruptcy.

The Chapter 13 Discharge

The bankruptcy law regarding the scope of the chapter 13 discharge is complex and has recently undergone major changes. Therefore, debtors should consult competent legal counsel prior to filing regarding the scope of the chapter 13 discharge.

A chapter 13 debtor is entitled to a discharge upon completion of all payments under the chapter 13 plan so long as the debtor: certifies that all domestic support obligations that came due prior to making such certification have been paid has not received a discharge in a prior case filed within a certain time frame and has completed an approved course in financial management . 11 U.S.C. § 1328. The court will not enter the discharge, however, until it determines, after notice and a hearing, that there is no reason to believe there is any pending proceeding that might give rise to a limitation on the debtor’s homestead exemption. 11 U.S.C. § 1328.

The discharge releases the debtor from all debts provided for by the plan or disallowed , with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

Also Check: How Often Can You File Bankruptcy In Wisconsin