Formal And Informal Proofs Of Claims

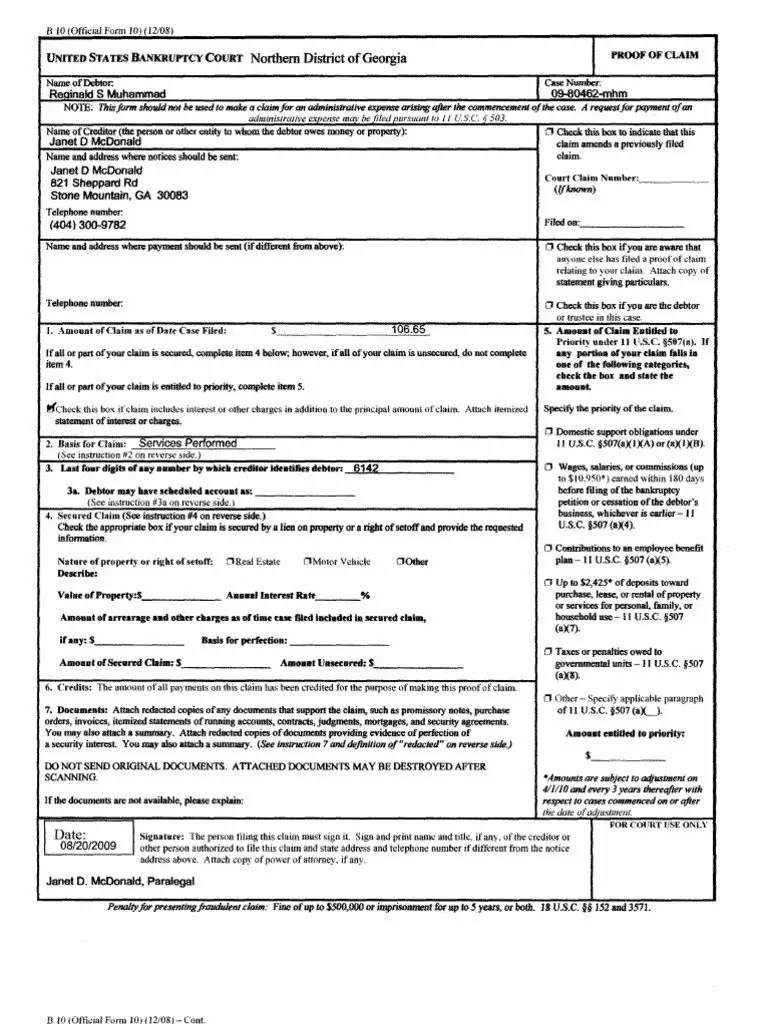

Form 410 provides the official proof of claim. A creditor will need to identify itself and state the debtors name, the case number, the type of claim, the nature of the debt, and the amount of the debt. It should include additional documents to support the information on the form, and the creditors representative must sign the form.

In some cases, a bankruptcy judge may accept an informal proof of claim. This must be a written document filed with the bankruptcy court, and it must make a demand against the debtors bankruptcy estate. If the document shows an intent to hold the bankruptcy estate liable for the debt, and it would be fair to accept the document under the circumstances, the judge will have discretion to accept it. They are not required to accept it, though, so a creditor should go through the formal process if possible.

How Do I Claim Or Declare Bankruptcy

Before you file, the trustee will review all your debt relief options so you can .

The trustee will ask questions about your income, assets, and debts . If you cannot afford to repay your debts in full, the trustee may recommend bankruptcy, but they might also suggest you consider filing a consumer proposal as an alternative to bankruptcy if this makes more sense for your financial situation.

If you are considering bankruptcy, talk with a Licensed Insolvency Trustee today.

Is The Claim Subject To A Right Of Setoff

If the debtor owes you money, and you owe the debtor money, they may cancel each other outat least partially. This tradeoff is known as a right of setoff. Identify the property you have that could be setoff against the claim.

For instance, if you have a deposit account at the bank, the bank owes you that money. If you also borrowed $1,000 from the bank, the bank could apply the $500 it owes you against the $1,000 you owe the bank. In that case, the property you identify is the bank account.

Recommended Reading: How Many Times Has Trump Declared Bankruptcy

When Must A Proof Of Claim Be Filed In Chapter 7 12 And 13 Bankruptcy Cases

The deadline for filing a proof of claim for non-governmental creditors in a Chapter 7, 12, or Chapter 13 bankruptcy case is 70 days after the petition filing date. . Government entities have additional time. They must file a proof of claim within 180 days after the date of the order for relief .

The first notice sent to creditors includes the deadline for filing proofs of claim. This notice informs creditors that a petition has been filed and indicates the date set for the meeting of creditors. This notice also sets the last date on which they can file objections to the discharge.

Although the court doesn’t usually permit extensions once the deadline has passed, the court has the power to extend the filing time if a creditor shows extenuating circumstances.

Formal Proof Of Claim

A proof of claim must conform substantially with the official bankruptcy form, Proof of Claim . You can download all of the official bankruptcy forms, including Form 410 from the U.S. Courts Bankruptcy Forms page.

The information a creditor will need to include is as follows:

- the debtor’s name and the bankruptcy case number

- the creditor’s information, including a mailing address

- the amount owed as of the petition date

- the basis for the claim , and

- the type of claim .

The creditor should attach supporting documentation, such as the contract, as evidence of the claim. Official attachment forms are available. Also, the creditor or an authorized representative must sign the proof of claim.

Also Check: How Many Times Did Donald Trump File For Bankruptcy

Myth: If Debtor Threatens Bankruptcy The Creditor Should Compromise Substantially To Avoid Bankruptcy

Not necessarily without further detailed analysis of the debtors assets and liabilities. In fact, a creditor should aggressively but legally step up its collection efforts to avoid limitations brought about by a bankruptcy filing. Although each case is different, we generally advise creditor clients that while the bankruptcy threat should be taken seriously, it should not sway a creditor from continuing to pursue the best deal possible. Once a bankruptcy is filed a creditors rights quickly become limited by what a creditor will and will not be permitted to do once the bankruptcy stay is in effect.

Furthermore, when a deal is struck with a debtor under the belief that the debtor is or is about to become insolvent, creditors are surprised to learn that money used to pay an antecedent debt may be subject to being repaid to the bankruptcy estate. Creditors should, however, be aware of bankruptcy pitfalls like preference and fraudulent conveyance claims when determining how and under what payment terms to settle an antecedent obligation.

Preferences

A payment made by a debtor to an unsecured creditor within 90 days prior to the date of the debtors bankruptcy is presumed to be a preferential payment pursuant to 11 U.S.C. §547. Under the Bankruptcy Code, a preference payment is a payment:

Fraudulent Conveyances

Objecting To A Proof Of Claim

The court usually accepts the proof of claim and its stated amount unless the debtor, trustee, or another interested party objects.

Some of the most common reasons that someone might object to a claim include:

- the amount is incorrect

- the claim includes improper interest or other penalty charges

- the claim indicates that it is a priority or secured claim when it is not

- the creditor filed the claim for the purpose of harassing the debtor, or

- the creditor did not attach supporting documentation.

In order to object to a creditor’s claim, the party objecting must file a written objection with the bankruptcy court and serve a copy and the notice of hearing on the creditor, the debtor, and trustee at least 30 days before a scheduled hearing.

Don’t Miss: Chapter 13 And Apartment Lease

Creditor’s Claims In Bankruptcy Proceedings

B. Asserting Claims To The Bankruptcy Estate

1. Whether to File a Claim

a. Necessity of filing

General rule: filing is required. The only claims allowed to share in the bankruptcy estate are those for which proofs have been filed. Wilson v. Allegheny Int’l, Inc., 134 B.R. 282 . When in doubt, file proof of claim.

Exceptions to filing requirement

Lack of knowledge

Of bankruptcy case

SeeIn re Global Precious Metals, Inc., 143 B.R. 204 . Held, lack of notice does not authorize court to extend bar date however, Code protects creditors, namely, § 523 § 726 § 501 .

Priority tax claim, filed late because IRS was not notified of bankruptcy case or bar date, should be treated same as if filed timely. United States v. Cardinal Mine Supply, Inc., 916 F.2d 1087 see alsoUnited States v. Ulrich , 151 B.R. 928 , rev’d, No. 93-15985, 1994 WL 447271 IRS v. Century Boat Co. , 986 F.2d 154, 156-57 United States v. Vecchio, 147 B.R. 303 , rev’d, 20 F.3d 555 .

Of existence of claim

In re Remington Rand Corp.

Debtor’s schedules — chapters 9, 11 — list claim as undisputed, fixed, liquidated. Rule 3003 see also Rule 1019 .

“No asset” chapter 7. Rule 2002, 3002. In some jurisdictions, clerk will not accept proof of claim in “no asset” case.

b. Reasons for asserting a claim

Grynberg v. United States

Involuntary petitions

Administration of estate — creditors’ committees. §§ 1102, 1103. However, under current law, government eligibility for committee membership is limited.

SeeSeeSee

You Are A Creditor If

- You are a person or institution to whom the debtor owes money or who claims to be owed money by the debtor.

- You have received a notice from the court about a particular bankruptcy case whereby the debtor has listed you in their bankruptcy case as someone to whom the debtor owes money or might owe money.

Also Check: Fizzics Group Llc

How Funds Are Recovered And Distributed

To help creditors recover some of what they are owed, non-exempt property owned by the bankrupt as of the date of the bankruptcy, or acquired prior to the bankruptcy discharge, may be seized and sold by the LIT. Exempt property includes property protected by applicable provincial and federal laws , property held by the bankrupt in trust for another and, in some cases, goods and services tax payments.

In addition, the LIT determines the bankrupt’s “surplus” income, i.e., the amount beyond what the bankrupt requires to maintain a reasonable standard of living. The bankrupt must pay this amount to the estate for distribution to the creditors after the costs of administration are deducted.

After the LIT has sold all of the bankrupt’s property, he or she must prepare a final statement of receipts and disbursements and a dividend sheet. The dividend sheet contains a list of creditors who will receive dividends and the amount to which they are entitled. You will be paid the dividends to which you are entitled before the bankruptcy file is closed, which is before the discharge of the LIT.

Once the secured claims have been settled, the dividends are distributed in the order set out in section 136 of the

These prior claims are subject to certain conditions and this list is not exhaustive.

The law gives priority to the claims of preferred creditors over those of other unsecured creditors.

Thomson Reuters Practical Law

Author, ,

A proof of claim is a written statement setting out a creditor’s claim and asserting its right to receive a distribution from the bankruptcy estate. It must “conform substantially” to Official Bankruptcy Form B410 ). The purpose of a proof of claim is to give notice of the claim to the court, the debtor, the trustee, and other creditors. A properly prepared proof of claim is prima facie evidence of the validity and amount of the claim #co_pp_ae0d0000c5150″ rel=”nofollow”> Fed. R. Bankr. P. 3001) and is deemed allowed, unless a party in interest objects #co_pp_8b3b0000958a4″ rel=”nofollow”> § 502, Bankruptcy Code and see Practice Note, Filing a Proof of Claim in a Chapter 11 Bankruptcy Case: Objections to Claims). This means any distribution of the debtor’s assets made on account of a claim is based on the filed proof of claim if it is not challenged .

For more information of filing proofs of claim, see:

Also Check: How Many Times Did Donald Trump File For Bankruptcy

Kansas Bankruptcy: Creditor Without Notice Denied Leave To File Claim Out Of Time

On March 10, 2021, the United States Bankruptcy Court for the District Court of Kansas denied a creditors motion for leave to file its proof of claim out of time, even though, and because, the creditor did not receive notice of the debtors Chapter 12 bankruptcy.

In In re Hrabe, , a creditor provided aerial chemical applications to the debtors farmland in June 2019. On Oct. 31, 2019, the debtors filed a Chapter 12 bankruptcy petition. The creditor was not listed in the petition or the Schedules. Accordingly, notice was not given to the creditor of the debtors bankruptcy petition.

The debtors bankruptcy case continued without the creditor. During the proposal of the third amended plan on Dec. 1, 2020, the creditor filed a motion for leave to file a proof of claim out of time. The creditor argued the debtors owed them $5,084.35 for the work completed in June 2019 and that the creditor should be allowed to file a proof of claim outside the Jan. 9, 2020 deadline. In denying the creditors request, the Bankruptcy Court for the District of Kansas evaluated the rules governing proofs of claim namely Rule 3002.

The Court determined here that since the creditor did not receive notice, Rule 3002 does not apply. Id. Accordingly, the Court denied the creditors motion because it does not meet one of the proof of claim exceptions under Rule 3002. Id.

Related People

Objections To A Creditors Claim

Anyone who has a financial stake in the outcome of the proceeding can make an objection to a claim. This is usually the bankruptcy trustee, but sometimes the debtor or another party will object as well. They must make their objection in writing and file it with the bankruptcy court. The objection and a notice of hearing must be served to the creditor, the debtor, and the trustee 30 days before the hearing.

An objection to a claim might arise if the trustee or the debtor believes that the amount of the debt is excessive, the creditor has classified a claim as secured when it is unsecured, the claim lacks supporting documentation, or the creditor is improperly seeking interest or penalty fees. The objecting party has the initial burden of production, which means that they need to provide evidence to support disallowing the creditors claim. If they meet this burden, the eventual burden of proof lies on the creditor.

Recommended Reading: Can You Get A Personal Loan After Bankruptcy

How Does Bankruptcy Stop Creditor Calls Collection Lawsuits

The automatic stay.

The filing of a bankruptcy petition creates an order of relief entered by the bankruptcy court immediately when the petition is filed. Included in that order of relief is an injunction against almost all types of collection activity against the debtor personally such a collection lawsuit. If a lawsuit has been filed against you personally, the moment the bankruptcy petition is filed that lawsuit is automatically stayed by the bankruptcy filing.

The automatic stay also prohibits a creditor with a lien from enforcing its lien against your assets. This includes car repossessions, foreclosures, wage garnishments, etc.

There are many good reasons for the immediate imposition of the automatic stay upon filing bankruptcy. First, it gives the debtor a much-needed breathing spell from creditors. Second, in doing so, the automatic stay prevents a rush of creditors to the courthouse to be the first in-line to try to take your assets. With the bankruptcy filing, the bankruptcy court will oversee a fair and orderly distribution of any assets that you have which are not covered by an exemption. However, in many bankruptcy cases, like a chapter 7, no assets get distributed to creditors. In many chapter 13 bankruptcy cases, unsecured creditor claims like medical bills and credit card debts get paid little if anything .

Attorney, Chris Chicoine

Who Can Object To A Creditors Claim

The court allows the bankruptcy trusteethe person charged with finding and distributing assets to creditorsto pay all claims unless someone files an objection. However, only a party in interest has the right to object.

To be a party in interest, you must have standing, or a financial stake in the claim. The most common interested parties include the person filing for bankruptcy , the trustee, or another creditor.

Here are examples of interested parties commonly found in bankruptcy cases.

- In most Chapter 7 and Chapter 13 cases, the trustee divides the available money among multiple claims. If the court were to deny one claim, the other creditors would likely receive more money. A creditor who would stand to gain from another creditors denied claim will have standing to object to a claim.

- A Chapter 7 bankruptcy filer. The bankruptcy filer will have standing only if the objection could affect how much the debtor is left owing creditors after bankruptcy, or if money would be returned to the filer after the case. If all of the filers debts would be discharged , and no money would be returned, the filer wont have standing.

- A Chapter 13 bankruptcy debtor. A Chapter 13 filer will almost always have standing to object to a claim in a Chapter 13 case because the debtors future earnings fund the Chapter 13 plan. One less claim might mean the filer will put less money into the repayment plan or that the plan can be shorter in duration.

You May Like: How To File For Bankruptcy In Ky

What Are Secured And Unsecured Claims

A secured claim is the amount of a debt equal to the value of creditors interest in assets of the estate. The claim is bifurcated and is secured to extent of the value of the collateral. Any amount of the creditors claim beyond the value of the collateral is classified as an unsecured claim. The amount of a claim is generally the debt owed at the time of filing, including all amounts that accrue pre-petition, interest, late charges and attorneys fees. A debt generally does not receive interest during the pendency of the bankruptcy without special exception. Debts arising after the filing of bankruptcy are not included in the bankruptcy estate. The only post-petition debts included in the bankruptcy estate are the administrative expenses of managing the estate or instances of post-petition financing. These claims generally receive administrative priority over the unsecured claims. The difference between the allowed claim amount paid to the creditor and the amount of the creditors claim is the amount of the debt discharged in bankruptcy.

Note: To be included as part of a secured or unsecured claim, attorneys fees must be permitted by contract or state law. If so allowed, attorneys fees are treated the same as interest on the debt.

Related Topics

How Do You Object To A Creditors Claim

After a creditor files a claim, you can review it to make sure that you agree with the reported information. If you disagree with anything, you can file a written objection stating why the court shouldnt allow the claim.

Here are a few common objections:

- the creditor doesnt have the right to make the claim

- the claim is for the wrong amount

- the filer already paid the claim

Also Check: Leasing A Car After Chapter 13