What Is A Chapter 13 Bankruptcy

With Chapter 13 bankruptcy, you must repay a portion or all of the debt through a 3-5 year repayment plan. When making the personal bankruptcy filing, you will submit the repayment plan to the court. After submitting this plan, you should begin making payments to the court. The court will then manage payments to the creditors. This step is required even if the plan hasnt yet been approved.

There will then be a hearing to approve your payment plan, which might take a few weeks. Creditors are allowed to object to the payment amounts. However, the judge has the final say. After the plan has been approved, you will continue making the payments to the court. Once the payment plan is completed, the remaining debt is discharged, and you are no longer liable for the remainder.

If you are a farmer or fisherman, you may want to consider filing for Chapter 12 bankruptcy. Chapter 12 bankruptcy is similar to Chapter 13 but can provide additional benefits to farmers and fishers in certain circumstances.

Medical Debt Can Sometimes Be Forgiven

Depending on your income and the amount of the debt, you may qualify for debt forgiveness from the hospital or healthcare provider.

Speak with the hospitals patient billing department about medical debt forgiveness options. While debt forgiveness isnt guaranteed, they can inform you of any help they can offer.

Also, all nonprofit and public hospitals must offer and promote financial help programs. Its possible to get some relief through a program like this.

What Is Medical Debt

The SIPP shows that in 2017, 19% of U.S. households carried medical debt, defined as medical costs people were unable to pay up front or when they received care. Among households with medical debt, the median amount owed was $2,000, meaning half had more and half had less.

Like other debt, medical debt means that households have less money to spend on other essential items, such as food and housing. People with medical debt, or at risk of accumulating medical debt, may also forgo needed medical care or treatment. Medical debt can also lead to bankruptcy.

Recommended Reading: Definition Of Chapter 7 Bankruptcy

How Does The Bankruptcy Code Treat Medical Debt

Bankruptcy law categorizes the debts that an individual owes creditors as secured or unsecured debt. Secured debt is backed by collateral that can be seized for nonpayment, such as an automobile serving as collateral for a car loan. Unsecured debt is money owed on credit cards, to public utilities, or for services, such as medical care. The third type of debt is what the Bankruptcy Code considers priority debt, including child support, alimony and taxes.

The law recognizes that, in personal bankruptcy, some debt will have to be forgiven for the debtor to emerge from bankruptcy. Some debt may be discharged. Unsecured debt, including medical bills, has the lowest priority for repayment in the eyes of the Bankruptcy Court.

Depending on the type of bankruptcy pursued a Chapter 7 liquidation or a Chapter 13 reorganization outstanding medical bills may be discharged or potentially reduced.

Many Debtors Cited Both Of These Medical Issues

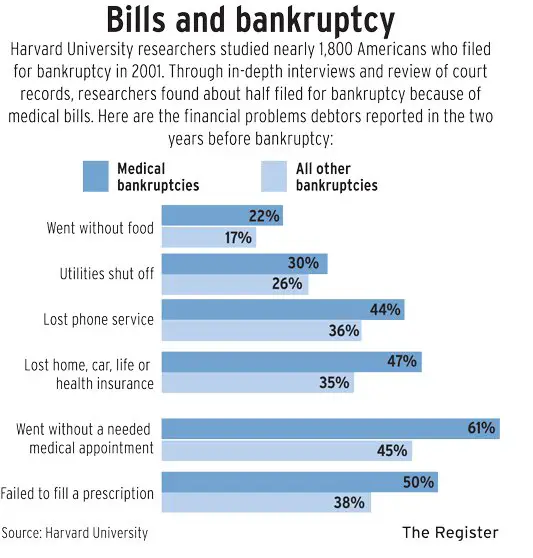

What percentage of bankruptcies are caused by medical bills. It determined that 462 percent of bankruptcies were attributable to a major medical reason. The fraction of bankruptcies caused by medical events is just 4 percent. According to a CNN Medical study of the estimated 15 million Americans who will declare bankruptcy in a given year some 60 percent of those will do so NOT because of overspending on a lavish lifestyle but because of an avalanche of overwhelming medical bills.

233 Zeilen According to that definition 621 percent of all bankruptcies in the United States were. And even among those bankruptcies it seems that medical bills may be less. And even among those bankruptcies it seems that medical bills may be less of a.

NerdWallet Health chose to include only bankruptcy explicitly tied to medical bills excluding indirect reasons like lost work opportunities. The fraction of bankruptcies caused by medical events is just 4 percent. Since Harvard what percentage of personal bankruptcies are due to medical bills estimates that 62 of all personal bankruptcies are medical expense related I think that states a lot about the medical care in the USA.

What percentage of bankruptcies in the United States are caused by medical bills.

2021 Medical Debt Statistics Singlecare

The Burden Of Medical Debt Section 3 Consequences Of Medical Bill Problems 8806 Kff

How Medical Costs Are Causing Bankruptcy John T Orcutt Health Care Expenses Lead To A High Number Of Bankrupt Filings

Don’t Miss: How To File For Bankruptcy In Indiana Without A Lawyer

About 1 In 10 Adults Delay Medical Care

Nearly one in 10 adults reported delaying or not receiving medical care due to cost in 2015. However, the rates of cost-related access barriers were lower than in any other year during the period of 1998 to 2015 for low-income people as well as those classified in worse health. Dental care, prescription drugs, and eyeglasses are the first things people give up because of health costs.

What Happens If You Cannot Pay Medical Bills

If you cannot pay your medical debt in full, you have three basic options: make a lump sum payment, an installment plan, or a settlement agreement with the creditor. While this should not be done without first consulting an attorney, it is often the best possible choice if there is money available but no clear legal option for dealing with it.

If you fail to make your payments, your creditor may file what is known as a default judgment with the court and ask the judge to impose sanctions on you. The judge would then issue an order requiring you to make monthly payments agreed upon by both parties and later enforced by collection agents hired by the creditor. The best option for dealing with medical bills is to avoid default judgments by making your payments under an installment plan or settlement agreement with the creditor upon receipt of notice from the other party.

Recommended Reading: Bankruptcy And Medical Bills

The Economic Consequences Of Hospital Admissions

Abstract

We use an event study approach to examine the economic consequences of hospital admissions for adults in two datasets: survey data from the Health and Retirement Study, and hospitalization data linked to credit reports. For non-elderly adults with health insurance, hospital admissions increase out-of-pocket medical spending, unpaid medical bills and bankruptcy, and reduce earnings, income, access to credit and consumer borrowing. The earnings decline is substantial compared to the out-of-pocket spending increase, and is minimally insured prior to age-eligibility for Social Security Retirement Income. Relative to the insured non-elderly, the uninsured non-elderly experience much larger increases in unpaid medical bills and bankruptcy rates following a hospital admission. Hospital admissions trigger less than 5 percent of all bankruptcies.

Also Check: How Many Times Did Trump Declare Bankrupcy

The Impact Of Medical Bankruptcies On The Economy

Although all functional aspects of filing for bankruptcy apply to this specific reason as well, discharging medical bills is not one of them, regrettably. A bankruptcy record stays on for ten years, which can make renting or buying a house or getting a loan difficult. Sometimes, bankruptcy can even restrain your job prospects.

A very unpleasant side of declaring bankruptcy is the risk of losing your home. However, that depends on the state. For instance, facts on medical bankruptcies by state show that in Delaware, someone could lose most of what they have due to the seizure of assets. Furthermore, the additional expenses accompanying the bankruptcy, like chapter filing with an attorney, can increase in urban areas.

Recommended Reading: How To Restore Credit After Bankruptcy

Is Medical Debt Dischargeable In Bankruptcy

You can’t limit a bankruptcy case to medical bills, but you can get relief from your medical debt through the bankruptcy process. In a bankruptcy, medical debt is considered non-priority unsecured debt: It’s dischargeable, meaning it can be forgiven. By contrast, priority debtsuch as tax bills, child support and most student loanscan’t be eliminated through bankruptcy. And defaulting on a secured debt like a mortgage or car loan will result in the loss of your collateral.

If you’re considering bankruptcy to help you deal with overwhelming debtincluding medical billsknow that this is a major step that will have lasting implications for your credit for years to come. During the bankruptcy process, you’ll work with a court-approved credit counselor and a trustee who will oversee your case. You will need to disclose all of your debts, income and property so that the court can determine what the outcome and next steps will be. Bankruptcy is complicated, so it helps to learn about the bankruptcy process before you start.

There are two main types of personal bankruptcy: Chapter 7 and Chapter 13. Both address the underlying problem of excess debt, but the two processes differ quite a bit. Here is a quick rundown on each.

Should I File For Chapter 7 Bankruptcy

Filing for a Chapter 7 bankruptcy, or any bankruptcy, is a serious matter that holds a lot of questions. How much debt do I have to accumulate before I qualify? What will this do to my credit score? Should filing for bankruptcy only take place at a certain time? There arent exact answers to these questions, and they could easily vary depending on your circumstances. However, a good rule of thumb is that you should at least consider filing if your debt is continuously accumulating, or you cannot pay off monthly cycles and your income is low enough to qualify for a Chapter 7 bankruptcy.

Also Check: How Bad Will Bankruptcy Affect My Credit

How Long Does Medical Debt Stay On Your Credit Report

Medical debt will remain on your as long as it is accurate, and the account is open. Once the account closes, you can expect negative information to fall off your credit report within seven years. If you claim bankruptcy, that can remain on your credit report for 10 years.

However, the rules are set to change. On July 1, 2022, medical debt in collections will be removed from your credit report once you pay it. In 2023, the major credit bureaus will stop reporting medical debt of less than $500.

Medical Debt And Bankruptcy

The cost of health care is a significant financial burden for many people. A 2021 Census Bureau study found nearly 1 in 5 households couldnt pay for medical care when it was needed. The Consumer Financial Protection Bureau reported in 2022 that whenever debt collectors contacted consumers, medical debt was the most likely reason.

This close connection between poor health and financial troubles carries through to bankruptcy. The link was notably made in a 2000 study that concluded medical bills accounted for 40% of bankruptcy filings the previous year.

That was years before the Affordable Care Act, but the expansion of health insurance coverage under the law known as Obamacare hasnt seemed to make much difference. In a 2019 study of 910 Americans who filed for bankruptcy, two-thirds said their filings were tied to medical issues.

Why do an estimated 530,000 families seek bankruptcy protection from medical bills each year? The short answer is: Because it works.

Also Check: How Long Do Bankruptcy Restrictions Last

Medical Debt In Bankruptcy

If you can’t settle the debt and it looks as if the creditor may pursue you for payment, then your good credit is going to take a hit anyway because a collection action will show up on your credit report. Also, if the provider sues you and gets a judgment, it can garnish your wages or take other collection action.

Not only can filing for bankruptcy wipe out your debt, but the sooner you file, the sooner you’ll be back on the road to financial recovery.

Some Bankruptcy Attorneys Have Noticed Fewer Medical Bankruptcies Since The Affordable Care Act Rollout

While the controversial Affordable Care Act has certainly helped some people , its unclear how much of an effect the universal health care law has had on bankruptcies. People arent required to declare why theyre filing bankruptcy, though we know many do so because of medical debt.

We polled some of our member attorneys on if the repeal of Obamacare would increase medical bankruptcies. Here are the results:

- 58% felt an Obamacare repeal would increase medical bankruptcies

- 34%thought it would have no impact

- 8% thought it would increase medical bankruptcies

Don’t Miss: How Do You Find Out Who Has Filed For Bankruptcy

+ Us Medical Bankruptcy Statistics For 2022

Medical bills are the most common reason for bankruptcies in the U.S. Our medical bankruptcy statistics will teach you everything you need to know about U.S. health care costs, debt and ways to stay financially well.

- Edited By

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Our fact-checking process starts with vetting all sources to ensure they are authoritative and relevant. Then we verify the facts with original reports published by those sources, or we confirm the facts with qualified experts. For full transparency, we clearly identify our sources in a list at the bottom of each page.

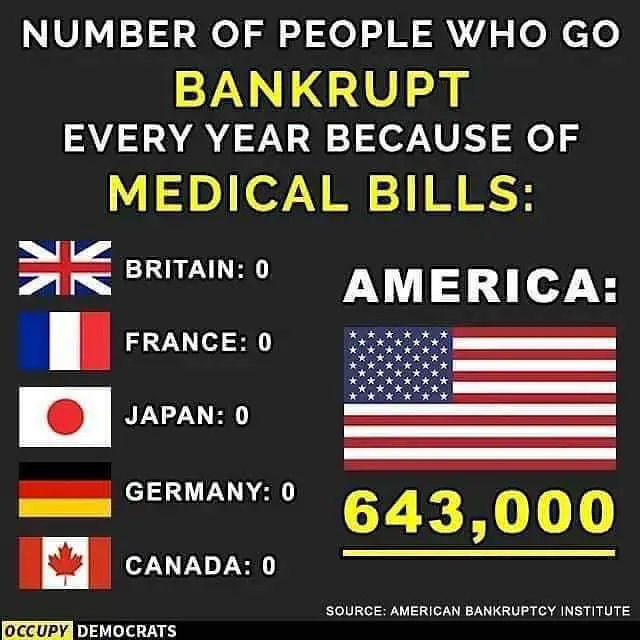

In America, medical bills are the most common reason for bankruptcy. In fact, medical bankruptcy statistics suggest that 17% of adults with health care debt had to declare bankruptcy or lose their home because of it as of 2022.

While America already has the most expensive health care of any country, prices are trending upward. Projections by the Centers for Medicare and Medicaid Services estimate that healthcare expenditures will reach approximately $6.2 trillion in 2028, a 50% increase from 2020.

Key Takeaways:

Meanwhile 1 In 5 Working

According to a Kaiser Family Foundation and New York Times survey conducted in 2016, 20% of Americans with health insurance found that when trying to pay off their medical bills, they had serious financial challenges and even changes in employment and lifestyle. For those uninsured, the number rose to 53%. Although its clear insurance helped in terms of peoples ability to make payments, about the same amount of people insured and uninsured alike still said their medical bills had a huge effect on their families.

You May Like: Product Pallets For Sale

Turning Medical Debt Into More Debt

The article contained another sad statistic. Ninety percent of those who had homes took out a second mortgage on their homes to pay their medical debt. This means that these people have turned their medical debt into mortgage debt to deal with the situation. Such a tactic is rarely, if ever, a smart option.

According to the article, these people are not the very poor in our society. Rather, they are middle class people. Two-thirds of them were homeowners. Sixty percent of them were college graduates. Some had private insurance and still had to cough up an average of $17,749.00 per family. These were people who were facing large and unexpected out-of-pocket costs for health care.

And, finally, according to the article, sixty-two of the two million personal bankruptcies filed each year are the result of medical debt.

So, if you are facing overwhelming medical bills that you cannot possibly afford to pay, you are clearly not alone. Bankruptcy may indeed be the best way to address the situation. As a consumer bankruptcy lawyer, I have helped many families over the years get the peace of mind they deserve when faced with overwhelming debts they couldnt possibly pay out of their household budget. And whether you consult with our firm or another competent and reputable consumer bankruptcy lawyer, you owe it to yourself and your family to get the help you need. You may be surprised just how good life can be without the crushing pressures of debt.

Fill Out The Required Bankruptcy Forms

You can find the documents online at the United States Courts website. There are at least 23 separate forms where you will need to list all of your total debts, personal properties, and any real estate that you own. You will also need to record every detail of your financial life, including your marital status, all family expenses, debt payments, and total family income.

If youre an individual debtor, these are the forms required to file a bankruptcy petition for your medical debt in America:

- Voluntary Petition for Individuals Filing for Bankruptcy

- Summary of Your Assets and Liabilities and Certain Statistical Information

- Schedule A/B: Property

- Schedule C: The Property You Claim as Exempt

- Schedule D: Creditors Who Hold Claims Secured by Property

- Schedule E/F: Creditors Who Have Unsecured Claims

- Schedule G: Executory Contracts and Unexpired Leases

- Schedule H: Your Codebtors

- Your Statement of Financial Affairs for Individuals Filing Bankruptcy

- Statement of Intention for Individuals Filing Under Chapter 7

- Your Statement About Your Social Security Numbers

- Chapter 7 Statement of Current Monthly Income

- Chapter 7 Means Test Calculation

There are optional additional forms if you plan to pay the filing fee in installments or seek to get the fee waived.

You May Like: How To File Bankruptcy Yourself In Arkansas

Hospital And Doctor Bills Can Be Written Off To Avoid Bankruptcy For Medical Bills

In some cases, theres no need to declare bankruptcy to eliminate medical debt, especially if this is the only debt and the debtor can make other regular payments, such as house or car payments, child support, and alimony. Moreover, medical creditors are better to work with compared to other debt creditors.

A public hospital or doctor of a Medicare or Medicaid patient will send a bill and wont bother them further. Those medical bills will stay in the billing department for as long as possible before being sent off to a collector and become medical debt collection.

Furthermore, some healthcare providers and doctors are willing to accept a tiny amount of the bill on an installment plan each month. Finally, the medical debt may not affect your credit score much since medical creditors seldom belong to credit reporting agencies.