Average Student Loan Debt Statistics

- Among borrowers with outstanding student debt, the median debt amount in 2021 was between $20,000 and $24,999.Go to footnote

- In 2020, bachelor’s degree earners from public and private nonprofit four-year schools who graduated with student debt had an average debt of $28,400.Go to footnote

- Among those who earned their bachelor’s degree from private and public nonprofit schools in 2020, the average student debt ranged from $18,344 in Utah to $39,928 in New Hampshire.Go to footnote

- The average student debt among all bachelor’s earners from nonprofit public and private schools increased at an average rate of 4% per year between 1996 and 2012. It leveled off around 2016.Go to footnote

Average Monthly Debt Payments By Age And Generation

Across all types of debt, Gen X members make the highest average monthly payments: $586. On the other end of the spectrum, Gen Z members make the lowest average monthly debt payments: $190. This makes sense, given that Gen X members have the highest average total debt, while Gen Z members have the lowest.

| Generation |

|---|

|

533.4 |

How Much Debt Is Ok

The Consumer Financial Protection Bureau recommends you keep your debt-to-income ratio below 43%. Statistically speaking, people with debts exceeding 43 percent often have trouble making their monthly payments. The highest ratio you can have and still be able to obtain a qualified mortgage is also 43 percent.

Read Also: Can You Rent An Apartment After Filing For Bankruptcy

What Is The Typical Debt Load For Graduates Of Four

The vast majority of four-year public university graduates complete their undergraduate degree with a relatively modest and manageable amount of student debt. About 42 percent of students at four-year public universities finished their bachelors degree* without any debt and 78 percent graduated with less than $30,000 in debt. Only 4 percent of public university graduates left with more than $60,000. And those with over $100,000 in debt are rarer still: they are anomalies representing less than half of 1 percent of all four-year public university undergraduates completing their degrees.1

Delinquent Credit Card Payments In : 242%

![American Debt Statistics [ Updated April 2020] Shift Processing American Debt Statistics [ Updated April 2020] Shift Processing](https://www.bankruptcytalk.net/wp-content/uploads/american-debt-statistics-updated-april-2020-shift-processing.jpeg)

Despite coronavirus-related financial woes, Americans remained surprisingly steady in paying their credit card bills on time. In the second quarter of 2020, the delinquency rate of credit card loans from commercial banks was 2.42%.

That’s the lowest it’s been since early 2017 — and while it’s possible that consumers are getting better about paying their debts, it seems more likely that it’s related to credit card providers and banks letting borrowers postpone their payments and otherwise avoid delinquency.

Will that number go up as we face continued effects of the coronavirus pandemic? We’ll have to see when the St. Louis Fed releases its Q3 data.

Also Check: When Does Bankruptcy Leave Credit Report

Get The Help You Need Along The Way

Say it again: Youre not in this alone. And guess what? You dont have to figure everything out on your own either. Learn the ins and outs of debt in Financial Peace University.

This nine-lesson course will teach you the plan to get outand stay outof debt, and get you pumped up to pay it off forever.

And listen: It actually works. The average debt paid off in the first 90 days of working this plan is $5,300.

When you’ve built a solid foundation of knowledge, it makes the debt-free journey quicker and easier. Thats a true win-win.

Choose A Repayment Method And Set A Goal

Whichever method you choose, the first step is going to be to take stock of everything you owe, how much you owe in total, and the interest rate. Then, you can start to prioritize what you owe.

Two popular strategies are the debt avalanche and the debt snowball. The debt snowball tackles the smallest debt first to build momentum, working through bigger debts next, while the debt avalanche focuses on paying down higher-interest debt first to decrease the amount you pay overall.

Also Check: Total Debt Ratio Formula

The Changing Economy And 2021 Debt

Credit card debt dropped again in Q1 of 2021, falling to $770 billion. But by the end of summer 2021, it was back on the rise at $787 billion. Note below that mortgage, auto loan and credit card debt all increased to over $300 billion collectively in Q2 of 2021.44

The uptick in these major debt categories could be from a variety of factors:

- Overall Inflation: As of August 2021, the inflation rate in America had climbed to 5.3% over the previous year.45

- Rising Home Costs: Going into 2021, the median home price in America was $340,000, which is 13.4% more compared to last year!46

- The Auto Shortage and Rise in Auto Prices: From October 2020 to October 2021, the price of a used car rose 29%.47

- Increase in Credit Card Interest Rates: The average interest rates for credit cards in 2021 went from 15.91% in Q1 to 16.30% in Q2 to 17.31% in Q3.48

- Increased Consumer Spending: Consumer spending in America increased 12% from Q1 of 2021 to Q2.49

The changing economy in 2021 is reflecting a rise in costs, spending and debt in at least three major debt categories.

Whats The Average Interest Rate On Peoples Credit Cards What About Those Who Carry A Balance What About New Credit Card Offers

For all credit cards, the average APR in the second quarter of 2022 was 15.13%.

For cards accruing interest, the average in the second quarter of 2022 was 16.65%.

For new credit card offers, the average today is 21.59% the highest rate weve seen since we began tracking rates monthly in 2019.

| Average APRs for current credit card accounts and new card offers | |

| Average APR for new credit card offers | 21.59% |

| Average APR for all accounts that accrue interest | 16.65% |

The Federal Reserves G.19 consumer credit report showed that the average APR for all current credit card accounts jumped in the second quarter of 2022, up from 14.56% in the first quarter. Meanwhile, APRs for cards accruing interest rose to 16.65%, up from 16.17% in the first quarter.

If youre planning to get a new credit card, your interest rate will likely be higher than those listed above. The latest LendingTree data on credit card APRs shows that the average APR with a new credit card offer is 21.59%, with the average card offering an APR range of 18.04% to 25.14%, with your rate varying based on your creditworthiness. Those rates have risen significantly in recent months, thanks to the Federal Reserves announcement of interest rate hikes in March, May, June and July. The Fed will likely do the same in September and perhaps more in 2022. When this happens, cardholders should expect to see their cards APRs rise in the next billing cycle or two as a result.

You May Like: What Percent Of Chapter 7 Bankruptcies Are Dismissed

Those With Higher Incomes Feel The Crunch Much More Than Those With Lower Incomes

The amount of outstanding debt is strongly tied to the level of income. This means that with higher income comes higher loan balances. With a higher income, you can obtain a larger mortgage or auto loan. You have a greater capacity to incur debt and a better capacity to repay it.

In terms of homeownership, a lower salary equals a lower probability of even qualifying for loan debt. Although credit card qualification is less demanding, the underlying guideline remains the same.

Average Monthly Credit Card Payment

The average next credit card payment for Credit Karma members is $173. But the average payment is naturally higher for those with higher total credit card debt. For example, Gen X members average $7,923 in credit card debt and have an average next payment of $222. On the flip side, Gen Z members have an average of $2,589 in total card debt and an average next payment of only $78.

You May Like: How To Find Out What Debt Collectors You Owe

Who Has Student Loan Debt

- As of 2021, 30% of all adults have incurred education-related debt.Go to footnote

- Of adults who went to college, over 40% went into debt for school.Go to footnote

- 20% of adults who went to college still carry student debt.Go to footnote

- In 2022, 43.4 million people owed money on a federal student loan.Go to footnote

While many students take out student loans, debt amounts vary according to race/ethnicity, gender, and degree type, among other characteristics.

Federal Student Loan Debt Statistics

Federal loans include subsidized loans meaning the government pays all or part of your loan interest if you demonstrate financial need and unsubsidized loans.

- Federal student loans account for roughly 92% of all student loan debt.Go to footnote

- In 2018-2019, 42% of first-time, full-time students were awarded federal student loans.Go to footnote

- Interest rates for federal student loans disbursed between July 2021 and July 2022 are:Go to footnote

- 3.73% for undergraduates

- 5.28% for graduate students using direct unsubsidized loans

- 6.28% for parents and graduate students using direct PLUS loans

Also Check: How Does Bankruptcy Work In Nc

What Percentage Of Americans Are In Debt

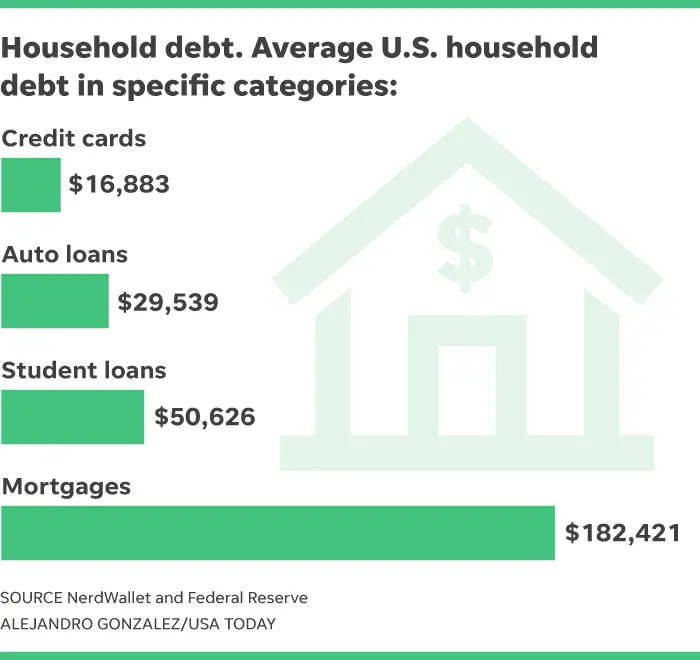

Just how many Americans are in debt? According to financial experts, the percentage of Americans in debt is around 80%. 8 in 10 Americans have some form of consumer debt, and the average debt in America is $38,000 not including mortgage debt. Owing money just seems to be a way of life for Americans, as collectively we have $14 trillion in debt. That amount is climbing ever higher. Consumer debt can be broken up into 4 main categories: mortgage debt, auto loans, student loans, and credit card debt. Unpaid medical bills and expensive medical costs are quickly contributing to debt that Americans currently carry.

At What Age Should You Have No Debt

Kevin O’Leary, an investor on Shark Tank and personal finance author, said in 2018 that the ideal age to be debt-free is 45. It’s at this age, said O’Leary, that you enter the last half of your career and should therefore ramp up your retirement savings in order to ensure a comfortable life in your elderly years.

Don’t Miss: Legit Debt Relief Programs

Health Disability And Medical Debt

Differences in health status and hospital stays or having adisability may also contribute to medical debt.

About 31% of households with a member in fair or poor healthhad medical debt compared to 14.4% of those with no members in fair or poorhealth .

The share of households with medical debt was almost doublefor those with any member experiencing a hospital stay than for thosewith no members with a hospital stay .

More than 1 in 4 households with at least one memberwith a disability had medical debt compared to 14.4% of households with nomembers with disabilities.

The Pandemic Impact On Debt

The less your income, the easier it is to pile up debt. That obvious lesson hit home in 2020.

The unemployment rate went from 3.5% pre-COVID to a peak of 14.8% in April 2020the highest level since 1948.

The total U.S. consumer debt balance grew $800 billion, according to Experian. That was an increase of 6% over 2019, the highest annual growth jump in over a decade.

Student loan debt increased the most , followed by mortgage debt and personal loan debt .

But dropped $73 billion, a 9% decrease from 2019 and the first annual drop in eight years.

A November 2020 Experian survey showed that 66% of consumers were spending the same or less during the pandemic than they had in 2019. About 33% of those surveyed said they put more in savings in 2020 than they did in the last year.

Recommended Reading: Who Reports Bankruptcies To The Credit Bureaus

What Is The Average Debt In America Per Household

The average amount of debt per household in the U.S. was $96,371 in 2021, according to a report conducted by Experian. That includes mortgages and vehicle loans. It is an increase of 3.9% over the previous year. The average debt also includes any loans and credit cards a person has. This often lumps student loans into the mix as well.

Another way to consider how much debt Americans have is to consider the amount of overall debt owed by all Americans. According to the Federal Reserve Bank of New York, in 2021, household debt across the county rose to $16.16 trillion. This includes mortgage debt as well as non housing balances. Of that, about $11.39 trillion in household debt, such as mortgage debt.

Overall, reports indicate that 340 million Americans have some type of debt, including mortgage and car loans. The Urban Institute notes that 64 million Americans have at least some credit card debt.

Which Generation Has The Most Debt

While we love to point our fingers at one generation, with baby boomers often ridiculously pitted against millennials like high school rivals, its actually Gen-Xers who have racked up the most debt out of modern generations.

If you take a closer look at average debt by age, those in the younger part of Generation X, between the ages of 35 and 44, had $93,700 of debt, with the older half of this generation close to that at $89,900. Studying average American debt by age tells us that those under 35 and over 65 tend to have the lowest amounts of debt, often because theyve not accumulated much debt or have paid it off already, respectively.

Read Also: Can A Bankruptcy Trustee Find Bank Accounts

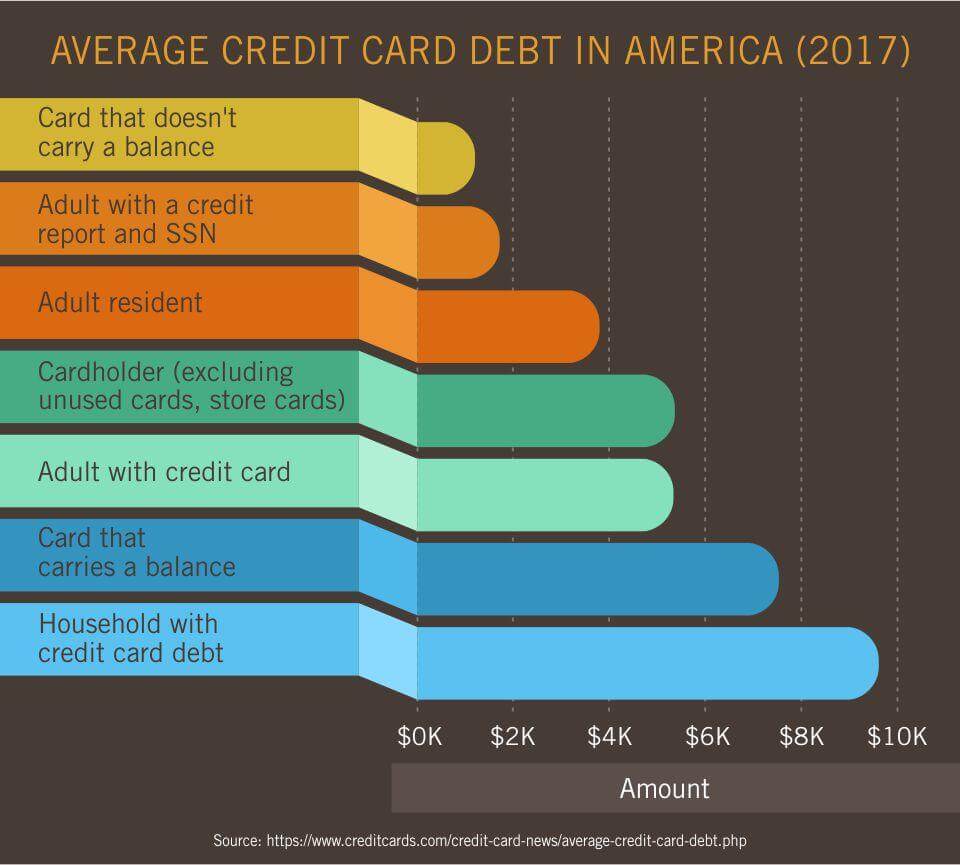

What Is The Average Credit Card Debt In America In 2022

The average amount of credit card debt per person varies depending on age, race, income and location. MoneyGeek analyzed key credit card debt statistics to explore the state of debt in the U.S. and understand the factors associated with credit card debt.

Key Findings

- There were 537 million credit card accounts in the U.S in Q1 2022, up 6% or 31 million since Q1 2021.

- Credit card debt totaled $841 billion in Q1 2022, down from $893 billion in Q1 2020 the last quarter before the pandemic but up $71 billion from Q1 2021.

- The average cardholder had $5,769 in credit card debt in Q1 2022, up from $5,611 in Q1 2021.

- Individuals 75 or older had the most debt , and those under 35 had the least .

- Alaska had the highest average credit card debt at $6,617 per person Iowa had the lowest at $4,289.

- Americans in the 60th to 79.9th annual income percentile were most likely to carry debt approximately 57% of individuals in this income bracket had credit card debt.

- White Americans had the highest average debt per person of any racial group , while those who identified as Black or African American had the lowest .

Total Student Loan Debt Statistics

- As of March 2022, student loan debt in the U.S. reached nearly $1.75 trillion.Go to footnote

- Americans owed about $141.5 billion in private student loans at the end of March, 2022.Go to footnote

- In the same period, Americans owed $1.6 trillion in federal student loans.Go to footnote

- In 2021, 96% of those with outstanding education-related debt had taken on a student loan to pay for their own education.Go to footnote

- By the end of Q1 2022, student loan debt made up 36.6% of non-housing debt.Go to footnote

Sources: FRED® Economic Research Federal Reserve Bank of St. Louis, Bureau of Labor Statistics, National Center for Education Statistics, Federal Student Loan Portfolio

Also Check: Are Bankruptcy Courts Affected By Government Shutdown

How Can I Start Paying Off My Debt

Many people carry a car loan, mortgage, or some other type of financial aid throughout their lives. But you can speed up the repayment process with some careful planning. Heres how you can get started paying down your personal debt.

1. Make a list of outstanding debts

To pay down debt, it helps to know how much money you currently owe. You can start by making a list of all your debts. Be sure to include loans, credit card balances, and any money you owe to family and friends.

As you write down each debt, include the most important details: the total outstanding balance, the interest rate, and the minimum monthly payment.

What is an interest rate?

The interest rate is the cost you pay each year to borrow money expressed as a percentage. This is in addition to paying back the original loan amount.

Just having this information written down can make you feel more in control of your finances. Now that you know exactly where you stand, youre ready to create a personalized debt payment plan.

2. Choose a debt payment method

Paying down your debt is much easier when you have a plan. A debt payment plan can motivate you to pay off your debt faster and more strategically.

Here are two popular payment methods to consider.

3. Make your debt more affordable

When you have debt, you pay interest on every dollar you owe. The higher your interest rates are, the more money you have to pay.

Why Is Student Loan Debt So High In The Us

The cost of higher education continues to rise. According to White House information, the cost of both a four year private and a four year public school has tripled from 1980 through 2022. While many students may have benefited from Pell Grants, which used to cover as much as 80% of those costs, that type of financial aid only covers about a third of the cost of higher education now. Financial aid may be available to those who qualify. That means more students are paying out of pocket or through third party loans to cover their overall costs.

Read Also: Can You File Bankruptcy For Free