How To Calculate Dti

Your debt-to-income ratio is your total monthly debt payments divided by your gross monthly income. When your lender goes to calculate your DTI, theyll most likely use an automated underwriting system to crunch the numbers for them. Its rare for a lender to do a manual DTI calculation. You can use a DTI calculator online to help you easily estimate your own debt-to-income ratio. Most calculators measure DTI by following these three primary steps:

Step 1: Add up your minimum, recurring monthly debt payments.

Step 2: Divide your total monthly debt payments by your gross monthly income.

Step 3: Multiply the result by 100 to get your DTI percentage.

Heres a way to apply the steps above to a real-life example. Lets say you have a mortgage payment of $1,200 per month, a minimum car payment of $200 and a minimum credit card payment of $100. That gives you a total monthly debt payment of $1,500. If you earn $4,500 per month, you can simply divide $1,500 by $4,500 for a DTI ratio of 0.33, or 33%.

What Should Your Dti Be To Buy A Home

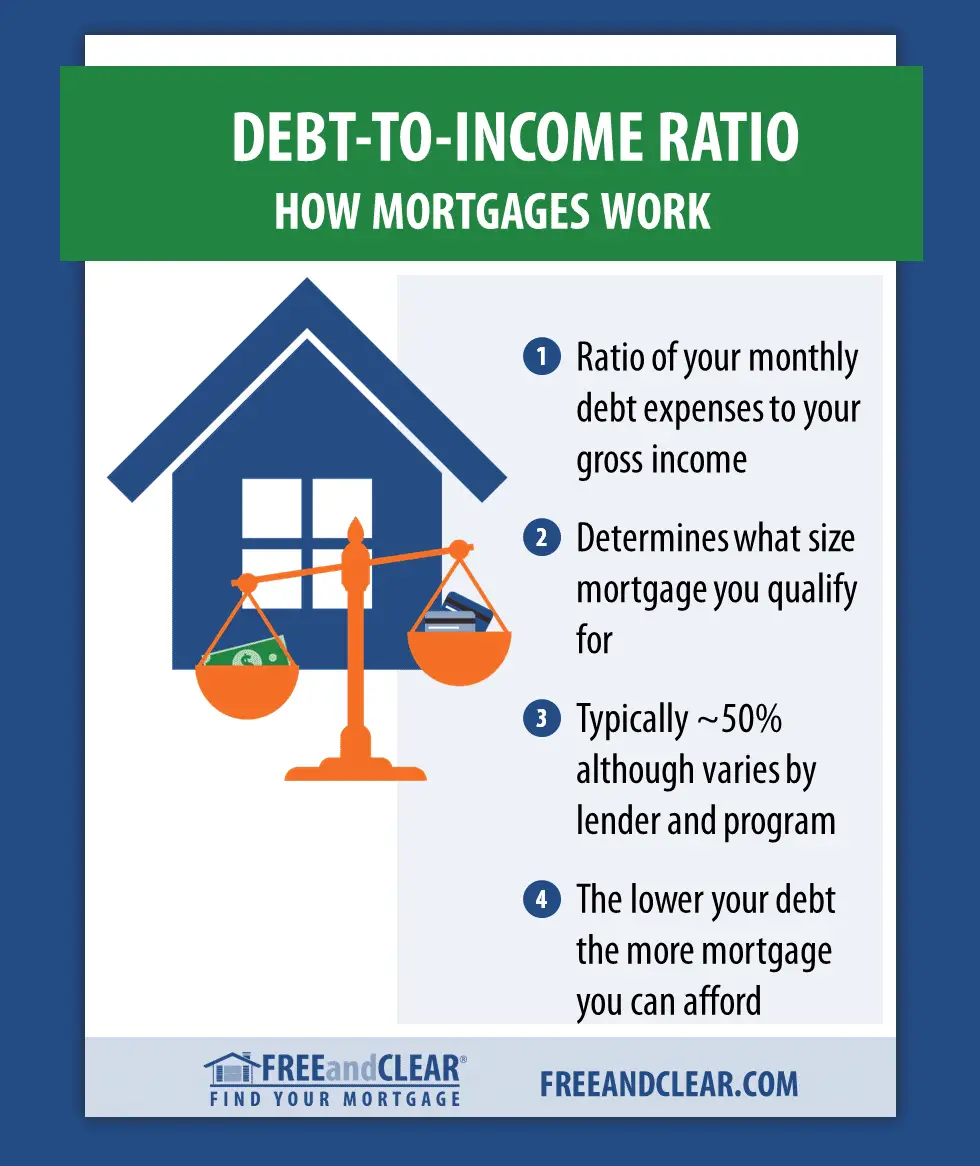

The lower your DTI, the betterthis means less of your income is tied to recurring debt payments, and youll likely be more able to continue making payments on time even if you experience a minor financial setback. Borrowers with higher debt obligations relative to their incomes are less able to absorb those setbacks, and are at greater risk of defaulting on their loan. This is why high DTI is the #1 reason mortgage applications get rejected.

So, whats the magic number when it comes to DTI? Well, it varies slightly based on the type of mortgage, the lender, and other aspects of your financial profile.

Typically, though, most lenders prefer to see a DTI of under 36%. In other words, the total of your monthly debts, including your estimated monthly mortgage payment, will be less than 36% of your monthly gross income. However, it may be possible to get a mortgage with a DTI of up to 50% depending on the lender. If you have a DTI of 50% or higher, then it could be challenging or even impossible to get approved for a mortgage until you lower your debt to income ratio.

Conventional loan DTI requirements

While many lenders require a DTI of no more than 43%, some lenders, including Better Mortgage, can provide mortgages to borrowers with DTIs up to 50%. This means even if your DTI is 49.999%, you could be eligible for a home mortgage loan.

FHA loan DTI requirements

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Read Also: When Will My Chapter 7 Bankruptcy Be Discharged

Don’t Miss: Who Can File Chapter 7 Bankruptcy

What Goes Into A Debt

Debt-to-income ratios come in two forms: the front-end DTI and the back-end DTI. Lenders look at both of these when considering your loan application.

Heres how those break down:

- Front-end DTI: Also called a PITI ratio , this number reflects your total housing debt in relation to your monthly income. If you take home $6,000 per month and are trying to buy a home that would require a $1,500 monthly payment, your front-end DTI would be:

- Back-end DTI: Your back-end DTI encompasses all your monthly debts in relation to your income. For example, if you make $6,000 a month, have a $600 car payment, a $400 student loan payment, and an expected $1,500 mortgage payment, your back-end DTI would look like this:

For most lenders, the back-end DTI is most important, as it more accurately reflects what you can afford each month.

Whats A Dti Ratio And Why Does It Matter

Your DTI ratio is calculated by taking the sum of your monthly debt payments and dividing by your gross monthly income. If you have a low DTI ratio, it means you dont have excessive debt to pay in relation to your income. A high DTI ratio means a large chunk of your income goes toward paying off debts. This can cause some lenders to see you as a high riskpotentially leading to the rejection of your loan application. Plus, a high DTI ratio can simply be hard to manage without missing payments.

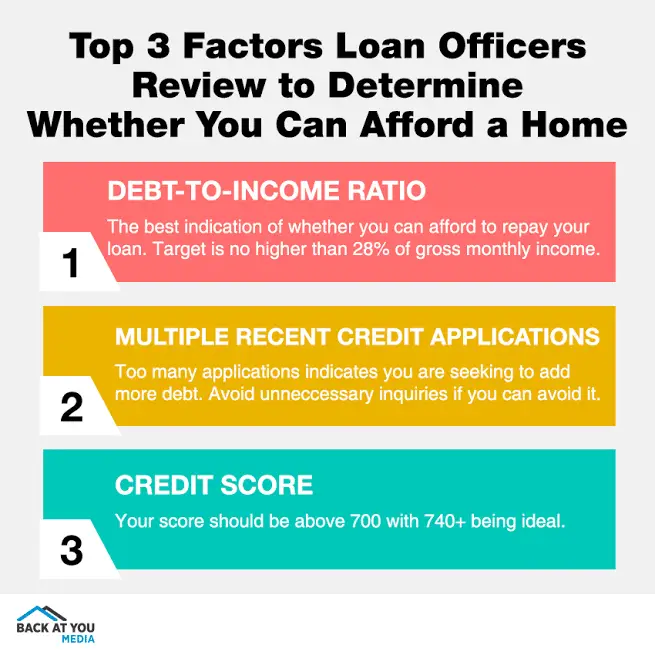

If youre hoping to get a mortgage soon, youll want to be mindful of your DTI ratio. Many lenders arent able to offer a Qualified Mortgage unless the borrowers DTI ratio is 43% or lower. Qualified Mortgages are meant to provide extra protections to consumers and are less likely to result in a borrower defaulting on their loan.

So, if you want to be eligible for a more accessible mortgage with potentially lower rates and fees, youll need a low DTI ratio.

Read Also: What Is A Good Bankruptcy Score

Calculate Your Dti Ratio

Divide your total monthly debt payments by your monthly net income. To convert this into a percentage, multiply it by 100 this number is your DTI ratio.

For example:

The DTI ratio youll need to qualify for a loan will depend on the type of loan you get as well as the lender. For example, if you want to take out a personal loan, your DTI ratio should be no higher than 40% though some lenders might require lower ratios than this.

If your DTI ratio seems to be in good shape and you want to apply for a personal loan, be sure to consider as many lenders as possible to find the right loan for you. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan? Credible makes it easy to find the right loan for you.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

Read Also: Why Did Detroit File For Bankruptcy

How To Lower Your Dti Ratio

Generally, if youre trying to lower your DTI, there are two things you can do: Increase your monthly income or decrease your outstanding debt. Heres a closer look at how to accomplish each of those goals:

- Increase your monthly income. Increasing your income is easier said than done. Still, if lowering your DTI is a goal, finding ways to increase your pay is one way to do it. It might be time to negotiate a raise at work or take on a few extra hours of overtime. You also can turn a hobby or skill into a lucrative side hustle and bring in extra income on the side when your schedule allows it.

- Your other option is to get rid of some debt so that your monthly payments are lower . Bonus at work? Tax refund? Use these windfalls to make extra lump-sum payments on your debt. By lowering the amount you owe on a monthly basis, your DTI will drop, too.

Add Fixed Monthly Debts

The first step in calculating the debt-to-income ratio is adding up all your existing monthly debt obligations. These expenses may include:

- Student loan payment

- Existing rent or house payment

- Monthly alimony or child support payments

- Wage garnishments or installment payments on back taxes.

Take how much you pay each month for each of these items and add them all together. This is how much you pay each month in debt.

Also Check: How To Build Credit Score After Bankruptcy

How To Calculate Debt

You can calculate your DTI ratio before you apply for a mortgage, regardless of which kind of loan youre looking to get.

First, there are two types of ratios lenders evaluate:

- Front-end ratio: Also called the housing ratio, this shows what percentage of your income would go toward housing expenses. This includes your monthly mortgage payment, property taxes, homeowners insurance and homeowners association fees, if applicable.

- Back-end ratio: This shows how much of your income would be needed to cover all monthly debt obligations. This includes the mortgage and other housing expenses, plus credit cards, auto loan, child support, student loans and other debts. Living expenses, such as utilities and groceries, are not included in this ratio.

The back-end ratio may be referred to as the debt-to-income ratio, but both ratios are usually factored in when a lender says theyre considering a borrowers DTI.

Qualifying With High Debt To Income Ratio For Conventional Loan

Home Buyers who need to qualify for conventional loans with high debt to income ratios can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at [email protected]. Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans. Not too many conventional lenders will go to the 50% debt to income ratio limit. Gustan Cho Associates has zero overlays on debt to income ratio for conventional loans and we just go off AUS FINDINGS. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Also Check: What Debts Can Be Discharged In Bankruptcy

How To Calculate Your Dti

To determine your debt-to-income ratio , start by adding up all your monthly debt payments.

Monthly debts for DTI include:

- Future mortgage payments on the home you want

- Auto loan payments

- Other non-debt expenses that dont appear on your credit report

Next, divide the sum of your debts by your unadjusted gross monthly income. This is the amount you earn every month before taxes and other deductions are taken out otherwise known as your pre-tax income.

Then, multiply that figure by 100.

* 100 = Your DTI

For example, say your monthly debt expenses equal $3,000. Assume your gross monthly income is $7,000.

$3,000 ÷ $7,000 = 0.428 x 100 = 42.8

In this case, your debt-to-income ratio is 42.8% just within the 43% limit most lender will allow.

Front-end DTI vs. back-end DTI

Note that lenders will examine your DTIs front-end ratio and back-end ratio.

Your front-end ratio simply looks at your total mortgage payment divided by your monthly gross income, says Cook.

Most lenders want to see a front-end ratio no higher than 28%. That means your housing expenses including principal, interest, property taxes, and homeowners insurance takes up no more than 28% of your gross monthly income.

But in most cases, says Cook, the front-end debt ratio is not the number that matters most in underwriting. Most loan underwriting programs today primarily look at the back-end debt ratio.

How Is The Debt

The debt-to-income ratio can be calculated using these two formulas:

Gross debt service ratio

This corresponds to the percentage of your gross income that goes towards housing fees for the home youâre looking to buy. Generally speaking, you need a GDS between 32% and 39% to get a loan, but your bank may require a lower ratio.

To calculate it:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Multiply the total by 100. 3. Divide the new total by your gross monthly income.

Total debt service ratio

This is the percentage of your gross monthly income that goes towards housing fees for the home youâre looking to buy, in addition to your other debts. Your TDS shouldnât exceed 44%, but a lender may require a lower ratio. Usually, a TDS under 40% is good enough to get a loan.

To calculate TDS:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Add your other monthly financial commitments to this total: Loans, typically 3% of the limit on each of your credit cards and lines of credit , child support and alimony, as well as any other debt payments. 3. Multiply the total by 100. 4. Divide the new total by your gross monthly income.

To calculate these ratios, you can use the Canada Mortgage and Housing Corporationâs debt service calculator.

Read Also: Pallets Of Returns For Sale

Benefits Of A Conventional Home Loan

Conventional loans are the most popular type of mortgage. After that come government-backed mortgages, including FHA, VA, and USDA loans.

Government-backed mortgages have some unique benefits, including small down payments and flexible credit guidelines. First-time home buyers often need this kind of leeway.

But conventional loans can outshine government-backed loans in several ways.

Dont Miss: How To Not Pay Student Loan Debt

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

You May Like: How Does Insolvency And Bankruptcy Code Work

How Dti Impacts Your Credit Score

Not only does your DTI impact your ability to secure a loan, it also indirectly affects your credit. That means even if you arent trying to borrow money right now, a DTI thats too high could knock points off your credit score and make it tougher to secure an apartment or open a utility account.

The main reason DTI and credit are related is because the total amount of debt you owe affects approximately 30% of your FICO score. The lower the amount of debt you owe in relation to your available credit, the better for your score. Conversely, the more debt you have to your name, the worse its impact on your score. So if you have a high DTI, it follows that you are probably using a significant portion of your available credit.

DTI also can impact your credit if you owe so much that you arent able to keep up with payments. As the most heavily weighted factor in calculating your credit score, payment history makes up 35%. Just one missed payment can knock quite a few points off your score, so its important to keep your debt levels manageable.

What Is The Minimum Credit Score For A Conventional Loan

Conventional Loans A conventional loan is a mortgage thats not insured by a government agency. Most conventional loans are backed by mortgage companies Fannie Mae and Freddie Mac. Fannie Mae says that conventional loans typically require a minimum credit score of 620. But lenders can raise their own requirements.

Recommended Reading: Can You Buy A House After Bankruptcy

Va Debt To Income Ratio

VA Loans evaluate borrower income differently than other popular mortgage counterparts. To meet VA debt to income requirements, qualified veterans or their spouses can have bottom ratios as high as 50% or greater if theyre approved through an automated underwriting system. VA loans also employ a Residual Income approach to evaluate veteran income. VA residual income guidelines

- VA Residual Income Requirements

How To Calculate Debt To Income Ratio

Okay easy enough, but your ratio is likely not as clear-cut as half your income . How do you calculate your exact DTI? Theres math involved, but thankfully its pretty basic .

Simply divide all your monthly debt payments by your gross income, and then multiply that number by 100. This will give you your DTI percentage.

In some cases, what constitutes income and debts is clear-cut. In other cases, not so much. Generally, lenders follow these guidelines for what to include for each.

Debt includes:

-

Minimum required credit card payments

Income includes:

-

Income from additional jobs or side hustles

-

Revenue from rental property or other investments

-

Regular income from annuities, trust funds, and retirement accounts

-

Any child support or alimony payments you receive

Lets look at a real-world example:

Auto loan: $350 per monthStudent loans: $220 per monthCredit cards: $130 minimum monthly paymentExpected housing costs: $1,800 per month= $2,500 monthly debt obligation

Monthly salary: 5,000 Monthly side-gig income: $1,500

x 100 = 38% DTI

The above scenario is for illustrative purposes only.

You May Like: How Much Is Bankruptcy Chapter 13