Is It The Right Time To File A Medical Debt Bankruptcy

The idea of wiping out thousands of dollars in bankruptcy can be compelling. However, it might not be the right time.

The timing matters because you can only receive so many discharges within a certain period. For instance, after receiving a Chapter 7 discharge, you must wait eight years before receiving another.

Here’s the potential problem.

Suppose you incur more medical bills after your first bankruptcy or some other expensive calamity occurs. You’d be at the mercy of debt collectors until you paid off the obligation or qualified for another discharge.

So before deciding to file, consider asking yourself two questions: “Has my medical condition stabilized? What’s the likelihood that another financial crisis will arise?”

‘i Live On The Street Now’: How Americans Fall Into Medical Bankruptcy

Having health insurance is often not enough to save Americans from massive debts when serious illness strikes

Its been over a dozen years since Susanne LeClair of West Palm Beach, Florida was first diagnosed with cancer and shes been fighting ever since. Now she, like many other Americans facing life-threatening illness, is bankrupt despite having health insurance.

Before her first cancer-related surgery, LeClair was told by the hospital they accepted her employer-based health insurance.

I paid my $300 copay. After the surgery, I started receiving all these invoices and came to find out the only thing covered was my bed because the hospital was out of network, said LeClair. My bills were hundreds of thousands of dollars, so I had no choice but to file bankruptcy.

LeClair is on the verge of having to file for bankruptcy a second time due to the mounting medical debt she has accrued for additional cancer-related surgeries, regular appointments, medications and supplies related to her recovery, despite having health insurance and paying as much as she can out of pocket for copays, deductibles and premiums to maintain insurance.

Bankruptcy can also make it difficult to find employment given that many employers will disqualify a candidate with a bankruptcy filing found from a background check.

A type 1 diabetic for years, he had to reduce his work hours for a cellular retail store when trouble regulating his blood sugar resulted in a toe amputation in April 2019.

How Does Bankruptcy And Discharge Of Medical Debt Work

Bankruptcy is a legal process designed to help you eliminate or repay debt including medical debt. This is usually achieved through liquidation of assets or a repayment plan.

Filing bankruptcy can stop most creditors from seeking to collect their debts from you. Bankruptcy also can provide you an opportunity to get current on your mortgage and car loans.

Read Also: How Do I File Bankruptcy And Keep My Car

There Are Two Main Kinds Of Consumer Bankruptcy

Chapter 7 and Chapter 13 are the two commonly used forms of consumer bankruptcy.

Chapter 7 allows consumers to sell or liquidate property to pay medical debts. Filing for this costs $335. Chapter 13, instead, allows you to follow a 3- to 5-year court-ordered repayment plan. Filing for Chapter 13 bankruptcy costs $310.

A major difference between the two is the means test requirement for Chapter 7. Your monthly income should be below your state’s median income to qualify for Chapter 7 bankruptcy.

If you have a regular income and can repay the debt over time, you may be a candidate for Chapter 13 bankruptcy instead.

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Recommended Reading: Can A Married Person File Bankruptcy Without Spouse

Can My Medical Debt Be Paid Off With Bankruptcy

Do not beat yourself up thinking of how to make ends meet in the midst of mounting medical bills. You are not alone. Personal bankruptcy is largely driven by unexpected causes, like medical debt.

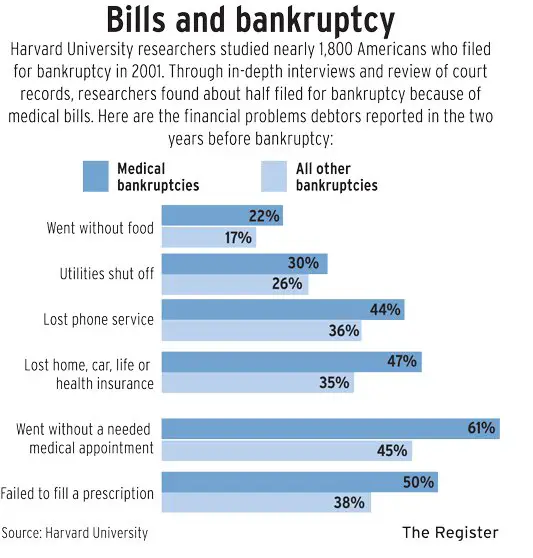

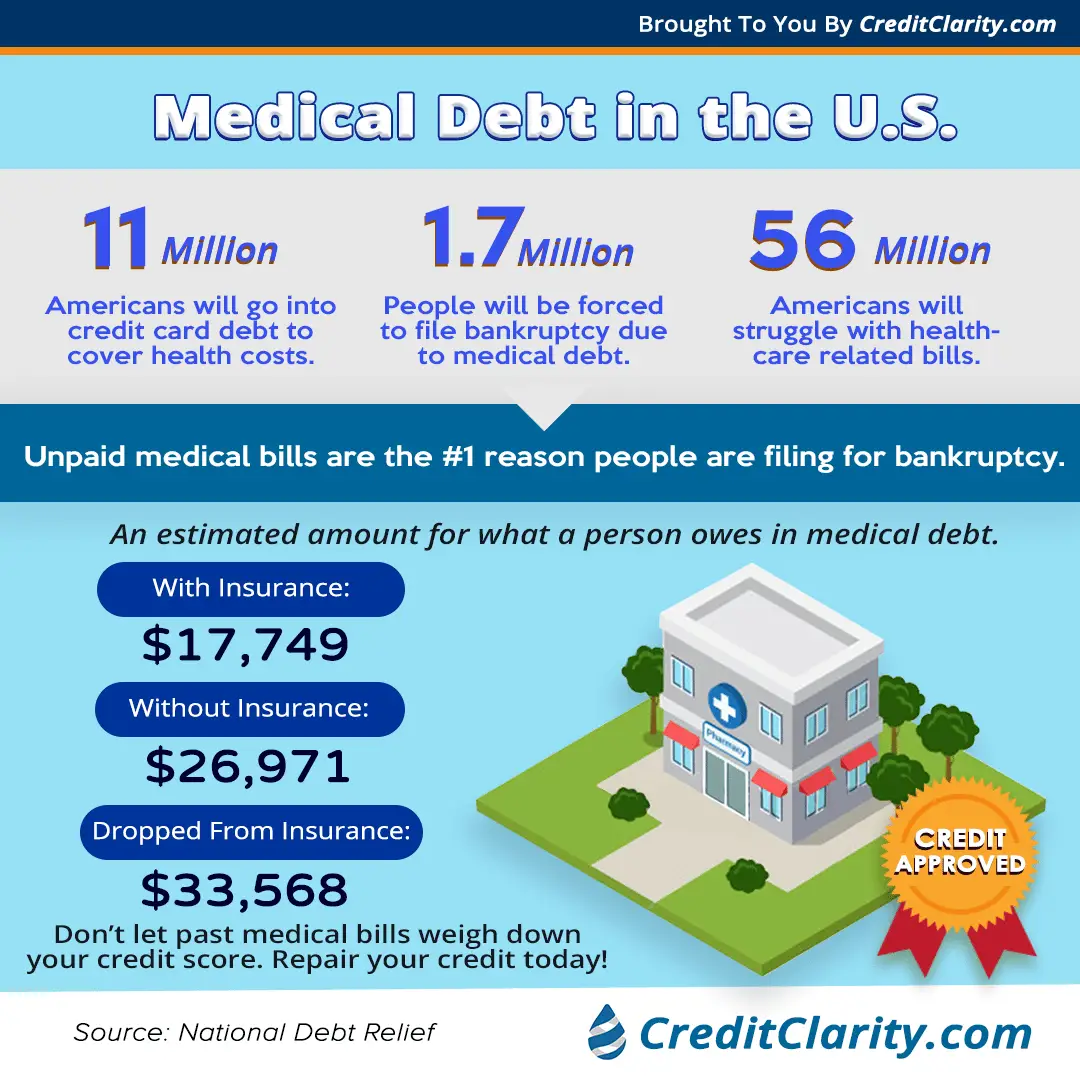

Monstrous medical bills are the biggest driver of personal bankruptcies in the US. In fact, an American Journal of Public Health study found 66.5% of all bankruptcies are related to medical issues. The cause of bankruptcy was expensive medical bills or absence from work. The study reviewed court filings for a random sample of 910 Americans who filed for bankruptcy between 2013 and 2016. They found that 530,000 families file for bankruptcy every year for medical issues or bills. The rising health care costs in the country contributes to one of the biggest expenses Americans have to pay. According to the study, Americans spent $3.4 trillion on medical care in 2017. In 2016, the average healthcare cost per person was $10,345. Experts predict that figure will increase to $14,944 in 2023.

Also according to the study, other reasons for personal bankruptcy include unaffordable mortgages or foreclosure , spending or living beyond ones means , providing help to friends or relatives , student loans , and divorce or separation .

Cons Of Using Chapter 13 For A Medical Debt Bankruptcy

- You might have too much debt. Your medical bills and other debts can’t exceed the Chapter 13 debt limits. If they do, you’ll be limited to filing an individual Chapter 11.

- Chapter 13 is always expensive. You’ll pay Chapter 13 creditors your disposable income for three to five years. Very few filers have much left over after paying a plan payment and monthly bills. Find out more in “Calculating a Chapter 13 Plan” below.

- Many people don’t make enough to qualify. Your income must be sufficient to cover the amounts you must pay through the plan. Otherwise, the bankruptcy court won’t approve or “confirm” your plan. If you’d like to see what you’d pay, try out the Chapter 13 payment plan calculator.

Also Check: Can You Buy A House After Bankruptcy Canada

How To Eliminate Medical Bills With Bankruptcy In Florida

Unexpected medical bills can financially devastate a family for many years to come. The rising cost of health care is proving to be a tremendous burden on families. Most people file bankruptcy because of medical bills. A study by the American Journal of Medicine found that 62.1% of all bankruptcy cases are attributable to medical reasons. Further, the study found that 92% of the people filing bankruptcy for medical reasons had over $5,000 in medical bills.

Bankruptcy is used so often because it can wipe out all your medical bills. See Bankruptcy law 11 USC 524. This is because medical bills are almost always an unsecured debt. Unsecured debts are loans in which the borrower does not provide any collateral for the loan. Other examples of unsecured debts can include credit cards, student loans, rent, and gym memberships. When adebt is discharged in bankruptcy, the borrower will be released from personal liability on the debt. For more information about a specific bill or case, contact a Tampa bankruptcy law firm for advice.

Why Its Important To Talk To A Richmond Hill Licensed Insolvency Trustee

There are also many different services related to debt relief in Richmond Hill. This includes everything from Payday services, loan consolidation companies, banks, debt counsellors and trustees in bankruptcy in Richmond Hill and surrounding areas. The question is If you have a serious debt problem, which type of company should you consult and who is looking out for your best interests?

While your first thought may be to consider contacting your financial institution or a loan consolidation company as a means to reducing your monthly payments, this is not always the best option.

- First, if you are turned down for the loan it will definitely be reflected in your credit score. Shopping around will only reduce your credit score further if each company runs a credit report.

- Second, their priority is to lend you money as that is how they make their money. There only concern is your ability to repay the loan, not necessarily your best interest.

You May Like: How To Boost Credit After Bankruptcy

What Are Alternatives To Bankruptcy For Eliminating Medical Debt

- Medical creditors are typically much easier to work with than creditors or collectors of other forms of debt.

If medical debt is the primary reason youre considering a bankruptcy filing, there are alternatives you may want to consider first. Unlike other forms of debt, medical creditors are usually more willing to work with you on repayment, possibly even accepting a lower amount. Many medical offices and hospitals will hold the bill as long as possible within their own billing departments before sending it off to a collector, if at all. Since medical creditors rarely belong to credit reporting agencies, medical debt is less likely to hurt your credit score than other types of debt. As such, there is substantial incentive to contact your care provider or hospital to negotiate a plan of repayment. Being saddled with medical debt can be onerous. It may be beneficial to speak with a bankruptcy lawyer so you can have a better understanding of all your options.

Will Chapter 7 Bankruptcy Eliminate My Medical Debt

If you have acquired a significant amount of medical debt, it may be in your best interest to file forChapter 7 bankruptcyas this process would allow you to discharge most, if not all, of your unsecured debt over a short period of time. Once you have liquidated your non-exempt assets and used the proceeds to repay your creditors, the court will order a discharge of all remaining debts. This, in turn, would free you of the legal obligation to repay them.

Known as fresh start bankruptcy, Chapter 7 is often the most practical way to rid yourself of overwhelming medical debt once and for all. If you do notqualify for this chapter, however, you should not hesitate to consider the possibility of Chapter 13.

Recommended Reading: How To File Bankruptcy In Colorado

Bankruptcy For Medical Bills

You can file bankruptcy for medical bills. Not only will your medical bills be discharged by the bankruptcy, but your other existing unsecured debt will be discharged by filing bankruptcy as well. While this is sometimes referred to as a Medical Bankruptcy, there is no specific legal term for this. It simply signifies that the primary reason you are filing bankruptcy is due to your medical bills.

Contact A Bankruptcy Lawyer Today

If youre considering filing bankruptcy and would like to learn more about Chapter 7 or Chapter 13 bankruptcy, contact an attorney at CMC Law today. We will help you decide what decision is best for you based on your financial situation.

You can learn more about your options by consulting with a bankruptcy attorney or by checking out more on Chapter 7 and Chapter 13 Bankruptcy. Or, start by finding out about the steps involved in bankruptcy once you decide to file.

Also Check: How To File For Bankruptcy In Ri

This Is The Real Reason Most Americans File For Bankruptcy

- Two-thirds of people who file for bankruptcy cite medical issues as a key contributor to their financial downfall.

- While the high cost of health care has historically been a trigger for bankruptcy filings, the research shows that the implementation of the Affordable Care Act has not improved things.

- What most people do not realize, according to one researcher, is that their health insurance may not be enough to protect them.

Filing for bankruptcy is often considered a worst-case scenario.

And for many Americans who do pursue that last-ditch effort to rescue their finances, it is because of one reason: health-care costs.

A new study from academic researchers found that 66.5 percent of all bankruptcies were tied to medical issues either because of high costs for care or time out of work. An estimated 530,000 families turn to bankruptcy each year because of medical issues and bills, the research found.

Other reasons include unaffordable mortgages or foreclosure, at 45 percent followed by spending or living beyond one’s means, 44.4 percent providing help to friends or relatives, 28.4 percent student loans, 25.4 percent or divorce or separation, 24.4 percent.

While the findings are consistent with past studies on bankruptcy, the data also highlight a key new factor: whether the Affordable Care Act has reduced the burden of medical debt for people.

More from Personal Finance:Medicare for All could take center stage in the 2020 election. Here’s what that means

Medical Debt And Chapter 7 Bankruptcy

Chapter 7, known as straight bankruptcy, aims to liquidate most, if not all, of your debt in exchange for your property, including your medical bills. All medical bills for services provided before bankruptcy filing should be discharged even if the service provider has not submitted an invoice. A provider can still collect against any health insurance, but any co-pay or uninsured amount will discharge. The only exception is if the creditor can prove an exception to discharge like a fraud.

To be eligible to file for Chapter 7 bankruptcy, a qualified attorney will examine your income, expenses, assets, and liabilities. Suppose your household is either below median income for Maryland, or you pass the means test. In that case, you qualify for Chapter 7 income from an income point of view. We also examine to make sure there are no assets available for a Chapter 7 Trustee to sell or liquidate.

Read Also: Auctions In My Area

Alternatives To Filing Bankruptcy

Often, our firm represents clients in debt settlement or debt negotiations. It may be that the client can not file bankruptcy or does not want to file bankruptcy. In any case, as a bankruptcy firm, we hold special leverage against creditors in the negotiation process. Often, this leads to a great result for the client.

Can You Declare Bankruptcy On Medical Bills

When you need medical treatment, bills may be your last concernand understandably so. Wellness is your first priority when your health is at stake. But medical bills can cause their own kind of injury, specifically aimed at your financial well-being.

If you’re overwhelmed with medical bills and don’t know how you’ll pay them, you may wonder if declaring bankruptcy on your medical debt is a possibility. Technically, it isbut not as a standalone option. There is no such thing as medical bankruptcy, but medical debt is dischargeable through regular bankruptcy proceedings.

Read Also: Can You Include Student Loans In Chapter 7 Bankruptcy

Is My Health Insurance Enough To Keep Me Out Of Medical Debt

You may feel secured because you are covered by your medical insurance. While it is true that getting yourself insured is best than not getting insured at all, having one is not a guarantee for immediate out-of-pocket costs when injuries happen and illness is in consideration. Here are some truth to why having health or medical insurance may not be an assurance to keep you out of debt:

- You have to pay a greater share of your bills out-of-pocket through rising deductibles and co-payments

- You may have been diagnosed with a chronic illness that wipes out your insurance plan in just one costly treatment

- Your health care provider may not be part of your insurances network of providers

- Your illness or injury may not be covered by your insurance

- You could not afford a premium insurance plan because of your low income

- You could not sustain paying for your insurance because of your medical condition and/or

- You could be denied of your claim

Filing Chapter 7 For Medical Debt

Chapter 7 will discharge all medical debt. There is no dollar limit on how much debt relief you can get for medical costs and medical care put on credit cards. There is also no repayment plan to pay back any of these debts.

You do need to pass the Chapter 7 Means Test to qualify for Chapter 7. This test looks at your state’s average income and your income minus necessary expenses. If your monthly income is less than the state’s median income, you can file for Chapter 7. You can also file if you do not have enough disposable income to cover certain expenses.

Keep in mind that bankruptcy will not discharge student loans or child support, and you will need to keep covering your health insurance during the bankruptcy. In some cases, the bankruptcy courts will use automatic wage garnishment from your paycheck to cover costs and other debts that are not dismissed in Chapter 7.

Read Also: Can You Get A Personal Loan After Bankruptcy

What Does Medical Bankruptcy Mean

Bankruptcy allows you to either get rid of debt or develop a realistic repayment plan. You can file for medical debt bankruptcy if you are overwhelmed by the total cost of your medical bills and need a fresh start. Once you declare bankruptcy, creditors cannot pursue you for medical debt repayment.

While you can discard medical debt during bankruptcy, it isnt the only debt. You also can clear out credit card debt, personal loans, and other forms of debt if you have them.

Yet, bankruptcy cannot clear all debts. For example, you cannot use bankruptcy to discharge child support, alimony, and, in some cases, student loans.

Bankruptcy even when due to medical bills hurts your credit score and can stay on your credit history report between 7 and 10 years, depending on the type of bankruptcy you file for.

Filing for bankruptcy typically also increases your lending risk in the eyes of lenders, making it harder to get financing for big purchases, including car loans or homes.

There is some good news, though. You have some new rights, thanks to recent changes in how credit reporting agencies treat medical debt:

Below are five things to know about so-called medical bankruptcy.