How Do We Tackle The Debt Ceiling

While the deficit for the years 2010 and 2011 actually declined from 2008 and 2009 levels, it wasnt enough to keep the overall debt from increasing. Moreover, this month, the debt ceiling expires.

The debt ceiling is the legal limit that the government is allowed to borrow and it is usually renewed and bumped up when necessary, without much debate or partisan bickering.

Today the difference between what the country owes and what the debt ceiling actually allows us to owe is about $38 billion. Raising the debt ceiling will permit us to borrow the extra money so that we can pay off debts that have already been incurred.

Failure to raise the debt ceiling would mean we couldnt borrow any more funds and we would necessarily default on certain payments.

Nobody believes that that would be a good idea. But Congressional Republicans have already threatened to withhold raising the debt ceiling unless they, Obama and Congressional Democrats can agree on spending cuts in the upcoming yearly budget process.

What will happen over the next several weeks is anybodys guess. But one thing is certain. More D words are coming: drama, distraction, deep division, and maybe even disaster.

5 Minute Read

Why Does China Hold So Much Of The Debt

China is the second-largest holder of the debt, even after it reduced its holdings, which it has been doing since 2011. It has held up to $1.3 trillion of U.S. debt.

Every year since 2010, China has held more than $1 trillion in U.S. debt. That’s when the U.S. Department of the Treasury changed how it measures the debt. Before June 2010, Treasury reports showed that China held about $843 billion in debt. This Treasury-led change makes it difficult to make long-term comparisons.

China is taking steps to make its currency, the yuan, transition to a global currency. To do that, China had to loosen its peg to the dollar. That made the yuan more attractive to forex traders in global markets. China’s economic growth has slowed over the years. As its exports decline, China is less able to invest in U.S. Treasurys.

China also is liberalizing its control of the yuan, also called the “renminbi.” It has opened yuan trading centers in London and Frankfurt. Its allowed the yuan to trade in a wider trading range around a basket of currencies that include the dollar.

China is also responding to accusations of manipulation. Most countries want their currency values to fall so they can win global currency wars. Countries with lower currency values export more, since their products cost less when sold in foreign countries.

What Makes The Debt Increase

Debt levels increase whenever the government borrows more money than it pays off. Generally speaking, that means that the national debt will increase whenever tax revenues are lower than expenditures.

On the expenditure side, debt grows whenever the government adds or expands programs or when outside forces require more federal spending, assuming taxes dont increase to offset costs. On the revenue side, debt increases whenever the government reduces taxes without a corresponding reduction in spending.

Debt also naturally increases during the recession phase of the business cycle both from reduced tax collections and increased spending. When the economy enters a recession, that often drives up the need for government assistance or stimulus spending. Tax revenues also tend to fall when the economy is not doing well, since people tend to have less income to tax.

Don’t Miss: How To File Bankruptcy For Free In Kansas

Does China Own The United States

For its part, China owned 191,000 acres worth $1.9 billion as of 2019. … Indeed, there has been a tenfold expansion of Chinese ownership of farmland in the United States in less than a decade. Six states Hawaii, Iowa, Minnesota, Mississippi, North Dakota and Oklahoma currently ban foreign ownership of farmland.

The National Debt Is Now More Than $30 Trillion What Does That Mean

The gross federal debt of the United States has surpassed $30,000,000,000,000. Although the debt affects each of us, it may be difficult to put such a large number into perspective and fully understand its implications. The infographic below offers different ways of looking at the debt and its relationship to the economy, the budget, and American families.

The $30 trillion gross federal debt includes debt held by the public as well as debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself.

Americas high and rising debt matters because it threatens our economic future. The coronavirus pandemic rapidly accelerated our fiscal challenges, but we were already on an unsustainable path, with structural drivers that existed long before COVID. Putting our nation on a better fiscal path will help ensure a stronger and more resilient economy for the future.

You May Like: How Will Bankruptcy Affect My Job

How Has The Us National Debt Changed Over Time

The US took on debt before it was even a country to fight the Revolutionary War. Economic growth helped reduce the debt before it deepened again during the War of 1812. President Andrew Jackson made it a priority to pay off the national debt, which he did by 1835 by selling federal lands in the West.

That would be the last time the country was debt-free. The US borrowed nearly $3B to fight the Civil War and then over $25B for World War I. Congress started setting a ceiling on the amount of debt the government could legally take on .

The national debt grew again during the Great Depression and New Deal. By the end of World War II, debt was more than 112 percent of GDP.

The post-war economy boomed, and the national debt was largely held in check through the 1950s and 60s. By 1974, it fell to 24 percent of GDP. But following tax cuts in the 1980s, debt was back up to 50 percent of GDP by the early 1990s. However, the rest of the 1990s saw a combination of rapid economic growth and increased tax rates. The government had a budget surplus for four consecutive years, though gross federal debt did not decrease.

Since the start of the new millennium, the US has been issuing debt at a record clip.

How Does The Federal Debt Work

The government finances the operation of the different federal agencies by issuing treasuries. The Treasury Department is in charge of issuing enough savings bonds, Treasury bonds, and Treasury inflation-protected securities to finance the government’s current budget.

Revenues generated by taxes are used to pay the bonds that come to maturity. Investors, including banks, foreign governments and individuals, can cash in on these bonds when they reach maturity. The debt ceiling is the cap that is set on what the Treasury Department can issue.

Congress keeps raising the debt ceiling to finance government spending. A deficit occurs when spending increases faster than revenues.

You May Like: Can Bankruptcy Stop You From Getting A Job

What If The Us Defaulted On Its Debt

What happens if the U.S. defaults? If Congress doesn’t suspend or raise the debt ceiling, the government would not be able to borrow additional funds to meet its obligations, including interest payments to bondholders. … The dollar’s value could collapse, and the U.S. economy would most likely sink back into recession.

There Is A Us$50 Million Debt To Chicago Unit Acquisition Trust Secured Against The Trump International Hotel And Tower In Chicago

This debt is mysterious. The trust is a corporation owned by DJT Holdings LLC that is, Donald J Trump. Trump appears to owe the money to himself. Asked about this unusual arrangement by The New York Times in 2016, Trump said: I have the mortgage. That is all there is. Very simple. I am the bank. But he is the debtor, too, and it is not a typical mortgage it is a springing loan, meaning it only comes due under specific conditions typically a credit event such as a decline in credit rating. It has been suggested that this arrangement could be part of a tax avoidance strategy.

Additional reporting by Laura Noonan in New York

Recommended Reading: Pallets Returns For Sale

What Would Happen If China Called In The Us Debt

What Would Happen If China Called In Its Debt? China’s position as the largest foreign holder of U.S. debt gives it some political leverage. It is responsible for lower interest rates and cheap consumer goods. If it called in its debt, U.S. interest rates and prices could rise, slowing U.S. economic growth.

How Does The National Debt Affect Me

Every dollar the government spends comes from somewhere. The biggest source of government revenue is individual income taxes. When the government borrows money, it avoids taking taxes today, but must collect taxes in the future to repay the debt with interest. In the present, the economy may be better off because people have more money to spend. That plays well to current voters. But a larger federal debt implies a larger future tax burden that the public will have to pay.

As of early June 2022, the national debt works out to more than$91,490 for every person living in the U.S. At some point, the government will need to collect money to pay off this debt and cover current spending.

Finally, the amount of money that you must pay to borrow changes based on how much risk lenders perceive. As the national debt grows, lenders may become more concerned about the governments ability to pay them back and charge higher interest rates. Spending more money on interest could also slow economic growth and means even less is available for programs that serve the public. In the extreme, the inability to borrow money could make it hard to finance national defense. Therefore, a large national debt can become an issue of national security.

You May Like: Did Donald Trump Ever File Bankruptcy

What Are The Consequences Of The Current Deficit Level

Borrowing at this rate is causing the cost of debt to increase. Securing additional funds is becoming increasingly difficult, and the government is faced with higher interest rates. It is estimated that the interest alone on the current federal debt will reach $7 trillion over the next 10 years.

The federal deficit will also impact economic growth and the private sector. A deficit means there are less funds available for projects that would dynamize the economy, such as financing construction projects to improve the country’s infrastructure.

The government is also flooding financial markets with treasuries, which means the private sector will have an increasingly hard time with securing funds from investors.

Want to know more about the consequences of the current deficit level? Check our charts about the national debt and its effects.

What Is The History Of The National Debt

Since the founding of the United States and the American revolution, debt has been a grim reality in America. When America needed funding for the Revolutionary War in 1776, it appointed a committee, which would later become the Treasury, to borrow capital from other countries such as France and the Netherlands. Thus, after the Revolutionary War in 1783, the United States had already accumulated roughly $43 million in debt.

To cover some of this debt obligation Alexander Hamilton, the first Secretary of the Treasury, rolled out federal bonds. The bonds were seemingly profitable and helped the government create credit. This bond system established an efficient way to make interest payments when the bonds matured and secure the governments good faith state-side and internationally.

The debt load steadily grew for the next 45 years until President Andrew Jackson took office. He paid off the countrys entire $58 million debt in 1835. After his reign, however, debt began to accumulate again into the millions once again.

Flash forward to the American Civil war, which ended up costing about $5.2 billion. Because the war dragged on, the U.S. was strained to revamp the financial systems in place. To manage some of the debt at hand, the government instituted the Legal Tender Act of 1862 and the National Bank Act of 1863. Both initiatives helped lower the debt to $2.1 billion.

In 2008, quantitative easing during the Great Recession more than doubled the national debt.

Read Also: Can A Home Equity Loan Be Discharged In Bankruptcy

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

Interest Expense On The Debt Outstanding

As of June 6, 2022, this data moved permanently to FiscalData.treasury.gov, where it is available for download in multiple machine-readable formats with complete metadata!

The Interest Expense on the Debt Outstanding includes the monthly interest for:

- State and Local Government series and other special purpose securities.

Amortized discount or premium on bills, notes and bonds is also included in the monthly interest expense.

The fiscal year represents the total interest expense on the Debt Outstanding for a given fiscal year. This includes the months of October through September.

Also Check: How To Claim Bankruptcy In Ontario Canada

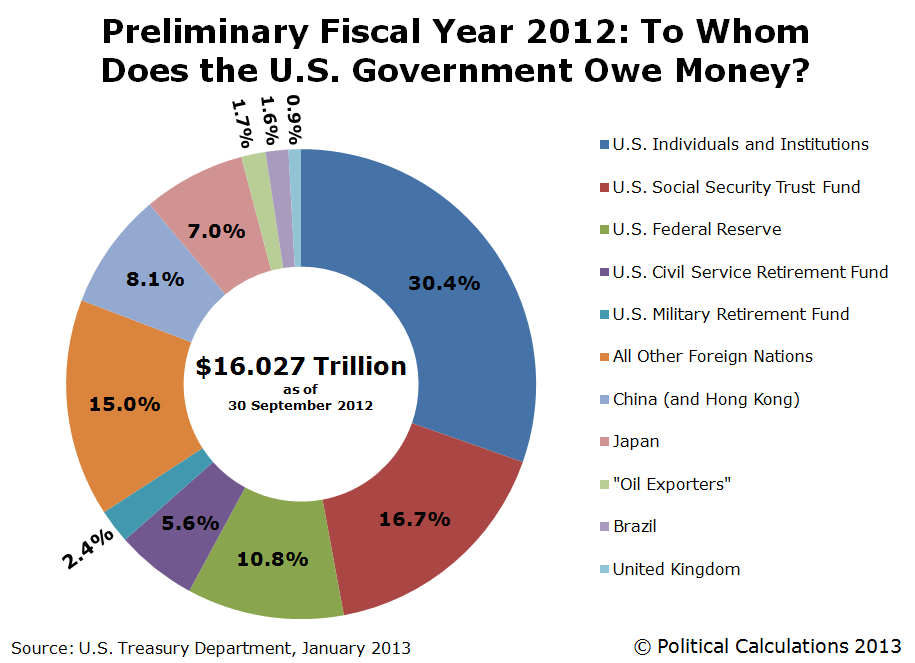

To Whom Does The Us Owe Money

From whom have we borrowed money to pay our yearly bills? Around a third of the debt, some $5.6 trillion, is owed to the countrys large institutional investors. That is:

- the Federal Reserve

- state and local governments

- and anyone else who holds U.S. Treasury bonds, bills or notes.

These investors have loaned us the money and in return, we have promised to pay them back with interest.

Another third, about $5.5 trillion, is owed to foreign governments. These countries, like our domestic investors, loaned us money in return for our promise to pay them back according to the binding agreements we made with them. China and Japan are the largest holders of American debt we owe each more than $1 trillion.

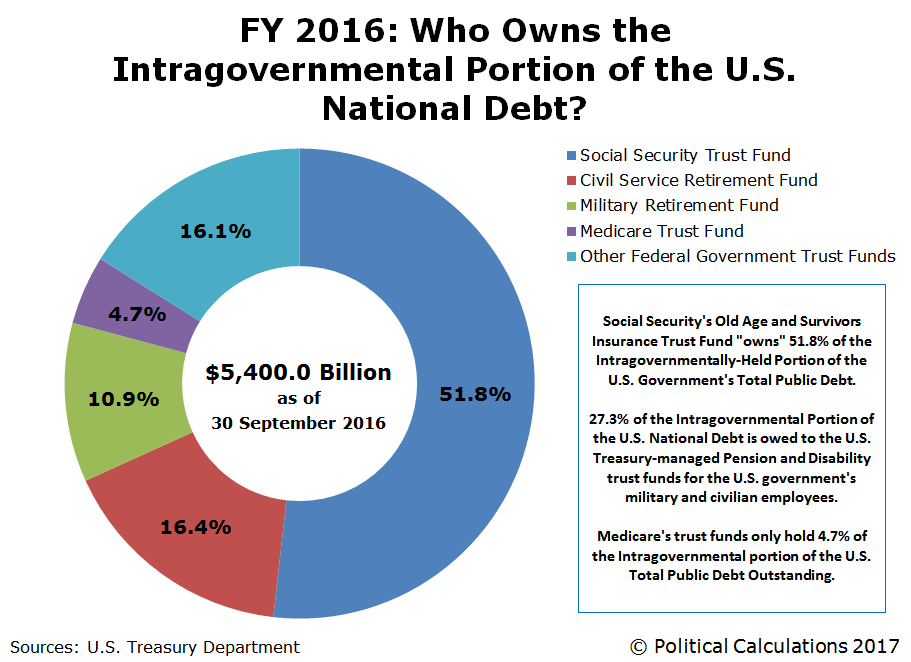

The final third, around $5 trillion, we actually owed to ourselves. Its money that the treasury has borrowed from various government trust funds Social Security, Medicare, retirement and pension funds, highway and airport accounts, unemployment and deposit insurance, etc. that have surpluses and are not part of the general revenue stream.

Top Countries The Us Owes Money To

If there’s one thing the good old U.S.A. has a lot of, it’s debt. In an almost embarrassingly short time frame , the United States has gone from having a budget surplus

If there’s one thing the good old U.S.A. has a lot of, it’s debt. In an almost embarrassingly short time frame , the United States has gone from having a budget surplus to being the most indebted nation in the world, racking up an estimated $16 trillion in debt, the burden of which works out to roughly $148,000 per taxpaying citizen. So who do we owe all this money to? Below are the top 10 countries the U.S. owes money to.

Read Also: How To Obtain Copies Of Bankruptcy Papers

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

What Causes The National Debt To Increase

Sometimes the government needs to increase spending to stabilize the economy, and protect Americans and businesses from unexpected economic conditions.

During The Great Recession , for example, Congress passed legislation injecting $1.8 trillion into the economy. But that pales in comparison to the $4.5 trillion the Trump and Biden administrations have pumped into the economy since the Covid pandemic began in March 2020.

However, there are other reasons the national debt increases, even during years where spending is moderate and the economy is in good shape.

Don’t Miss: How Does Bankruptcy Work For Creditors