Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Focus On Increasing Your Income

Boosting your income can also help you work toward an ideal debt-to-income ratio. If youre overdue for a raise, it might be time to ask your boss for a salary increase. You could also pick up a side job, such as tutoring, freelancing in a creative field or working as a virtual admin, to increase your earnings. Those looking to make a more extreme change might seek out a new company or career path.

Finding ways to make more money will not only help you get the right debt-to-income ratio for a personal loan, mortgage or another type of financing, it can also give you more financial stability. You may have more wiggle room in your budget to build an emergency fund and avoid taking on new debts.

Also Check: Are Mortgage Discount Points Worth It

You May Like: I Need Help Getting Out Of Debt

Estimating Your Dti Ratio With Your Spouse

Using the above calculator, you can determine your DTI ratios before you apply for a mortgage with your spouse. For example, lets say your gross monthly income is $6,500 while your spouses monthly income is $4,500 after taxes. The following table details your housing expenses and other debt payments, as well as your estimated front-end and back-end DTI ratios.

| DTI Ratio Details | |

|---|---|

| Back-end DTI ratio | 34.17% |

In this example, if you apply for a mortgage with your spouse, your front-end DTI ratio will be 20.53%, and your back-end DTI ratio will be 34.17%. If your lenders DTI limit is 28% for front-end DTI, and 36% for back-end DTI, you have a good chance of qualifying for a mortgage. And since your DTI is low, youre entitled to a more favorable rate.

Getting a Co-signer

Pay Off The Loans You Have

If you can, try to double or triple up on your loan payments to get rid of them faster. If you have credit card balances, the more you pay off, the lower your balance will be. The lower your balance on your credit cards, the lower your monthly payments will be which will directly affect your debt-to-income ratio.

Also Check: What Does Filing For Bankruptcy Do To Your Credit Score

What Is The Highest Debt

According to the Ability-to-Repay rule or the âQualified Mortgage Ruleâ created by the Consumer Financial Protection Bureau to protect consumers following the 2008 mortgage crisis, the highest debt-to-income ratio to qualify for a mortgage should be 43%.

However, some lenders will accept a higher-debt-to-income ratio because of an exemption in the rule if the lender can prove by other means that the consumer would be able to make payments on the mortgage. The highest debt-to-income ratio quoted by lenders who will consider high debt-to-income ratios is currently 50%.

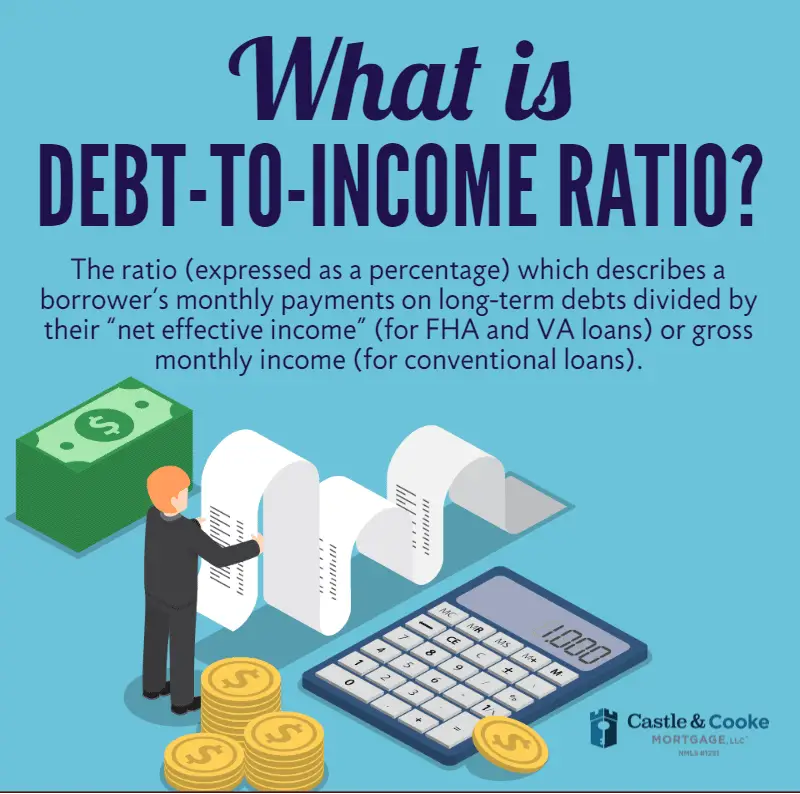

What Is The Difference Between Debt

Both calculations evaluate your risk as a borrower, but consider different factors of your financial profile.

The DTI ratio considers your income and all monthly debt obligations to see how much money goes into paying off your debt. Lending institutions use the DTI ratio to evaluate borrowers, but it doesn’t impact your credit score.

The credit utilization rate is a key evaluating factor of your credit score. This calculation measures your credit usage by comparing your maximum credit limit to your outstanding balance. Unlike the DTI ratio, the credit utilization rate only considers revolving credit credit cards, personal credit lines and HELOCs. It doesn’t factor in installment debt or your monthly income.

Also Check: Can You File Bankruptcy Without Your Spouse

How To Get Around A High Dti

The easiest way to lower your debt-to-income ratio is to pay off as much debt as you can but many borrowers dont have the money to do that when theyre in the process of getting a mortgage, because much of their savings are tied up in a down payment and closing costs.

If you think you can afford the mortgage you want but your DTI is above the limit, a co-signer might help solve your problem. Unlike with conventional loans, borrowers can have a relative co-sign an FHA loan and the co-signer wont be required to live in the house with the borrower. The co-signer does need to show sufficient income and good credit, as with any other type of loan.

Sometimes, though, a co-signer isnt the answer. If your DTI is too high, for example, you should consider focusing on improving your financial situation before committing to a mortgage.

How Can I Lower My Debt To Income Ratio Quickly

How to lower your debt-to-income ratio

Don’t Miss: How To Obtain A Copy Of Bankruptcy Discharge Papers

Get Clarity On Your Dti With A Pre

At Better, we want you to be as prepared for buying a home and the mortgage process as possible.

Applying for a pre-approval takes as little as 3 minutes and will provide you with a clear picture of how much you can afford. Youll undergo a soft credit check that allows our underwriters to look at your debts, income, and credit in detail to obtain a more accurate picture of your DTI.

Although your DTI ratio is just one important factor to consider when buying a home, carrying less debt relative to your income will make it easier to get a mortgage and help ensure youll be able to afford your home for years to come.

Better Mortgage can help you understand your DTI and the financing options available to you. Start your pre-approval process today.

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Read Also: What Does The Bankruptcy Trustee Investigate

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

What Should You Do To Make Sure Your Dti Ratio Doesnt Derail Your Mortgage Application

Although a lower DTI is better, some lenders are more flexible than others. In fact, you may be able to find loan options with a DTI as high as 50% in some cases. If you have a high ratio, youll need to shop around more carefully to find a lender willing to work with you.

Another option may be to pay off debt. If youre able to reduce what you owe and eliminate some debts or lower your monthly payments, you should hopefully be able to get your DTI to a level that makes you a more competitive borrower.

Since this can also help your , you may just find that youre offered a much better deal on a mortgage if you work to pay down some of your debt before applying for one. The savings on interest over time can be considerable, so its worth working on debt paydown if you can.

You May Like: How To File For Bankruptcy In Michigan Without A Lawyer

Importance Of Dti In Mortgages

Lenders are going to use DTI in conjunction with your to make a more realistic picture of you as a borrower.

Not just by how good you were in paying your debts in the past, but also do you have the means to take on additional debt and have enough income to cover it all every month.

Lenders want to see if you have a balance, and you dont have a ton of debts.

Also, they want to see that your income and your debts are pretty balanced. Lenders would look at how many debts can you afford as opposed to how many debts you are already paying.

If most of your income is going towards your existing debts, a lender might see this as no room left for additional debt, and your loan application may be denied.

When looking at the DTI, lenders know that people with lower DTI have a higher chance to get the desired loan.

If your DTI is low, the lender understands that there is less risk involved and would anticipate your payments accordingly.

Borrowers with low DTI are more likely to make payments with less chance of default.

What’s Included In Your Debt

Mortgage lenders actually calculate your debt-to-income ratio twice, because they look at a front-end DTI and a back-end DTI.

Calculating the front-end DTI is easy because the focus is only on the new mortgage obligations. Lenders look at your new housing payment, including principal, interest, taxes, and insurance, and they compare total housing costs to gross income. Most lenders like this ratio to be below 28%.

Calculating your back-end DTI becomes a little more complicated, though. This time, lenders look at all of your current debt obligations when they decide whether or not to approve you. That means a lot more debts count, including:

- Your new monthly mortgage payments

- Minimum monthly payments on medical debt

- Your monthly car loan payment

- The monthly payments on any personal or business loans you may have

- Alimony or child support payments

- Any other required monthly payments

Lenders will take a close look at your and may ask for financial account statements in order to determine all of the obligations you have.

They’ll add up the monthly payments for all of these different expenses and then compare that to income. For example, say that your total monthly obligations add up to $2,000 when taking into account all your minimum payments and your new mortgage — and say your income is $6,000. You’d divide $2,000 divided by $6,000 to see your DTI is .333 or 33.3%.

Recommended Reading: How To Buy Homes In Foreclosure

What Is The Maximum Allowable Debt

FHA uses two different debt-to-income ratios. The âfront-endâ ratio looks at housing-related debts such as a monthly mortgage payment and property taxes. The âback endâ ratio involves all of your debts including the mortgage but also credit cards, car loans, personal loans, etc.

According to official FHA guidelines, debt-to-income ratios limits are 31% on the front end, and 43% on the back end. But the FHA can make exceptions if your back-end ratio is as high as 50%, if you can qualify in other ways such as having cash reserves or some other income. Itâs on a case-by-case basis.

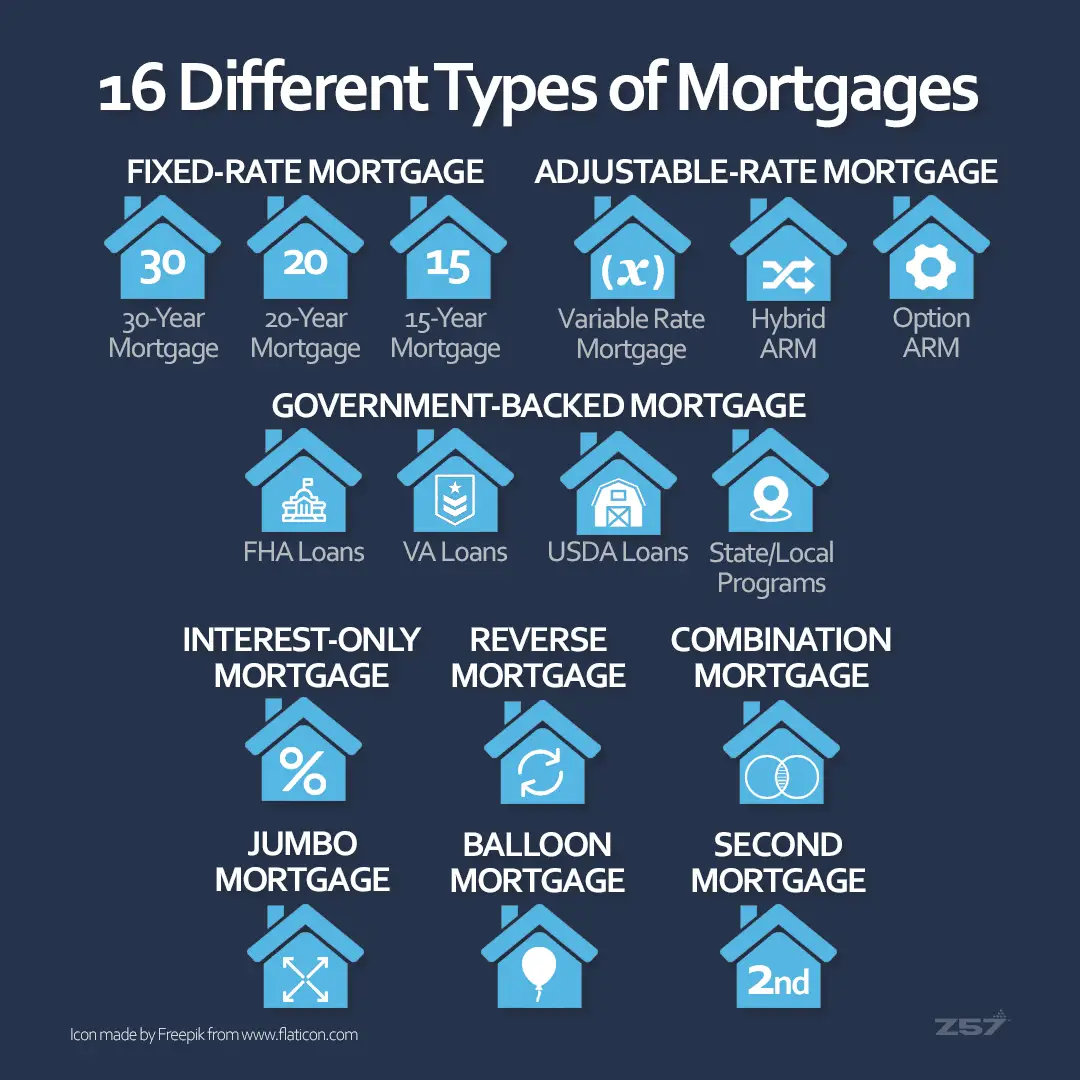

Dti Limits For Different Types Of Mortgages

The following chart shows specified DTI limits for different types of mortgages. It includes conventional mortgages and government-backed loans such as FHA loans, VA loans, and USDA loans.

| Loan Type | ||

|---|---|---|

| 41% | 41% | Loans that cater to borrowers in rural markets with incomes below 115% of the local median income. See more details here. |

The soft back-end limits may allow approval using automated underwriting software. Meanwhile, the hard limits usually require manual approval and other compensating factors, such as a high credit score or perhaps a co-signer for mortgage approval. Government-backed mortgages also tend to have lenient DTI limits compared to conventional loans. If you have low income and considerable debts, obtaining a government loan might be a good fit for you.

To increase income and improve DTI ratio, borrowers apply for a mortgage together with their spouse. When the lender evaluates your DTI ratio, it combines your spouses monthly income and debt obligations.

If Your Spouse Has Unsatisfactory Credit

You May Like: How To Find Out About Foreclosures In Your Area

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

What Is The Best Debt

Long term, the answer is as low as you can get it.

However, hard numbers are better tools for comparison. Take a look at the following DTI ranges:

- 35% or less = Good

- 36-43% = Acceptable but Needs Work

- 44% and up = Bad

If youre trying to get a home loan, 36% is the most recommended debt-to-income ratio. If you dont have a significant down payment saved up, 31% is a better target.

Read Also: Will Filing Bankruptcy Affect My Credit

High Dti Mortgage Options

There are a few high DTI mortgage options that you should consider. With these, you will overcome the issue you may have with conventional mortgages or traditional lenders who are telling you that your DTI is too high.

FHA Loans with High DTI

An FHA loan is the first option that you should consider. The debt to income ratio requirements will allow for a DTI up to 56.9%. The key here is to find a lender who is willing to allow for a DTI that high. There are lenders in our network who can help with this.

No Ratio Mortgages for High DTI

Another option when your DTI is high is a no ratio mortgage. With this mortgage, you do need the two year work history but the debt to income ratios will not be calculated or factored. You can expect the down payment and interest rates to be higher for this program. There are few lenders who offer this program but they are available.

What Can I Do As A Borrower

To prepare for your home loan application, its usually best you cut out or at least reduce unused debt facilities.

For example, if you have a $2,000 limit on your credit card but find that you rarely use this amount per month, consider cancelling it.

Another example is expenses that arent vital and can be easily cut from your spending such as entertainment subscriptions, going to the pub, gym memberships, going to music festivals or sporting events, or simply eating take-away on a regular basis.

Please call us on 1300 889 743 or fill in our and we can weigh up your home loan options.

There are lenders out there that dont apply debt to income ratios caps.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

Don’t Miss: Do Student Loans Go Away With Bankruptcy

Calculating A 25% Dti

- Monthly Social Security Income : $6,000

- Monthly recurring debts: $500

- Monthly recurring debts: $2,000

- Monthly housing payment: $2,500

Most mortgage programs require homeowners to have a DebttoIncome of 40% or less, but loan approvals are possible with DTIs of 45 percent or higher. In general, mortgage applicants with elevated DTI must show strength on some other aspect of their application.

This can include making a large down payment showing an exceptionallyhigh credit score or having large amounts of reserves in the bank accounts and investments.

Also, note that once a loan is approved and funded, lenders not longer track DebttoIncome ratio. Its a metric used strictly for loan approval purposes. However, as a homeowner, you should be mindful of your income versus your debts. When debts increase relative to income, longterm saving can be affected.

Also Check: 10 Year Treasury Vs 30 Year Mortgage