Twin Towers Attacks Corporate Scandals And Wars In Afghanistan And Iraq

The terrorist attack of September 11, 2001, led to the War in Afghanistan, and eventually, the invasion of Iraq in March of 2003. The war lasted more than eight years, ending on December 18, 2011.

The stock market had experienced a brief slide after the terrorist attacks. But after rallying, the market began to fall again in March of 2002, partially due to corporate fraud scandals of 2001, such as Enron, Tyco, and WorldCom.

National Debt: $6.783 trillion

Tracking The Federal Deficit: June 2019

The Congressional Budget Office reported that the federal government generated an $8 billiondeficit inJune, theninth monthof Fiscal Year 2019, for a total deficit of$746 billionso far this fiscal year. If not for timing shifts of certain payments, Junes deficit would have been $57 billion, which is $28 billion larger than the adjusted deficit forJune 2018. Total revenues so far inFiscal Year 2019increased by3 percent , while spending increased by7 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Individual and payroll taxes together rose by 3 percent , reflecting an expanding economy and a low unemployment rate. Furthermore, customs duties increased by 77 percent versus last year, primarily due to the imposition of new tariffs. On the spending side, Social Security expenditures increased by 6 percent compared to last year due to increases in the number of beneficiaries and the average benefit payment. Finally, net interest payments on the federal debt continued to rise, increasing by 16 percent versus last year due to higher interest rates and a larger federal debt burden.

You May Like: Forclosed Home For Sale

Coronavirus And The National Debt

The U.S. government has taken efforts to offset the effects of worldwide health pandemic by borrowing money to invest in individuals, businesses, and state and local governments. Of these responses, the CARES Act has been the largest stimulus package in U.S. history. This stimulus package included $2.3 trillion towards relief for large corporations, small businesses, individuals, state and local governments, public health, and education. In order to pay for the relief fund, the government needed to expand its debt to do so, the government borrowed money from investors through the sales of U.S. government bonds.

You May Like: Auction Properties For Sale

Us Federal Interest Since 1900

Chart D.14f: Federal Interest since 1900

Federal interest payments began the 20th century at less than 0.2 percent of GDP. But the debt incurred in World War One caused the debt to explode to over 1.3 percent of GDP in 1921,and debt interest cost about one percent of GDP through the middle of World War II.Interest expense peaked at 1.7 percent of GDP in 1946 and settled down to about 1.1 to 1.2 percent ofGDP until the 1970s.

Federal Interest payments cost 1.39 percent of GDP in 1974 and continued climbing, as the Federal Reserve increased interest rates,reaching 1.51 percent of GDP in 1978, 2.14 percent of GDP in 1981 before peaking at 3.16 percent of GDP in 1991.With a recession in 1990 and spending cuts in the 1990s, interest expense declined to 1.31 percent of GDP by 2004. Then it increased briefly before credit was relaxed in the Great Recession of 2008-09.Interest expense held steady at about 1.3 percent of GDP for the mid 2010s, rising to 1.75 percent GDPin 2019 before declining modestly during the COVID pandemic of 2020-2021.

Tracking The Federal Deficit: October 2018

Analysis of Notable Trends in October 2018:The Congressional Budget Office reported that the federal government generated a $98 billion deficit in October, the first month of Fiscal Year 2019. Octobers deficit is 56 percent higher than the deficit recorded a year earlier in October 2017. Total revenues increased by 7 percent , while spending increased by 18 percent , compared to a year earlier.

Methodological Note:

The monthly tracker entries report preliminary spending, revenue, and deficit data from the Congressional Budget Offices Monthly Budget Reviews that are published throughout each fiscal year . These summaries are released around the fifth business day of each month and preview the release of official budget data from the Treasury Department, which is released around the eighth business day of each month . Historically, CBOs preliminary data is accurate, often differing from Treasurys final figures by only a few billion dollars, if at all. For example, CBO preliminarily reported that the total FY2019 deficit was $984 billion in their September 2019 review, matching the official figure Treasury reported later.

The deficit tracker graphic is updated retroactively with official Treasury data the monthly text entries are not.

Support Research Like This

With your support, BPC can continue to fund important research like this by combining the best ideas from both parties to promote health, security, and opportunity for all Americans.

Don’t Miss: Can You File Bankruptcy On Titlemax

Savings And Loan Crisis

During the Savings and Loan Crisis, more than 1,000 of the nation’s savings and loans failed, costing taxpayers $132 billion and bankrupting the Federal Savings and Loan Insurance Corporation. This year marked the end of what had once been a secure source of home mortgages.

National Debt: $2.602 trillion

Are The National Debt And The Budget Deficit The Same Thing

No, the deficit and the national debt are different things, although related. The national debt is the sum of a nations annual budget deficits, offset by any surpluses. A deficit occurs when the government spends more than it raises in revenue. To finance its budget deficit, the government borrows money by selling debt obligations to investors.

Don’t Miss: Debt To Income Ratio For Heloc

What Is The National Debt

The national debt is the debt that the federal government holds – this includes public debt, federal trust funds, and various government accounts. In simpler terms, the national debt includes both what the government owes others and owes itself. This is the total amount of deficit that the government has accumulated over the years.

The national debt today stands at more than $30.2 trillion. Here are some facts to give you an idea of how big this number really is:

- With $23.8 trillion held by the public, the government could give $71,000 per U.S. citizen.

- From 2000 to 2019, the federal debt increased 297%.

- $23.8 trillion is about the size of the economies of China, Japan, and Germany combined – the three largest economies in the world after the united States.

- $23.8 trillion is enough to cover a four year college degree for every American high school graduate for the next 57 years.

Calculating The Annual Change In Debt

Conceptually, an annual deficit should represent the change in the national debt, with a deficit adding to the national debt and a surplus reducing it. However, there is complexity in the budgetary computations that can make the deficit figure commonly reported in the media considerably different from the annual increase in the debt. The major categories of differences are the treatment of the Social Security program, Treasury borrowing, and supplemental appropriations outside the budget process.

Social Security payroll taxes and benefit payments, along with the net balance of the U.S. Postal Service, are considered “off-budget”, while most other expenditure and receipt categories are considered “on-budget”. The total federal deficit is the sum of the on-budget deficit and the off-budget deficit . Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998FY2001.

Also Check: Foreclosed Homes In Michigan

Understand Inflation And How It Affects You

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, will be 8.7 percent next year. Here is what that means.

- Budget Surpluses: Up to 20 states are using their excess funds to help taxpayers deal with rising costs. But some economists worry that the payments could fuel inflation.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, its going to affect the size of your paycheck next year.

In recent weeks, administration officials have walked a thin line on deficits. They have championed deficit-cutting moves like the climate, health care and tax bill that Mr. Biden signed into law in August as necessary complements to the Feds efforts to bring down inflation by raising interest rates. They have said Mr. Biden would be happy to sign further deficit cuts into law, in the form of tax increases on high earners and large corporations.

Our budgets have been heavily fiscally responsible, and they build a very compelling architecture toward critical investments and fiscal responsibility, Jared Bernstein, a member of the White House Council of Economic Advisers, said in an interview. So it would be a mistake to overtorque in reaction to current events.

Debt Held By Foreign Creditors

15. 26.16% of the US government debt was owned by foreign and international institutions in December 2021.

As of December 2021, the largest component of the US government debt 40.94% was owned by the federal reserve and government accounts. However, it is the foreign-held debt that could be a matter of concern. According to the national debt chart, 11.09% is held by mutual funds, 5.87% by depository institutions, 4.9% by state and local government, etc.

16. Japan is the largest holder of US treasury securities, valued at $1.3 trillion in May 2022.

Other countries with significant holdings are China , the United Kingdom , Ireland , and Luxembourg .

The large foreign holdings of the national debt of the United States leave the country vulnerable in the event of a shock, such as a collapse in housing prices or an extreme national security breach. There are other concerns, as well, when foreign countries, including potentially antagonistic ones, hold a large portion of the countrys securities.

17. China has held more than $1 trillion in US national debt since 2010.

Read Also: What Is Your Credit Score After A Bankruptcy

The Federal Debt Ceiling

The federal debt ceiling is the legal amount of federal debt that the government can accumulate or borrow to fund its programs and pay for fees such as the national debt interest. Since its creation through the Second Liberty Bond Act in 1917, the debt ceiling has grown about 100 times. These instances have included permanent raises, temporary extensions, and revisions to what the debt limit can be defined as. When the debt ceiling isnt raised, the federal government is unable to issue Treasury bills and must rely solely on tax revenues to pay for its programs this has occurred 7 times since 2013.

History Of The Us National Debt

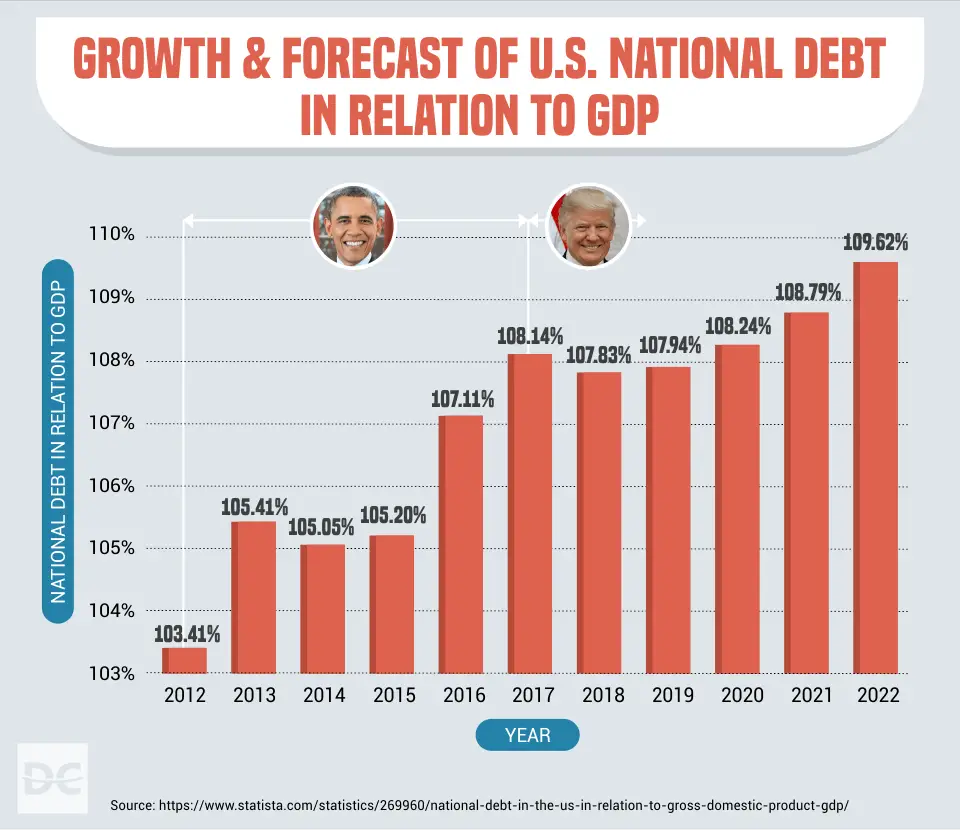

Until recently, the U.S. debt-to-GDP ratio hit its highest point in the years immediately following World War II. In 2020, at the height of the Covid-19 pandemic, the U.S. debt-to-GDP ratio spiked to more than 134%. Itâs fallen steadily since then to settle back around 121% today.

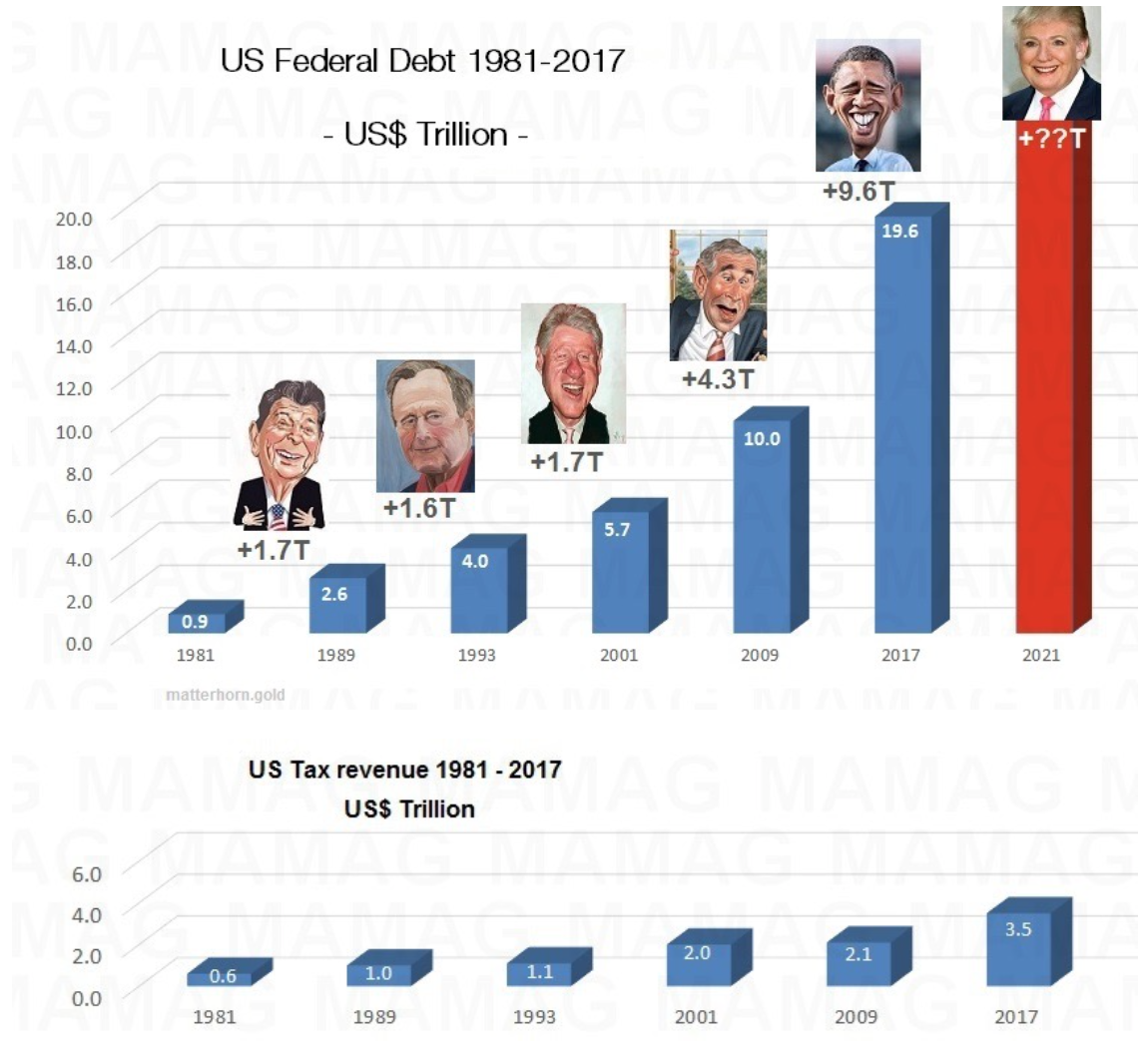

The U.S. has not run a budget deficit every year of its existence. The most recent budget surplus the U.S. faced was in 2001. It was the fourth year in a row that the U.S. ran a budget surplus. These surpluses were eventually accounted for by tax breaks under the George W. Bush administration.

For the remainder of the 21st century, the U.S. budget deficits have added more than $100 billion per year to the national debt. In 2020 alone, as a result of spending to offset the Covid-19 global pandemic, the U.S. ran a more than $3 trillion budget deficit.

You May Like: Consumer Adjustment Collection Agency

Budget Deficit Trends In The Us

The budget deficit should be compared to the country’s ability to pay it back. That ability is measured by dividing the deficit by gross domestic product . The deficit-to-GDP ratio set a record of -26.68% in 1943. The deficit was then only about $55 billion, and GDP was only $203 billion, both much lower than 2022 numbers.

The deficit-to-GDP ratio is much lower in 2022, even though the country is working with trillions of dollars in budget deficits and GDP. That’s because GDP is much higher than it was in 1943. GDP was nearly $24 trillion at the end of 2021.

Public And Government Accounts

As of July 20, 2020, debt held by the public was $20.57 trillion, and intragovernmental holdings were $5.94 trillion, for a total of $26.51 trillion. Debt held by the public was approximately 77% of GDP in 2017, ranked 43rd highest out of 207 countries. The CBO forecast in April 2018 that the ratio will rise to nearly 100% by 2028, perhaps higher if current policies are extended beyond their scheduled expiration date.

The national debt can also be classified into marketable or non-marketable securities. Most of the marketable securities are Treasury notes, bills, and bonds held by investors and governments globally. The non-marketable securities are mainly the “government account series” owed to certain government trust funds such as the Social Security Trust Fund, which represented $2.82 trillion in 2017.

The non-marketable securities represent amounts owed to program beneficiaries. For example, in the cash upon receipt but spent for other purposes. If the government continues to run deficits in other parts of the budget, the government will have to issue debt held by the public to fund the Social Security Trust Fund, in effect exchanging one type of debt for the other. Other large intragovernmental holders include the Federal Housing Administration, the Federal Savings and Loan Corporation’s Resolution Fund and the Federal Hospital Insurance Trust Fund .

Also Check: Heloc Debt To Income Ratio

Us National Debt Statistics

- The current US national debt is $26,498,433,296,171 TreasureDirect – The debt to the Penny and Who Holds It

- Thatâs an increase of $3,326,434,162,341 since January 2nd 2020

- In 2020, national debt has increased $14,850,152,510 per day or $1.031 million per minute

- By December 31st 2020, the national debt is currently set to increase a further $2.15 trillion to $28,651,705,410,186

- The national debt per citizen equals $80,274 per person

- Between 2010 and 2020, national debt increased $9,157,778,722,542, an increase of 71.9%

- Since Jan 12nd 2020, national debt has increased more than $2.9 trillion

- National debt has increased for the last 64 years consecutively – the last time it fell was 1956 – 57

- The most expensive decade in American history was the 1860s, where national debt increased 3,726% from $64.8 million to $2.48 billion.

- 1836 – 37 saw the fastest ever increase in US national debt, soaring 882%. This was even quicker than the second fastest debt increase in history, 1835 – 1836, when it rose 798%

- National debt was almost eradicated in in the 1830s, dropping 99.4% during Andrew Johnsonâs Presidency

The U.S. national debt gets a lot of attention from the media and politicians. Still, few Americans truly understand what it means.

Risks To Economic Growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 34% when debt was relatively moderate or low , but it dips to just 1.6% when debt was high . In April 2013, the conclusions of Rogoff and Reinhart’s study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that “Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

Also Check: How Many Bankruptcies Has Donald Trump

Why The Deficit Is Less Than The Increase In The Debt

There’s an important difference between the deficit and debt. The deficit has been less than the increase in debt for years because Congress borrows from the Social Security Trust Fund surplus. The surplus emerged back in the 1980s when there were more people working than there were retirees. As such, payroll tax contributions were greater than Social Security spending, allowing the fund to invest the extra revenue in special Treasury bonds. Congress spent some of the surplus so it wouldn’t have to issue as many new Treasury bonds.

Us Federal Debt Since The Founding

Chart D.15f: Federal Debt since the Founding

The United States federal government began with a substantial debt, the cost of the Revolutionary War. Under Alexander Hamiltons funding system the debt was paid off by 1840. Government debt has typically peaked after wars. It breached 30 percent of GDP after the Revolutionary War, the Civil War, and World War I. It breached 100 percent of GDP in World War II. Government debt also breached 100 percent of GDP in the aftermath of the financial crisis of 2008.

Recommended Reading: At& t Bankruptcy Department

Why The Budget Deficit Matters

The federal deficit and debt are concerns for the country because the majority of the national debt is held by those who have purchased Treasury notes and other securities. A continuous deficit adds to the national debt, increasing the amount owed to security holders.

The concern is that the country won’t be able to pay its debt off. Debt holders demand higher interest to compensate for the higher risk when that happens. This increases the cost of all interest rates and can cause a recession.