What Is Medical Debt

The SIPP shows that in 2017, 19% of U.S. households carried medical debt, defined as medical costs people were unable to pay up front or when they received care. Among households with medical debt, the median amount owed was $2,000, meaning half had more and half had less.

Like other debt, medical debt means that households have less money to spend on other essential items, such as food and housing. People with medical debt, or at risk of accumulating medical debt, may also forgo needed medical care or treatment. Medical debt can also lead to bankruptcy.

Filing For Bankruptcy Can Provide Relief From Medical Bills But It Can Also Have Undesirable Consequences For Other Debts Credit Scores And Key Assets Like A House Or Car

If youre considering bankruptcy as a solution for medical debt, youre not alone. Unmanageable medical care debt and the hardships that often come along with it like loss of work or reduced access to credit can be a recipe for financial ruin.

But filing for bankruptcy isnt always an ideal solution. Although bankruptcy can help you manage or eliminate medical debt, its not possible to limit your claim to only one kind of debt during the process. Plus bankruptcy has a long-term negative impact on your credit and can put your assets in jeopardy.

Heres what you should know before you file.

Medicaid And Medical Debt

If you have Medicaid coverage, your medical debt may be paid back using Medicaid payments. When applying for Medicaid, there is a part of the form that asks about unpaid health care costs. This is called medical backdating of eligibility. If you meet the Illinois residency requirement for the months before your application, you may check the box that you have unpaid medical bills from the 3-month period before your application. Do this if you want your Medicaid coverage to include your medical debt.

You May Like: Chapter 13 Vs Chapter 7 Bankruptcy

What Should You Know About Filing For Medical Bankruptcy

Here are 5 main points that you need to know before filing for medical bankruptcy:

1 Medical Bankruptcy Happens When You File a Legal Petition

The bankruptcy process is initiated once you file a petition with a US federal court specializing in hearing bankruptcy cases. You can file for medical bankruptcy alone or along with your spouse.

According to the type of bankruptcy you file, you may have to give away some assets or may be asked to follow a more practical repayment plan.

You can hire a lawyer to file for bankruptcy or file the petition yourself. To find advice on filing for medical bankruptcy, it is highly recommended to consult with lawyers specializing in medical bankruptcy through the American Bar Association or through the Legal Services Corporation.

Besides these, you can also seek assistance from non-profit organizations that specialize in helping people manage medical debts and bankruptcy, which include the RIP Medical Debt service at or the Upsolve team at .

It is highly recommended that before filing for bankruptcy, you must attend credit counseling. Once you file the legal petition, you will also be required to undergo a debtor education course.

Overview Of Medical Debt

Some types of debt are treated as special priorities and cannot be wiped out through bankruptcy. Luckily, medical bills do not fall into this category.

In bankruptcy, medical bills are similar to credit cards in that theyre considered general unsecured debts. This means that medical bills are a type of debt that can be eliminated through a bankruptcy filing.

However, medical debt is treated differently depending on the type of bankruptcy you file for, with Chapter 7 being the most common and Chapter 13 being slightly more complicated.

Recommended Reading: What Is The Average Attorney Fee For Bankruptcy

What Does It Mean To Declare Medical Bankruptcy

The phrase medical bankruptcy is a non-legal word for bankruptcy caused by medical debt.

Medical bankruptcy is not covered by any particular chapter of the Bankruptcy Code. However, the phrase medical bankruptcy has gained popularity in recent years due to a rise in the number of people applying for bankruptcy owing to medical debt.

While the actual magnitude of the issue is debatable, there is no question that massive medical expenditures may lead to bankruptcy.

Despite having health insurance, many people have been saddled with medical debt due to expenses not covered by their policys small print. As a result, some people have resorted to bankruptcy as a solution to their financial problems. Individuals may file for Chapter 7 or Chapter 13 bankruptcy relief to get rid of their medical debt.

Impact On Your Healthcare Services

Chapter 7 bankruptcy can also affect your relationship with your doctor or make it more difficult to get medical treatment. Legally speaking, hospital emergency rooms are required by law to treat patients regardless of their ability to pay. But you could be denied care at a doctors office due to unpaid bills. Some people elect to pay medical debt even after filing bankruptcy to maintain a relationship with their doctors.

Don’t Miss: Can You Save Your Home From Foreclosure

Why Might Someone Declare Medical Bankruptcy

The reasons as to why someone might declare medical bankruptcy are many. Of course, theyre all going to have to do with medical bills in one way or another, but the ways in which medical expenses pile up can vary tremendously. Medical bankruptcy reasons include:

- Sudden unexpected medical bills

- Significant medical bills over a long period of time

- Medical bills on top of other debts

Essentially, medical bills can either be the main player in the bankruptcy or they can be a side player that just happens to increase debt so much that an individual is unable to manage all of their debts. No matter what these medical bills end up being, bankruptcy can help a person reduce their bills in general.

Sometimes Medical Debt Can Be Prevented

There are some tactics you can use to help prevent medical debt:

-

Negotiate. Sometimes, you can negotiate with a healthcare provider on pricing.

-

Seek financial help. Many public and nonprofit hospitals are lawfully required to offer financial assistance programs.

-

Ask for a payment plan. Some hospitals may allow you to break the debt into a payment plan. You should receive a discount if you offer to pay a lump sum.

-

Work with a medical billing advocate. Organizations like the Patient Advocate Foundation and Californias Health Consumer Alliance can help you resolve billing problems for free if you qualify.

-

Ask for the Medicare rate. Healthcare providers should know the Medicare rate for procedures. Ask to pay this amount, as it can mean paying less for healthcare charges.

-

Set up a health savings account . If you have a qualifying high-deductible health plan, consider saving pre-tax money in an HSA for eligible medical expenses. You can add up to $3,650 for solo coverage and $7,300 for a family in 2022.

-

Assess your health coverage. Having adequate health insurance is critical to preventing medical bills.

-

See if you qualify for help paying medical bills from these organizations:

Recommended Reading: Bankruptcy Attorney Twin Falls Idaho

Impact On Nonmedical Debt

Chapter 7 bankruptcy eliminates many types of unsecured debt, including debt from credit cards and personal loans, so filing may not be a great solution if you hold other debts but only want to solve an issue with medical bills.

Debts not backed by property or other collateral are considered unsecured. Unsecured debt generally includes, but isnt limited to, medical debt, credit card debt and certain kinds of personal loans.

Will Chapter 7 Or 13 Be The Better Choice When Filing Bankruptcy On Medical Bills

In many instances, bankruptcy is the best option. You can eliminate medical debt in Chapters 7 and 13, but the two chapters work very differently. The type of bankruptcy you’ll choose will depend on three things:

- the amount of money you make and your qualification status

- whether you can discharge all of your debts, and

- if you’re willing to lose property or would rather pay to keep it.

Below you’ll learn more about what you’ll want to consider when facing a Chapter 7 vs. Chapter 13 bankruptcy dilema.

Also Check: Foreclosure Real Estate Agent

Factors At Play In Medical Bankruptcy Cases

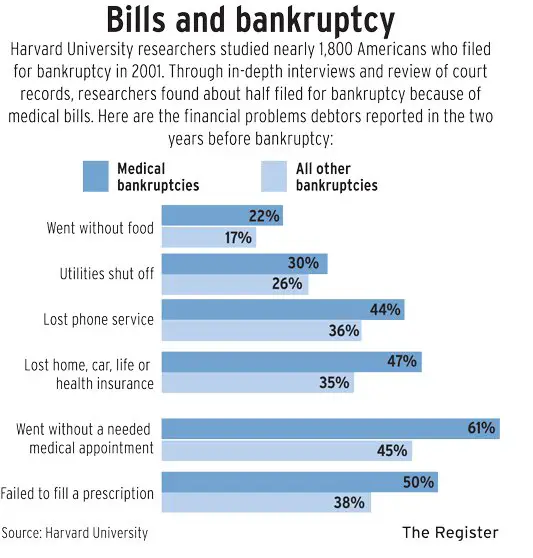

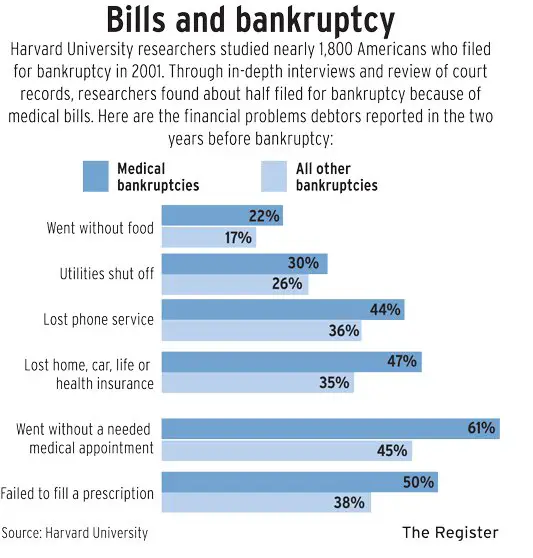

The studies found that on average, people filing bankruptcy due to medical debt were approximately two years older than other filers. They also had additional dependents, such as children or elderly parents to take care of. This suggests that elderly and chronically ill individuals require a greater degree of medical care, often resulting in excessive medical debt. People who are married or parents with children also contribute to the need for medical care, and for these families, one person falling ill can catapult medical debt to impossible heights.

Inadequate employment coupled with expensive medical bills also contributes heavily to the number of people filing bankruptcy due to crushing medical debt. Among the people who attributed unmanageable medical expenses as a reason for filing bankruptcy, they were 10% more likely to be struggling with unemployment themselves or with a partner who is unemployed.

This includes families who have a member who is in the military on active duty. The people in these households are less likely to have an education that would garner them employment with good health benefits, leaving working families with inadequate health coverage. Although members of the military, whether active duty or veteran, have access to healthcare benefits, their spouses and children may not have enough coverage.

Chapter 13 And Medical Debt

If you don’t qualify for Chapter 7 bankruptcy, or you own assets that you might lose in a Chapter 7 bankruptcy, you can file for Chapter 13 bankruptcy. In Chapter 13, you’ll pay back the portion of the medical debt you can afford through your repayment plan. The court will discharge the remainder at the end of the case.

Read Also: How To Declare Bankruptcy In Idaho

Proposition 209 Could Spur Similar Debt

At a time when inflation and the economy are of concern to U.S. voters, Proposition 209 attracted national attention as a test case for other states, according to the Fairness Project, a national nonprofit that funds, organizes and advocates for ballot measures and supported Proposition 209.

Before now, voters had never taken up medical debt on a statewide ballot measure, but Arizonans have charted a path forward to take on predatory lenders through direct democracy,” Fairness Project executive director Kelly Hall said in a statement after Proposition 209 passed.

“Were looking forward to working with citizens in other states who want to pass more ballot measures to protect working families from exploitative lending practices.”

While supporters touted the measure as a way to protect Arizonans with medical debt from bankruptcy and poverty, opponents from the business community have argued that it was too broad and would have the unintended consequence of making it more difficult for working Arizonans to get loans.

Critics also said the measure was misleading because it was billed as offering relief for medical debt but included other measures that apply to general consumer debt, not just medical debt.

People of color, who are also more likely to be without health insurance, are disproportionately affected by debt, the Urban Institute research says.

Reach healthcare reporter Stephanie Innes at or at 602-444-8369. Follow her on Twitter @stephanieinnes

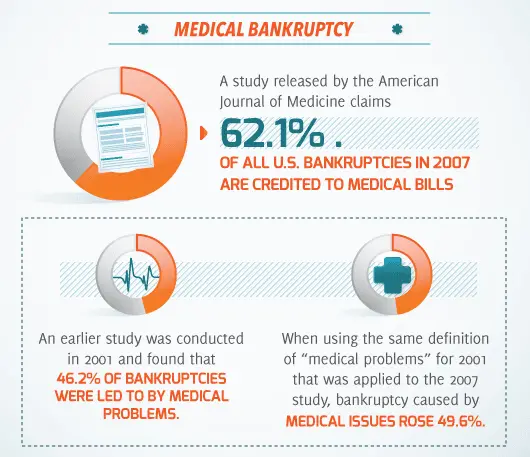

What Proportion Of Bankruptcies Are Caused By Medical Problems

In a large number of instances, medical debt is both a direct and indirect cause of bankruptcy.

We dont know how many people file for bankruptcy because of medical debt. The number of people filing for bankruptcy due to medical debt will vary from year to year, depending on various factors such as economic conditions, political policy changes, and so on.

During the discussions over Obamacare, healthcare reform supporters claimed that medical expenses were the cause of more than half of all bankruptcies in the United States.

That figure has been debunked by much research. Instead, they claim that medical debt is a small but growing component of consumer bankruptcy debt. Regardless, there is little question that medical debt-related bankruptcy is a significant issue in the United States.

Don’t Miss: How Do You Rebuild Your Credit After Bankruptcy

Chapter 7 Bankruptcy And Medical Debt

When people file for bankruptcy in an effort to discharge medical debt, they most commonly file for Chapter 7 bankruptcy protection. Under this situation, medical bills would be classified as non-priority general unsecured debts. This means that they are given no special consideration by debtors and are often the last to get paid during the Chapter 7 bankruptcy process.

In fact, because of their non-priority status, these debts are often not repaid at all by the time the bankruptcy process has completed. In addition to medical debts, things like credit card debts and even unsecured personal loans would all fall under this banner.

In terms of medical debt, there is no limitation on the amount that you can discharge through Chapter 7 provided that you qualify for it in the first place. Even if some portion of your medical debts are paid during the bankruptcy process, it is very likely that the rest will be eliminated entirely without further action on your part the moment you receive your discharge. This is a large part of why so many people who file for bankruptcy for medical reasons end up filing for Chapter 7.

Or have us contact you by filling out the form below:

Can Medical Debt Be Discharged Through Bankruptcy

- Yes, medical debt is a form of debt dischargeable through the bankruptcy process.

Bankruptcy law classifies medical debt as unsecure debt. Unsecure debt simply means it is debt that is not tied or attached to any property or assets that you own. Bankruptcy is frequently used as a method for discharging unsecure debts like credit card debt, medical debt, etc.

Secure debts, meanwhile, are debts tied to assets which can be repossessed by the creditor if the debt is not paid. A home mortgage is an example of a secure debt if you fail to pay your mortgage, the bank may foreclose on your home. A discharge of your medical debt through bankruptcy means that you are no longer liable to repay this debt. The hospital, doctors office, or collection agency can no longer send you notices or call you to collect on a medical bill once that debt has been discharged.

Read Also: How To Buy Foreclosed Houses

The Impact Of Medical Bankruptcies On The Economy

Although all functional aspects of filing for bankruptcy apply to this specific reason as well, discharging medical bills is not one of them, regrettably. A bankruptcy record stays on for ten years, which can make renting or buying a house or getting a loan difficult. Sometimes, bankruptcy can even restrain your job prospects.

A very unpleasant side of declaring bankruptcy is the risk of losing your home. However, that depends on the state. For instance, facts on medical bankruptcies by state show that in Delaware, someone could lose most of what they have due to the seizure of assets. Furthermore, the additional expenses accompanying the bankruptcy, like chapter filing with an attorney, can increase in urban areas.

What Happens When People File Medical Bankruptcies

Filing for bankruptcy is a controversial decision. On the one hand, its subject to moral judgment and can even be seen as a failing. On the other hand, however, there are also benefits of declaring bankruptcy, like a chance to get a fresh start, move forward, and get out of uncontrollable debt due to an accident or severe illness.

Bankruptcy can be good for the economy because the affected people become contributing members of society again. The US Constitution established the uniform laws on the subject of bankruptcy throughout the United States as a mechanism to help people in such situations.

As for what happens tomedical debt after death, the medical bills dont go away. Instead, medical debt, as well as all the other debt you have, is paid by your estate. And by estate, we mean all the assets you owned at death. Moreover, even thoughlife insurance programsguarantee payments after the insured persons death, health insurance pays for their medical expenses.

Recommended Reading: When Does A Bankruptcy Fall Off Your Credit Report

Milwaukee County Bankruptcy Lawyer Guides You Through Relieving Medical Debt

Filing for bankruptcy is a stressful and exhausting period in your life. There is an overwhelming amount of information you need to be aware of before choosing to file. You need the help of an experienced, professional bankruptcy lawyer to guide you through the process of filing for bankruptcy and restoring financial order to your life.

Oak Creek bankruptcy lawyer Steven R. McDonald is a helpful guiding hand through one of the most important periods in your life. Mr. McDonald boasts 15 years of experience helping residents of southeastern Wisconsin through the trials and tribulations of filing for bankruptcy.

He can help you, too. You aren’t alone. Call his office in Oak Creek today and begin to piece your financial life back together.

Contact Oak Creek bankruptcy lawyer Steven R. McDonald today to schedule a free consultation when you’re considering filing for bankruptcy to relieve debt from medical bills.

Bankruptcy And Medical Debt

You may be considering filing for bankruptcy to help with medical debt. Its possible to use bankruptcy to discharge your medical debt. But you should learn about the different types of bankruptcy you can file first.

Its important to understand that filing bankruptcy is not a perfect solution. It will have a negative effect on your credit score. It may make it harder for you to get credit in the future on affordable terms. Moreover, the bankruptcy process is complicated, time-consuming, and expensive. If you have medical issues that will result in more bills, you may not be able to use bankruptcy to get rid of those future debts. Talk to a lawyer or other experienced advisor to understand these issues in making decisions on whether and how to file a chapter 7 or chapter 13 bankruptcy.

Learn more about bankruptcy.

Read Also: How Fast Can I File Bankruptcy