Why Your Mortgage Dti Ratio Matters

Your debt-to-income ratio helps to determine whether you can afford to repay a mortgage. A low DTI ratio demonstrates your ability to manage your existing debt and a new home loan. But a higher DTI ratio can make it harder to qualify for a mortgage because it shows your budget is stretched too thin. In other words, you dont have enough income to cover more debt.

Mortgage lenders establish maximum DTI ratios as part of their loan approval process. The often-cited rule of thumb is to keep your back-end ratio at or below 43%, according to the Consumer Financial Protection Bureau.

Here are the maximum back-end DTI ratios by loan type:

- Federal Housing Administration : 43%

- U.S Department of Agriculture : 41%

- U.S. Department of Veterans Affairs : 41%

Some lenders may allow a slightly higher DTI ratio up to 50% in many cases if you have compensating factors, such as a higher credit score or larger down payment.

How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

What Do Your Dti Results Mean

A high debt-to-income ratio means that a significant portion of your income goes towards paying down your debts, leaving you with little leftover cash to put towards other expenses or set aside for savinga red flag to potential lenders. Having less disposable monthly income can lead to a greater reliance on credit cards and thus, more debt. Plus, having a significant chunk of your income claimed by bills limits your ability to cover unexpected expenses like an ill-timed car accident or medical emergency.

A low debt-to-income ratio, on the other hand, indicates financial stability. It shows youre not debt-burdened or bogged down with other financial obligations. Lenders view this positively because it means you have greater discretionary income and the financial means to take on more debt while also being able to afford other expenses that may arise.

You May Like: Which Is Better Chapter 7 Or 13 Bankruptcy

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Improving Your Dti Ratio

If a high debt-to-income ratio prevents you from getting approved, you can take the following steps to improve your numbers:

- Pay off debt: This logical step can reduce your debt-to-income ratio because youll have smaller or fewer monthly payments included in your ratio.

- Increase your income: Getting a raise or taking on additional work improves the income side of the equation and reduces your DTI ratio.

- Add a co-signer: Adding a co-signer can help you get approved, but be aware that your co-signer takes a risk by adding their name to your loan.

- Delay borrowing: If you know youre going to apply for an important loan, such as a home loan, avoid taking on other debts. You can apply for additional loans after the most important purchases are funded.

- Make a bigger down payment: A large down payment helps keep your monthly payments low.

In addition to improving your chances of getting a loan, a low debt-to-income ratio makes it easier to save for financial goals and absorb lifes surprises.

Don’t Miss: How To File Bankruptcy In California

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.

You May Like: How Long After Bankruptcy Can You Buy A Home

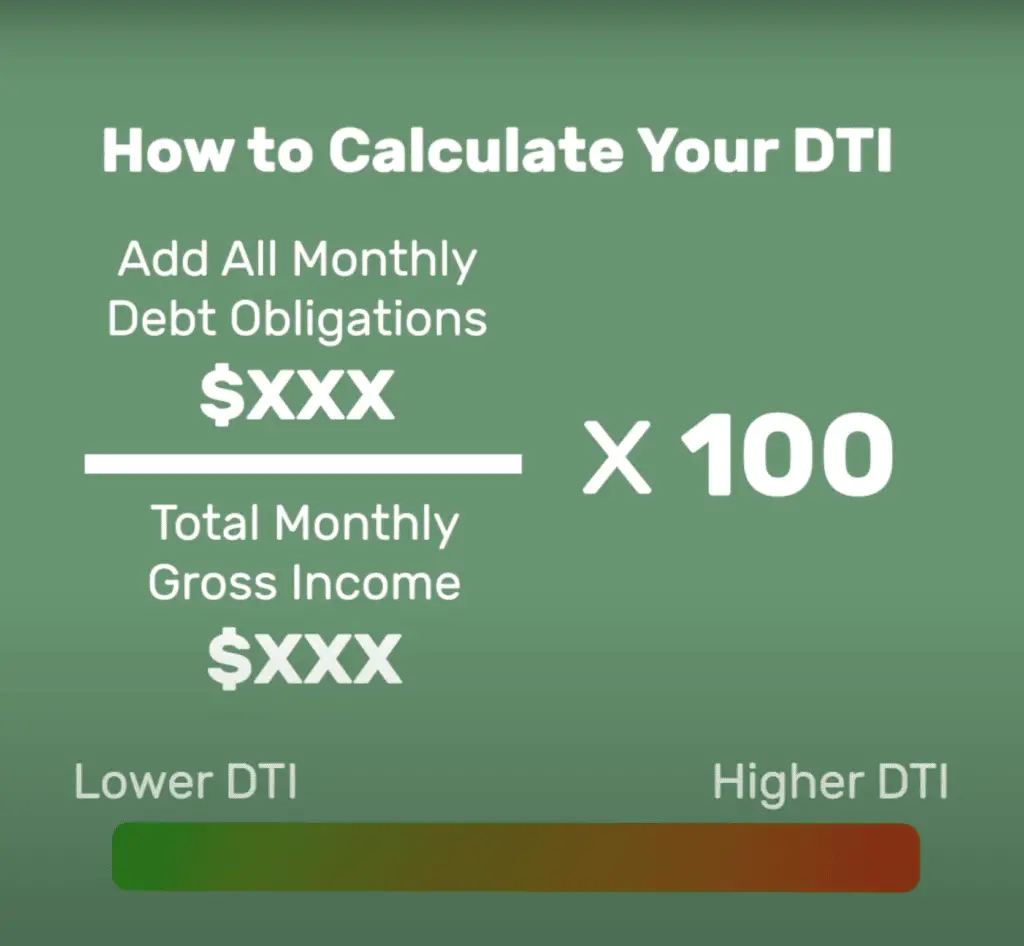

The Debt To Income Ratio Formula

Calculate your DTI with the following formula: total debt divided by gross monthly income times 100.

Let’s say you have a total monthly debt payment of $5,000 and a gross monthly income of $6,000. The first number you get is 0.8333. Multiple this number by 100 and you get 83.3%. In this example, your DTI is 83%.

If you have $5,000 in debt and $4,000 in gross monthly income, your first number is 1.25. Multiply by 100 to get a percentage: 125%.

If you have $2,000 in debt and $6,000 in gross monthly income, your first number is 0.33. Multiply by 100 to get a percentage: 33%.

It’s pretty simple, but if you prefer to use a debt-to-income ratio calculator, there are several available online.

How To Decrease Your Debt

1) Create a budget: Creating a budget is one of the first recommendations of most personal finance experts, and for good reason. Having a better sense of your income, expenses and monthly cash flow will make it far easier to manage your money, and payoff any existing debts faster. As Dave Ramsey so famously quipped a budget is telling your money where to go instead of wondering where it went.

2) Consolidate your existing debts: If you already have a home loan, theres a good chance you can reduce your total monthly debt repayments, by consolidating every loan into your mortgage.

Even if you dont have a mortgage, there are lending institutions that can consolidate all your debt into one payment, which has three primary benefits:

Benefit 1: Single Repayment A single repayment will can simplify the process of paying all your debts each month. It is less hassle and more manageable for most people.

Benefit 2: Lower Interest Rate When done correctly, the overarching interest rate of your debt should decrease. This will automatically reduce your DTI ratio, and thereby increase your chances of being granted a loan.

Benefit 3: You can pay off your debt faster The goal of most reputable debt consolidation agencies is to drastically reduce the amount of time it takes you to pay off your debts. Ideally, you should be aiming for something in the 3-to-5-year range.

Recommended Reading: Can You File Irs Debt In Bankruptcy

Add Up Your Monthly Debt Payments

Once you’ve determined your monthly gross income, you can focus on your monthly debt payments. This is the money that’s taken out of your paycheck each month. Expenses like groceries and utilities generally are not included. Once you’ve figured out all of your monthly debts, take the sum of each value.

Example: You owe $1,000 in rent, $300 in student loans and $100 for a credit card payment. You would then add 1,000, 300 and 100. This would result in monthly debt payments of $1,400.

$1,000 + $300 + $100 = $1,400

What Is The Dti Preferred By Lenders

The maximum DTI ratio varies from lender to lender. Lenders generally may set a front-end ratio at no more than 28% and the back-end ratio at 36% or lower.

Major lenders often use the following guidelines for DTI ratios:

-

35% or less: This ratio reflects that your debt is manageable and you likely will have money remaining after paying monthly bills.

-

36% to 49%: Your DTI ratio is adequate but you have room for improvement. Lenders might ask for other eligibility requirements.

-

50% or higher: The ratio reflects that you may have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

However, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios depending on the type of loan you’re applying for. Keep in mind that the lower your DTI ratio, the better your chances of being approved for a loan.

Also Check: Will Filing Bankruptcy Help My Credit

Doing The Simple Math

Once you’ve calculated what you spend each month on debt payments and what you receive each month in income, you have the numbers you need to calculate your debt-to-income ratio. To calculate the ratio, divide your monthly debt payments by your monthly income. Then, multiply the result by 100 to come up with a percent.

Examples Of How To Calculate Dti

Example 1: Recently Graduated Student

- Monthly child support payments

- Any other monthly debt that you are currently paying

From the list above it should be plain to see that every debt payment that you currently have is factored into your DTI ratio. The only exception is rent, which is substituted for a mortgage repayment when assessing people that dont own a home.

Other monthly expenses like grocery shopping, electricity, digital subscriptions, petrol and other regular expenses are excluded from your DTI calculation. In essence, there needs to be a loan associated with the expense in order for it to be classified as a debt. The only exceptions are rent and child support payments.

Recommended Reading: What To Do When You Can’t Pay Your Debt

Weigh Your Monthly Debt Payments Against Your Income To See If Youre Overextended

A debt-to-income ratio is a key factor that lenders use to determine if youll be approved for a loan. During the underwriting process after you apply for a loan, the underwriter will check your debt-to-income ratio to see if you can afford the loan payments. If your DTI is too high, you wont get approved for the loan.

For consumers, debt-to-income is an easy way to measure the overall health of your finances. You can check your DTI to see if you have too much debt for your income. If your debt ratio is too high, then you know to scale back and focus on debt repayment. If you need help, call to speak with a trained credit counsellor for a free debt and budget evaluation.

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

Recommended Reading: Can You File Bankruptcy On Utility Bills

Divide Your Debt Payment By Your Gross Income

Now that you’ve determined your monthly gross income and your monthly debt payments, divide your monthly debt by your gross monthly income:

monthly debt payment total / gross monthly income = debt-to-income ratio

Example: Divide your monthly debt payment total of $1,400 by your gross monthly income of $3,467. This would result in a debt-to-income ratio of 0.40.

$1,400 / $3,467 = 0.40

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

Also Check: How Long To Wait To File Bankruptcy Again

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

You May Like: Will Bankruptcy Affect Renting An Apartment

What Is A Good Debt

The lower your DTI ratio, the more likely you will be able to afford a mortgage opening up more loan options. A DTI of 20% or below is considered excellent, while a DTI of 36% or less is considered ideal. Compare your debt-to-income ratio to our measurement standards below.

| 36% or less | DTI ratio is good | A debt-to-income ratio of36/43 is favorable to lenders, because it shows you’re not overstretched. After paying your monthly bills, you most likely have money left over for saving or spending. |

|---|---|---|

| 37% – 50% | DTI ratio is OK | The maximum allowed DTIcan vary depending on the type of home loan you’re applying for and the requirements set by your lender. In most cases, the highest DTI that a homebuyer can have is 50%. |

| 51% or higher | DTI ratio is high | Just because you have a high DTI ratio doesn’t mean you can’t still qualify for a home loan. Lenders will look at your credit score, savings, assets, down payment and property value in addition to your DTI when considering your loan eligibility. Paying down debt or increasing your income can helpimprove your DTI ratio. |

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

Don’t Miss: How To Declare Bankruptcy In Quebec

Pay More Than The Minimum

Pay off your debt and save on interest by paying more than the minimum every month. The key is to make extra payments consistently so you can pay off your loan more quickly. Some lenders allow you to make an extra payment each month specifying that each extra payment goes toward the principal. Before you begin, check the terms of your loan to determine whether additional fees or prepayment penalties may apply.

How To Lower Your Dti Ratio

If you have a high DTI ratio, you’re probably putting a large chunk of your monthly income toward debt payments. Lowering your DTI ratio can help you shift your focus to building wealth for the future.

Here are a few steps you can take to help lower your DTI ratio:

- Increase the amount you pay each month toward your existing debt. You can do this by paying more than the minimum monthly payments for your credit card accounts, for example. This can help lower your overall debt quickly and effectively.

- Avoid increasing your overall debt. If you feel it’s necessary to apply for additional loans, first aim to reduce the amount of your existing debt.

- Postpone large purchases. Prioritize lowering your DTI ratio before making significant purchases that could lead to additional debt.

- Track your DTI ratio. Monitoring your DTI ratio and seeing the percentage fall as a direct result of your efforts may motivate you to continue reducing your DTI ratio, which can help you better manage your debt in the long run.

Don’t Miss: Can You Keep Your Car If You File Bankruptcy