The Birth Of Public Debt

George Washington,portrait by Gilbert Stuart

“No pecuniary consideration is more urgent than the regular redemption and discharge of the public debt: on none can delay be more injurious, or an economy of the time more valuable.”

George Washington, 1793, Message to the House of Representatives

The public debt of the United States can be traced back as far as the American Revolution. In 1776, a committee of ten founders took charge of what would become the Treasury, and they helped secure funding for the war through “loan certificates” with which they borrowed money for the fledgling government from France and the Netherlands. This committee morphed over the next decade into the Department of Finance. Robert Morris, a wealthy merchant and Congressman , was chosen to lead a new Department of Finance in 1782.

As the new Superintendent of Finance, Morris was the first committee member to order a reporting of the total government debt owed. This marked the beginning of annual Treasury reports to the President. On January 1, 1783, the public debt of the new United States totaled $43 million.

Are We Helpless When It Comes To The National Debt

In some ways, yes. But there are actions you can take to mitigate the effect of the national debt on your life.

- Pay your taxes: According to the IRS, the federal government loses $1 trillion each year due to unpaid taxes.

- Put pressure on your Congressional reps: Call or write to your Representatives and Senators in support of tax code reform, increased funding for the IRS to track down tax cheats and closing loopholes that give the countrys most profitable companies tax bills that are lower than most Americans.

- Follow your reps voting history: If youre curious how your Representatives and Senators have voted on fiscal policy issues, thats easy to check. You can use voting history to back up your concerns when writing or calling your reps.

- Learn about healthcare reform: While national healthcare remains a contentious topic, it could pay to learn how other countries control healthcare costs and how those policies could benefit you, your neighbors and the impact rising healthcare costs has on the national debt.

Rehling from Wells Fargo Investment Institute says that while the national debt has increased substantially over the past decade, the U.S. isnt unique in this regard. The rest of the developed world has seen similar trends.

While these budget trends are unsustainable over the long run, there is no indication that current debt levels are overly worrisome, he says.

The Pandemic Impact On Debt

The less your income, the easier it is to pile up debt. That obvious lesson hit home in 2020.

The unemployment rate went from 3.5% pre-COVID to a peak of 14.8% in April 2020the highest level since 1948.

The total U.S. consumer debt balance grew $800 billion, according to Experian. That was an increase of 6% over 2019, the highest annual growth jump in over a decade.

Student loan debt increased the most , followed by mortgage debt and personal loan debt .

But dropped $73 billion, a 9% decrease from 2019 and the first annual drop in eight years.

A November 2020 Experian survey showed that 66% of consumers were spending the same or less during the pandemic than they had in 2019. About 33% of those surveyed said they put more in savings in 2020 than they did in the last year.

Also Check: How Do You Declare Personal Bankruptcy

How Much Do Other Countries Owe The Us

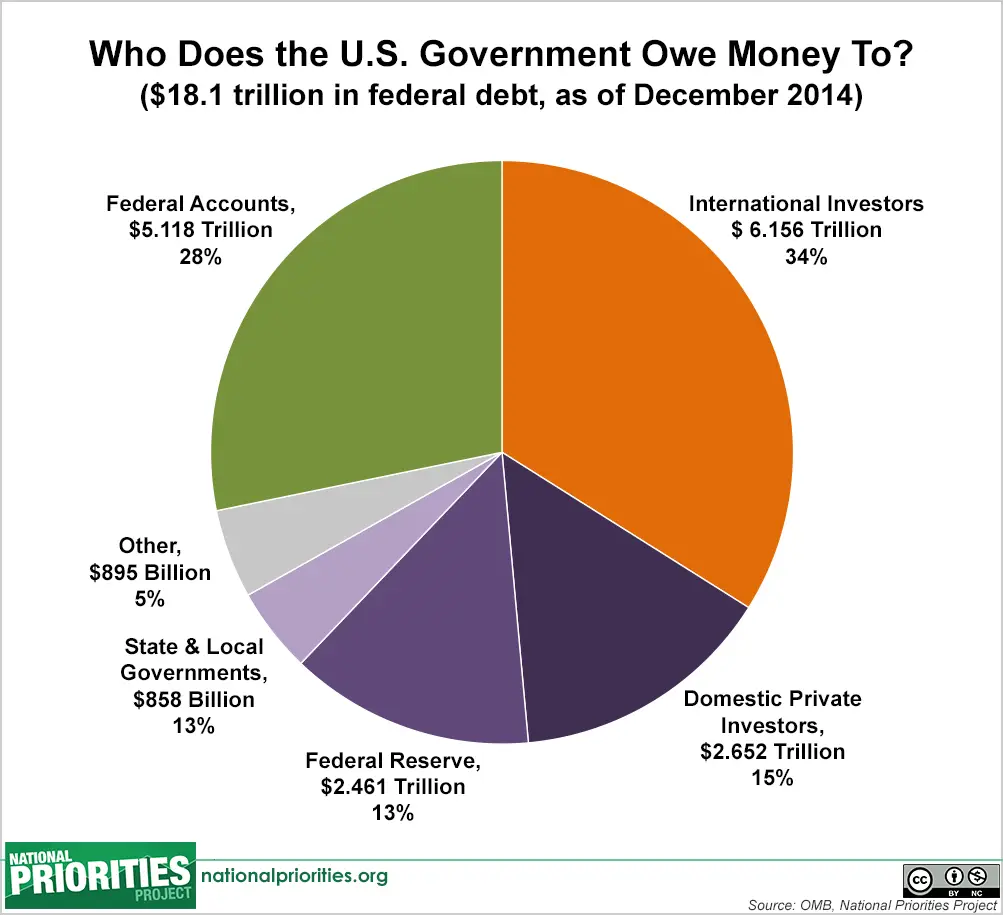

Public debt makes up three-quarters of the national debt, and foreign governments and investors make up one-third of public debt. As of , the countries with the most debt owed to the U.S. are Japan, China, the United Kingdom, Luxembourg, and Ireland.

Though China had been the long-standing top placeholder for the country with the most debt owed to the United States, Japan currently holds $1.3 trillion worth of U.S. debt. The second place holder, China, currently holds $1.1 trillion in Treasury holdings. Together, they hold 31% of all foreign-owned U.S. debt.

How Did The Debt Get Where It Is Today

More on:

The United States has run annual deficitsspending more than the Treasury collectsalmost every year since the nations founding. The period since World War II, during which the United States emerged as a global superpower, is a good starting point from which to examine modern debt levels. Defense spending during the war led to unprecedented borrowing, with the debt skyrocketing to more than 100 percent of gross domestic product in 1946.

Don’t Miss: How Long Is A Chapter 7 Bankruptcy On Your Record

Why Is It Happening

The underlying conditions driving this unsustainable fiscal outlook existed well before the pandemic. Every fiscal year since 2002, the federal government has run a deficitmeaning spending exceeds its revenuesand added to its debt. Going forward, spending, including for Social Security, Medicare/Medicaid, and net interest on the debt, is projected to continue to outpace revenue by increasing amounts.

Demographic and other trendslike rising health care costsare putting pressure on declining Social Security and Medicare trust funds. Higher interest rates could also combine with rising debt to increase deficits going forward.

Learn more in our annual report:

National Debt By President

The National Debt has always been an area of interest for the United States President George Washington appointed future President Alexander Hamilton to understand and solve the $80 million debtthat had accrued due to the Revolutionary War. Hamilton came up with the plan to pay off the debt through taxes and the creation of the national bank. Since then the United States has steadily increased its budget deficit, and the national debt has continued to rise.The first time that the national debt hit the $1 billion mark was in 1863 while the Civil War was occurring it hit the $2 billion was two years later when the civil war ended in 1865. As the country went to battle during World War I and World War II, the national debt hit the $10 billion mark and $100 billion marks respectively. By 1982 after the Vietnam War and the Cold War, the national debt hit the $1 trillion mark for the first time in history. By the 21st Century, the national debt got to $20 trillion after major events such as the War on Terror and the Great Recession. Today , the national debt stands at $30.2 trillion and public debt is roughly 100% of the country’s GDP.

You May Like: Can You Buy A Home While In Bankruptcy

The National Debt Is Big And Getting Bigger Does It Matter

WASHINGTON The United States national debt is nestled in a brick-laden underpass just a block away from Times Square. It ticks away, month after month, year after year, never getting smaller, never slowing down.

That national debt clock the brainchild of the real estate tycoon Seymour Durst, who installed it on West 43rdStreet in Manhattan in 1989 isnt actually the national debt. Its a representation of the national debt, a simple tally of how much money the federal government has borrowed from the public and has yet to pay back.

Durst said of the clock when it was installed that it was meant to strike anxiety if not fear into passersby. If it bothers people, he said, then its working.

When Durst died in 1995, the national debt totaled more than $4 trillion. In 2008, less than 20 years later, the debt clock ran out of digits, forcing the Durst Organization to add two more. The clock can now track our collective debt into the quadrillions.

The clock currently reads $28 trillion, give or take, and will grow rapidly in the coming years. The coronavirus pandemic has cost the U.S. economy $16 trillion, give or take, and Congress appropriated more than $3 trillion in aid in 2020.

Lawmakers have echoed Dursts distaste for the national debt for decades, with varying degrees of sincerity. And we are hearing them again, as Congress debates a nearly $2 trillion relief package to respond to the pandemic and its economic fallout.

Raising Reserve Requirements And Full Reserve Banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund, published a working paper called The Chicago Plan Revisited suggesting that the debt could be eliminated by raising bank reserve requirements and converting from fractional-reserve banking to full-reserve banking. Economists at the Paris School of Economics have commented on the plan, stating that it is already the status quo for coinage currency, and a Norges Bank economist has examined the proposal in the context of considering the finance industry as part of the real economy. A Centre for Economic Policy Research paper agrees with the conclusion that “no real liability is created by new fiat money creation and therefore public debt does not rise as a result.”

The debt ceiling is a legislative mechanism to limit the amount of national debt that can be issued by the Treasury. In effect, it restrains the Treasury from paying for expenditures after the limit has been reached, even if the expenditures have already been approved and have been appropriated. If this situation were to occur, it is unclear whether Treasury would be able to prioritize payments on debt to avoid a default on its debt obligations, but it would have to default on some of its non-debt obligations.

Don’t Miss: What Happens After Bankruptcy Petition Is Filed

Public Debt Goes Online

Official White House photoof President Bill Clinton,1993

Despite backlashes against ’80s “greed,” and the obstacle of the huge public debt , the economy of the United States was relatively strong at the start of the new decade. The government made a commitment to “fiscal discipline,” and in 1998, President Bill Clinton presented to Congress the first balanced federal budget since 1969.

Throughout the ’90s, a Wall Street boom drove investment in Treasury securities. Treasury kept up with demand by taking advantage of many technological breakthroughs.

In 1992, Bureau computer systems are again upgraded when the IBM mainframe is replaced with an Amdahl system. It’s about this time that the first “computer virus” strikes at Public Debt.

Building The American Future

Its obvious that the fiscal path were on is unsustainable and dangerous, threatening the future that we all want for our nation and our children. Despite clear warnings, policymakers have failed to show leadership, unwilling to make responsible, forward-looking decisions to do right by the next generation.

Fortunately, there is a better path, and many solutions exist. A sustainable fiscal outlook will give our economy the best chance to succeed, creating the conditions that encourage economic growth. A stable path enables an environment with greater access to capital, increased public and private investment, enhanced confidence, and a reliable safety net. Those factors, in turn, create a more vibrant economy with rising wages, greater productivity, and expanded opportunities for Americans.

The theologian Dietrich Bonhoeffer said: “The ultimate test of a moral society is the kind of world that it leaves to its children. This idea underpins the American Dream that is so central to our democracy and our society. Our leaders have a critical opportunity and responsibility to fulfill their moral obligation to future Americans by looking beyond the next election, and thinking instead about the next generation.

Don’t Miss: How To File Bankruptcy Chapter 7

How Much Does Rising Us Debt Matter

The massive borrowing due to the pandemic, along with Bidens big spending plans, has renewed debate over the peril posed by the national debt. Some economists fear that the United States will become stuck in a debt trap, with high debt tamping down growth, which itself leads to more debt. Others, including those who subscribe to the so-called modern monetary theory, say the country can afford to print more money.

Some say that servicing the debt could divert investment from vital areas, such as infrastructure, education, and the fight against climate change. There are also fears it could undermine U.S. global leadership by leaving fewer dollars for U.S. military, diplomatic, and humanitarian operations around the world. Other experts worry that large debts could become a drag on the economy or precipitate a fiscal crisis, arguing that there is a tipping point beyond which large accumulations of government debt begin to slow growth. Under this scenario, investors could lose confidence in Washingtons ability to right its fiscal ship and become unwilling to finance U.S. borrowing without much higher interest rates. This could result in even larger deficits and increased borrowing, or what is sometimes called a debt spiral. A fiscal crisis of this nature could necessitate sudden and economically painful spending cuts or tax increases.

The Federal Debt Ceiling

The federal debt ceiling is the legal amount of federal debt that the government can accumulate or borrow to fund its programs and pay for fees such as the national debt interest. Since its creation through the Second Liberty Bond Act in 1917, the debt ceiling has grown about 100 times. These instances have included permanent raises, temporary extensions, and revisions to what the debt limit can be defined as. When the debt ceiling isnt raised, the federal government is unable to issue Treasury bills and must rely solely on tax revenues to pay for its programs this has occurred 7 times since 2013.

Read Also: How To File For Bankruptcy In Australia Yourself

How The Debt Compares To Gdp Plus Major Events That Impacted It

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

The U.S. national debt moved above $30 trillion on Jan. 31, 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt.

When the debt gets so big that it hits the debt ceilingthe limit put in place by Congressinvestors may worry that the U.S. will default on the debt. In that case, the government will need to raise the debt ceiling or reduce the debt through higher taxes, spending cuts, and more.

Recovery From The Civil War

The Civil War alone is estimated to have cost $5.2 billion when it ended and government debt skyrocketed from $65 million to $2.6 billion. Post-Civil War inflation along with economic disturbance from Europes financial struggles contributed to the vulnerable economic climate of the late 19th century.

The collapse of Jay Cooke & Co., a major bank invested in railroading, caused the Panic of 1873. Nearly a quarter of the countrys railroads went bankrupt, more than 18,000 businesses closed, unemployment hit 14 percent and the New York Stock Exchange began sinking.

This period of deflation and low growth continued for 65 months making it the longest depression, according to the National Bureau of Economic Research. During this time the government collected less money in taxes and the national debt grew.

You May Like: Does Chapter 13 Bankruptcy Cover Student Loans

President Andrew Jackson Cuts Debt To Zero

The War of 1812 more than doubled the nations debt. It increased from $45.2 million to $119.2 million by September 1815. The Treasury Department issued bonds to pay a portion of the debt, but it was not until Andrew Jackson became president and determined to master the debt that this national curse, as he deemed it, was addressed.

The time of prosperity was short-lived, as state banks began printing money and offering easy credit, and land value dropped.

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.

Don’t Miss: Does Filing Bankruptcy Affect Taxes Owed