What Are Leverage Ratios

A leverage ratio is any kind of financial ratio that indicates the level of debt incurred by a business entity against several other accounts in its balance sheet, income statement, or cash flow statement. These ratios provide an indication of how the companys assets and business operations are financed . Below is an illustration of two common leverage ratios: debt/equity and debt/capital.

Industry & Business Model

| eCommerce, online services | < 0.5 / 50% |

For instance, capital-intensive companies with stable cash flows operate successfully with a much higher debt ratios.

Also, the more established a company is, the more stable cash flows and stronger relationships with lenders it tends to have. As a result, larger and more mature companies can typically afford to have higher debt ratios than other industries.

Hence, benchmarking is an essential part of ratio analysis, where you compare companies of a similar size and business model in the same industry.

Leverage Ratio Example #2

If a business has total assets worth $100 million, total debt of $45 million, and total equity of $55 million, then the proportionate amount of borrowed money against total assets is 0.45, or less than half of its total resources. When comparing debt to equity, the ratio for this firm is 0.82, meaning equity makes up a majority of the firms assets.

You May Like: How Often Can Someone File Chapter 7 Bankruptcy

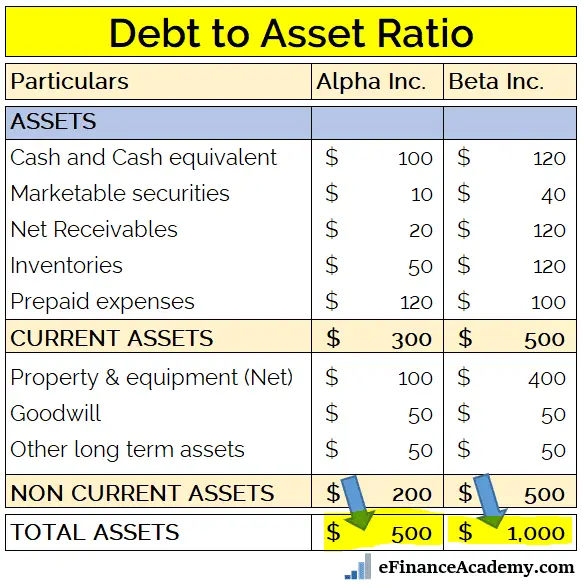

How To Calculate Debt Ratio

Calculating your company’s debt ratio is an important step in determining whether or not your business faces financial risk. As you make your calculations, refer to your company’s balance sheet. Keep in mind, calculating your debt ratio is dependent on the type of ratio and information you’re working with. Here are the steps to calculate the general debt ratio:

Calculate The Debt Ratio

Once you have identified both your total liabilities and your total assets, you are ready to calculate your debt ratio. To calculate the debt ratio, divide the total liabilities by the total assets.

It is important to note that the low or high debt ratio depends on the particular industry.

However, a debt ratio greater than 1 indicates high future financial risk, and a low debt ratio means that the business has a good financial base and can be protracted.

Don’t Miss: What Does Declaring Bankruptcy Do To Your Credit

How Is Your Dti Ratio Calculated

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

An Important Key To Business Credit

Debt service is one of the four C’s of business credit the “capacity” to repay the loan. Debt service measurements verify that a business can generate revenues to pay off business loans, leases, and other debts.

A lender will only lend money to your business if they have a reasonable expectation that the loan will be repaid. One of the major factors in repayment is the current debt being carried by the borrower. Your business credit rating will show this too, but many lenders have found debt service to be a reliable indicator of repayment potential.

Banks and other lenders prefer that you list debt service separately on your income statement . Debt service is considered a current expense for your business. Listing debt service as an expense shows how it adds in with other expenses and compared to the income your business will be getting each month.

For income tax purposes, the interest on business loans is considered a deductible business expense. The loan principal is not a deductible business expense.

You May Like: How To File Bankruptcy When You Have No Money

D/e Ratio For Personal Finances

D/E ratio can apply to personal financial statements as well, serving as a personal D/E ratio. Here, equity refers to the difference between the total value of an individuals assets and their aggregate debt, or liabilities. The formula for personal D/E ratio is slightly different:

Debt/Equity \begin & \text = \frac } – \text } \\ \end Debt/Equity=Personal AssetsLiabilitiesTotal Personal Liabilities

Personal D/E ratio is often used when an individual or a small business is applying for a loan. Lenders use the D/E figure to assess a loan applicants ability to continue making loan payments in the event of a temporary loss of income.

For example, a prospective mortgage borrower is more likely to be able to continue making payments during a period of extended unemployment if they have more assets than debt. This is also true for an individual applying for a small business loan or a line of credit. If the business owner has a good personal D/E ratio, it is more likely that they can continue making loan payments until their debt-financed investment starts paying off.

What Does A D/e Ratio Of 15 Indicate

A D/E ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million. Because equity is equal to assets minus liabilities, the companys equity would be $800,000. Its D/E ratio would therefore be $1.2 million divided by $800,000, or 1.5.

You May Like: How To File Bankruptcy Myself In Michigan

Other Debt To Equity Ratio Formulas To Consider

Depending on what metrics you’d like to evaluate, you may need to use a different formula. To compare a companys short-term liquidity use the cash ratio:

Cash ratio = cash + marketable securities/short-term liabilities

The cash ratio is used to evaluate the ability of an organization to pay its short-term obligations with cash. If the ratio comes out higher than 1, it means the organization has enough cash to cover its debts. If less than 1, the organization has more short-term debts than cash.

Additionally you can opt to use the current ratio:

Current ratio = short-term assets/short term liabilities

The current ratio also evaluates an organization’s short-term liquidity, and compares its current assets to its current liabilities. It evaluates an organization’s ability to pay its debts and obligations within a year.

Short-term debt can include wages, payments to suppliers,or short-term notes payable. Short-term liabilities are considered less risk because they are typically paid within a year.

What Is A Debt Ratio

The debt ratio for a given company reveals whether or not it has loans and, if so, how its credit financing compares to its assets. It is calculated by dividing total liabilities by total assets, with higher debt ratios indicating higher degrees of debt financing. Debt ratios can be used to describe the financial health of individuals, businesses, or governments. Investors and lenders calculate the debt ratio for a company from its major financial statements, as they do with other accounting ratios.

Whether or not a debt ratio is good depends on the contextual factors. But it’s actually hard to come up with an absolute number. Keep reading to learn more about what these ratios mean and how they’re used by corporations.

You May Like: How To Get Copy Of Bankruptcy Papers

What Is A Debt Ratio Guide With Examples

One of the most crucial parameters to assess the health of a particular company is its financial position. The debt ratio, also known as the risk gearing ratio, is used to carry out the financial leverage of a company and to calculate the weight of the debt ratio and total debt and financial liabilities to total capital .

Let’s have a look at what’s in store:

- What Is the Debt Ratio?

- The Technical Side of Debt Ratio

- Interpretation of Debt Ratio

- How is the Debt Ratio Calculated?

- Examples of debt ratio for personal and business purposes:

- Importance and use of debt ratio formulas

- Benefits of Calculating the Debt Ratio

- Limitations of the Debt Ratio

- What Are the Risks Associated with Debt Ratio?

- What is the ideal Debt Ratio?

- Types of Debt Ratio

What Is The Debt Service Ratio

The debt service ratiootherwise known as the debt service coverage ratiocompares an entity’s operating income to its debt liabilities. Expressing this relationship as a ratio allows analysts to quickly gauge a company’s ability to repay its debts, including any bonds, loans, or lines of credit. This is an especially important calculation for bankers, who may be deciding whether or not to allow a business to take on more debt.

The name of the ratio stems from debt service, which is the amount of money required over a period of time to repay debts. A common timeframe for debt service is a year.

If you have a $100,000 loan at 6% interest for 10 years, for example, debt service might be measured by 12 monthly payments of $1,110.21. In other words, your annual debt service for this loan is $13,322.52.

Don’t Miss: Amazon Pallets For Sale Charlotte Nc

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

What Is A Good Debt

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Don’t Miss: How Long Does A Bankruptcy Show On Your Credit Report

What Is The Difference Between Total Debt To Total Assets

Total debt to total assets is a leverage ratio that shows the total amount of debt a company has relative to its assets. The long-term debt-to-total-assets ratio is a solvency measurement that shows the percentage of a corporations assets that are financed with debt that has repayment terms of more than one year.

Determine The Total Debt

Your company’s total debt is the sum of that debt and other financial obligations. It is a combination of short-term debt and long-term debt. Examples of total debt are wages, credit card debt, utilities, or invoices to be paid. Most often, it’s the money your company is borrowing at any given time.

Also Check: How Much Will Credit Score Increase After Bankruptcy Falls Off

What Is The Net Debt To Ebitda Ratio

The net debt to earnings before interest, taxes, depreciation, and amortization ratio measures financial leverage and a companys ability to pay off its debt. Essentially, the net debt to EBITDA ratio gives an indication as to how long a company would need to operate at its current level to pay off all its debt. The ratio is commonly used by to determine the probability of a company defaulting on its debt.

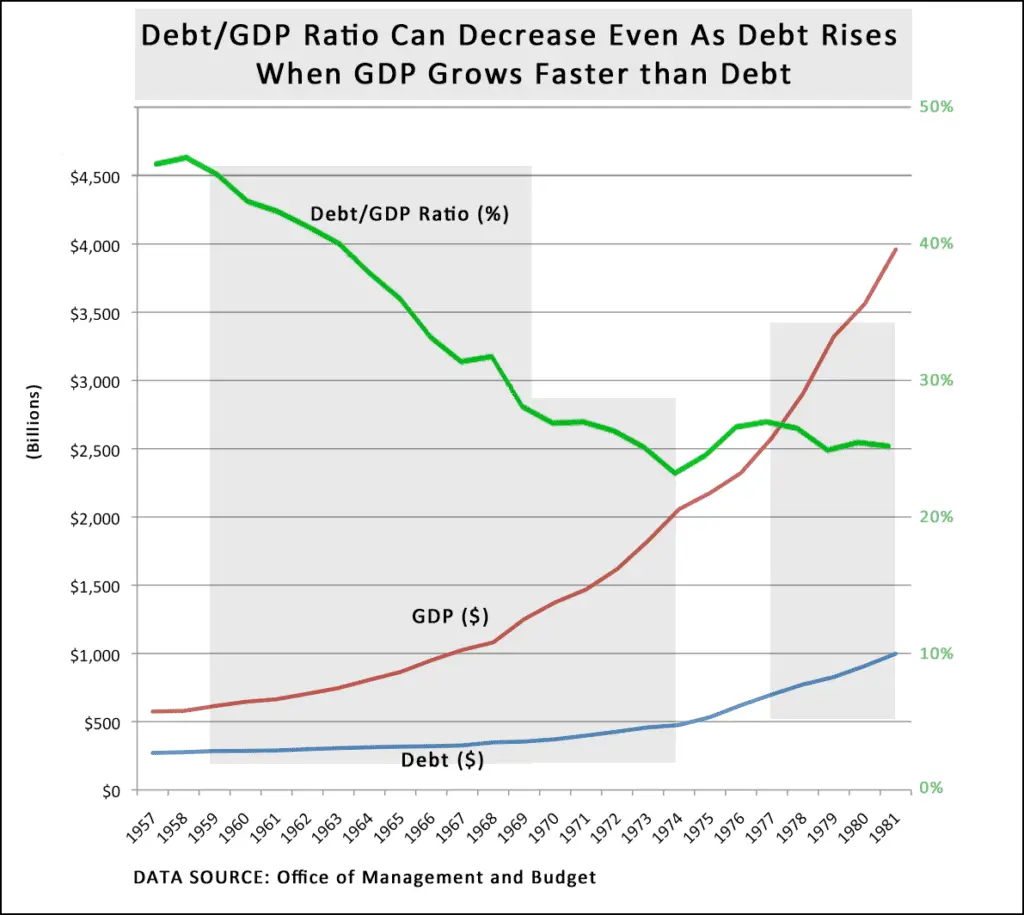

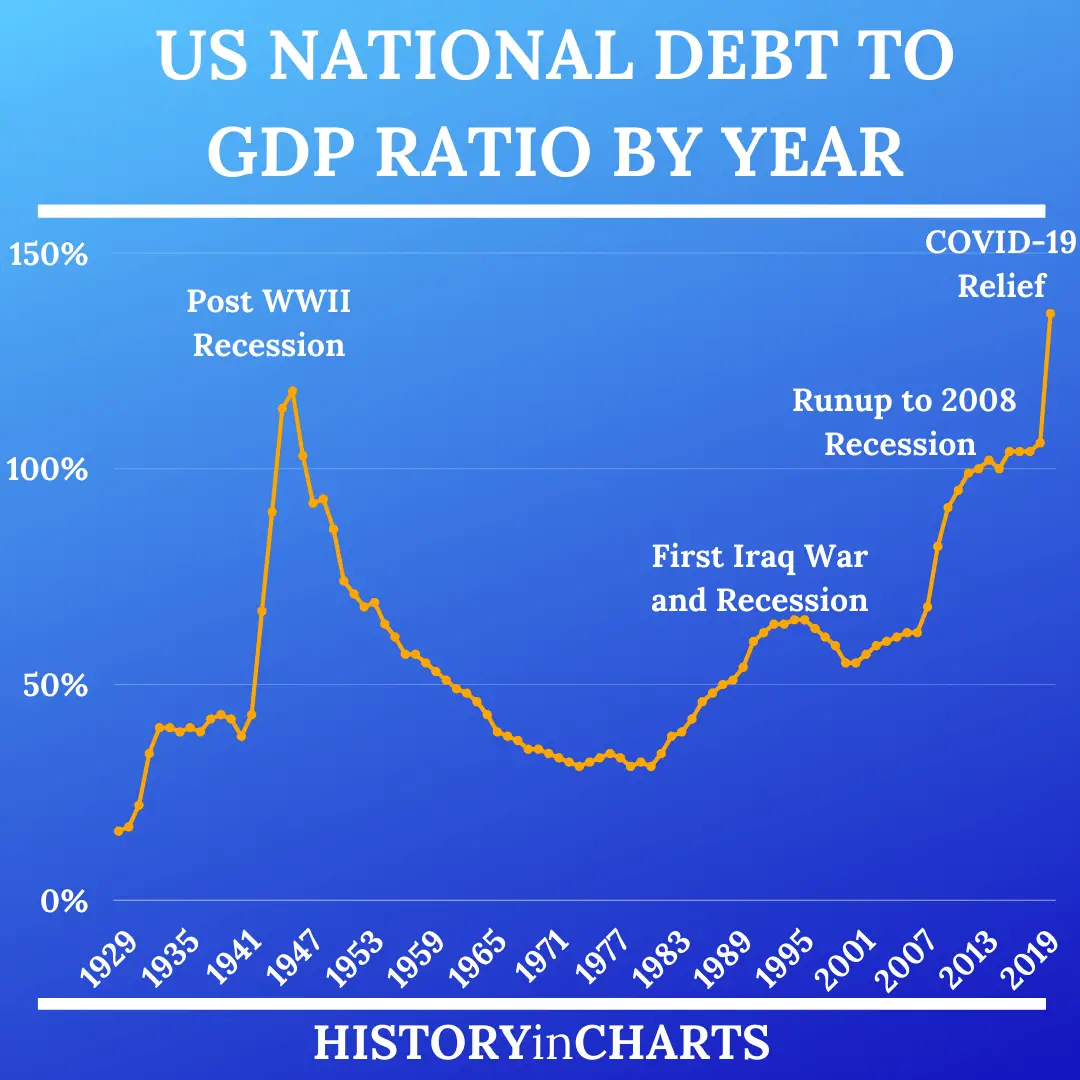

Whats The Difference Between The National Debt And The Federal Deficit

The terms national debt and federal deficit are widely used by our politicians. But the two are not interchangeable. Heres a quick explanation of each. What is the Federal Deficit? The deficit is the difference between the money federal government takes in, called receipts, and what it spends, called outlays, each year.

Recommended Reading: Buying Merchandise By The Pallet

Debt Ratio Meaning Formula And Example

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Investopedia / Zoe Hansen

Debt Ratio: Types And How To Calculate

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

If you own a business, it’s important to calculate and analyze the amount of money your company owes in relation to its total assets. In essence, your debt ratio allows you to determine whether or not your company will be able to pay off its liabilities with its assets. Determining your debt ratio is especially important if you’re hoping to catch the attention of lenders or investors because many prefer to work with companies that have lower levels of liabilities. In this article, we define debt ratio, list examples and outline how to calculate it for your business.

Don’t Miss: Single Family Foreclosed Homes

Limitations Of D/e Ratio

When using D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value thats common in one industry might be a red flag in another.

Utility stocks often have especially high D/E ratios. As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital. Companies in the consumer staples sector tend to have high D/E ratios for similar reasons.

Analysts are not always consistent about what is defined as debt. For example, preferred stock is sometimes considered equity, since preferred dividend payments are not legal obligations and preferred shares rank below all debt in the priority of their claim on corporate assets. On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt.

Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio. This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts .

Formula For The Debt Ratio

The debt ratio is calculated as total debt divided by total assets. The formula is:

Total debt ÷ Total assets

A variation on the debt formula is to add the debt inherent in a capital lease to the numerator of the calculation. An even more conservative approach is to add all liabilities to the numerator, including accounts payable and accrued expenses.

You May Like: How Does Bankruptcy Affect Your Future In Canada

How Can Deskera Help You

An online accounting and invoicing application, Deskera Books is designed to make your life easier. This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location.

The platform works exceptionally well for small businesses that are just getting started and have to figure out many things. As a result of this software, they are able to remain on top of their client’s requirements by monitoring a timely delivery.

Thanks to our well-designed and well-thought-out templates, you can now anticipate that your work will become simpler. A template can be used for multiple actions, including invoices, quotes, purchase orders, back orders, bills, and payment receipts.

Take a small tour of the demo here to get more clarity:

Lastly, you would be able to assess all the reports- be it income statement, profit and loss statement, cash flow statement, balance sheet, trial balance, or any other relevant report from your laptop and your mobile phone.

Deskera Books hence is the perfect solution for all your accounting needs, and therefore a perfect assistant to you and your bookkeeping and accounting duties and responsibilities.

How To Use The Debt Ratio

To find the debt ratio for a company, simply divide the total debt by the total assets. Total debt includes a company’s short and long-term liabilities , while total assets include current, fixed and intangible assets .

The debt ratio:

- Johnâs Company currently has £200,000 total assets and £45,000 total liabilities.

- The debt ratio for his company would therefore be: 45,000/200,000.

- The resulting debt ratio in this case is: 4.5/20 or 22%.

- This is considered a low debt ratio, indicating that Johnâs Company is low risk.

Recommended Reading: Can You Open A Checking Account While In Bankruptcy

What Are The Risks Associated With Debt Ratio

High levels of debt carry two major risks.