Your Creditors Get Your Disposable Income

In Chapter 13 bankruptcy, you’re allowed to keep all of your property and repay your debt over a period of three to five years through a court-approved repayment plan.

You fund your plan with your “disposable income,” or the amount remaining after paying allowed monthly expenses. Because bankruptcy law assumes a reasonable lifestyle, not the filer’s actual lifestyle, you won’t be able to use all of your actual expenses. For instance, reasonable rent, food, and utility payments are predetermined according to your area. So most people must live frugally under a Chapter 13 plan.

Also, your disposable income is not static. The amount you’re expected to pay can change throughout your repayment period. For instance, if your income increases but your expenses stay the same, your disposable incomeand your plan paymentwill increase.

Are All Of The Debtor’s Debts Discharged Or Only Some

Not all debts are discharged. The debts discharged vary under each chapter of the Bankruptcy Code. Section 523 of the Code specifically excepts various categories of debts from the discharge granted to individual debtors. Therefore, the debtor must still repay those debts after bankruptcy. Congress has determined that these types of debts are not dischargeable for public policy reasons .

There are 19 categories of debt excepted from discharge under chapters 7, 11, and 12. A more limited list of exceptions applies to cases under chapter 13.

Generally speaking, the exceptions to discharge apply automatically if the language prescribed by section 523 applies. The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units for fines and penalties, debts for most government funded or guaranteed educational loans or benefit overpayments, debts for personal injury caused by the debtor’s operation of a motor vehicle while intoxicated, debts owed to certain tax-advantaged retirement plans, and debts for certain condominium or cooperative housing fees.

Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

You May Like: Bankruptcy Lawyer Software

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your credit report. The NFCC can provide debt counseling services, help review your credit reports, work with lenders, and help create a debt management plan free of charge.

As always, be wary of predatory credit organizations or companies. Make sure to find a reputable counseling agency and keep a lookout for any red flags, like hidden fees or lack of transparency.

When looking for a credit counselor, the Federal Trade Commission advises consumers to check out each potential agency with:

- The Attorney General of your state

- Local consumer protection agencies

- The United States Trustee program

Removing Errors From Your Credit Report

When you find errors on your credit history related to bankruptcy, you should dispute them immediately. You will need to reach out to any of the three credit reporting agencies that show incorrect information. You can contact these agencies online or by mail. Itâs best to do so by mail because the agenciesâ online forms frequently make you agree to clauses that prevent you from suing. Sending the dispute by mail also leaves a paper trail. The Consumer Financial Protection Bureau and Federal Trade Commission both have templates for writing the letter.

Your letter should include your personal information like your name, credit report number, date of birth, and address. Be sure to date the letter, so you know when the timeline starts to hear a response. You can include your Social Security number and driverâs license number, but these arenât required. Then include information related to the dispute such as:

-

The account number

-

The dates of the disputes

-

Which company is responsible for the dispute

-

A numbered list of items to correct

-

An explanation of all of the inaccuracies

-

A list of documents that you are using to support your claim.

Dispute Timeline

If the credit bureau disagrees they still need to provide you an answer within the required time frame. But if they disagree, they wonât remove the information. Even so, you can ask to include a statement regarding the dispute on your future reports.

Recommended Reading: Buying A New Car After Bankruptcy

Hire A Credit Repair Company To Help

If you’d rather save yourself the time of going through this entire process yourself, you may want to look into hiring a professional credit repair company to help you do it.

Take a look at our review of the best credit repair companies.

Keep in mind that these companies charge a fee for their services, so you’ll need to factor cost into your decision.

You Must Complete Your Repayment Plan

In Chapter 13 bankruptcy, you agree to pay your disposable income to the bankruptcy trustee appointed to administer your case for three to five years. On successful completion of the plan, any remaining balance on nonpriority unsecured debt , gets discharged .

Your income determines the minimum length of time you must make payments, called the applicable commitment period. Here’s how it works.

- Below your state’s median income. If your income is less than the median income in your state and you want to file Chapter 13 bankruptcy instead of Chapter 7 bankruptcy, you must pay all of your disposable income into the plan for at least three years. However, your disposable income is figured differently. The court will consider your actual expenses.

- Above your state’s median income. If your income is above the median in your state, the applicable commitment period is five years. Throughout this period, you must pay either your disposable income or the value of the property the Chapter 7 trustee would have sold for the benefit your creditors , whichever amount is greater.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Report Credit Repair Fraud

State Attorneys General

Many states also have laws regulating credit repair companies. If you have a problem with a credit repair company, report it to your local consumer affairs office or to your state attorney general .

Federal Trade Commission

You also can file a complaint with the Federal Trade Commission. Although the FTC can’t resolve individual credit disputes, it can take action against a company if there’s a pattern of possible law violations. File your complaint online at ftc.gov/complaint or call 1-877-FTC-HELP.

May An Employer Terminate A Debtor’s Employment Solely Because The Person Was A Debtor Or Failed To Pay A Discharged Debt

The law provides express prohibitions against discriminatory treatment of debtors by both governmental units and private employers. A governmental unit or private employer may not discriminate against a person solely because the person was a debtor, was insolvent before or during the case, or has not paid a debt that was discharged in the case. The law prohibits the following forms of governmental discrimination: terminating an employee discriminating with respect to hiring or denying, revoking, suspending, or declining to renew a license, franchise, or similar privilege. A private employer may not discriminate with respect to employment if the discrimination is based solely upon the bankruptcy filing.

Also Check: Is Taco Bell Filing For Bankruptcy

How A Bankruptcy Filing Affects Your Credit Score

When you file for bankruptcy, your credit score will drop. The range of the drop is usually 130 to 240 points. Typically, people who have a higher credit score of over 700 points lose more points. If you already have a poor credit score, the deduction of these points may not really affect you that much.

When you have a bankruptcy on your credit score, it can be difficult to get approval for new credit and get the best deals people with excellent credit scores enjoy. For example, if you are planning to get a cell phone plan with bad credit, you will not be eligible to get the best deals available that require no deposit or no upfront fees. If you have bad credit due to a bankruptcy, you may have to settle for a no credit check cell phone plan where you have to buy the device in full and prepay your usage.

Tips To Help Rebuild Your Credit After Bankruptcy

If youve already felt the wrath of bankruptcy, chances are youre not feeling too optimistic about your future credit score. However, the good news is filing for bankruptcy wont haunt you forever, and the odds of rebuilding your credit are definitely in your favor.

Of course, having the bankruptcy removed from your credit report is the easiest way to get your credit back on track in the shortest period possible. You can also take the following actions to boost your score:

Read Also: How Many Times Has Donald Trump Declared Bankruptcy

Curious About Your Bankruptcy Status

You can get a free copy of your current credit report once a year ââ¬â be wary that checking too often can harm your credit score.

If you see a bankruptcy record that should not be there or any bankruptcy paperwork has a mistake, a bankruptcy attorney can give you an honest idea about how long the repair process will take.

Thank you for subscribing!

Can I Rebuild My Credit After Bankruptcy

You can rebuild your credit after bankruptcy, but its a long process. Your options will be limited at the start, but it is key to not get discouraged. As time goes on, if you consistently pursue a credit rebuilding strategy, your reports and scores can improve.

Here are some recommendations to start with:

- Understand the cause: Identify, accept, and learn from the root causes of your bankruptcy so you wont find yourself in the same position down the road.

- Stick to a budget: Re-evaluate your finances and see where you can cut expenses and save more money if you can.

- Start establishing a new credit history: No, this does not mean using an alias . It means starting fresh with whatever credit you can obtain.

This may mean settling for an extremely high-interest rate, taking on a co-signer, depositing cash into a secured credit card, or other options that have been designed specifically to help you re-establish a positive credit record.

Use these credit options sparingly and never put more on a card than you can pay off by the end of the month so your credit improves over time.

Recommended Reading: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy

What You Will Need

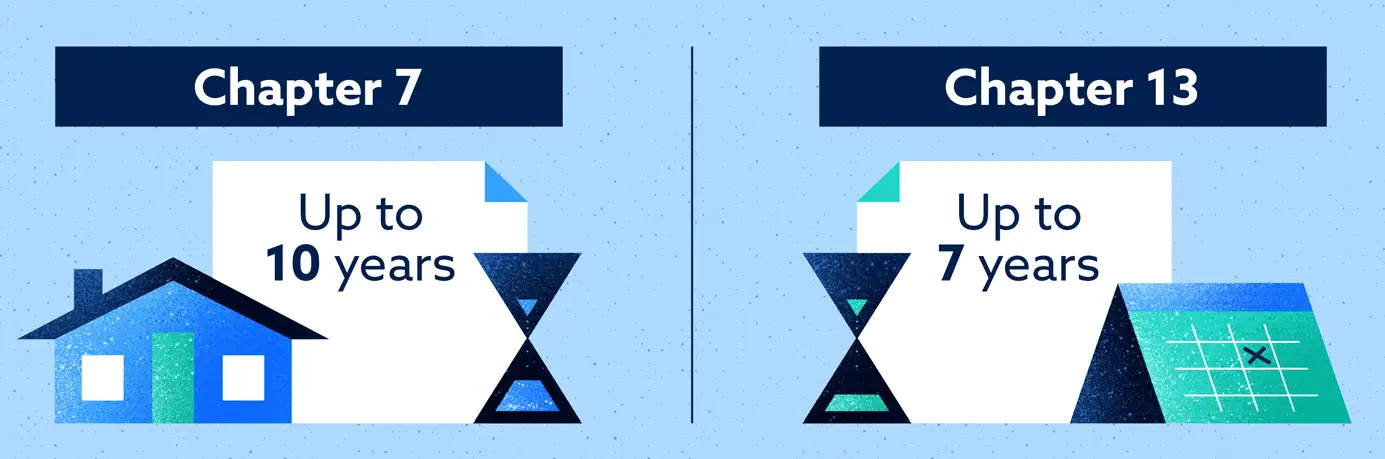

Depending on the type of bankruptcy declared, after 7-10 years, bankruptcy will automatically come off your credit report. But what if you want to remove it early?

Removing bankruptcy early means you have the possibility of getting a mortgage, car loan, or other types of credit without extremely high-interest rates that follow people with bankruptcy.

Do not let one mistake affect your life for the next ten years.

Bankruptcy makes it challenging to get any type of loan or credit. Having financial limitations can drastically affect your life for the worse.

So, Removing bankruptcy can be a long and tedious process, but it is worth attempting.

For this tutorial you will need:

Make Sure The Right Accounts Were Reported

After your debts are discharged, review your credit reports to make sure that only the accounts that were part of your bankruptcy are reported by the as discharged or included in bankruptcy on your reports. If you find mistakes, notify the credit bureaus and dispute the errors on your credit reports .

Don’t Miss: Can Restitution Be Discharged In Bankruptcy

Bankruptcys Impact On Getting A New Job

Employers are allowed to use credit reports to make hiring decisions, as well as when they evaluate employees for promotion, reassignment, and retention. In fact, many employers ask for credit reports, driving records, and criminal histories.

The prospective employer has to let you know theyre going to pull your credit report and get your written authorization to do so.

The bankruptcy law says the government cant deny you a job just because you filed for bankruptcy. Private employers cant fire you because you filed for bankruptcy.

As to new employers, the rule is unclear because that part of the law is written poorly. Courts in New York have ruled that a private employer cant refuse to hire you because you filed for bankruptcy. Judges in Mississippi, Pennsylvania and Florida, however, have said the opposite.

My experience as a bankruptcy lawyer over the past 20 years shows its better to be out of debt when you apply for a new job than to have past due debts showing up on your credit report.

If you owe money, your employer may think youve got a motivation to steal. Once youre debt free, that motivation disappears and your potential employer is likely to be more comfortable hiring you. Lots of people have come to me after Human Resource Managers and headhunters have told them to get their debts wiped out to for a better chance at a good job.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Recommended Reading: How Many Bankruptcies Has Donald Trump Filed

Taking Action After A Dismissal

In cases of involuntarily dismissal or dismissal without prejudice, you can try to get your bankruptcy case reinstated if you move quickly and proactively. Youll often have a small window to continue pleading your case before its thrown out, so you have to pursue the issue immediately.

An honest mistake, or administrative dismissal, can sometimes be rectified by a motion to reconsider the case. This is your first step, combined with ascertaining and resolving the reason for the dismissal.

A reinstatement is always an option, even if your mistake was an accident. There is also sometimes the option of filing an appeal.

If a dismissal is final, sometimes you can immediately file a new one. But any case of dismissal with prejudice, or for abuse, involves a waiting period, usually of 180 days. After that time you can file a new case, but your automatic stay might be limited to one month, making it more difficult to get approved.

Worth repeating a final time is the fact that a bankruptcy filing will be recorded on your credit report as soon as you file it, and it could remain on your report even if your case is dismissed. Filing a second time will drop your credit scores still further.

How To Build Your Credit After Filing For Bankruptcy

If you are one of those people who want to swear off credit altogether, this is actually a bad idea. You want to rebuild your credit score after bankruptcy even if you dont have any immediate plans on making big purchases. This is because when you have a good credit score, it gives you access to better deals and savings. You dont have to pay deposits or high-interest rates when getting necessary services like utilities and cell phone plans.

So, how can you rebuild credit without going under debt again? Here are some practical tips.

Also Check: How Many Bankruptcies Has Donald Trump Filed

Diy Vs Professional Credit Repair

It can often feel like credit repair is a catch-22. You may not have a lot of expendable income to hire a professional credit repair company, but you likely dont have the know-how or emotional bandwidth to tackle it yourself either. We get it.

Bankruptcy is the negative item we most encourage our readers to get professional help with though. The steps weve outlined are advanced tactics that in most cases are best left to credit repair specialists. They are more familiar with the ins and outs of the credit bureaus and court systems, as well as the steps well be outlining.

Below are the credit repair companies we recommend.

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

Don’t Miss: Virtual Bankruptcy Petition Preparer