After Filing Bankruptcy In Canada How Long Will It Be On My Credit Report

How long will bankruptcy show on credit reports in Canada for the first time bankrupt after receiving a ?

There are two large credit reporting agencies in Canada: Equifax and Trans Union. ;Unfortunately neither of them is very forthcoming with regards to their credit reporting practices.

A few years ago you could go to their websites and read a complete description of their reporting procedures. ;Today, unfortunately, their websites are mostly sales vehicles, so that they can sell you their credit reporting services, and thats a key point to remember: Credit bureaus are profit making businesses: they exist to sell credit information to the lenders and to consumers . ;They are not impartial arbitrators; they are there to earn a profit. ;Theres nothing wrong with earning a profit, but its important that you understand their perspective.

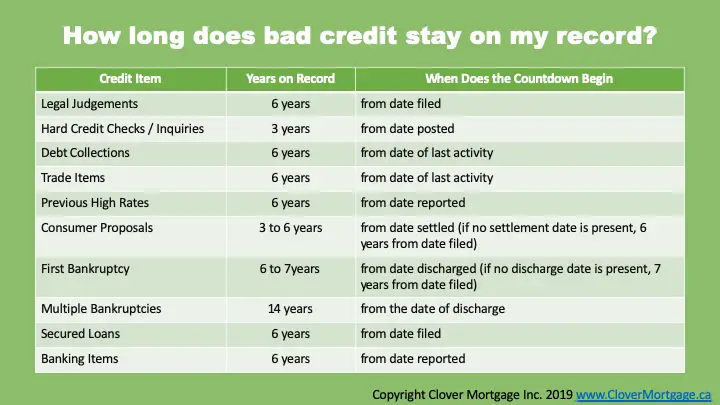

With that background, based on the most recently available information , Equifaxs policy is to retain the note about your first bankruptcy on their system for;six years after the date of discharge.

So, for example, if you in January of year 1, and you were not discharged until October, year 2, the note about your bankruptcy would remain on your credit report for six more years, until the end of October, year 8. ;Its not the date that your bankruptcy started that matters; its the date you were discharged.

In the past Trans Union maintained this information for seven years.

Can I Remove A Bankruptcy From My Credit Report On My Own

It is possible to pursue removing a bankruptcy from your credit report on your own, and some people have managed to do so. However, it is a time-consuming, labor-intensive process that many people find complicated, confusing, and frustrating.

We encourage you to learn as much as you can about credit report disputes and credit repair processes, then count the real cost of DIY credit repair before committing to handling this important task on your own.

People who have needed to remove a bankruptcy from their credit reports have achieved success by working with a provider like Lexington Law Firm. If other questionable negative items are affecting your credit report and score, we can help you challenge those as well.

Contact us today for a free personalized credit report consultation to find out how we can help you meet your credit goals.

Reviewed by Vincent R. Mayr, Supervising Attorney of Bankruptcies at Lexington Law. by Lexington Law.

What If I Need A Loan Or Credit Card Immediately After Bankruptcy

Luckily, most mortgage companies provide FHA loans for scores of 560-600. Traditional financing options often require a score of 600 or higher.

There are options for buying high-cost necessities after filing bankruptcy claims. Secured credit cards and loans exist for those facing bankruptcy. You can look into credit builder loans or other financing options specially built for people after bankruptcy.

Also Check: How Many Bankruptcies Has Donald Trump

What Bankruptcy Will Affect While On Your Credit Score

Your payment history, on-time payments, and recent credit reporting can all affect how lenders work with you.

Once you file bankruptcy and businesses see your credit report’s negative information, you may have concerns about:

- Getting a car loan

- Getting loans without a qualified co-signer

- Adding authorized users to some credit cards

- Security deposits and returns of safety deposits

You have options regarding all these concerns if you are having credit or debt issues. There are ways to address each concern by yourself or with professional help. Getting a fresh start is possible, especially after filing bankruptcy.

Are There Any Employment Restrictions

The;Bankruptcy Act 1966;does not impose any restrictions on employment, either during or after bankruptcy. However some trades or professions may impose restrictions.

We recommend you contact the relevant agency or association to see if your bankruptcy will impact your employment. Common professions that bankruptcy may affect are listed under;employment restrictions.

Also Check: How Many Bankruptcies Has Donald Trump Filed

Bankruptcy: How Long Does It Stay On Your Credit Report

Being declared bankrupt can trigger many emotions, and there are consequences that will impact you immediately and longer term. In this article, we cover how bankruptcy can impact your credit score, how long it will stay on your credit report and how it can impact your ability to borrow money in future.

How Long Does Bankruptcy Stay On Your Record

How long bankruptcy negatively impacts your credit score depends mainly on the type of bankruptcy you file. Chapter 7 versus Chapter 13 on a credit report is different from each other. Chapter 7 bankruptcy remains on your credit report for ten years, while Chapter 13, which involves repayment, stays on your credit report for only seven years. Each of these types of bankruptcy and their presence on your record are discussed more below.

Also Check: How Many Bankruptcies Has Donald Trump Filed

Learn Positive Financial Habits

As time goes by after your bankruptcy and you begin to earn new forms of credit, make sure you dont fall back into the same habits that caused your problems. Only use credit for purchases you can afford to pay off, and try using a monthly budget to plan your spending. Also, work on building an emergency fund to cover three to six months of expenses so a random surprise bill or emergency wont cause your finances to spiral out of control.

How Long Does Bankruptcy Stay On Credit Report

| Bankruptcy Types | |

| Wage Earner Bankruptcy | 7 years |

So coming to know about bankruptcy, we also knew that how critical it is. This is because bankruptcy is a type of debt trap. And once you get into this trap it will crush you in it, till everything will get out of your hands.

As we know further about bankruptcy we come to know that, bankruptcy is a legal course that is undertaken by the company to make free itself from debt obligations. Especially debts which are not being paid to the credit lenders completely are forgiven by the owners. Apart from that bankruptcy filling vary from country to country.

So in the USA, 2 main chapters are basing on the concept of Bankruptcy and its adverse effects on the Credit report. These chapters are 7 and 13. So as we came to studying this chapter 7 of the United States bankruptcy law. This chapter is also liquidation bankruptcy. Harrison refers the chapter 7 as straight bankruptcy.

Chapter 13 of the United States Bankruptcy Laws mainly deals with the bankruptcy of the wage earners, by virtue of which the consumer can get a stay of 7 years on its credit report.

Read Also: What Does Dave Ramsey Say About Bankruptcy

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?

Like all negative information reported to the credit credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.

What Is Chapter 13 Business Bankruptcy

Chapter 13 business bankruptcy is Chapter 11 for smaller businesses. To file Chapter 13, you cant owe more than $419,275 in unsecured loans or $1,257,850 in secured loans. For this reason, Chapter 13 is used primarily by sole proprietors since they tend to have very few creditors. Those debt limits change periodically based on factors like inflation and the average cost of living.

If you file for Chapter 13 as a sole proprietor, you must file under your name instead of the businesss name. Sole proprietorship lacks the legal protection of registered business entities. Theres no legal difference between personal assets and business assets. The trustee will, therefore, review your personal assets when evaluating your eligibility for Chapter 13 as well as your reorganization plan.

Earlier, we mentioned that sole proprietors are the only business entity that can have debts discharged. Hence, some sole proprietors who file for Chapter 13 only have to pay back some of their debt.

Recommended Reading: How To File Bankruptcy In Texas Without An Attorney

The Things That Happen Immediately After Filing Bankruptcy

As soon as you file your Chapter 7 bankruptcy, you are given a case number and a bankruptcy trustee is assigned to your case. The bankruptcy trustee will oversee your bankruptcy filing, will review your bankruptcy forms, and may ask for additional documents to verify your information. The trustee will also conduct the meeting of creditors.

Protection from your creditors begins immediately after filing for Chapter 7 or Chapter 13 bankruptcy. This is called the automatic stay. Once you file and the automatic stay takes effect, your creditors are not allowed to take collection action against you.

After you file for bankruptcy protection, your creditors can’t call you, or try to collect payment from you for medical bills, credit card debts, personal loans, unsecured debts, or other types of debt. Wage garnishments must also stop immediately after filing for personal bankruptcy.

Do You Have To Disclose Your Bankruptcy To Your Employer

You don’t have a proactive duty to tell your current employer that you filed for bankruptcy in the past. However, because your bankruptcy filing is a public record, your employer can find out about it through a public record search or credit check. Also, if you are in a Chapter 13 bankruptcy and fail to make your monthly plan payments, in some states, the court or the bankruptcy trustee will send your employer a wage deduction order to withhold the payments directly from your paycheck.

You May Like: Can You Rent An Apartment After Filing For Bankruptcy

Rebuilding Your Credit And Finances After Bankruptcy

When the process of bankruptcy is over, your LIT will give you a Notice of Discharge. This notice means you no longer have those debts. You are debt-free at this point, minus any other obligations that were not part of the bankruptcy. That may include secured debts on assets that qualified for exemption, taxes, child support, alimony, and student loans less than seven years old.

Now comes the process of rebuilding your credit and restoring your finances. Youve hopefully learned money management skills and know how to keep your budget. Easy ways to start new credit include secured credit cards and other new credit programs. A secured credit card is when you have an account with a credit card company that is secured by a cash deposit. Your credit limit is equal to the amount you deposit. Always follow and keep your budget. Understand what expenses you have and plan for your wants and needs.

Read Also: Which Of The Following Phrases Best Summarizes Chapter 7 Bankruptcy?

How Will Bankruptcy Affect My Credit In 2021

5 minute read ⢠Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card. Explore our free tool

In a Nutshell

Filing bankruptcy does not ruin your credit forever! If you need debt relief but are worried about how a bankruptcy affects your credit rating, this article is for you.

Written by Attorney Andrea Wimmer.

Also Check: How Many Bankruptcies Has Donald Trump Filed

What Is Your Credit Score After Bankruptcy

Bad news first: filing for bankruptcy can put a crater-sized dent in your credit score, causing it to plummet more than 200 points. But while this is happening, you are working on having debts you would never be able to pay off discharged, and/or reorganizing your ability to pay back those debts.

Soon, you will be either free of debts or making positive payments on those debts , and your score will begin to rise. The relative impacts of filing for bankruptcy on your credit score are short compared to ones lifespan.

Can Bankruptcy Stop Eviction

3 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Yes, bankruptcy can stop an eviction temporarily in most cases, but will not stop an eviction in the long term.

Written byAttorney Eva Bacevice.

Filing a bankruptcy case can stop or stay an eviction proceeding, whether before it is in process or even if it has already begun. This is not, however, a permanent solution and there are exceptions when it will not work at all. In this article we will explore how a bankruptcy can temporarily stop an eviction, what are the circumstances where it will not help, and how you can utilize the time it affords you to potentially recover.

Don’t Miss: What Is Epiq Bankruptcy Solutions Llc

How Bankruptcy Affects Your Credit

Filing for bankruptcy makes it challenging to receive credit cards or lower interest rates because lenders will consider you risky. These consequences could occur immediately, affecting any short-term needs such as getting affordable interest rates or approval from prime lenders.

Rebuilding your credit as soon as possible is paramount. One way to increase your credit score is to pay all your bills on time each month, creating and sticking to a budget and not incurring more debt.

You should also avoid overuse of credit cards and failing to pay balances in full each month. Having a good credit score gives consumers access to more types of loans and lower interest rates, which helps them pay off their debts sooner.

The Final Steps Of Your Journey Towards Lasting Debt Relief

Getting all of your bankruptcy forms prepared and filed with the bankruptcy court is usually the most time-intensive process of a Chapter 7 bankruptcy. But that doesnât mean that your job is done. There are a few things everyone filing Chapter 7 bankruptcy has to do to successfully complete their bankruptcy case and receive a discharge. Letâs take a look at what you can expect will happen in your Chapter 7 bankruptcy.

Pay Filing Fee in Installment Payments

If you can’t pay the entire Chapter 7 bankruptcy filing fee and you don’t qualify for a fee waiver, then you can apply to pay the filing fee in installments. You can ask to make four installment payments. The entire fee is due within 120 days after filing.

If the bankruptcy court approves your application, it will grant an Order Approving Payment of Filing Fee in Installments. Your installment payment due dates will be in that order. You must pay all installments on time or your case is at risk of being dismissed.

Take Bankruptcy Course 2

You will complete a credit counseling course before filing bankruptcy. There’s a second course you must take after filing bankruptcy. It covers personal financial management and can help you take advantage of your fresh start after erasing your debts through bankruptcy.

You have to take this course after your case is filed but make sure itâs be completed within 60 days from the date of the meeting of creditors. A certificate of completion must be filed with the court.

Read Also: What Is Epiq Bankruptcy Solutions Llc

Business Bankruptcy: Additional Tips

As you can see, business bankruptcy isnt always a death sentence. But thats no reason to take this decision lightly in any way. Business bankruptcy should only enter the discussion when you have no other possible options for repaying your debts.

Filing for bankruptcy can negatively affect numerous aspects of your life, not just your personal credit or financing eligibility.

For example, once you file bankruptcy forms to the court, your bankruptcy becomes public record. If you are considering filing, get ready to explain your decision to different people time and time again. Its relatively safe to assume that anyone who should know about your bankruptcy will eventually know. This includes competing businesses, employees, family members, and potential employers.

Depending on your desired field, having a bankruptcy on your record can make it very difficult to get a job. You should probably steer clear of the finance industry or any industry with comprehensive employee screening policies, like law enforcement. Rebuilding your reputation and sense of confidence after filing for bankruptcy could be one of the most stringent tests of your career.

Can A Chapter 7 Bankruptcy Stop A Foreclosure

Yes, this type of bankruptcy stops a foreclosure auction immediately. The bankruptcy court will order an automatic stay, which will delay the foreclosure proceedings for about 3 to 4 months, from the date you filed for bankruptcy to the date your debt is discharged. All collection activities and foreclosure proceedings will be suspended.

However, lenders can file a motion asking the court to lift the automatic stay and allow the foreclosure sale to resume. Unless the judge approves, the foreclosure sale cant take place during that period. Filing such a request requires lenders to hire a lawyer, which could be a costly option and thats why most of them just let the time pass for the automatic stay and set the foreclosure sale date afterward.

Note that Chapter 7 offers debt relief by selling your assets and using the proceeds to pay off the loan. It may discharge your debt but it wont get rid of the lien on the property thats used as collateral. You may no longer be legally obliged to pay back the loan but the lender can still enforce the lien and foreclose the house so that they can sell it and recover their monetary losses even partially.;

The other commonly discharged debts include credit card charges, medical bills, utility bills, and personal loans from employers, friends, and family.

Read Also: Can You Rent An Apartment After Bankruptcy