What Type Of Bankruptcy To File

Now that you understand the differences between Chapter 7 and Chapter 13 bankruptcy, you may be wondering who decides which chapter a debtor files.; You cant pick the one you prefer.; There is an aspect of the bankruptcy law called the Means Test, which dictates the chapter of bankruptcy the debtor files.; This can be a complicated area of the law, so it is always wise to get the help of an experienced bankruptcy attorney.

How Does Bankruptcy Work

Bankruptcy is a method to eliminate or at least reduce your debt when bills pile up beyond your ability to repay them. It should be viewed as a last resort to be considered only when all other potential courses of action to get back on track have been exhausted.

Individuals filing for bankruptcy mostly use either Chapter 7 or Chapter 13. The biggest difference between the two is what happens to your property:

- Chapter 7, which is known as liquidation bankruptcy, involves selling some or all of your property to pay off your debts. This is often the choice if you don’t own a home and have a limited income.

- Chapter 13, also known as a reorganization bankruptcy, gives you the chance to keep your property if you successfully complete a court-mandated repayment plan that lasts between three and five years.

Depending on where you live and your marital status, some of your property may be exempt from being sold when you file Chapter 7 because of state-specific and federal exemptions. With exemptions, whether they be your home equity, retirement accounts or even personal possessions such as jewelry, you receive the allowed exemption amounts, and the rest of the proceeds will be used to pay off debts. You can read more about potential exemptions, and check out this chart for a quick rundown on the two types:

| Chapter 7 |

|---|

- Child support or alimony

- Student loans

Can I File Bankruptcy

Bankruptcy may be the answer to your debt problems, but not everyone qualifies. Find out if you meet the requirements and can file for bankruptcy.

If you are faced with overwhelming debt, bankruptcy may be a solution for your problems. There are restrictions that control who can , so if you are wondering should I file bankruptcy, it is important to understand the rules when weighing your options.

Means Test

If you are interested in filing bankruptcy Chapter 7, the type of bankruptcy that completely wipes out most of your debts and lets you start fresh, you must pass a bankruptcy means test. The only people exempted from this are disabled veterans filing for bankruptcy to discharge debt incurred while they were on active military duty or people with debt that comes from operating a business. Everyone else must pass the means test.

Understand Median Income

The first step in the means test is monthly median income. If your current income is lower than your states median income for a household of your size, you immediately qualify to file. Income includes: wages, salary, tips, bonuses, commission, overtime, business income, interest, royalties, child support, spousal support, unemployment, workers comp, annuities, retirement income, rent, and dividends. It does not include Social Security retirement benefits or income tax refunds.

Find Your Disposable Income

Bankruptcy Means Test Calculator

Other Bankruptcy Requirements

About the Author

Read Also: Does Declaring Bankruptcy Affect Your Spouse

What Happens Once You File For Bankruptcy

Filing for bankruptcy has multiple consequences. The main one is the opportunity for a fresh start. Filing for bankruptcy allows you to discharge debts and reorganize your personal and business financial debts.

However, there are multiple consequences of filing bankruptcy that you should be aware of before you begin the process.

Some common consequences of filing for bankruptcy are:

- Reduction of credit score.

- Difficulty in obtaining new credit or credit cards.

- Difficulty in obtaining a mortgage.

- Possibility of losing property such as your home and/or car. Check here to see if you can keep your car after filing bankruptcy.

- Possibility of losing your cash. In Chapter 13 this will not happen, but under Chapter 7, you may be able to shelter up to $10,000.

We recommend that you seek specific advice to understand the consequences of the type of bankruptcy that applies to your particular case.

Types Of Bankruptcy In Canadapersonal And Small Business Or Corporate

There are two main types of bankruptcy in Canada: one is personal and the other is business. Whether youre considering filing bankruptcy as an individual or a business, you need to make an informed decision before pursuing this option. Theres a lot of information about bankruptcy that can help you decide if you should file or not.

You May Like: Epiq Corporate Restructuring Llc

Chapter 7 Bankruptcy Liquidation

The title of Chapter 7 is Liquidation, which is why a Chapter 7 bankruptcy is called liquidation bankruptcy. Assets are liquidated, or sold off, to recoup funds for creditors.

With this first type of bankruptcy, you sell off almost everything that you own, take that money, and pay what you can before you walk away debt-free. Chapter 7 bankruptcy is a way to hit the reset button and start over.

Are There Advantages To Filing Chapter 11

The biggest advantage is that the entity, usually a business, can continue operations while going through the reorganization process. This allows them to generate cash flow that can aid in repayment process. The court also issues an order that keeps creditors at bay. Most creditors are receptive to Chapter 11 as they stand to recoup more, if not all, of their money over the course of the repayment plan.

Also Check: What Is A Bankruptcy Petition Preparer

Being Discharged From Bankruptcy

When a debtor receives a discharge order, they are no longer legally required to pay the debts specified in the order. What’s more, any creditor listed on the discharge order cannot legally undertake any type of collection activity ;against the debtor once the discharge order is in force.

However, not all debts qualify to be discharged. Some of these include tax claims, anything that was not listed by the debtor, child support or alimony payments, personal injury debts, and debts to the government. In addition, any secured creditor can still enforce a lien against property owned by the debtor, provided that the lien is still valid.

Debtors do not necessarily have the right to a discharge. When a petition for bankruptcy has been filed in court, creditors receive a notice and can object if they choose to do so. If they do, they will need to file a complaint in the court before the deadline. This leads to the filing of an adversary proceeding to recover money owed or;enforce a lien.

The discharge from;Chapter 7 is usually granted about four months after the debtor files to petition for bankruptcy. For any other type of bankruptcy, the discharge can occur when it becomes practical.

The Personal Types Of Bankruptcies

The first type of personal bankruptcy most people talk about is Chapter 7 bankruptcy. With Chapter 7, you give your assets over to your creditors.

In exchange, your unsecured debts and some secured debts will get forgiven. The courts will also provide you legal protection from further collection actions done by your creditors to get their money back .

The other main individual type of bankruptcy is Chapter 13 bankruptcy. Instead of seizing your assets, the court will instead create a payment plan for you to follow every month over a few years to pay back your debts. Chapter 13 affords you a degree of protection from creditors as well.

In exchange for not seizing your assets though, the court gets to see your spending habits and regulate them strictly. Youre also ineligible for Chapter 13 bankruptcy if your unsecured debt exceeds around $419,000 and/or your secured debt exceeds around $1,257,000.

In some cases, individuals can file for Chapter 11 bankruptcy. This type involves figuring out how to cycle around your assets and keep you in the financial game while paying off your debts. However, theres a very high financial bar of entry: only those with a massive amount of assets can use Chapter 11 viably.

Also Check: How To File Bankruptcy In Wisconsin

Can Spouses File A Bankruptcy Together

Yes. The Bankruptcy Code allows spouses to file jointly for bankruptcy. The question of whether you and your spouse should file a bankruptcy together depends on whether you both are liable for the debts involved. You should remember that filing bankruptcy generally protects only the person who files for it.

Which Type Of Bankruptcy Is Best For You

When evaluating the different types of bankruptcies as an individual, youre most likely going to settle for either Chapter 7 or Chapter 13.;

Each type of bankruptcy offers alleviation from at least a partial amount of your debt through a bankruptcy discharge. However, each carries its own drawbacks.

Chapter 7 bankruptcy is usually a faster affair, resolving itself within half a year, and you dont need to deal with trustees since there isnt a repayment plan. The major drawback, if you have anything of value that is non-exempt, then its most likely going to be liquidated to repay the creditors.

Chapter 13 bankruptcy can be long and drawn out, most likely ending after five years from the submission of the petition. You will need to deal with trustees going over your spending since youll be under a new payment plan to reimburse your creditors. However, unlike Chapter 7 bankruptcy, youll be able to retain your property.

When choosing between the two forms, keep in mind that some types of debt cant be discharged by a bankruptcy judge. Debt such as alimony, child support, student loans, and income tax needs to be paid regardless of the Chapter you file.

Read Also: Chapter 7 Falls Off Credit Score

Benefits And Drawbacks Of Chapter 12 Bankruptcies

- The debt ceiling is substantially higher than other bankruptcy options.

- The process is simpler and more affordable than Chapter 11 bankruptcy.

- You must repay all of your secured debts if you have any remaining disposable income.

- At least half of your households income must be derived from fishing or farming.

Types Of Bankruptcies Explained

Ambika Taylor April 9, 2021GeneralComments Off on Types of Bankruptcies, Explained61 Views

March 2021 saw a significant rise in businesses filing for bankruptcy in courts, and its unclear whether or not this trend will continue to trend upward. In the event that it does, however, its important to familiarize yourself with the terms of bankruptcy in case misfortune strikes you or your company.

That said, bankruptcy isnt a one size fits all sort of deal: there are multiple types people can declare for different situations. But how can you figure out which one is which?

Well, look no further. Were here to give you our guide to all the different types of bankruptcies out there. Lets start by looking at the bankruptcies a person can declare.

Read Also: What Is Epiq Bankruptcy Solutions Llc

What Are The Disadvantages Of Filing Chapter 11

Chapter 11 bankruptcy is the most complex of all bankruptcy cases. It is also usually the most expensive form of a bankruptcy proceeding. For a company that is struggling to the point where it is considering filing for bankruptcy, the legal costs alone might be a bit onerous. Plus, the reorganization plan has to be approved by the bankruptcy court and must be manageable enough to where they can reasonably pay off the debt over time. For these reasons, a company must consider Chapter 11 reorganization only after careful analysis and exploration of all other possible alternatives.

Plus Info On The 2019 Small Business Reorganization Act

Most new small businesses dont survive and are faced with the decision concerning whether they should file for some form of business bankruptcy. Between 2005 and 2017, only about one-fifth of new small businesses survived more than one year. About half of those businesses continued on for up to five years, while only about one-third made it to 10 years.

Bankruptcy is a process a business goes through in federal court. It is;designed to help your business eliminate or repay its debt under the guidance and protection of the bankruptcy court. Business bankruptcies are usually described as either liquidations or reorganizations depending on the type of bankruptcy you take.

There are three types of bankruptcy that a business may file for depending on its structure. Sole proprietorships are legal extensions of the owner. The owner is responsible for all assets and liabilities of the firm. It is most common for a sole proprietorship to take bankruptcy by filing for Chapter 13, which is a reorganization bankruptcy.

Corporations and partnerships are legal business entities separate from their owners. They can file for bankruptcy protection under Chapter 7 or Chapter 11, which is a reorganization bankruptcy for businesses. The different types of bankruptcies are called chapters due to where they are in the U.S. Bankruptcy Code.

Also Check: How To File Bankruptcy In Wisconsin

Small Business Bankruptcy In Canada

If a small business is set up as a partnership or sole proprietorship and it ends up insolvent it will be treated like a personal bankruptcy.

The reason for this is that a sole proprietorship or partnership is legally the same as the individual that runs the business.

The assets of the business are not separate from the owners personal assets.

However, when a business is incorporated the business bankruptcy process will be quite different, and can become quite challenging.

An incorporated business and its assets and liabilities are their own legal entity and are separate from the business owner.

If your business is incorporated or a sole proprietorship / partnership we can help you find the trustee for filing bankruptcy who has extensive experience handling business bankruptcies in Canada.

Why Both Types Of Bankruptcy Change Your Life

No matter how you slice it, if you declare bankruptcy, your life will never be the same again. And the 10-year road to get back to normalcy is hard. We are definitely not financial advisors of any sort. But if you asked our opinion, it would be this We would personally only ever use bankruptcy to avoid repossession of everything in our life or avoid going to jail.

There is no feeling like being debt-free! You wake up feeling differently, you go to work feeling differently, your life seems brighter, and you are happier overall. There will be many who tell you bankruptcy is the way to achieve all that.

Those people are most likely only trying to get money out of you. If you meet someone who has been through the process and tells you that it is absolute bliss, first understand that no two bankruptcies are the same. Next, ask them a few questions. How is their living situation? When was the last time they rented a car? How high are their insurance rates, assuming they can find someone to insure them? How easy is it to buy something, anything, without cash in hand?

Don’t Miss: How Soon After Filing Bankruptcy Can I Buy A House

Small Business Bankruptcy In Canadasame As Declaring Personal Bankruptcy

No one wants to or expects to end up insolvent and unable to live up to their financial obligations. When a business is a sole proprietorship or partnership, its bankruptcy is essentially a personal bankruptcy. This is because the people are the business. Legally, the assets of the business are not separate from someones personal assets.

If a business is incorporated, then legally, the business and its assets are their own entity. If the business faces financial hardship and must consider insolvency options, the assets of the business are separate from the owners personal assets. Business bankruptcies can be quite involved, so contact us to get help finding a trustee in your area who has experience with business bankruptcies.

What Are The Types Of Bankruptcies

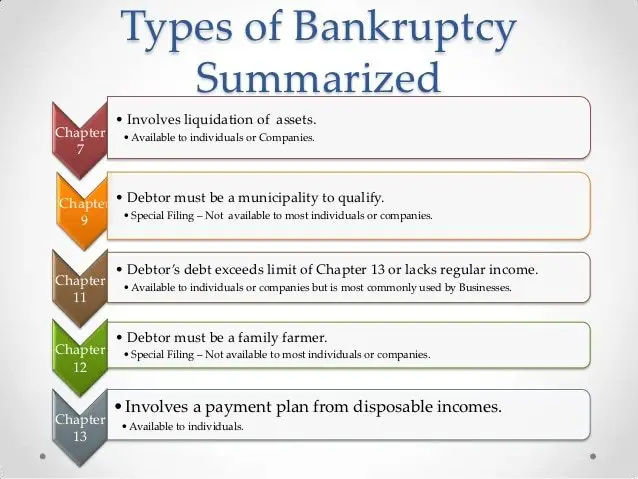

Even though the general goal of bankruptcy is to clear debt, not all bankruptcies are created equal. In fact, there are six different types of bankruptcies:

-

Chapter 7: Liquidation

-

Chapter 15: Used in Foreign Cases

-

Chapter 9: Municipalities

You may have just taken one look at this list and zoned out for second. Thats okay. More than likely, you would only be dealing with the two most common types of bankruptcies for individuals: Chapter 7 and Chapter 13. But well take a look at each type so youre familiar with the options.

Recommended Reading: Bankruptcy Falls Off Credit Report

Types Of Bankruptcies: Acts Of Bankruptcy

So what are they? A debtor commits an act of bankruptcy in each of the following cases:

- If in Canada or elsewhere the debtor makes an assignment of its property to a trustee for the benefit of its creditors.

- A debtor makes a fraudulent gift delivery or transfer of all or part of its property.

- The debtor makes any transfer of its property or any part of it that creates a charge on it that would be void as against a trustee and bankruptcy.

- If with the intent to defeat or delay creditors the debtor departs out of Canada and absence itself.

- If the debtor permits any execution or another process to be levied against it where its property is seized in order to be sold and the debtor does not redeem its property.

- If the debtor exhibits to any meeting of creditors a statement of assets and liabilities that shows the debtor is insolvent if the debtor removes disposes of property or attempts to do so intending to defraud defeat or delay creditors.

- If the debtor gives notice to any creditor that payments are being suspended or if the debtor ceases to meet its liabilities generally as they become do a bankruptcy application must be accompanied by an affidavit attesting to the debt and the alleged acts of bankruptcy