Why Consolidate Your Debt

- Potentially lower interest rates: If you have several credit cards with double-digit interest rates and you qualify for a debt consolidation personal loan at a lower rate, you can potentially save a lot of money in interest and fees.

- Sooner debt payoff: Combining all the debt into one bucket can make it easier to pay the debt off sooner, because you dont have to balance separate payments.

- Simplified finances: Credit card rates are variable, so your monthly payments differ depending on your balance, and it can be hard to know when your debts will be paid off. Debt consolidation puts everything into one place so you can keep track of it easier.

- Set repayment schedule: A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments stay the same. You dont have to worry about multiple due dates or varying payment amounts.

What Is Debt Consolidation

Debt consolidation is a sensible financial strategy for consumers tackling . Consolidation merges multiple bills into a single debt that is paid off monthly through a debt management plan or consolidation loan.

Debt consolidation reduces the interest rate on your debt and lowers monthly payments. This debt-relief option untangles the mess consumers face every month trying to keep up with multiple bills and multiple deadlines from multiple card companies.

In its place is a simple remedy: one payment to one source, once a month.

What Is A Debt Consolidation Program

Debt consolidation combines high-interest credit card bills into a single monthly payment at a reduced interest rate. Paying less interest saves money and allows you to pay off the debt faster.

Debt consolidation is available with or without a loan. It is an efficient, affordable way to manage credit card debt, either through a debt management plan, a debt consolidation loan or debt settlement program.

If you cant make more than minimum payments on your monthly credit card bills, a debt consolidation program is a very good way to regain control of your finances.

Read Also: What Happens When You File For Bankruptcy Chapter 11

Home Equity Line Of Credit

Some people use a home equity line of credit as a type of debt consolidation. This secured loan allows you to borrow cash against the current value of your home, using the equity youve built up in your home as collateral.

Equity is the difference between what you owe on the house and its market value. So, with a HELOC, youre basically giving up the portion of your home you actually own and trading it in for more debt so you can pay off your other debts. That right there is a debt trap! And those sneaky financial moves dont help you . . . they keep you in debt longer and put your house at risk!

Your Choices And Goals

No matter which method of debt consolidation you choose, remember the goal is to get out of debt and stay out of debt. Sustained behavioral changes, such as planning and sticking to a budget, saving up money to pay for large purchases and focusing on needs rather than wants, will help you reach your financial goals.

You May Like: Bankruptcy Attorney In Tampa

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Bank Of America Clean Sweep Debt Consolidation Pros

- One of the pros is that your interest rate can be reduced to as low as 8% or so. This rate is much lower than most people currently pay on their credit card bills and other loans that they may currently have outstanding. However, a con is the interest rate is a variable APR and this is expanded upon below.

- They will charge you a 3% transaction fee each time you need an advance. So if you take out only one advance, and you also have the lower 7 or 8% interest rate, this will still benefit you as that 3% fee will be a one time fee. So while there is a cost involved, the lower monthly interest expenses can often make it worthwhile. However, you cant take out multiple advances, as that fee is too high to keep paying it. And if you do not qualify for a competitive interest rate, than the 3% fee may be too much to pay.

- Some additional pros of this option from BofA include there is no collateral needed for this loan, so you are not mortgaging your home or personal possession! This will somewhat reduce your risk. You can prepay the loan, with no additional fees needing to be paid. Another added benefit of the debt consolidation loan is that you are building a re-accessible cash reserve as you pay down the balance. No annual fee is due, and you can get a decision within 15 minutes of applying.

Also Check: How Many Times Has Trump Filed Bankruptcy

Best Bank Of America Travel Card

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

The Bank of America Premium Rewards credit card is great for travel and dining purchases, which earn you 2 points for every dollar spent. You also earn 1.5 points on all other eligible purchases, and you can enjoy travel benefits you wont find with other Bank of America cards, including up to $100 in Airline Incidental Statement Credits annually.

- This card charges a $95 annual fee.

- There are no intro APR offers on purchases or balance transfers.

additional features

- This card charges a 3 percent foreign transaction fee.

- There is no rewards program for the card, decreasing its long-term value.

additional features

You May Like: Everfi Credit And Debt Answers

How Can I Build Or Repair My Credit

- Know what determines your score. Most credit scores are known as FICO Scores and are based on your credit reports.

- Pay your entire balance on time every month.

- Make sure your credit card limits donât exceed the money in your savings account.

- Try adding even a small amount to your minimum payment each month for bills, loans and debt.

- Review your credit reports every year.

- Donât open too many accounts at once.

See our Featured articles for more tips and resources.

Don’t Miss: Can You Put Medical Bills On Bankruptcy

Whats The Difference Between Debt Consolidation And Debt Settlement

Theres a huge difference between debt consolidation and debt settlement.

Weve already covered consolidation loans: a type of loan that rolls several unsecured debts into one single bill. But debt settlement is when you hire a company to negotiate a lump-sum payment with your creditors for less than you owe.

Sounds great right? Someone does the dirty work for you and you get to keep more of your paycheck? Not so fast. These debt settlement companies also charge a fee for their services, usually anywhere from 2025% of your debt! Ouch. Think about it this way: If you owe $50,000, your settlement fees would range from $10,00012,500.

And if thats not bad enough, dishonest debt settlement companies often tell customers to pay them directly and stop making payments on their debts. And while youre putting money into a separate savings or escrow account, your debt settlement company is sitting on their hands, waiting for the right time to negotiate your debtonly after you fork over the fee of course. And sadly, many of these companies dont even negotiate, leaving you stranded with even more debt.

Most of the time, these companies will just take your money and runleaving you on the hook for late fees and additional interest payments on debt they promised to help you pay!

How Debt Consolidation Loans Affect Your Credit

When you consolidate with a personal loan, you will notice the following changes in your credit report:

Here is how a debt consolidation loan may affect your credit score:

- The hard credit inquiry may decrease your score by a few points, but this will diminish over the next six months.

- The new loan account may decrease your credit age which measures the average age of your accounts.

- Your credit utilization ratio will be decreased significantly. While loans dont increase your credit limit, your current balances on all the cards you consolidate will drop to zero.

- Payments made on the loan will improve your payment history.

Don’t Miss: How To File Bankruptcy In Milwaukee Wi

Whats The Fastest Way To Get Out Of Debt

The fastest way to get out of debt is to get on a plan and stick to it. But before you see any life-change, youve got to decide its time to change the person in the mirror . If that feels overwhelming, we get it. But life-change starts with one small decision at a time, one day at a time.

Its definitely not easy, but its way easier when you have a plan! Put one foot in front of the other and keep moving. That plan is called Financial Peace University. Youll walk through nine lessons that show you everything from how to save for emergencies, how to pay off debt, and even how to save for the future. Nearly 10 million people have learned what it takes to win with money . . . and you can too.

Debt Consolidation As A Debt Relief Strategy

Although many people think so, debt relief doesnt have to mean youre in trouble. In the case of debt consolidation, it simply means your financial situation has become too complex to handle easily. When paying your creditors makes you feel like a multi-tasking octopus with not enough hands to pay out, debt consolidation might be the right choice for you.

Don’t Miss: What Happens When You File Chapter 7 Bankruptcy

Explore Your Debt Consolidation Options

- How it works: Once you know your numbers, you can start looking for a new loan to cover the amount you owe on your existing debts. If you’re approved for the loan, you’ll receive loan funds to use to pay off your existing debts. Then you start making monthly payments on the new loan.

- Consider your options. Wells Fargo offers a personal loan option for debt consolidation. With this type of unsecured loan, your annual percentage rate will be based on the specific characteristics of your credit application including an evaluation of your credit history, the amount of credit requested and income verification. Some lenders may have secured loan options which may offer a slightly lower interest rate, but keep in mind you are at risk of losing your collateral if you fail to repay the loan as agreed.

- Use our online tools. Wells Fargo customers can use the Check my rate tool to get personalized rate and payment estimates with no impact to their credit score. Funds are often available the next business day, if approved

Will Debt Consolidation Hurt My Credit Score

Consolidating your debt with a personal loan can help and hurt your credit score. When you use the loan to pay off your credit cards, you lower your credit utilization, which measures how much of your credit limit is tied up. Lowering your credit utilization can help your credit.

On the other hand, applying for a loan requires a hard credit check, which can temporarily ding your credit score. And if you turn around and rack up new credit card debt, your credit score will suffer.

Making late payments on your new loan can also hurt your credit score, while on-time payments can help.

» MORE: Pros and cons of debt consolidation loans

You May Like: How To File For Bankruptcy Chapter 7 In Ny

How Debt Consolidation Works

Debt consolidation is more of a process than a single solution. In fact, there are a range of financial products that allow you to consolidate debt. These include:

- Balance transfer credit cards

- Life insurance policy loans

Some of these products are better than others. For instance, in most cases you want to avoid borrowing against your 401 retirement plan or life insurance. Borrowing against your 401 can drain income youll need later in life and could significantly delay your retirement. Your life insurance policy is there to protect your family in case something happens to you.

Borrowing against home equity can also be risky for homeowners, as it can increase your risk of foreclosure. Its usually not advisable to borrow against your equity solely for the purpose of paying off credit cards and other unsecured debts. You essentially convent unsecured debt to secured.

However, if youre thinking about borrowing against your equity for other purposes, such as home renovations, you may consider using some of the funds to consolidate debt. If so, always consult with a HUD-certified housing counselor so you can understand the risks and weigh the benefits.

But for the purpose of this guide, well be focusing on the three most popular and unsecured ways to consolidate debtbalance transfers, consolidation loans, and debt management programs. Here is a detailed explanation of how each of these solutions works:

Work With A Debt Settlement Company To Set Up A Payment Plan On Your Reduced Debt

You pay the debt settlement company an affordable monthly payment. When youve submitted enough money to pay off the lowered loan amount, the company sends it to the creditor.

The company gets its share.The debt settlement agency will also take a cut of the savings it negotiated for you.

Say you have $50,000 in combined debt with personal lenders, credit card debts, and auto loans.

Cut the total debt in half. The debt settlement agency will contact all your creditors. It might talk them down to a total debt of $25,000.

Youll pay the debt settlement company a monthly installment to pay down the debt over an agreed upon period.

Every time your installments total enough to pay off one of your debts, the company will submit the payment.

Be prepared to pay the fee.In our $50,000 example, you will have to pay more than the renegotiated total of $25,000, since the debt settlement company needs its cut of the $25,000 in debt forgiveness it just saved you.

The fee youll get charged depends on how much money the company saved you.

Your credit score is going to take a beating.Although a debt settlement company is going to reduce your debt, your credit score is going to be battered since full payments were never received by your creditors.

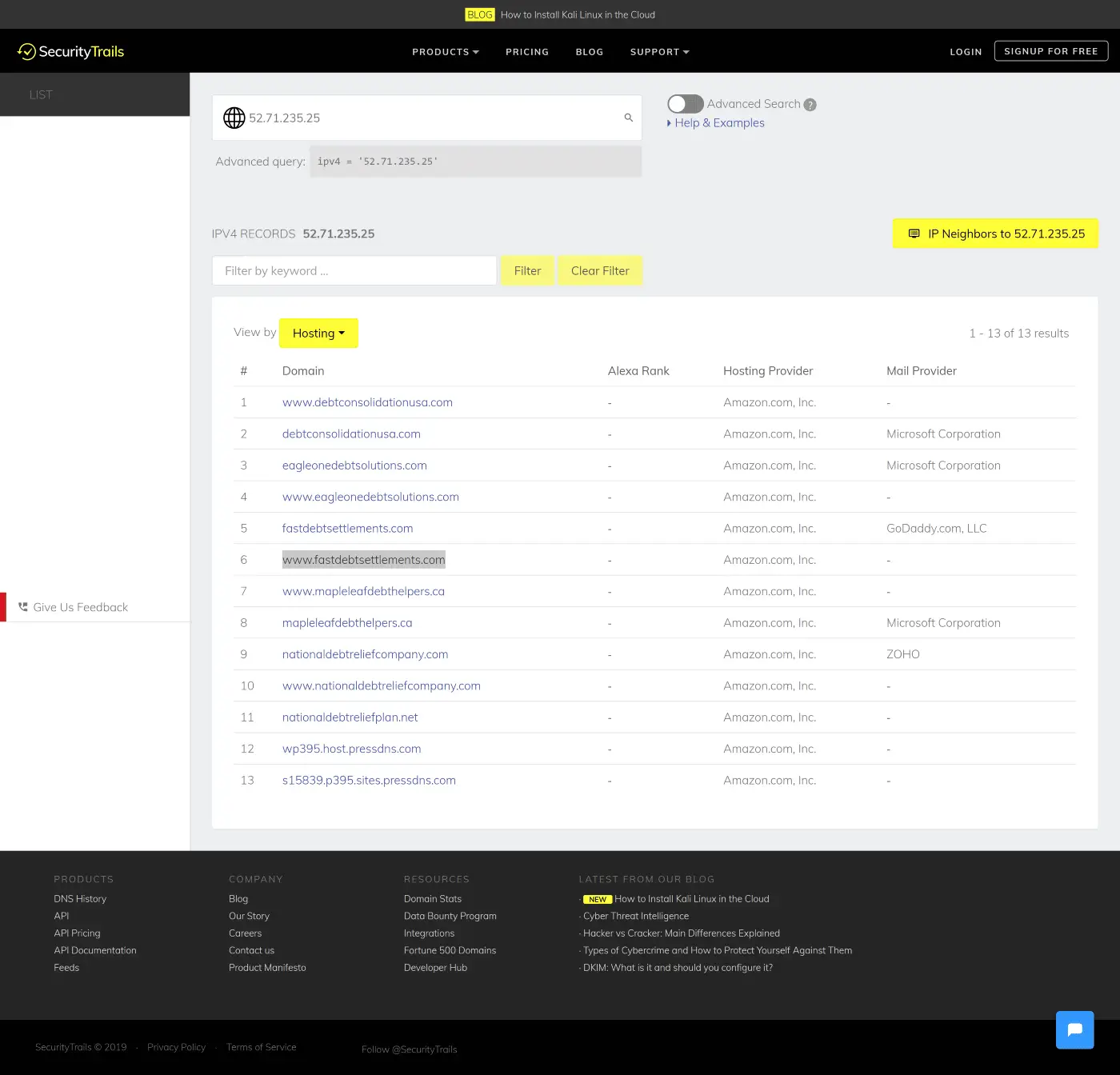

Watch out for sketchy companies.The internet can connect you to legit debt settlement companies. It could also lead you to some unethical companies set up to take advantage of people with out-of-control debt.

You May Like: Is My Ira Protected From Bankruptcy

How To Apply For Debt Consolidation Loans

While the process varies by lender, follow these general steps to apply for a personal loan:

- Check your credit score.Check your credit score for free through your credit card issuer or another website that offers free scores. This will help you understand your creditworthiness and qualification chances. Aim for a score of at least 610 however, a score of at least 720 will yield the most favorable terms.

- If necessary, take steps to improve your credit score. If your score falls below 610 or you want to boost your score to receive the best terms possible, take time to improve your score before applying, such as lowering your credit usage or paying off unpaid debts.

- Determine how much debt you need to consolidate. Once you check your credit score, calculate how much money you need to borrow to consolidate all of your debts. Remember, though, youll receive your money as a lump sum, and youll have to pay interest on the entire amountso only borrow what you need.

- Shop around for the best terms and interest rates. Many lenders will let you prequalify prior to submitting your application, which lets you see the terms you would receive with just a soft credit inquiry and without hurting your credit score.

- Submit a formal application and await a lending decision. After you find a lender that offers you the best terms for your situation, submit your application online or in person. Depending on the lender, this process can take a few hours to a few days.

Customized Debt Consolidation Loans

Here at National Debt Relief, we know everyones financial situation is different and thats why we customize every debt consolidation loan program. We pride ourselves on offering a program that isnt one size fits all. Instead, we take the time to analyze your specific financial needs and prepare a personalized debt consolidation loan quote that will lay out exactly how much you can expect to save.

Don’t Miss: How Long Does Bankruptcy Last In Australia