Shop Around For A Consolidation Loan

Be aware that some companies may offer consolidation loans with interest rates that are higher than the debts you are trying to consolidate. Make sure to shop around when youâre trying to consolidate your debt.

Different financial institutions may offer you different interest rates depending on the type of product you choose. For example, you may pay less interest on a line of credit than on a consolidation loan.

If you shop around for a consolidation loan, make sure you do so within a period of two weeks, so that it doesn’t affect your credit score.

How Do I Get A Debt Settlement Offer From My Credit Card

Your debt settlement offers should always be directed toward companies with which youve fallen behind on your payments. Start by calling the main phone number for your credit cards customer service department and asking to speak to someone, preferably a manager, in the debt settlements department.

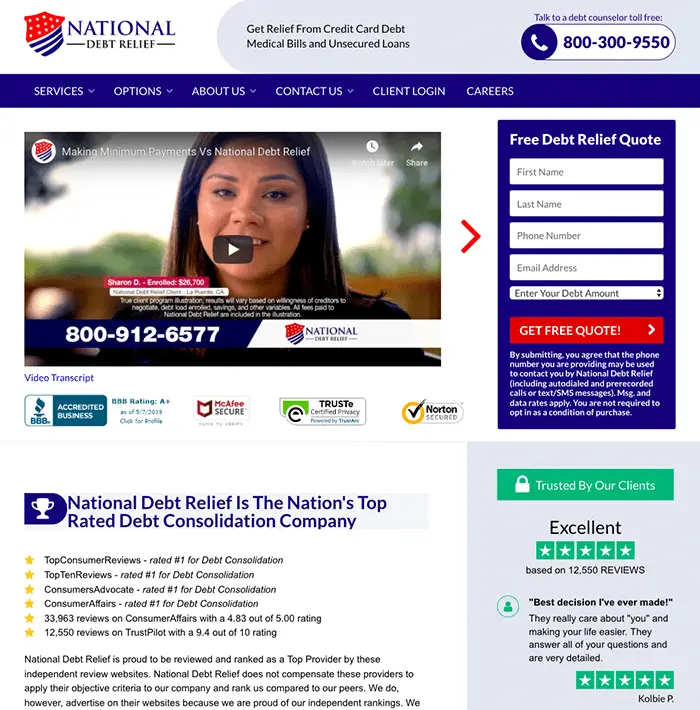

How Does National Debt Relief Work

National Debt Relief claims that its clients save 50 percent on average on their debts or 30 percent after paying the companys fees. However, only those with unsecured debt can qualify for this type of relief. People who wish to qualify must have at least $7,500 in qualifying debt to be considered.

Once youve been given the green light to use National Debt Relief, you will set up a payment plan. Then, you will begin making payments into a fund, which is insured to protect your investment. After you have built up a considerable amount, it will be used as leverage to try to settle with your debtors for a one-time lump sum of money.

If a settlement is reached, the payment will be sent and National Debt Relief will collect its fee from your account as well. There is no monthly fee for their services. Theyll take a portion of the money theyve saved you on each account instead.

National Debt Relief says it will handle any discussion with companies you owe money to and will advocate on your behalf.

Don’t Miss: What Happens When Bankruptcy Is Discharged

National Debt Relief: Qualifying For A Debt Relief Program

National Debt Relief offers a debt settlement program to help consumers who are struggling with their bills. Similar to other debt relief companies, here are their major requirements:

Financial hardship: If the creditor believes that you have the means to pay them back then they will have less incentive to negotiate a settlement. National Debt Relief looks if you are going through a financial crisis with no quick end in sight. Some of the common reasons are a recent job loss or reduction in hours, a separation or divorce which caused a reduction in income, unexpected medical or hospital bills, or death of a spouse.

Behind in payments: To qualify for a debt settlement program you need to be at least several months behind in your payments.

Ability to make a monthly payment: You need to be able to make a monthly payment to the program. In general, the monthly payment will be less than your current minimum payments. National Debt Relief builds its program around a 24-48 month period. If for example, you owe $10,000 in credit card debt, expect to pay about $156 per month for a four year program versus minimum payments of about $250.

Sufficient debt to warrant the program: Due to large overhead expenses, National Debt Relief requires you to enroll at least $7,500 in debt.

Debt Settlement: Freedom Financial

Why Freedom Financial stands out: Freedom Financial reports having resolved over $12 billion in debt since 2002, and the company offers a free, no-risk debt relief consultation to help you decide if its program is right for you.

- Eligible debt Freedom Financials debt relief program helps settle unsecured debts, including credit cards, outstanding medical bills and personal loans. You must have at least $7,500 in unsecured debt to qualify for its program.

- Fees Freedom Financial doesnt charge upfront fees. But if the company successfully negotiates a debt settlement for you, it typically charges a fee of 15% to 25% of your total debt. Fees can vary based on where you live.

- Client dashboard Freedom Financials client dashboard lets you track your progress so you can see how close you are to paying off your debt.

Recommended Reading: Can Utility Bills Be Discharged In Bankruptcy

Fees For National Debt Reliefs Services

National Debt Relief charges a fee of 18%-25% of enrolled debt. This means if you came into the program with $20,000 in debt, expect to pay NDR between $3,600 and $5,000 in fees. There may be additional service or maintenance fees to pay depending on your state.

Keep in mind that in 2010, the Federal Trade Commission made it illegal for debt settlement companies to charge upfront fees. If a company tries to weasel your credit card number out of you before establishing your eligibility for the program, its probably a red flag.

Forgiving Student Loans: Budgetary Costs And Distributional Impact

President Biden has previously expressed support for wide-scale federal college student loan debt forgiveness of up to $10,000 per borrower, potentially with some income eligibility qualification. Some members of Congress have expressed support for canceling up to $50,000 per borrower. Vice-President Harris recently stated that the Biden Administration will soon announce their intended policy on forgiving federal college student loan debt.

The United States already has several income-based repayment programs that cover major sources of federal college lending, including many forms of direct Stafford, direct PLUS, and FFEL loans.1 We estimate that actual take-up rates in income-based repayment plans range from 6 percent to 50 percent, depending on the loan size . Some previous studies that attempt to estimate the budgetary cost of debt forgiveness do not include any participation in IBR programs. Those studies, therefore, tend to over-estimate the total cost of debt forgiveness since the government will recoup some costs from lower future IBR subsidy rates. Alternatively, some previous studies assume full participation in existing IBR programs, which, conversely, tends to under-estimate the total cost of debt forgiveness.

Our estimate includes the income-based repayment programs under current law using current take-up rates. We also consider the cost of one time forgiveness of existing student debt as well as the cost of continuing forgiveness over the next decade.

Don’t Miss: What Debts Can Be Discharged In Bankruptcy

Is Debt Settlement Bad

If youre deeply in debt, youre probably aware of offers from debt settlement companies that promise to help you settle debt for some small portion of the total amount you owe. They often claim that a debt settlement plan can enable you to settle tens of thousands of dollars in debt for just a few hundred bucks. In practice, debt settlement is rarely so easy, but it does work for some consumers. But is debt settlement bad when it comes to your credit rating and how financial institutions view your credit worthiness? Heres a brief look at the question Is debt settlement bad?

How Does Debt Settlement Affect Your Credit Score

Debt settlement offers a way to pay off debts for less than the amount that you owe and a way to become more financially secure. But this road to financial security can come with some bumps. One of those potential bumps: a hit to your credit score.

While debt settlement affect your credit score for a period of time, it also might put you closer to whipping your credit into shape and eventually raising your credit score.

Read Also: How Long Before Filing Bankruptcy Again

Freedom Vs National: Which Is The Best Debt Relief Company

| Monday through Saturday |

Debt is not a necessary evil that’s just a part of life.

You can conquer debt, and a debt relief company is a great way to start. Though National Debt Relief does have slightly lower average fees and provides debt relief services to more states, Freedom Debt Relief has greater customer satisfaction, more glowing debt relief reviews, better accessibility, and has been in business for a much longer time.

The final decision is up to the customer, but there’s a reason Freedom Debt Relief is ranked number one for debt relief programs on Best Company: over 10,300 positive reviews from satisfied customers resulting in 4.7/5 stars.

So, if Freedom Debt Relief wins over National Debt Relief, how does it compare to some of the other companies in the industry?

How Involved Will I Be In The Debt Relief Process

Though debt relief customers might be tempted to just hand over their financial reins to a debt management company, it is vital to be involved in the process from start to finish.

Customers should seek not only to alleviate debt but also to nurture habits that lead to a debt-free life. When approaching a debt relief company, ask how much you can be involved in the relief process this could be a good sign that you’ve found the right debt relief company.

|

Freedom Debt Relief offers customer support and information for non-clients seven days a week. Additionally, customers can monitor their progress 24/7 through an online Client Dashboard. They can see which debts are being negotiated next and manage account information. |

National Debt Relief offers customer support for current clients Monday through Friday. Non-clients can reach the company Monday through Saturday. |

Read Also: How To File For Personal Bankruptcy In California

Is Debt Settlement Bad Compared To Debt Management

Debt management also has little to no impact on your credit score. Thats because, under a debt management plan, youll continue making payments to your creditors until you have paid off your debt over time usually in 60 months or less. Also, youll be working with a credit counseling agency to develop the skills youll need to avoid debt in the future.

To learn more about debt management, schedule a free credit counseling session with a certified credit counselor from American Consumer Credit Counseling, a nonprofit company working to help people just like you find the best way out of debt.

One of America’s leading non-profit debt consolidation companies, American Consumer Credit Counseling provides and debt management solutions to consumers who are struggling with credit card bills and other types of unsecured debt. Unlike some debt relief companies, we can help you consolidate your credit without having to take a . If you’re wondering how to consolidate debt in the more prudent, effective way, contact us for a free consultation with one of ACCC’s consolidation counselors. Be sure to check out our debt consolidation reviews to hear from our customers what makes ACCC such a trusted and effective debt consolidation company.

How Do We Make Money As A Debt Settlement Company

Here is a list of our partners and heres how we make money. National Debt Relief is a debt settlement company that negotiates on behalf of consumers to lower their debt amounts with creditors. The company says consumers who complete its debt settlement program reduce their enrolled debt by 30% after its fees, according to the company.

Read Also: How To File Personal Bankruptcy In Ct

Running Up Credit Card Balances Again

Debt consolidation loans can take away the oppressive burden of overwhelming debt very quickly, but if consumers are undisciplined, they could find themselves in worse trouble.

When consumers go through the hard work of paying off their debt payment by payment, they learn valuable lessons. Chances are strong that they will be less likely to run up their debt again. However, with a debt consolidation loan, it can be all too easy to continue to spend and live above ones means.

Consumers that take a debt consolidation loan to pay off their debt and then continue to accumulate debt on credit cards can spend their way into financial ruin. If theyve used their home to obtain a loan, they could put their most valuable asset at risk.

National Debt Relief Review: Does Debt Settlement Work

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

National Debt Relief is a debt settlement company that negotiates on behalf of consumers to lower their debt amounts with creditors.

Consumers who complete its debt settlement program reduce their enrolled debt by 30% after its fees, according to the company.

But NerdWallet cautions that debt settlement, whether through National Debt Relief or any of its competitors, is risky:

-

Debt settlement can be costly.

-

It can destroy your credit.

-

It takes a long time. Getting any net benefit requires sticking with a program long enough to settle all your debts often two to four years.

NerdWallet recommends debt settlement only as a last resort for those who are delinquent or struggling to make minimum payments on unsecured debts and have exhausted all other options. For many consumers, bankruptcy is a better option as it offers a faster route to resolving debt. And bankruptcy generally protects consumers from being sued, which is a risk while enrolled in a debt settlement program.

Also Check: How To File Bankruptcy For Free

How Does Debt Relief Work

Here is a breakdown of the different plans that fall under the debt relief banner.

The objective of each of these methods is to get a handle on your mounting debt by reducing or eliminating your outstanding balancesbut that doesn’t mean they are all good options. Debt can be stressful, but it is important to do research and understand your options so you don’t choose a debt relief method that could hurt you even more in the long run.

Benefits Of Debt Settlement

If a creditor being willing to accept a percentage of what you owe and cancelling the rest of the debt sounds too good to be true, it often is exactly that. Outside the debt settlement industry, debt settlement is viewed as risky business for consumers in part because it can be a playground for scam artists. In some cases, that life preserver tossed your way wont keep your head above water.

But consumers reasonably considering debt settlement also recognize they have limited options. And the benefits for those people are worth consideration.

Read Also: Can You Buy A House With Bankruptcy On Your Record

Assessing Debt Reliefs Fiscal And Cash

Earlier this week, the President announced the Administrations plan to forgive student debt for those who need it most.

Cash-Flow Impact

One way to assess the cost of student loan debt relief is by focusing on the impacts to expected annual student loan repayments. This effect on cash flows is distinct from the official budgetary impact , however the cash flow effect is what matters when it comes to federal borrowing and the national debt. Since many borrowers pay off their student loans over several years, if not decades, the annual impact from reducing or eliminating those loans on federal borrowing is spread out over a lengthy period of time.

Assuming a take-up rate of 75 percent, we estimate that over the decade from 2023-32, the average cash flow impact will be approximately $24 billion annually. This estimate is based on data from the Department of Education, and would necessarily change based on new data on actual take-up and several other factors.

Multi-Year Budgetary Impact

As noted above, this score will show the long-term cost to the government, which will include costs that extend beyond the usual 10-year budget window. As a result, comparing this score to the 10-year score of other policiessuch as the Inflation Reduction Act is misleading. A more instructive comparison would be to compare the score of the Administrations targeted debt relief plan to the lifetime savings from the IRA, or at least the two-decade savings that bill will produce.

How Does Wage Garnishment Affect Your Credit Report

Since 2017, the three major credit bureaus Equifax, Experian, and TransUnion have had a policy of removing civil judgments and tax liens from the public record section of all credit reports.

Experian notes that courts dont send in information regarding wage garnishments. But this doesnt mean a garnishment wont have an impact on your score.

The delinquent account that caused your wages to be garnished will likely still appear on your credit report, and the creditor may add a notation that a wage garnishment has been used to obtain payments on the credit card debt.

While this may hurt your score, its important to note that by the time a court has ordered your wages to be garnished, its fairly certain that your credit score has already been heavily damaged by your failure to pay your credit card debts.

Also Check: How Does Bankruptcy Affect Tax Return

Talk To Your Creditor

If you are having trouble meeting your loan repayments, its important to get in contact with your credit or service provider early. Taking action quickly will help a small problem from turning into a big one.

You should start by telling your credit or service provider that you are experiencing financial difficulty. Many providers have hardship programs that are designed to help support you through moments like these.

You may be able to reach the following arrangements with your provider:

- more time to pay

- a flexible payment arrangement

- a smaller payment to settle the debt.

Some of these options may be legally enforceable and you may wish to seek your own independent advice before making a decision.

Working With National Debt Relief

How to qualify: National Debt Relief works with consumers who have at least $7,500 and up to $100,000 in unsecured debt from credit cards, personal loans and lines of credit, medical bills, business debts and private student loan debts.

National does not settle debt from lawsuits, IRS debt and back taxes, utility bills or federal student loans. It can’t settle auto or home loans, or other types of secured debts .

The average client has more than $20,000 in total debt, according to Grant Eckert, chief marketing officer at National Debt Relief. National does a soft credit pull during the application process to verify your creditors and outstanding balances owed on each debt, according to Eckert. A soft credit pull does not affect your credit score.

Due to varying state regulations, National is not available in these states: Connecticut, Georgia, Kansas, Maine, New Hampshire, Oregon, South Carolina, Vermont and West Virginia.

The debt settlement process: Once you hire National Debt Relief, you open a separate savings account in your name. Then, rather than paying your creditors, you deposit a monthly payment to this account. National determines the monthly payment level, which is often lower than the total monthly payments on customers unsecured debts.

Ceasing payment to your creditors means you become delinquent on your accounts, accruing late fees and additional interest, and your credit score will tumble.

Read Also: Can Irs Debt Be Included In Bankruptcy