How To Calculate Your Dti

We talked a lot about debt-to-income ratios in this article. Knowing yours is key to learning how much house you can afford.

So, in case you were wondering, heres how you can calculate your own DTI ratio for mortgage qualifying.

- First, add up all the monthly expenses included in your DTI:

- Estimated monthly housing expenses

- Minimum credit card payments

- Obligations like alimony and child support

Next, you need to know your gross monthly income.

Remember, thats the highest figure on your pay stub, before deductions for tax and so on. If your income varies considerably perhaps seasonally use an average over the last year or two.

Now, divide the first figure by the second .

Federal regulator the Consumer Financial Protection Bureau gives an example:

If you pay $1,500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000.

If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

If you use a calculator, youll need to multiply the result by 100 to get a percentage. So your display says 0.3333 but your DTI is 33.33% .

Fannie And Freddie Minimum Income Guidelines

When underwriting conventional mortgage loans, most lenders follow the guidelines of Fannie Mae and Freddie Mac.

Fannie and Freddies list of acceptable income documentation is extensive, but it isnt set in stone. For example, if you have a relationship with a bank that knows your history and thinks youre good for a loan, you might be able to secure a mortgage without meeting every standard requirement.

Navy Federal Credit Union is an example of an institution that considers a customers relationship with the institution.

Were open to considering loans for customers who might not meet normal standards, says Randy Hopper, former senior vice president of mortgage lending with the credit union.

There are also borrower programs that deviate from standard income requirements.

For example, FHA loans have no specific income requirements. For these loans, lenders look at how much income is eaten up by monthly bills and debt service, as well as your employment track record. A borrowers salary doesnt play a big role in FHA underwriting, though typically, a lender will assess applicants with higher salaries as less-risky borrowers.

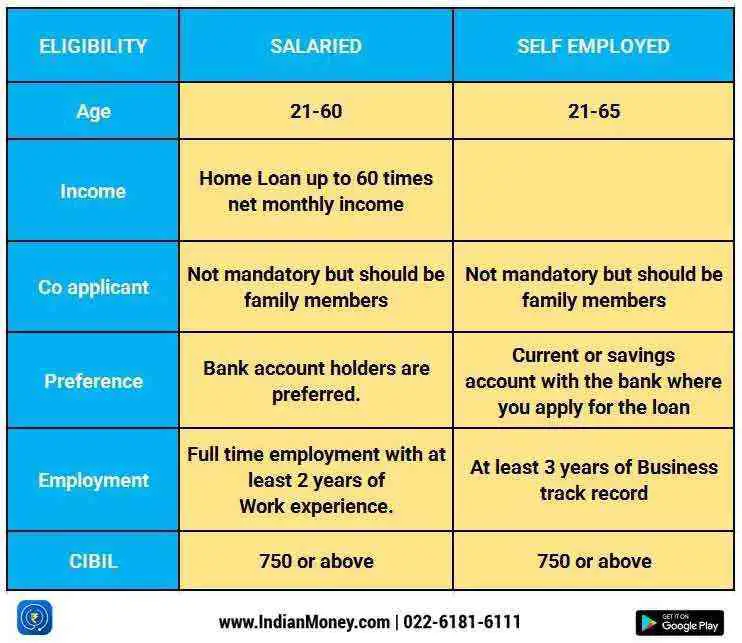

Borrowers reporting income from second jobs must provide tax documents in support. Those who are self-employed usually have to show proper tax documents and complete Fannie Maes Cash Flow Analysis, or another similar tool as part of their application.

For the most part, however, borrowers should have these documents are in order:

How Long Do I Need To Show Income For A Mortgage

The standard qualification rules for a conventional mortgage, the more popular mortgage type, generally require at least two years of employment history. There are, however, circumstances where a lender would work with a borrower outside of this standard. Other loan types, such as FHA or VA loans, the requirements will differ by lender.

Recommended Reading: Can You File Bankruptcy On Attorney Fees

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

What Percentage Of Income Do I Need For A Mortgage

A conservative approach is the 28% rule, which suggests you shouldn’t spend more than 28% of your gross monthly income on your monthly mortgage payment.

Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage. Outside of credit score, lenders typically look at your debt-to-income ratio, which compares your monthly debts, including the prospective mortgage payment, to your expenses. With lenders looking at income and expenses, our mortgage calculator provides a great option when determining what you can potentially afford.

Recommended Reading: Bank Repo Houses For Sale

The Conservative Model: 25% Of After

On the flip side, debt-despising Dave Ramsey wants your housing payment to be no more than 25% of your after-tax income.

Your mortgage payment should not be more than 25% of your take-home pay and you should get a 15-year or less, fixed-rate mortgage Now, you can probably qualify for a much larger loan than what 25% of your take-home pay would give you. But its really not wise to spend more on a house because then you will be what I call house poor. Too much of your income would be going out in payments, and it will put a strain on the rest of your budget so you wouldnt be saving and paying cash for furniture, cars, and education.

Notice that Ramsey says 25% of your after-tax income while lenders are saying 35% of your pretax income. Thats a huge difference! Ramsey also recommends 15-year mortgages in a world where most buyers take 30-year mortgages. This is what Id call conservative.

Another reader put it this way:

- Your mortgage payment should be equal to one weeks paycheck.

- Your mortgage payment plus all other debt should be no greater than two weeks paycheck.

Thats on the conservative side, too. One weeks paycheck is about 23% of your monthly income.

How Much Do I Need To Make For A $750000 House

A $750,000 house, with a 5% interest rate for 30 years and $35,000 down will require an annual income of $183,694.

We’re not including additional liabilities in estimating the income you need for a $750,000 home. Use our required income calculator above to personalize your unique financial situation.

You May Like: What Happens At The End Of Chapter 13 Bankruptcy

Mortgage Required Income Calculator

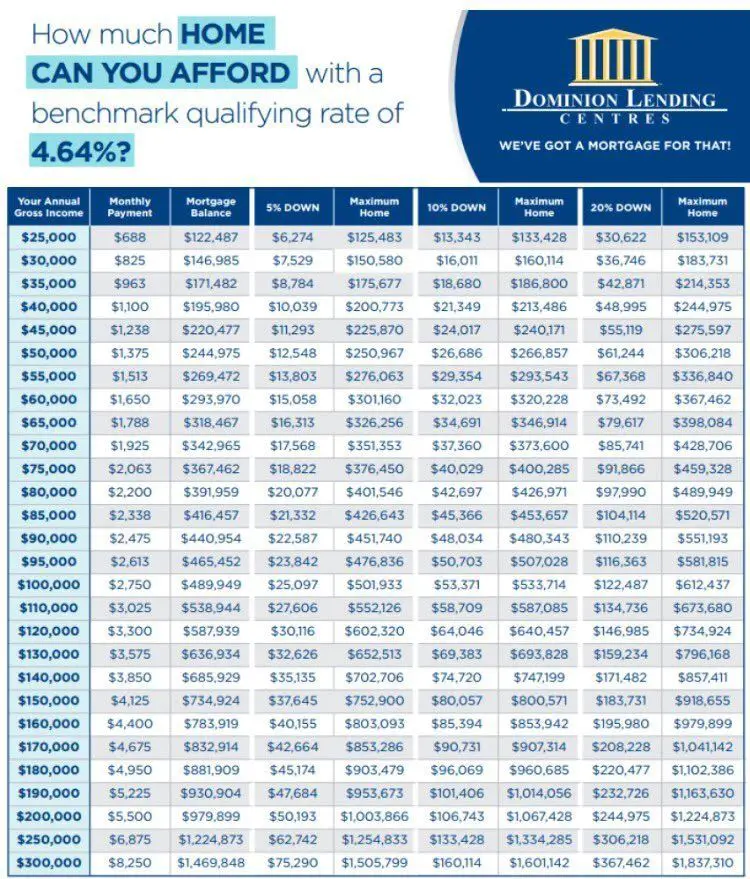

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately 41%.

The amount a borrower agrees to repay, as set forth in the loan contract.

Can I Get A Mortgage If I Have Debt

Having some degree of debt like an auto loan doesnt disqualify you from getting a mortgage. But your DTI certainly will influence how a lender evaluates your loan application. Generally speaking, a lender wont approve you for a mortgage if your DTI is above 43%.

Personally, I advise you to hold off on a mortgage until your DTI is below 40% max. And a 33% DTI is an even better goal before applying for a mortgage. Going into a mortgage with a lower DTI gives you more financial breathing room in the event that unexpected expenses pop up.

Also Check: Average Cost Of Bankruptcy

Do Earnest Clients Follow The 30% Rule

To address the first question, Earnest took a look at our dataset of more than 15,000 student loan applicants.1 We found that at salary levels below $30,000, spending above 30% of gross income on housing is the norm.

At incomes above $30,000, however, Earnest applicants increasingly have lower monthly expenses than the benchmark down to around 10% of their gross incomes for the wealthiest renters. This reflects the economic idea that a persons generally decreases with increasing income. In other words, if your income doubles, youll likely start spending more, but not a full two times more.

Among Earnests loan applicants, people making around $30,000 happen to be following the 30% Rule, but generally, most people are paying much more or much less.

House Affordability Based On Fixed Monthly Budgets

This is a separate calculator used to estimate house affordability based on monthly allocations of a fixed amount for housing costs.

In the U.S., conventional, FHA, and other mortgage lenders like to use two ratios, called the front-end and back-end ratios, to determine how much money they are willing to loan. They are basic debt-to-income ratios , albeit slightly different and explained below. For more information about or to do calculations involving debt-to-income ratios, please visit the Debt-to-Income Ratio Calculator.

Because they are used by lenders to assess the risk of lending to each home-buyer, home-buyers can strive to lower their DTI in order to not only be able to qualify for a mortgage, but for a favorable one. The lower the DTI, the more likely a home-buyer is to get a good deal.

Recommended Reading: Can You File Bankruptcy On A Judgement

What Is Considered A Good Debt

Lenders consider different ratios, depending on the size, purpose, and type of loan. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and guidelines vary, most lenders like to see a DTI below 3536% but some mortgage lenders allow up to 4345% DTI, with some FHA-insured loans allowing a 50% DTI. For more on Wells Fargos debt-to-income standards, learn what your debt-to-income ratio means.

Lower Your Monthly Debt Obligations

Temporarily prioritize debt payments over savings and investment account contributions, other than any employer-sponsored plan contributions you must make to qualify for your employer match. Throw as much money as you can at smaller debt balances that you can zero out quickly, Martucci advises. Eliminating these payments and accounts will reduce your DTI ratio.

Read Also: When Do You File For Bankruptcy

How Much House Can I Afford Home Affordability Calculator

To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment.

Generally, lenders cap the maximum amount of monthly gross income you can use toward the loans principal and interest payment to not more than 28% of your gross monthly income and traditionally limit your total allowable debt-to-income ratio to not more than 36%. This final figure includes the mortgage loans principal and interest payments, plus taxes, insurance and any other debts you are required to repay.

Prequalifying for a mortgage is simple, and is intended to give you a working idea of how much mortgage you can afford. Combine this amount with your down payment, and you’ll answer your question of how much house can I afford? This is not the same as being preapproved for a mortgage loan, which involves borrowers placing an application and providing documentation to a lender, who will formally evaluate your financial situation.

Remember — this is just a guide. Your final amount will vary depending on a number of factors, especially interest rate, which will be based on your credit score. When you’re ready, a lender can give you a more precise figure.

Dti Formula And Calculation

The debt-to-income ratio is a personal finance measure that compares an individualâs monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individualâs ability to manage monthly payments and repay debts.

Also Check: Can You File Bankruptcy Without Tax Returns

How Do Lenders Determine What I Can Afford

These are the major factors mortgage lenders weigh to determine how much mortgage a borrower can reasonably afford:

- Gross income Your gross income is your total earnings before taxes and other deductions are factored in. Other sources of income, such as spousal support, a pension or rental income, are also included in gross income.

- DTI ratio Your DTI ratio is your total monthly debt obligations divided by your total gross income.

- Your credit score is a major factor lenders look at when evaluating how much you can afford. In general, the higher your credit score, the lower your interest rate, which impacts how much you can feasibly spend on a home.

- Work history Lenders look for a stable source of income to ensure you can repay your mortgage. When you apply for a loan, youll be asked to provide evidence of employment from at least the past two years. If you work for yourself, youll be asked to provide tax returns and other business records.

What Happens If You Default

Ten years ago, there was a terrible problem with people getting overextended & defaulting on loans. The problem was that low variable interest rate loans fueled speculators that got burned when the rates increased as they tried to roll into a fixed rate. The ugly truth for those people was that they either ended up doing a short sale or having their homes foreclosed upon because in many housing markets the price of homes shaply declined. Today, when your home value doesn’t match your loan, you are considered to be under water. If you owe more than your home is worth because it dropped in value and you have a variable rate loan, you will not be able to roll it to a fixed rate loan, leaving you with a sad decision to make.

Fortunately, while select cities like Toronto & Vancouver have ran up in prices, most of the housing market in Canada rarely contains bubbles. If you focus on getting the best fixed rate loan that you can & don’t chase prices in the few core hot markets, you will likely never experience the type of trouble that people had during that time period.

If you are unsure if you are running ahead of yourself, check out Garth Turner’s Greater Fool blog, which details some of the recent astromical home price rises seen in parts of Vancouver & Toronto, along with the justifications people make while over-extending themselves.

Also Check: How Do You Recover From Bankruptcy

What You Qualify For Vs What You Can Afford

Though the above steps can give you a good idea of what you can afford, the number you come up with may not match what a mortgage lender deems you’re eligible for when you apply.

Mortgage lenders base your loan amount and monthly payment on several factors, including:

When you apply for a mortgage loan, your lender will give you a loan estimate that details your loan amount, interest rate, monthly payment and total loan costs. Loan offers can vary greatly from one lender to the next, so you’ll want quotes from a few different companies to ensure you get the best deal.

How Much House Can You Afford The 28/36 Rule Will Help You Decide

You found your dream home, but can you safely afford it? Before you commit to the biggest financial decision of your life, consider the 28/36 rule.

The rule is used by lenders to determine what you can afford, according to Ramit Sethi, best-selling author of I Will Teach You to Be Rich.

Its used by lenders, but its also a really helpful tool for us as individuals to decide how much debt we can afford, Sethi tells NBC News.

The rule is simple. When considering a mortgage, make sure your:

- maximum household expenses wont exceed 28 percent of your gross monthly income

- total household debt doesnt exceed more than 36 percent of your gross monthly income .

In other words, if your maximum household expenses and total household debt are at or lower than 28/36, you should be able to safely afford the home.

Don’t Miss: What Happens When You Declare Bankruptcy In Monopoly

Calculating Your Mortgage Payment

This mortgage calculator can answer some of the most challenging questions in the home search journey, short of talking to a lender, including what kind of payment can I afford? How much do I need to make to afford a $500,000 home? And how much can I qualify for with my current income?

We’re able to do this by not only considering the loan amount and interest rate but the additional factors that affect your ability to qualify for a mortgage. We include your other debts and liabilities that have to be paid each month and costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment. Doing so makes it easy to see how changes in costs and mortgage rates impact the home you can afford.

While determining mortgage size with a calculator is an essential step, it won’t be as accurate as talking to a lender. Get pre-approved with a lender today for exact numbers on what you can afford.

Salary Is A Poor Indicator Of Mortgage Affordability

Lets suppose your salary is $100,000 a year. You could, by this rule of thumb, afford a mortgage of between $200,000 and $250,000.

But one person on that income may have much less left at the end of each month than another.

For example, lets assume that one is a real estate agent with a big auto loan and credit card balance from expensive lifestyle choices. Theres nothing wrong with any of that if he can afford it.

But another person with the same household income may have a much lower cost of living. Maybe hes a freelance graphic designer who drives a paid-off car. His wardrobe costs a few hundred a year to maintain and he zeroes his card balances every month.

These two people have significantly different available income to pay towards a mortgage. So pre-tax income on its own doesnt capture the whole picture.

Read Also: Chapter 7 Bankruptcy Lawyers