Tracking The Federal Deficit: May 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $132 billion in May, the eighth month of fiscal year 2021. Mays deficit was the difference between $463 billion of revenue and $596 billion of spending. To note, May spending was impacted by May 1 falling on a weekend, shifting certain payments into April that are normally paid at the beginning of May. If not for these timing shifts, the May deficit would have been $192 billion.

So far this fiscal year, the federal government has run a cumulative deficit of $2.1 trillion, the difference between $2.6 trillion of revenue and $4.7 trillion of spending. This deficit is 10% greater than at the same point in FY2020when only three months of pandemic-related spending had occurredand 179% greater than at this point in FY2019.

Analysis of notable trends: The pandemic response continues to disrupt normal spending and revenue patterns. Individual income taxes are usually paid in April however, in both 2020 and 2021, the federal government pushed back Tax Day due to COVID-19. This year, individual income taxes were due on May 17, compared to July 15 in 2020. Additionally, this year, estimated quarterly tax payments were due in April, whereas they were due in July in 2020. These shifting dates must be taken into account when considering year-over-year deficit comparisons.

Building The American Future

Its obvious that the fiscal path were on is unsustainable and dangerous, threatening the future that we all want for our nation and our children. Despite clear warnings, policymakers have failed to show leadership, unwilling to make responsible, forward-looking decisions to do right by the next generation.

Fortunately, there is a better path, and many solutions exist. A sustainable fiscal outlook will give our economy the best chance to succeed, creating the conditions that encourage economic growth. A stable path enables an environment with greater access to capital, increased public and private investment, enhanced confidence, and a reliable safety net. Those factors, in turn, create a more vibrant economy with rising wages, greater productivity, and expanded opportunities for Americans.

The theologian Dietrich Bonhoeffer said: The ultimate test of a moral society is the kind of world that it leaves to its children. This idea underpins the American Dream that is so central to our democracy and our society. Our leaders have a critical opportunity and responsibility to fulfill their moral obligation to future Americans by looking beyond the next election, and thinking instead about the next generation.

Tracking The Federal Deficit: December 2020

The Congressional Budget Office estimates that the federal government ran a deficit of $143 billion in December, the third month of fiscal year 2021. This deficitthe difference between $346 billion of revenue and $489 billion of spendingwas made greater because January 3 fell on a Sunday, causing some payments normally made on that day to instead be made in December. If it were not for this timing shift, Decembers deficit would have been $96 billion, still $55 billion greater than that of December 2019. The deficit so far in fiscal year 2021 has climbed to $572 billion, which is $215 billion more than at this point last year. While revenues in these months were nearly unchanged from last year, outlays have grown by 16% .

Analysis of notable trends: December extended the pattern of fiscal year 2021, with little year-over-year change in revenue but a 17% rise in spending. Of all outlays, unemployment insurance benefitswhich totaled $3 billion last December but $28 billion this Decembercontributed the most to the spending increase. This has been a trend: Unemployment insurance benefits have caused almost 40% of greater cumulative spending from this point last year, soaring from $7 billion in the first three months of fiscal year 2020 to $80 billion so far this fiscal year. Decembers spending on Medicaid and Social Security benefits further added to the deficit.

Revenues rose 3% from last December, thanks to greater individual income and payroll tax receipts.

Recommended Reading: Why Is My Bankruptcy Still On My Credit

Fiscal Year 2021 In Review

The federal government ran a deficit of $2.8 trillion in fiscal year 2021, the difference between $4.0 trillion in revenues and $6.8 trillion in spending. This deficit was 12% lower than in fiscal year 2020, due to revenue increases outpacing expenditure growth. The FY2021 deficit, however, was almost three times that of FY2019 , as federal COVID-19 relief spending has continued to drive outlays to record highs. This years deficit amounted to approximately 13% of GDP, the second largest deficit as a share of the economy since 1945. Revenues tallied 18% of GDP, while spending rose to 30% of GDP.

Receipts totaled $4.0 trillion in FY2021an 18% year-over-year increasereflecting the general strength of the economy during the initial stages of the pandemic recovery. Individual income and payroll tax revenues together rose 15%, due to a combination of higher wages, increased employment, and payroll taxes that had been deferred by most employers from 2020 to 2021 per the CARES Act of March 2020. Corporate tax revenues increased by 75% in part due to higher corporate profits, and unemployment insurance receipts increased by 31% as states replenished their unemployment insurance trust funds.

Is The National Debt A Problem

The subject of government borrowing is controversial both politically and economically.

While it is a truism that an economy and a government cannot sustainably spend more than it earns indefinitely, the idea that government must maintain a balanced budget each year, has been long consigned to the dustbin of UK economic history.

Controversy therefore attends to the question of whether any given level of borrowing is sustainable, and for how long. Discussions around these points invoke a range of different perspectives:

The ability to live with the national debtDespite the national debt rising by £1.5 trillion in the period 2000 to 2020, and despite it being set to rise by a further £1 trillion as a consequence of the coronavirus pandemic, the national debt expressed as a proportion of GDP still remains lower than it did in the aftermath of the Second World War.

And although national debt as a proportion of national output in the UK is higher than in Germany, it currently remains below the equivalent figures for both France and America.

As detailed above, the current period of low interest rates, also continues to make the servicing of the national debt relatively affordable. And although inflation, would likely lead to adverse effects elsewhere in society , others point to how the national debt would be further eroded by future inflation.

This narrative came to the fore in the financial year in 2011/12.

Also Check: Foreclosure.homes.com Login

Tracking The Federal Deficit: February 2020

The Congressional Budget Office reported that the federal government generated a $235 billion deficit in February, the fifth month of fiscal year 2020. Februarys deficit is a $1 billion increase from the $234 billion deficit recorded a year earlier in February 2019. Februarys deficit brings the total deficit so far this fiscal year to $625 billion, which is 15% higher than the same period last year . Total revenues so far in FY2020 increased by 7% , while spending increased by 9% , compared to the same period last year.

Analysis of Notable Trends inThis Fiscal Year to Date: Through the first five months of FY2020, individual income tax refunds fell by 6% , increasing net revenue, as the timing of refund payments varies annually. Customs duties rose by 14% , partly due to tariffs imposed by the current administration, primarily on imports from China. On the spending side, net interest on the public debt increased by 6% even amidst historically low interest ratesbecause the overall debt burden has risen. Outlays for the Department of Veterans Affairs rose by 7% because of rising participation in veterans disability compensation, growing average disability benefits, and increasing spending on a program that helps veterans receive treatment in non-VA facilities.

What The National Debt Means To You

The U.S. national debt has long been the subject of significant political controversy. Given its rapid rise in recent years following federal spending increases tied to the COVID-19 pandemic, it’s easy to understand why the issue is drawing more attention from economists, financial markets participants, and critics of government policies.

Polls have long shown high levels of public unease with the U.S. government’s debt, which topped $31 trillion in October 2022. The debt has grown in nominal terms and also relative to the U.S. gross domestic product .

At the same time, large majorities of Americans backed the pandemic relief spending while opposing spending cuts for the costliest government programs. Most also believe they’re already paying too much in federal income tax, while increasingly backing tax increases for corporations and the rich.

The public debt people say makes them uncomfortable is the inevitable result of the tax and spending policies that continue to enjoy broad public support. A related problem is that many aren’t sure what effect the national debt has or might have on their own lives and finances.

You May Like: Is A Consumer Proposal Considered Bankruptcy

Tracking The Federal Deficit: April 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $225 billion in April, the seventh month of fiscal year 2021. Aprils deficit was the difference between $439 billion of revenue and $663 billion of spending. If not for a shift in the timing of some payments because May 1 fell on a weekend, Aprils deficit would have been $165 billion.

So far this fiscal year, the federal government has run a cumulative deficit of $1.9 trillion, the difference between $2.1 trillion of revenue and $4.0 trillion of spending. This deficit is 26% greater than at the same point last fiscal year and 252% greater than at this point in fiscal year 2019.

Analysis of notable trends: In normal years, spending and revenues typically follow similar monthly patternsan influx of individual income taxes arrives in April, corporate income taxes are paid quarterly, refundable tax credits are largely paid in February and March. These patterns allow analysts to gauge changes in federal finances by comparing each months spending and revenues to the same month in the prior year.

Consequences Of Growing National Debt

Japans experience shows that sovereigns can incur a surprising amount of debt if the countrys central bank is willing to monetize the borrowing, and as long as it doesnt stoke inflation.

But even if the remote risk of default is discounted, rising debt imposes higher interest costs, especially when interest rates rise. The CBO expects the U.S. governments net interest costs to triple over the next decade, reaching $1.2 trillion annually by 2032.

That will force lawmakers to decide between running even larger deficits just to keep spending and revenue constant, or some combination of spending cuts and revenue increases.

If the choice is even larger deficits, bond buyers might require higher yields to compensate them for the resulting increase in risk. Or they may not if slowing economic growth prompts investment flows into fixed income amid expectations of lower interest rates.

You May Like: Government Help With Debt

National Debt Vs Budget Deficit

Its important to understand the difference between the federal governments annual budget deficit and the national debt. The federal government generates an annual deficit when its spending over the course of a year exceeds government revenue from sources including taxes on personal income, corporate income, and payroll earnings.

When annual congressional appropriations exceed federal revenue, the U.S. Treasury finances the deficit by issuing Treasury bills, notes, and bonds. These Treasury products may be purchased by investors including individuals and pension funds banks, insurers, and other financial institutions and the Federal Reserve as well as foreign central banks.

A countrys national debt is the sum of such annual budget deficits and any offsetting surpluses. It is the total amount of money that a country owes .

How The Debt Compares To Gdp Plus Major Events That Impacted It

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

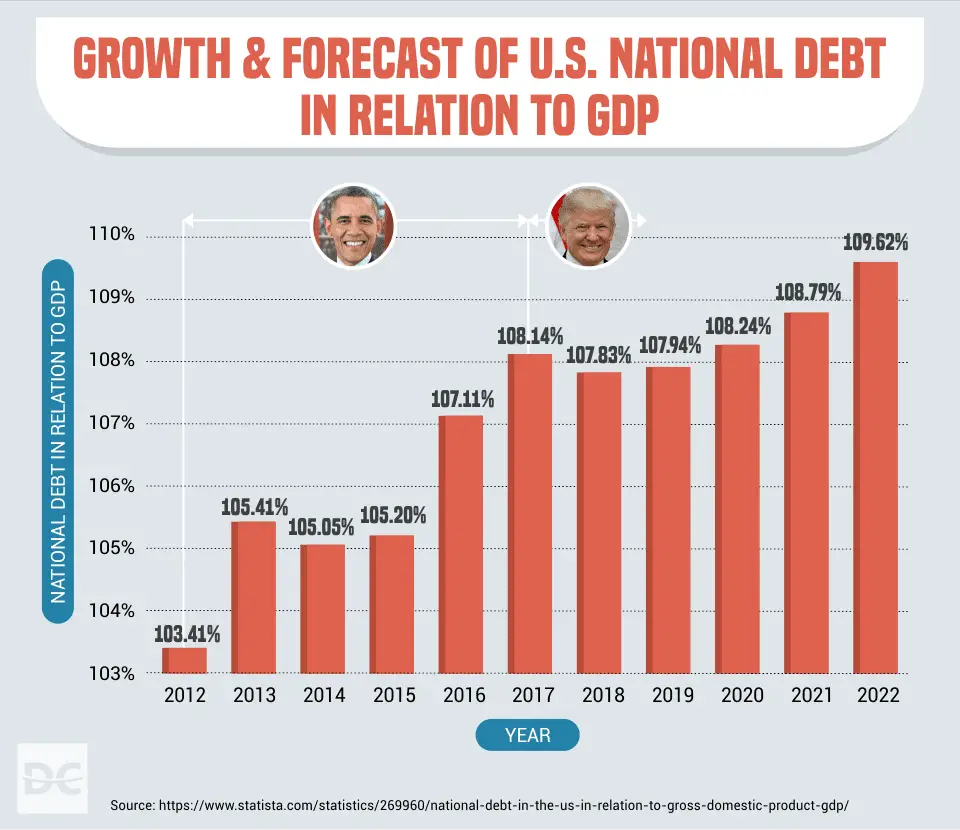

The U.S. national debt grew to a record $31.12 trillion in October 2022. It has grown over time due to recessions, defense spending, and other programs that added to the debt. The U.S. national debt is so high that it’s greater than the annual economic output of the entire country, which is measured as the gross domestic product .

Throughout the years, recessions have increased the debt because they have lowered tax revenue and Congress has had to spend more to stimulate the economy. Military spending has also been a big contributor, as has spending on benefits such as Medicare. In 2020 and 2021, spending to offset the effects of the COVID-19 pandemic also added to the debt. In 2022, tax increases on the wealthy and corporations decreased the future debt outlook, but student loan forgiveness increased it.

One way to look at the national debt is by comparing it to GDP each year, as well as other major events that have impacted it. Below, we’ll dive into the U.S. national debt per year and what caused it to grow over time.

Read Also: What Does Declaring Bankruptcy Do For Me

Tracking The Federal Deficit: February 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $216 billion in February 2022, the fifth month of fiscal year 2022. Februarys deficit followed a surplus in January and was the difference between $290 billion in revenues and $506 billion in spending. This deficit level is $95 billion less than the deficit recorded in February 2021.

Analysis of notable trends: In the first five months of FY2022, the federal government ran a deficit of $475 billion, 55% less than at this point in FY2021 . The cumulative deficit for FY2022 thus far is $149 billion lower than even the deficit over the comparable period in FY2020, pre-dating the onset of the COVID-19 pandemic.

Receipts continue to grow robustly at $1.8 trillion for FY2022 to date, $371 billion more than the government collected during the first five months of the prior fiscal year. Individual income and payroll tax receipts increased by 25% , reflecting rising wages and salaries primarily among higher-income workers subject to higher tax rates, as well as the influx of some payroll taxes that companies were allowed to defer under pandemic relief legislation. Corporate income tax revenues increased by 31% over the past five months compared to the same period last fiscal year.

Solutions To Reduce The National Debt

76% of voters believe that the President and Congress should allocate more time and energy towards addressing the national debt. Americans care about the national debt, and some work has been done in order to address this issue. Solutions include raising revenue , cutting spending, and growing the countrys GDP.

Policy options such as the Simpson-Bowles plan and the Domenici-Rivlin Task Force have made efforts to create plans to reduce the national debt. Centers and institutes such as the American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, and Economic Policy Institute all proposed things ranging from slow growth to reduction in benefits for high-income individuals.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nations fiscal future, or get involved by learning about how you can make a difference in your own community.

Don’t Miss: Can You Buy A Car While In Chapter 13 Bankruptcy

Tracking The Federal Deficit: July 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $212 billion in July 2022, the tenth month of FY2022. This deficit was the difference between $272 billion in receipts and $484 billion in spending. This is the second largest single month deficit this fiscal year, but still $90 billion less than July 2021. July receipts were up by $10 billion , as outlays decreased by $80 billion compared to this time last year.

Analysis of notable trends: Over the first 10 months of FY2022, the federal government ran a deficit of $727 billion29% the size of the $2.5 trillion deficit over the same period in FY2021. So far this year, revenues were $789 billion higher than over the same period in FY2021. Individual income and payroll tax receipts increased by $709 billion over the same period, in part because wages and salaries remained high amid a tight labor market. Customs duties and excise tax receipts went up by $18 billion and $11 billion respectively, reflecting increased domestic and international economic activity this year.

Tracking The Federal Deficit: January 2022

The Congressional Budget Office estimates that the federal government ran a surplus of $119 billion in January 2022, the fourth month of fiscal year 2022. Januarys surplus was the first recorded since September 2019, and it was the difference between $467 billion in revenues and $348 billion in spending. In comparison, last January, the federal government ran a $163 billion deficit. Additionally, both this year and last year, the timing of the New Years Day federal holiday shifted some payments that would have normally been due at the beginning of January into December. In the absence of these timing shifts, the federal government would have run a smaller monthly surplus in January 2022 of $95 billion.

Analysis of notable trends: In the first four months of FY2022, the federal government ran a deficit of $259 billion, $477 billion less than at this point in FY2021. It is noteworthy, however, that the cumulative deficit for FY2022 thus far compares favorably to that of FY2020 , prior to the onset of COVID-19.

Notably, net interest on the public debt rose 22% to $140 billion for the fiscal year to date, primarily reflecting the impact of rising inflation on adjustments to the principal of inflation-protected securities.

Also Check: Can You File Bankruptcy On Secured Loans