What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

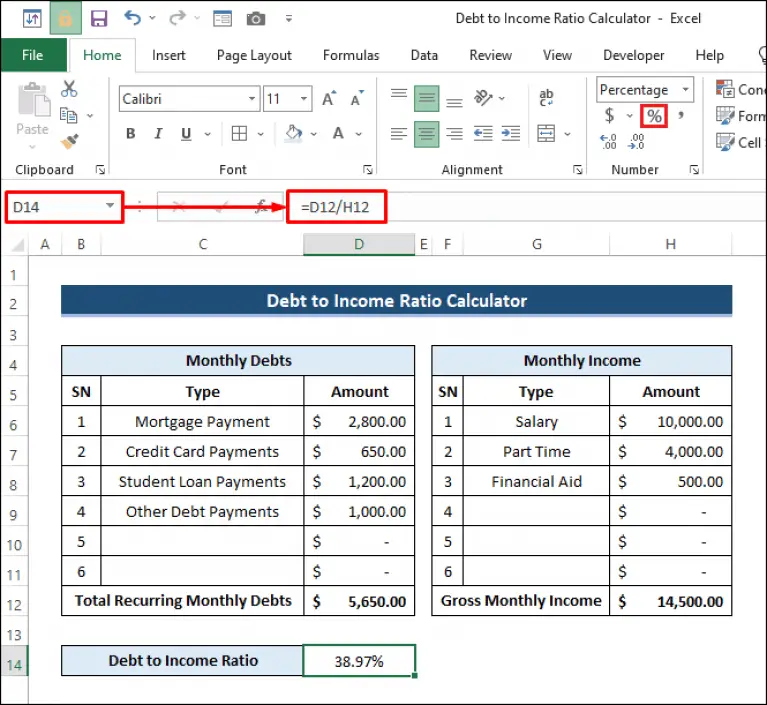

How Do You Calculate Debt

Calculating your DTI is a fairly simple process, as long as you know the right numbers. In the simplest terms, you can calculate your DTI by dividing your total debt each month by your total income. But what expenses actually count toward your total debts? Lets break down what you should include when estimating your DTI.

While you can calculate this manually, you can also use the debt-to-income calculator in this article to calculate your DTI ratio quickly.

How To Improve Your Debt

The goal is usually 43% or less, and lenders often recommend taking remedial steps if your ratio exceeds 35%. There are two options to improving your debt-to-income ratio:

Neither one is easy for many people, but there are strategies to consider that might work for you.

Don’t Miss: What Are 4 Advantages Of Filing Bankruptcy

Why Calculate Your Dti Ratio

Lenders use this percentage to assess your ability to manage monthly payments and repay the money you want to borrow from them. Ultimately, it helps lenders determine how much money theyre willing to lend you.

The lower your DTI ratio, the more likely you are to receive the loan amount you want because your low DTI ratio illustrates a good balance between debt and income . Low DTI numbers typically indicate to lenders that you as a borrower are more likely to successfully manage your monthly payments with a new loan debt.

A higher DTI ratio could be a red flag for lenders because it means you have too much debt for your income. To the lender, this means you may not be as able to meet the additional financial obligations from a new loan. Many lenders dont approve big loans for borrowers with high DTI ratios for this reason.

How To Calculate Debt

The debt-to-income formula is simple: Total monthly debt payments divided by total monthly gross income . Then, multiply that number by 100. That final number represents the percentage of your monthly income used towards paying your debts.

Say you make $3,000 a month before taxes and household expenses. Your monthly debts include $1,200 for rent, $200 in student loan payments, and $100 in car payments, for a total of $1,500. Divide your total monthly debt payments by the total monthly income, $3,000, and the result is 0.5 or 50%. This means that 50% of your monthly income goes towards paying back your debts.

Read Also: Can You File Bankruptcy Without A Job

Pay Off Your Most Expensive Loan First

Your most expensive loan is the loan with the highest interest rate. By paying it off first, youre reducing the overall amount of interest you pay and decreasing your overall debt. Then, continue paying down debts with the next highest interest rates to save on your overall cost. This is sometimes referred to as the avalanche method of paying down debt.

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

Don’t Miss: Can Bankruptcy Stop You From Getting A Job

Interest Rates’ Impact On The Housing Market

Most people need a mortgage to buy a home, and this means borrowing money from a lender. The lender will always charge interest on top of the principal amount used to buy the home. The interest rate depends on a number of factors, including those related to monetary policy and the health of the economy, as well as those related to your personal finances and credit history. Learn more about how these rates affect the housing market and your bottom line.

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

You May Like: Does Bankruptcy Stay On Your Record Forever

How To Lower Debt

Increase IncomeThis can be done through working overtime, taking on a second job, asking for a salary increase, or generating money from a hobby. If debt level stays the same, a higher income will result in a lower DTI. The other way to bring down the ratio is to lower the debt amount.

BudgetBy tracking spending through a budget, it is possible to find areas where expenses can be cut to reduce debt, whether it’s vacations, dining, or shopping. Most budgets also make it possible to track the amount of debt compared to income on a monthly basis, which can help budgeteers work towards the DTI goals they set for themselves. For more information about or to do calculations regarding a budget, please visit the Budget Calculator.

Make Debt More AffordableHigh-interest debts such as credit cards can possibly be lowered through refinancing. A good first step would be to call the credit card company and ask if they can lower the interest rate a borrower that always pays their bills on time with an account in good standing can sometimes be granted a lower rate. Another strategy would be to consolidating all high-interest debt into a loan with a lower interest rate. For more information about or to do calculations involving a credit card, please visit the . For more information about or to do calculations involving debt consolidation, please visit the Debt Consolidation Calculator.

Bottom Line: Knowing Your Dti Ratio Gives You Peace Of Mind

For the sake of your financial health, its crucial to keep your DTI ratio as low as possible. Determining your personal DTI ratio has never been easier just use our simple debt-to-income calculator to quickly discover yours. While you cant plan for the unexpected, knowing your financial status ahead of time can pave the way to a smoother borrowing process.

Resources

Read Also: How Long To File Bankruptcy Petition

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

Read Also: How To Boost Credit After Bankruptcy

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

How Does Your Dti Ratio Affect You

Your debt-to-income ratio affects your chances of qualifying for a mortgage. The lower your DTI, the more likely you are to qualify for a home-related loan.

Your debt-to-income ratio also determines whether you’re eligible for the type of loan you want, and improving your DTI can help you get lower mortgage rates.

Lenders factor DTI for mortgage loans, mortgage refinancing, and home equity products. You can calculate these using our free mortgage calculator.

You May Like: What Happens To Your Credit When You File Bankruptcy

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Pay More Than The Minimum

Pay off your debt and save on interest by paying more than the minimum every month. The key is to make extra payments consistently so you can pay off your loan more quickly. Some lenders allow you to make an extra payment each month specifying that each extra payment goes toward the principal. Before you begin, check the terms of your loan to determine whether additional fees or prepayment penalties may apply.

You May Like: How Does Bankruptcy Chapter 7 Work

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

Have Home Equity Cash

If youve been in your home for several years or more, chances are you have what is known as home equity, which means youve paid off a substantial part of your mortgage loan. You can turn your home equity into cash with a cash-out refinance or a home equity loan. Refinancing your mortgage may also allow you to lock in a lower interest rate, helping you save money in the years to come.

Don’t Miss: Can They Take Your Home If You File Bankruptcy

Add Up All Your Monthly Debt

When lenders add up your total debts, they typically do it one of two ways these two methods of determining your DTI are called front-end and back-end ratios.

Your front-end ratio only takes into consideration your housing related debts, such as rent payments, monthly mortgage payments, real estate taxes, homeowners association fees, etc.

Your back-end ratio, however, includes those monthly payments as well as other debts that might show up on your credit report, such as , personal loans, auto loans, student loans, child support, etc.

Your lender might calculate your front-end or back-end ratio when determining your DTI and sometimes they may look at both to get a better idea of your financial situation. When calculating your own DTI, its a good idea to add all these expenses up as part of your monthly debt to be prepared. Keep in mind that when tallying up your debts, lenders typically only look at things that appear on your credit report so things like utility payments may not actually count toward your total.

Spring Cleaning With The Help Of A Home Equity Line Of Credit

Spring is right around the corner, and that means its time to get your home in shape. Spring cleaning is a time for cleaning, organizing and improving your living space. From adding a new deck to renovating your kitchen, there are so many projects to consider. However, spring cleaning home improvements can be costly. Depending on the size and scope of your project, you might need to borrow money. You can use a HELOC to help finance your spring cleaning plans. Learn more about how to use a HELOC to improve your home.

Don’t Miss: Can You Declare Bankruptcy On Back Taxes

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How To Lower Your Debt

If looking at your debt-to-income ratio made your blood pressure rise a little, take a breath. You actually have more control over that number than you might think. If you want to lower your DTI, you need to decrease your monthly debt or increase your monthly income. Or both.

Here are a few practical tips to lower your debt-to-income ratio:

Dont take on any more debt.A perfect new couch thats calling your name? That boat youve been eyeing for years? Nope. And nope. Taking on more debt will just make your DTI percentage rise . Dont be tempted to add any more payments to your plate. Work on getting rid of the payments you already have.

Earn additional income.Negotiate a higher salary. Pick up a few extra hours. Start some freelance work. Anything you can do to earn more income will help lower your DTI. But dont just earn more money for the sake of improving your debt-to-income ratio. Use that extra cash to pay off more debt.

Throw more money at your debt than just the minimum payment. Minimum payments = minimal progress. Seriously, if youre only paying your minimum payments, those balances will hang around forever. And nobody wants that. To pay off debt faster, start by tackling the smallest debt first, not the one with the highest interest rate . When you use the debt snowball method, youll get quick wins and see progress on that debt right awaywhich will keep you motivated to pay off the rest even faster.

Read Also: Can You Lose Your Home In A Bankruptcy

How Is The Debt

How Lenders View Your Debt

Now that you know how a debt-to-income ratio is calculated, you might be wondering what lenders think of your score.

The criteria can vary from lender to lender, but heres a general breakdown of the industry standards:

DTI less than 36%Lenders view a DTI under 36% as good, meaning they think you can manage your current debt payments and handle taking on an additional loan.

DTI between 3643%In this range, lenders get nervous that adding another loan payment to your plate might be challenging, especially if an emergency pops up. You wont necessarily get turned down for another loan, but lenders will proceed with caution.

DTI between 4350%When your DTI gets to this level, youre almost too risky for lenders, and you may not be able to get a loan.

DTI over 50%At this point, youre in the danger zone, and lenders probably wont lend you money. With a DTI ratio over 50%, that means over half of your monthly income is going to pay debt. Add in normal living expenses, like groceries and insurance, and theres not much left over for saving or covering an emergencyand another loan could tip you over the edge.

Also Check: Why Did Detroit File For Bankruptcy