How Can I Improve My Debt

There are a number of ways you can try to improve your debt-to-income ratio. The basic idea is lowering your debt or increasing your income. Here are some ideas.

- Pay down debt early. If you have room in your finances, make more than the minimum payments on your debts each month so that you pay them down faster. For example, pay more than your minimum credit card payment every month.

- Cut monthly expenses to pay off more debt. Look at your budget and consider ways you can adjust your spending so that you have more money to use toward debt repayment.

- Consider a debt-consolidation loan. If you cant make extra payments on your debt or trim your budget, a debt-consolidation loan could be a good option. This may help you reduce the amount of interest you pay while you work to pay down your debts.

- Get a side hustle or ask for a raise. Extra income from side jobs can count toward your income when you calculate your debt-to-income ratio. The boost in salary youd get from a raise could also help to lower your DTI.

The Good And Bad Of Store Credit Cards

If youve ever been to a department store or chain retailer, the salesperson probably asked you if you wanted to open a store credit card, which is like a normal credit card except that, in most cases, you can only use it at participating stores and businesses. Some of the biggest chain outlets and retailers, such as Target, Home Depot, Walmart, Macys and other clothing retailers offer this option. But how do these cards work? And can they actually help you save money? Lets find out.

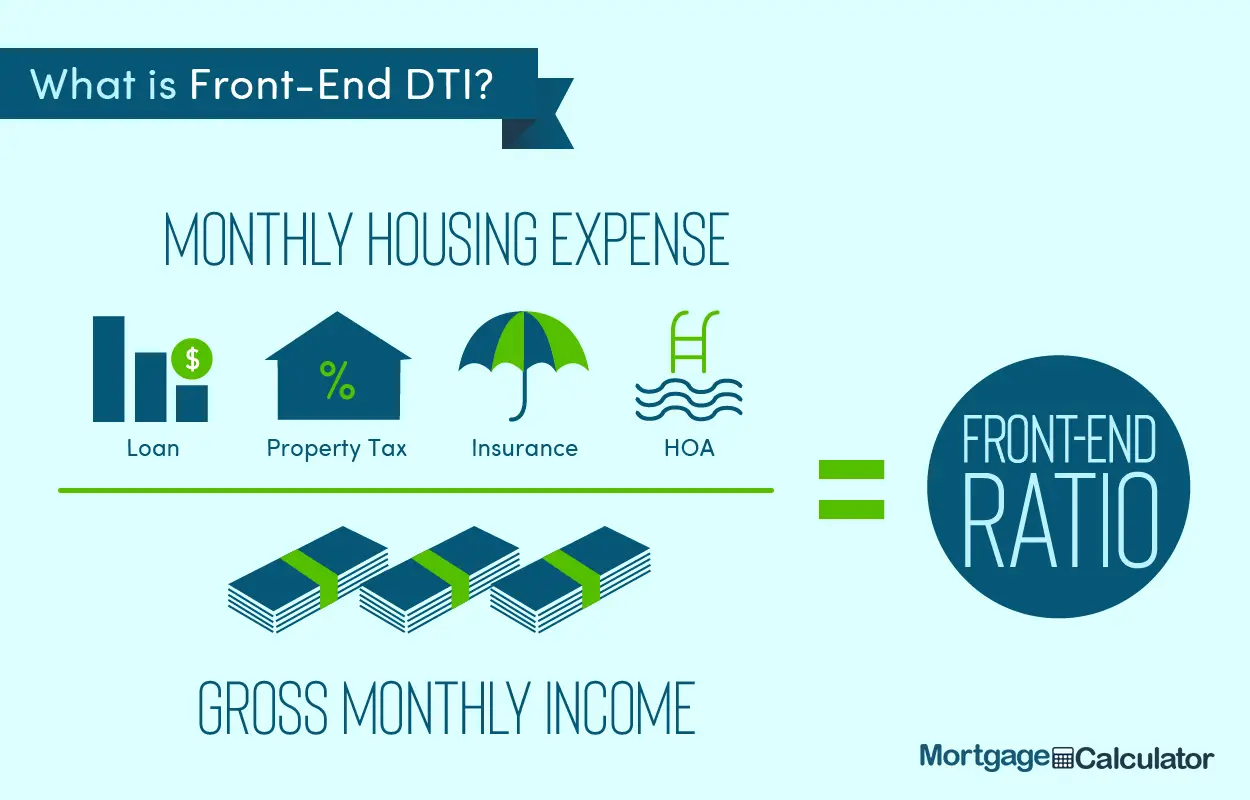

How To Calculate Your Front End Debt

| Front End Ratio Example |

|---|

| Back End Ratio | 33% |

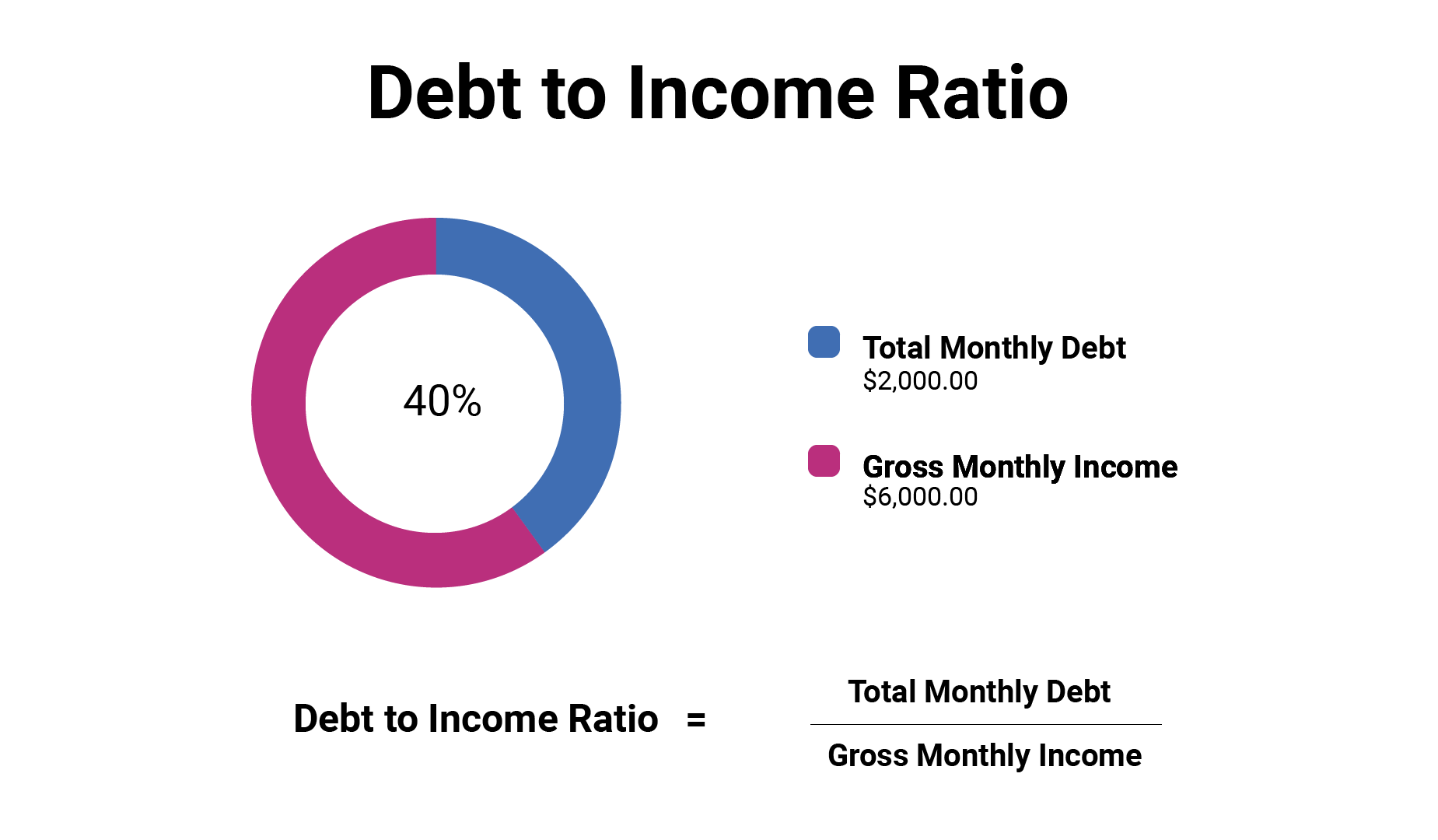

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn’t necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

Recommended Reading: What Student Loans Can Be Discharged In Bankruptcy

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Weigh Your Monthly Debt Payments Against Your Income To See If Youre Overextended

A debt-to-income ratio is a key factor that lenders use to determine if youll be approved for a loan. During the underwriting process after you apply for a loan, the underwriter will check your debt-to-income ratio to see if you can afford the loan payments. If your DTI is too high, you wont get approved for the loan.

For consumers, debt-to-income is an easy way to measure the overall health of your finances. You can check your DTI to see if you have too much debt for your income. If your debt ratio is too high, then you know to scale back and focus on debt repayment. If you need help, call to speak with a trained credit counsellor for a free debt and budget evaluation.

Don’t Miss: How Long Is The Bankruptcy Process

What Your Credit Score Means

Your credit score reflects how well you’ve managed your credit. The 3-digit score, sometimes referred to as a FICO® Score, typically ranges from 300-850. Each of the 3 credit reporting agencies use different scoring systems, so the score you receive from each agency may differ. To understand how scores may vary, see how to understand credit scores.

How Is Your Debt

You can determine your debt-to-credit ratio by dividing the total amount of credit available to you, across all your revolving accounts, by the total amount of debt on those accounts.

For example, say you have two credit cards with a combined credit limit of $10,000. If you owe $4,000 on one card and $1,000 on the other for a combined total of $5,000, your debt-to-credit ratio is 50 percent.

Also Check: Will My Credit Score Go Up After Bankruptcy Falls Off

How Is The Debt

The debt-to-income ratio can be calculated using these two formulas:

Gross debt service ratio

This corresponds to the percentage of your gross income that goes towards housing fees for the home youre looking to buy. Generally speaking, you need a GDS between 32% and 39% to get a loan, but your bank may require a lower ratio.

To calculate it:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Multiply the total by 100. 3. Divide the new total by your gross monthly income.

Total debt service ratio

This is the percentage of your gross monthly income that goes towards housing fees for the home youre looking to buy, in addition to your other debts. Your TDS shouldnt exceed 44%, but a lender may require a lower ratio. Usually, a TDS under 40% is good enough to get a loan.

To calculate TDS:

1. Add up your monthly occupancy expenses: Mortgage payments + municipal taxes + school taxes + heating and electricity + 50% of the condo fees . 2. Add your other monthly financial commitments to this total: Loans, typically 3% of the limit on each of your credit cards and lines of credit , child support and alimony, as well as any other debt payments. 3. Multiply the total by 100. 4. Divide the new total by your gross monthly income.

To calculate these ratios, you can use the Canada Mortgage and Housing Corporations debt service calculator.

What Is A Good Debt

A lower debt-to-income ratio is a good indicator that youre able to take on more debt and pay it off.

Keep in mind that any type of debt, including student loans, credit card balances, auto loans, personal loans or mortgages, can increase your DTI ratio as well as costs like child support or alimony payments.

On the flip side, income from your job, along with any part-time or freelance work and any alimony payments you receive, can count toward your gross income. So its important that you keep track of all your debts and income in order to monitor your DTI ratio.

Don’t Miss: Is It Better To Settle With Creditors Or File Bankruptcy

Dti Formula And Calculation

The debt-to-income ratio is a personal finance measure that compares an individuals monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individuals ability to manage monthly payments and repay debts.

S To Decrease The Debt

1. Decrease monthly debt payments

Consider an outstanding $50,000 student loan with a monthly interest rate of 1%. Scenario one involves an individual who is not repaying their principal debt, while scenario two involves an individual who has paid down $30,000 of their principal debt.

As illustrated above, as an individual pays down more of their principal debt, the monthly interest payments decrease.

2. Increase gross income

Consider two scenarios with a monthly debt payment of $1,500 each. However, the gross monthly income for scenario one is $3,000, while the gross monthly income for scenario two is $5,000. As such, the debt-to-income ratio would be as follows:

DTI Ratio = $1,500 / $3,000 x 100 = 50%

DTI Ratio = $1,500 / $5,000 x 100 = 30%

Also Check: Is It Hard To Rent An Apartment After Bankruptcy

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

How To Figure Debt To Income Ratio That Is Attractive To Mortgage Lenders

When applying for a conventional home loan, your DTI should be 50 percent or below to increase the chance of approval. For an FHA home loan, which is backed by the Federal Housing Administration, the requirements are more lenient. However, aiming for a DTI of less than 50 percent will make the qualifying process more streamlined. In all cases, approval is more likely for mortgage borrowers with a DTI of 43 percent or less. So, how do you calculate debt to income ratio to see if you are within this ideal range?

You May Like: Why Do People File For Bankruptcy

What Should You Do To Improve The Dti Ratio

- You can increase your EMIs toward a personal loan that you have availed. Though this will temporarily increase your DTI ratio , it will, in the long run, bring down your total debt considerably. This, in turn, will reflect well on your DTI ratio.

- Do not acquire more debt.

- Postpone a few large purchases if you can. This will give you more time to save and help you make a larger lump sum payment in time.

- Dont forget to keep track of the debt-to-income ratio every month. This will make it easier for you to notice deviations if any, and take corrective measures.

Additional Read: What Is Debt Consolidation?

Availing of the financial assistance you need is easier with pre-approved offers on personal loans from Bajaj Finserv. All you need to do is share a few details and get your pre-approved offer.

*Terms and conditions apply

How Much Equity Do I Need For A Home Equity Loan

One upside to owning a home is that you can start building equity. Once you pay off a certain percentage of your mortgage, you can use this equity to borrow money against your property by taking out whats known as a home equity loan. This money is often used by homeowners to make repairs, pay down debt or invest in their education. If you are interested in borrowing against the equity youve built up in your home, learn more about how these loans work and how to qualify.

Also Check: Pros And Cons Of Filing Bankruptcy In Texas

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Whats Considered A Good Debt

The lower the DTI, the better. More specifically, a DTI of 36% or below is generally considered good, while a DTI of 37-42% is considered manageable. A DTI of 43% or higher will likely mean you wont qualify for a loan, as anything 43% or higher is considered cause for concern. A DTI of 50% or higher is considered dangerous.

Why 43%? Lenders came up with this number as a result of mortgage-risk studies that analyzed the type of borrowers who are most likely to have trouble making repayments and ultimately default on their loans.

Your DTI is a factor lenders consider when determining the rates and terms of your loan. In general, youre more likely to get a better rate with a lower DTI.

Don’t Miss: How To Get My Bankruptcy Records

Formula To Calculate Debt Ratio

The debt ratio is the ratio of total debt liabilities of a company to the companys total assets this ratio represents the ability of a company to hold the debt and be in a position to repay the debt, if necessary, on an urgent basis. For example, a company with a debt liability of $30 million out of $100 million total assets has a debt ratio of 0.3.

It is one of the most used solvency ratiosSolvency RatiosSolvency Ratios are the ratios which are calculated to judge the financial position of the organization from a long-term solvency point of view. These ratios measure the firms ability to satisfy its long-term obligations and are closely tracked by investors to understand and appreciate the ability of the business to meet its long-term liabilities and help them in decision making for long-term investment of their funds in the business.read more by investors. And it is pretty easy to calculate too.

Let us look at the formula of debt ratio:

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

You need to look at the balance sheet and determine whether a firm has enough total assets to pay off its total liabilities.

How Debt Affects Your Credit Scores

Since income does not appear on your credit report and is not a factor in credit scoring, your DTI ratio doesn’t directly affect your credit report or credit scores. However, while your income is not reported to credit bureaus, the amount of debt you have is directly related to multiple factors that do affect your credit scores, including your . This ratio compares your total revolving debt with the total amount of credit you have available. Credit utilization ratios are important factors in determining many credit scores.

Other ways your debt can affect your credit scores include:

- The total amount of debt you have

- The age of loans or revolving debts

- The mix of types of credit you’re using

- How many recent hard inquiries have been made into your credit report

- How consistently you’ve paid your debts over time

Don’t Miss: Can You File Bankruptcy On Titlemax

How Much Can I Spend On A House

Now that you know how to calculate GDS and TDS, you should be able to figure out how much of a monthly mortgage payment you can afford. But how does that translate to the actual purchase price of a home? To figure that out, youll need to use a mortgage payment calculator and know how much you plan to contribute as a down payment.

Mortgage calculators are readily available online. Simply plug in a few details, such as the mortgage amount and interest rate, and itll calculate your monthly payment. Your down payment can be used to bridge the gap between your maximum mortgage amount and the purchase price of the home.

Why Is The Debt

Debt-to-income ratio is an important determinant in analyzing whether you’ll be accepted for a loan. A lender uses it to measure whether you’ll be able to pay them back. It can be said that borrowers with a higher debt-to-income ratio will have a harder time making debt payments. Because lenders obviously want to get paid every month, they prefer taking a smaller risk by offering loans to people with a lower debt-to-income ratio.

Throughout your lifetime, you’ll likely have to get a loan. Determining your debt-to-income ratio and being mindful of it and its progress is the first step in knowing whether you have a chance of qualifying for a loan.

Recommended Reading: Can You Still File Bankruptcy On Credit Cards

Explanation Of Debt To Income Ratio Formula

The debt to income ratio is used by lenders to determine whether the further loan could be issued to the borrower and whether the borrower has the ability to return the loan payments. It is generally preferred that the borrower should have a low Debt to Income Ratio. A ratio of 28% is generally preferable, while 43% is the highest that Debt to Income ratio could be. A ratio of debt to income higher than 43% signals that the borrower might not be able to return the loan taken.

As can be understood from the formula, there are two ways of lowering ones debt to income ratio. One can either reduce their recurring monthly debt or increase their gross monthly income. Lowering recurring debt payments can be achieved by prepaying some of the loans.

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

Recommended Reading: Why Is It Bad To File Bankruptcy