The Bottom Line On Debt

Itâs always worth talking to a lender, even if you think your DTI is on the high side. You may end up qualifying anyway, and if you donât, they may be able to help you strategize how to pay down your debts.

At Fairway, we offer a Creditool program that provides homebuyers with a plan for improving their credit scores, which often includes paying down certain debts. That can help improve your DTI as well.

â Debt-to-income ratio is monthly debt/expenses divided by gross monthly income.

Copyright©2022Fairway Independent Mortgage Corporation. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. Fairway is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity.

Get A Lower Mortgage Rate

One way to reduce your ratios is to drop the payment on your new mortgage. You can do this by buying down the rate paying points to get a lower interest rate and payment.

Shop carefully. Choose a loan with a lower start rate, for instance, a 5-year adjustable rate mortgage instead of a 30-year fixed loan.

Buyers should consider asking the seller to contribute toward closing costs. The seller can buy your rate down instead of reducing the home price if it gives you a lower payment.

If you can afford the mortgage you want, but the numbers arent working for you, there are options. An expert mortgage lender can help you sort out your debts, tell you how much lower they need to be and work out the details.

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Also Check: How Many Times Has Mike Bloomberg Filed Bankruptcy

What Expenses And Income Are Included In Dti

If you are applying for a loan, everyone who will be on the loan will have to include these figures in debt:

- Minimum credit card payments

- Other financial obligations including child support and alimony

- Your current housing payments do not count if you are going to sell the house before you buy the new house. If you are keeping the house you will have to count the payments as debt. This means if you are renting and plan to buy a rental property but keep renting where you live, the rent will count against your DTI.

- Your estimated future housing expense, which includes principal, interest, taxes, insurance, and any HOA fees.

To calculate your income you use:

- Your gross monthly salary before taxes, plus overtime and bonuses. Include any alimony or child support received that you choose to have considered for repayment of the loan.

- Any additional income like rental property profits. This is tricky because some lenders will not count any rental income until it shows up on your taxes. Other lenders will count 75 percent of your rental income if you are an experienced investor or have the house leased.

Work With A Credit Counselor

A credit counselor helps consumers navigate current debt and create a plan to pay off loans in a way that makes the most sense. This can include a goal of lowering total interest paid, getting out of an endless debt cycle, and lowering monthly payments .

Nonprofit credit counseling organizations are funded by grants from credit companies, which means youll pay no fees if you qualify by having over $5,000 in unsecured debt. They can help:

- Set up a debt management plan with payments you can afford

- Negotiate with creditors to reduce APR and stop penalties and fees on your accounts

- Eliminate contact from collectorsyour counselor will act as an intermediary

- Teach you more about credit and budgeting

Recommended Reading: How To File For Bankruptcy In Maryland

Why Does Your Debt To Income Ratio Matter

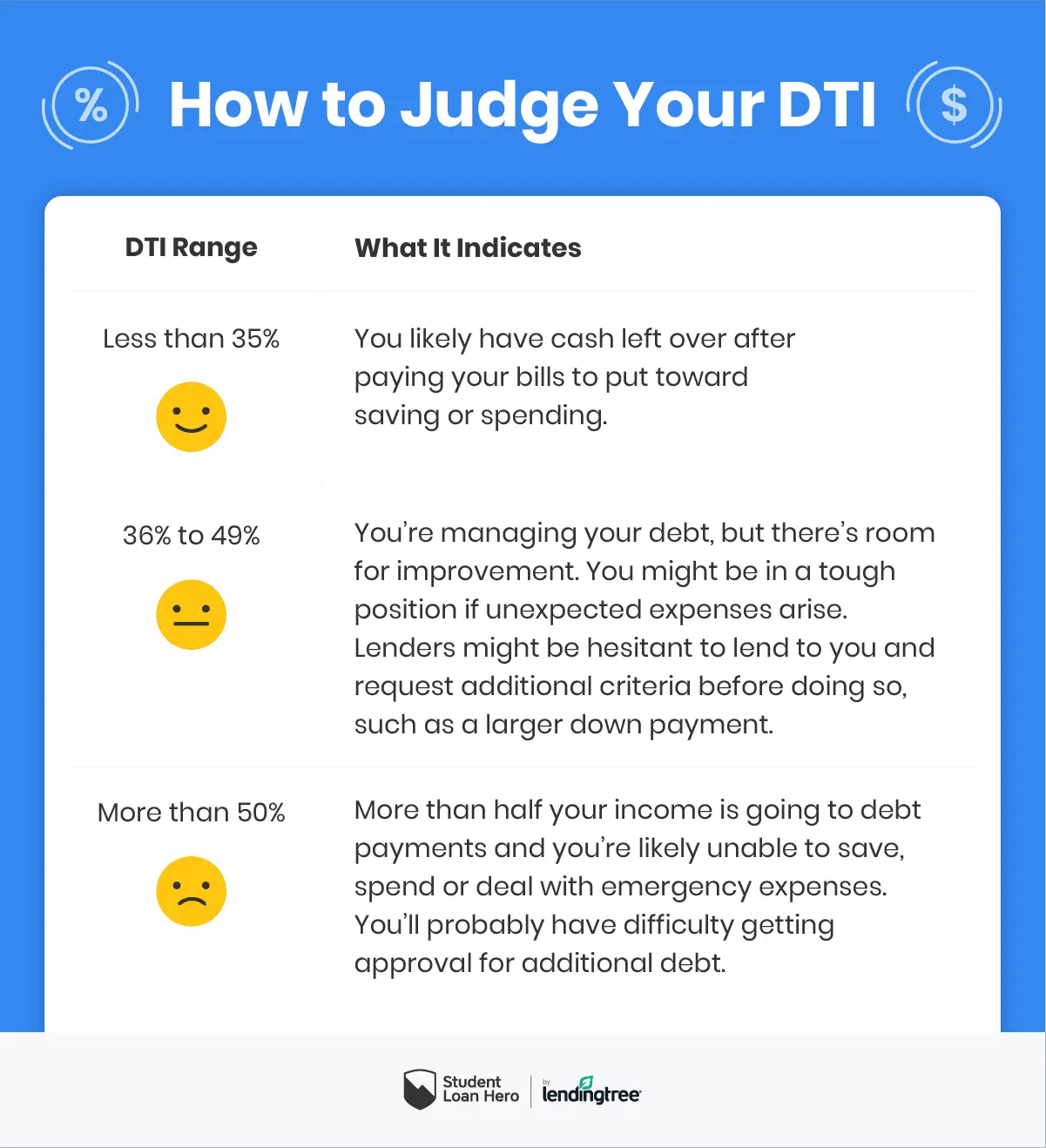

Your debt to income ratio shows how much debt you have for every dollar you earn. If your ratio is high, it means you owe a lot compared to your income. It could be very difficult for you to get out of debt, save money or even make your minimum monthly payments. A high debt to income ratio could also prevent you from getting approved for other loans or a mortgage.

If your ratio is low, it suggests that you are in good financial shape. Lenders like to see a low debt-to-income ratio as it could mean that you are at lower risk of defaulting on a loan or credit card payments.

How Can You Reduce Your Debt

When you apply for a loan, your lender looks at your financial profile to find out what type of borrower you’re likely to be. Your credit score assesses the likelihood you’ll miss a payment in the near future. Your shows how responsibly you’ve handled debt and expenses over time. And your debt-to-income ratio gives lenders a quick indicator of how much debt you can currently afford.

If you’re carrying a lot of debt, you may need to reduce your DTI to convince lenders you have the ability to take on another financial obligation. To reduce your DTI, you’ll need to understand what goes into calculating it and what actions you can take to put yourself in a better borrowing position.

Before you start submitting credit and loan applications, take a moment to calculate your DTI. What you learn may help you find the best loans and credit, help you decide which borrowing options are right for you, and help you take measures to improve your odds of approval.

Also Check: Over Stock Phone Number

Work On Paying Down Debt

Paying off loans and bringing down debt balances can improve your debt-to-income ratio. To free up cash flow you can use to pay down your debt faster, give your budget a second look.

You may find ways to cut down on monthly expenses such as by:

- Shopping for a lower-cost cell phone plan

- Reducing how often you get food delivery or takeout

- Canceling streaming services you no longer use

When deciding which debt to pay down first, borrowers often use one of two strategies. The debt avalanche method involves targeting your highest-interest debt first, while continuing to make minimum payments on all other debts. This strategy helps you save money on interest over time. The other method, debt snowball, has borrowers focus on the debt with the lowest balance first, while keeping up with the minimum payments on other debts. It helps borrowers stay motivated by giving them small wins on their path to getting out of debt.

If youre unsure how to approach your debt, you could sign up for free or low-cost debt counseling with a certified credit counselor. These professionals can provide personalized financial advice, help you create a budget and provide useful tools that can teach you about money management. You can search for a certified credit counselor through the Financial Counseling Association of America or the National Foundation for Credit Counseling .

How To Improve Your Dti

Wed like to tell you to just spend less and save more, but youve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

Don’t Miss: Who Gets Paid First In Bankruptcy

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

If thats the case or youre buying a house on your own with a high DTI, you can always ask a family member or close friend to co-sign the mortgage loan with you. When you use a co-signer, lenders will factor in their DTI when reviewing your application, potentially helping you qualify for a larger mortgage or a lower interest rate.

How To Lower Your Debt

If your debt-to-income ratio is close to or higher than 36 percent, you may want to take steps to reduce it. To do so, you could:

- Increase the amount you pay monthly toward your debt. Extra payments can help lower your overall debt more quickly.

- Avoid taking on more debt. Consider reducing the amount you charge on your credit cards, and try to postpone applying for additional loans.

- Postpone large purchases so youre using less credit. More time to save means you can make a larger down payment. Youll have to fund less of the purchase with credit, which can help keep your debt-to-income ratio low.

- Recalculate your debt-to-income ratio monthly to see if youre making progress. Watching your DTI fall can help you stay motivated to keep your debt manageable.

Keeping your debt-to-income ratio low will help ensure that you can afford your debt repayments and give you the peace of mind that comes from handling your finances responsibly. It can also help you be more likely to qualify for credit for the things you really want in the future.

Don’t Miss: Overstock Customer Service Chat

Increasing What You Can Pay Toward Your Debt

Extending Your Loan Term

Another way to reduce your DTI ratio is by extending your loan term. When you extend your loan term, your loan payments are stretched out over a longer period. This, in turn, reduces how much you owe each month, which means a lower monthly bill.

For instance, if your mortgage payment is $1,500 per month, you can refinance with your mortgage lender and increase your term from 15 to 30 years. You are still paying the same total amount for the loan, but you stretch it out over a longer period, reducing your monthly minimum payment.

The exact amount of the reduction depends on your down payment and the amount outstanding on your mortgage. But, as an example, say your monthly payment is now $1,000. Youve reduced your monthly debt obligation by $500, which in turn lowers your DTI ratio.

Also Check: Can You File Bankruptcy On A Judgement

Using Tools And Apps To Lower Your Debt

When working to pay off debt, consider researching the debt avalanche and debt snowball methods. One calls for you to pay off your debt with the highest interest rate first, while the other requires you to pay off your debt with the lowest balance first.

By lowering your debt, you’ll reduce your and, in turn, your DTI ratio.

Of course, there are tools available to help you pay off your debt. One such tool is Tally. Tally is an automated credit card payoff app offering a low-interest line of credit that helps pay down your existing balances through the debt avalanche method. Because the service is automated, you don’t have to worry about missing due dates.

Lower Your Student Loan Debt

In the first and second quarters of 2021, U.S. student loan debt was over $1.5 trillion . Thats almost double what it was 10 years ago.

If youre dealing with student loan debt, you should know that its adding to your monthly DTI.

Fortunately, there are ways to make your student loans cheaper. Some options include:

- Student loan refinancing

- Student loan deferment or forbearance

Recommended Reading: How To File Bankruptcy In Texas For Free

Debt To Income Calculation

The DTI ratio calculation is simple, just divide the fixed monthly expenses by the borrowers monthly gross income.

A good DTI ratio in the traditional lending world is considered to be 43%, meaning that your monthly expenses do not exceed 43% of your gross income. In the real estate investing world, that number varies.

Private lenders, like Rehab Financial Group, LP will look at the borrowers overall income and expenses and review how much free cash the borrower has on a monthly basis. The acceptable DTI can vary greatly generally the higher the income, the higher the DTI can be. It is perhaps easiest to explain it by examples as follows:

How Do You Calculate Your Dti Ratio

To calculate your DTI, take your total monthly debt payments and divide it by your total monthly income .

Alternatively, you can automatically calculate your DTI using the Harvest PRO Index.

On the debt side, only debts for which you still have nine or more months more of payments to make are included in the calculation of your DTI.

Expenses that are not related to any money youâve borrowed are not factored into your DTI.

Also Check: Can Sba Loans Be Discharged In Bankruptcy

Change Your Spending Habits

Theres no amount of cleaning up your current debt that will help in the long run without having a solid plan going forward. Understanding debt-to-income ratio and calculating your own is an excellent start to basic financial planning.

Be sure you also have a comfortable handle on:

- Your current debts, monthly payments, and total interest paid on loans

- Categorizing wants versus needs and how to prioritize both

- Monthly spending in cash and other ways that are less trackable than bills

- Setting savings goals and how to fund short and long-term savings

- Your short-term emergency savingshow much you need and how to set it aside

- Understanding interest rates and compound interest

Why Do I Need To Know My Debt

The reason your DTI ratio matters is because lenders use it as a way to determine your ability to manage your monthly bills, lifestyle, and any potential loan that they may extend you. In other words, if youre ever looking to get a major loan such as a mortgage, car loan, or student loan, you want to ensure that your current debt-to-income ratio is low enough to take on additional debt.

If your gross monthly income is $5,000, then your monthly debts should be no more than $2,150. At face value, that sounds pretty reasonable since that would leave you with $2,850 for the rest of your monthly expenses right? Not exactly.

Remember, the debt-to-income ratio is based on gross income. When you factor in the average taxes you would pay as a Canadian resident, your gross income of $5,000 per month is a net income of about $4,100 a month. After you pay your monthly debts, that leaves you with $1,250 in disposable income. That leftover income needs to cover all your other expenses, including vacations, retirement savings, insurance, raising children, and much more.

Recommended Reading: Can You Discharge Medical Bills In Bankruptcy

What Is Debt To Income Ratio

The debt to income ratio determines the proportion of debt you have to the amount of income you bring in before taxes. It is an indicator to lenders of whether you can easily meet your monthly debt payments based on your income. Lenders and creditors use this ratio to understand if your income can afford to take on more debt, to ensure that you can repay the debt.

How Is The Debt

Don’t Miss: Foreclosure Process In Nc