Your Public Records On Annulment

Youll need to check the details of the bankruptcy are removed from your credit record. If an IVA has been agreed, this will be put on your file.

You will need to apply to both Land Charges and Land Registry to have your bankruptcy entry removed from any properties you still own after paying your debts. If you do not do this, the entries will remain for 5 years.

Chapter 7 Vs Chapter 13

Chapter 7 and Chapter 13 are the two most common types of personal bankruptcy.

In a Chapter 7 bankruptcy, a trustee appointed by the bankruptcy court will liquidate many of your assets and use the proceeds to pay your creditors some portion of what you owe them. Certain assets are exempt from liquidation. Those typically include part of the equity in your home and automobile, clothing, any tools you need for your work, pensions, and Social Security benefits.

Your nonexempt assets that can be sold off by the trustee include property , a second car or truck, recreational vehicles, boats, collections or other valuable items, and bank and investment accounts.

In Chapter 7, your debts are typically discharged about four months after you file your bankruptcy petition, according to the Administrative Office of the U.S. Courts.

In a Chapter 13 bankruptcy, by contrast, you commit to repaying an agreed-upon portion of your debts over a period of three to five years. As long as you meet the terms of the agreement, you are allowed to keep your otherwise-nonexempt assets. At the end of the period, your remaining debts are discharged.

In general, people with fewer financial resources choose Chapter 7. In fact, to be eligible for Chapter 7, you must submit to a means test, proving that you would be unable to repay your debts. Otherwise, the court may determine that Chapter 13 is your only option.

Effect Of Chapter 13 On Bankruptcy

In a Chapter 13 bankruptcy case, you will have to repay taxes, but how much you repay depends on the classification of the tax debt as either a priority claim or a non-priority unsecured claim. Priority tax debts include recent property taxes, taxes that you are required to collect or withhold , employment taxes, excise taxes, and non-punitive tax penalties. Priority tax debts must be paid in full, but most bankruptcy filers only pay a portion of non-priority unsecured claims, which may include some tax debts. Once the bankruptcy court approves your debt payment plan, the IRS cannot object to your payment plan. This means you can repay priority tax debts at an interest rate of 0%, which is usually more favorable than the deals you can strike directly with the IRS.

Non-priority unsecured claims must be paid only after priority and secured claims are fully paid. In most cases, you only pay a percentage of the unsecured debt, and this percentage is calculated by looking at the value of your nonexempt assets. A tax debt is non-priority and unsecured if it is income tax that meets the five conditions described above.

Don’t Miss: How To File Bankruptcy Yourself In Texas

How To Avoid Future Tax Debt Problems

To avoid debt problems in the future, it is important that you understand how you arrived at your current situation, in which you owe a great deal of money to Canada Revenue Agency.

Do you owe taxes because you cashed in the last of your RRSPs to pay your debts? This cant happen again soon, because any remaining RRSPs will be liquidated in your bankruptcy.

On the other hand, if you are self-employed, you can easily find yourself with a tax debt at the end of the year. It is important to prepare for such an eventuality and to make sure that you make payments throughout the year.

We recommend that at the beginning of each year, self-employed individuals estimate the amount of income taxes they will owe and then remit one twelfth of this amount to the tax authorities even if the tax authorities do not require such frequent payments. Then, at the end of the year, tax time will actually be enjoyable as you will have minimal or no accumulated income tax debt. You might even receive a refund!

Finally, make sure you have realistic expectations concerning your lifestyle and your expenses . When do we accumulate tax debt? When we dont feel we can afford to pay it. Proper budgeting and business management can eliminate the monthly deficit that often contributes to serious tax arrears.

The Individual Insolvency Register On Annulment

Once notice of the annulment is received your bankruptcy will be removed from the Individual Insolvency Register after:

- 28 days if the bankruptcy order should not have been made

- 3 months if the debts were paid in full or an IVA has been agreed

If an IVA has been agreed, details of this will appear on the register.

Don’t Miss: Did Donald Trump Ever File For Bankruptcy

Is A Form 1099 From A Creditor After My Bankruptcy Case Considered Taxable Income

A very important question Im often asked every year by my clients is: What effect does their bankruptcy have on their income taxes?

Or, whether or not debts discharged in a bankruptcy case must be included as income on federal or state income tax returns.

This often arises when a client receives a Form 1099 statement from a creditor after their discharge in bankruptcy has been granted. Creditors send 1099 statements when they are required to, but this does not necessarily mean that the amount on the 1099 form must be included in the taxpayers gross income for that year.

Is Cancelled Debt Taxable

If a credit card company or other creditor cancels your debt, thats really good news, right?

Such cancellation of debt usually happens when the creditor gives up on collecting the debt, or when the statute of limitations on collecting the debt runs out.

Cancellation of debt is not all positive news, however.

Aside from the negative impact on your , you may owe tax on the cancelled amount.

You should receive a Form 1099-C, Cancellation of Debt from the company, which they also send to the IRS. The amount of debt shown on Form 1099-C as cancelled is taxable income on your return unless you qualify for an exception.

Recommended Reading: When Did Student Loans Become Non Dischargeable

What Taxes Are Included In Bankruptcy

A reader has asked which years income taxes are included in bankruptcy? HMRC used to have a special status as a preferred creditor, but since 2003 tax debts are treated the same as other debts and are wiped out by bankruptcy. There are however a few complications, so this article looks at all the different types of taxes and what happens to each of them when you go bankrupt. In particular, there has been a change this month in how the current years council tax is handled in bankruptcy.

How A Chapter 13 Bankruptcy Can Help

If your state tax obligation wont go away, Chapter 13 bankruptcy will let you spread the payments over three to five years. Youll have the added benefit of potentially paying less on other debt, such as credit card balances, leaving you a larger percentage of your income to pay off the tax.

Understand, however, that tax debt can be complicated. Before you explore this route, youll want to get an assessment with a bankruptcy attorney. Getting legal help isn’t as expensive as you’d think, and most people believe hiring a bankruptcy lawyer is well worth the cost.

You May Like: Trump’s Yacht Repossession

Do You Have To Pay Taxes On Debt Discharged In Bankruptcy In Arizona

Bankruptcy is one of the most efficient ways to eliminate debt in Arizona but one important question remains. Do you have to pay taxes on debt discharged in bankruptcy? Many people ask this question because they think that debt elimination that occurs via a bankruptcy is similar to what would happen whenever a creditor discharges some debt. The processes, however, are quite different from each other.

Debts Never Discharged In Bankruptcy

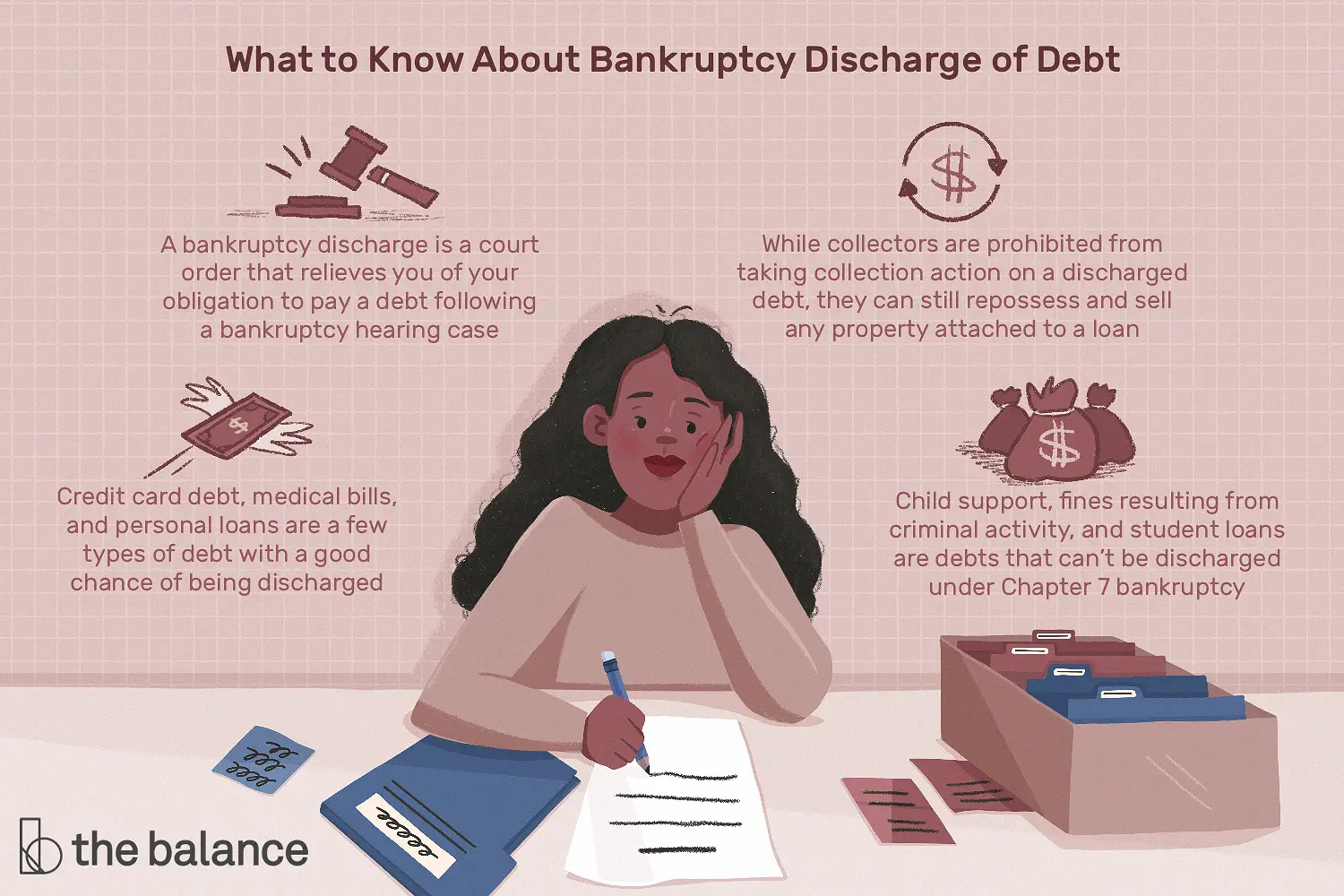

While the goal of both Chapter 7 and Chapter 13 bankruptcy is to put your debts behind you so that you can move on with your life, not all debts are eligible for discharge.

The U.S. Bankruptcy Code lists 19 different categories of debts that cannot be discharged in Chapter 7, Chapter 13, or Chapter 12 . While the specifics vary somewhat among the different chapters, the most common examples of non-dischargeable debts are:

- Alimony and child support.

- Certain unpaid taxes, such as tax liens. However, some federal, state, and local taxes may be eligible for discharge if they date back several years.

- Debts for willful and malicious injury to another person or property. âWillful and maliciousâ here means deliberate and without just cause. In Chapter 13 bankruptcy, this applies only to injury to people debts for property damage may be discharged.

- Debts for death or personal injury caused by the debtorâs operation of a motor vehicle while intoxicated from alcohol or impaired by other substances.

- Debts that you failed to list in your bankruptcy filing.

Read Also: How Much Does A Bankruptcy Lawyer Cost In Florida

Tax Returns And Chapter 13 Bankruptcy

You must be up to date on your tax returns before you file a Chapter 13 case, but the rules allow you a little wiggle room. You’ll provide copies of the returns for the previous four tax years to the Chapter 13 trustee before the 341 meeting of creditors . If you’re not required to file a return, your trustee might ask for a letter, an affidavit, or a certification explaining why. Sometimes local courts will impose additional rules for documents in their districts.

If you owe the IRS a return but don’t file it before your 341 meeting of creditors, things can happen to derail your case.

- A motion. The trustee will file a motion giving you a very brief period to provide your returns. If you miss the deadline, the court can automatically dismiss your case, leaving you no chance to plead your case to the judge.

- A substitute return. The IRS might file a “best estimate” claim based on your past income. The problem? IRS estimates are almost always higher than what you would owe after you file a proper return.

What Happens To Debt Discharged Prior To The Bankruptcy

Any debt that you have had discharged prior to your Arizona bankruptcy becoming a fact would be a completely different issue.

If a Form 1099-C has been submitted to you and the IRS before youve filed for bankruptcy, the respective sum would be considered taxable income. Thus, even if you file bankruptcy later on, you will still be expected to pay taxes on the respective amount.

The reason for this condition is simple the discharged amount is no longer considered debt and as such, its not affected by the bankruptcy filing. The debt has now been transformed into income and your subsequent actions have no effect on it.

Recommended Reading: How Many Bankruptcies For Donald Trump

Debts Discharged In Bankruptcy Are Not Considered Taxable Income

Fortunately, debts that you wipe out in bankruptcy are NOT considered income to a taxpayer. Mortgage companies will often send out a 1099-C to a taxpayer that has discharged an old mortgage debt out of an abundance of caution, but it doesnt mean its going to be counted by the IRS as income.

While a debt forgiven outside of bankruptcy is taxable income, there is an exception to this rule pursuant to Internal Revenue Code Section 108 which provides that debts discharged in a bankruptcy case do NOT need to be included as income for forgiveness of debt.

Even though debts discharged in a bankruptcy are not counted as taxable income to a debtor, the amount of debt discharged can be used by the IRS to reduce certain tax attributes of the debtor such as net operating loss carryover, minimum tax credit, basis reduction in certain assets, foreign tax credits, and net capital loss and capital loss carryovers. This is not an exhaustive list, so please consult a CPA when it comes time to file your taxes after filing bankruptcy. Most of these tax attributes wont apply to 99% of people who file bankruptcy. Your attorney will let you know if these issues should be taken into consideration at tax time.

Contact Us for Help!

What Happens If I Have Tax Debt That Cant Be Erased Yet

Plenty of taxpayers are in this boat, and they all have several legal options. An attorney can advise you on the best course of action, but ultimately, the decision is yours.

Pay in installments. Some people talk to the IRS about a payment plan. The IRS usually backs off once the taxpayer starts an installment agreement. After all, the IRS just wants the money. It doesn’t really want to garnish your wages. Keep in mind that installment agreements are only a good idea if you have the money. If thatâs not the case, you need another option.

Participate in the Offer in Compromise program. The IRS has many programs to help taxpayers pay their tax debt when they have little or no money. The main example is the Offer in Compromise program where taxpayers pay what they can, and the IRS forgives the rest. This program can be extremely complex, and few people qualify. Also, if the taxpayer has any assets whatsoever the IRS will force the taxpayer to sell them. Finally, while the taxpayer negotiates, the IRSâs harassing collections techniques continue.

Read Also: How Many Times Has Trump Filed For Bankruptcy

File Irs Form 982 After Bankruptcy Discharge

The correct way to ensure that you do not have to pay taxes on any debt forgiven in bankruptcy, and properly allocate any tax attributes, is to file IRS Form 982 for the tax year in which you received your bankruptcy discharge. See IRS Publication 4681 for detailed information explaining all the above. Many people and even accountants are unaware of this form and the importance of filing it. Be proactive and mention it to your accountant before filing your returns .

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Renting An Apartment After Bankruptcy

How Does Cancellation Of Debt Affect Your Taxes

In many cases, canceled debt may add to your taxable income. This can increase how much you owe the IRS or eat into your expected tax refund. Heres an example:

- You made $40,000 this year, and due to higher-than-necessary withholdings on your paycheck, youre expecting a $1,000 refund.

- You also settled debts for $15,000 this year. That means the IRS might consider you having $15,000 more in incomebringing you up to $55,000.

- You didnt yet pay taxes on that $15,000, so you may need to do so in April. Depending on all other factors, that tax amount could take your entire $1,000 refund, and you could owe even more.

Not all canceled debt works against you when it comes to tax burdens, though. The IRS provides a list of exceptions of 1099-C canceled debt that isnt added to income. That includes:

- Certain debts canceled or discharged in bankruptcy

- Certain qualified farm debts

- Certain qualified business debts

As you can see, whether or not a canceled debt is counted as income for federal tax purposes can be a complex topic. The bottom line is that discharged debt may come back to burden you in the form of additional income on your tax return, so its important to be aware of this possibility.

Are Debts Discharged In Bankruptcy Considered Taxable Income

Imagine this scenario: youve filed a Chapter 7 bankruptcy, and after youve received your bankruptcy discharge wiping out your debts, you receive a 1099-C from a creditor. A 1099-C stands for Cancellation of Debt income because under normal circumstances, if a creditor forgives a debt you owe, it will be counted as income to you that must be reported to the IRS or your state taxing authority. So the question we are often asked is whether income reported to the IRS by a creditor on a 1099-C on a discharged debt is actually taxable income for federal or state tax purposes.

You May Like: Do It Yourself Bankruptcy Chapter 7 Software

What Happens To Your Credit Rating After Discharge

The official receiver will not tell the credit agencies when your bankruptcy ends. You might need to ask the credit agencies to update their records to include details of your discharge.

The bankruptcy can stay on your record for 6 years after the date of the bankruptcy order.

Read more on this in the Information Commissioners Office Credit explained document.

Bankruptcy And Taxes: Qualifying For Discharge

Whether you can discharge tax debt will depend on the type of tax, how old the tax debt is, if you filed a return, and the type of bankruptcy. Federal income taxes in Chapter 7 are dischargeable if you meet all of the following conditions:

- The discharge is for income taxes: Payroll taxes and penalties for fraud are not eligible for discharge.

- You filed legitimate tax returns: You filed a tax return for the relevant tax years at least two years before filing for bankruptcy.

- The tax liability is at least three years old: The tax debt is from a tax return that was originally due at least three years before filing for bankruptcy.

- You are eligible under the 240-day rule: The IRS assessed the tax debt at least 240 days before you filed for bankruptcy. If the IRS suspended collection activity during negotiation, the applicable date may be extended.

- You did not commit willful tax evasion: Possible evasive actions include changing your Social Security number, your name, or the spelling of your name repeated failure to pay taxes filing a blank or incomplete tax return and withdrawing cash from a bank account and hiding it.

- You did not commit tax fraud: The return contains no information that was intended to defraud the IRS.

You May Like: How Many Times Has Trump Filed Bankrupsy