Consider A Debt Management Plan

If you have the money to pay the debt and want to clear it up, you could talk with a not-for-profit credit counselling agency and arrange a debt management plan.

However, you must repay your debt in full, as this is a requirement with any payment plan through a credit counselling agency. A credit counsellor cannot settle your debt for less even if the collection agency is willing to accept less than the full amount.

A new note will be placed on your credit report when you enter into a debt management plan. This note will remain for two to three years from completion. However, some creditors continue to report your monthly payment made through a collection agency as regular transactions, refreshing the last activity date. So the debt can remain on your credit report for six years after you complete your debt management plan. Since a DMP can be anywhere from 1 year to 5 years, that one account could impact your credit history for a long time if you go through a credit counsellor.

What To Know About Old Debts

What if my debt is old?

Debt doesnt usually go away, but debt collectors do have a limited amount of time to sue you to collect on a debt. This time period is called the statute of limitations, and it usually starts when you miss a payment on a debt. After the statute of limitations runs out, your unpaid debt is considered to be time-barred.

If a debt is time-barred, a debt collector can no longer sue you to collect it. In fact, its against the law for a debt collector to sue you for not paying a debt thats time-barred. If you do get sued for a time-barred debt, tell the judge that the statute of limitations has run out.

How long the statute of limitations lasts depends on what kind of debt it is and the law in your state or the state specified in your credit contract or agreement creating the debt.

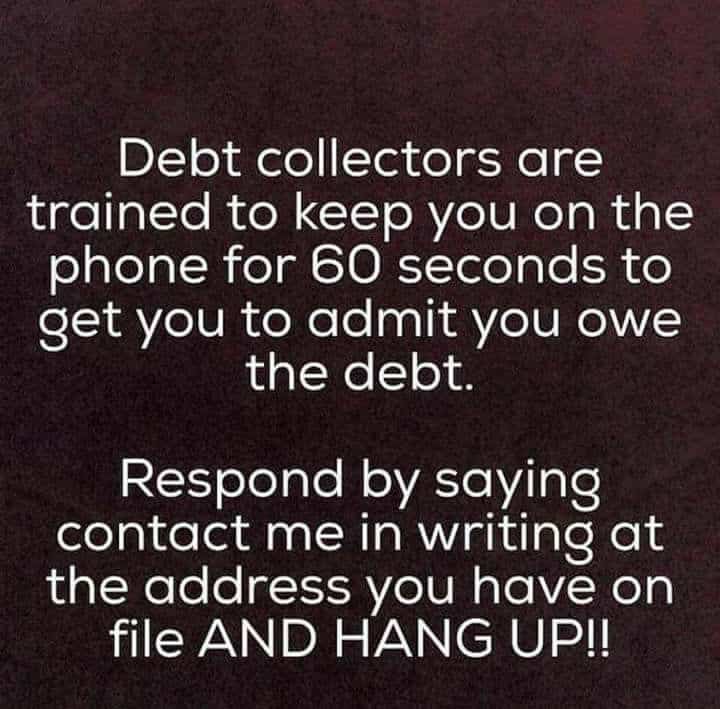

Also, under the laws of some states, if you make a payment or even acknowledge in writing that you owe the debt, the clock resets and a new statute of limitations period begins. In that case, your debt isnt time-barred anymore.

Can a debt collector contact me about a time-barred debt?

Sometimes. It depends on which state you live in. Some state laws say its illegal for a debt collector to contact you about a time-barred debt. But even if you live in a state where a collector may still contact you, they cannot sue or threaten to sue you over a time-barred debt.

What if Im not sure if my debt is time-barred?

Does a time-barred debt stay on my credit report?

How Do I Pay Off Old Debt In Collections

How to pay off debt in collections

Read Also: How Can Bankruptcy Affect Your Credit

Threaten Legal Actions Beyond Lawsuits

A collection agency cannot sue a debtor on your behalf, nor can it seize a debtors property or garnish their wages. It can indicate that an account is in collections on the debtors credit report, and they can regularly contact the debtor , but thats all it can do. Its up to you if you want to bring the case to court.

Rates Of Interest Might Become Unfavorable

If you do not pay Houston commercial collection agency on time, believe us when we say that taking loans or making later payments for other commodities or services will be difficult. You might want to make purchases based on your credit card. But once the owner checks the credit score, there is a chance that will sell you the product at a higher rate of interest. Having an impending debt makes you an unreliable customer. So they wont be willing to give you any product without charging a higher rate of interest for security reasons. You can skip all these troubles by just paying and contacting the debt recovery services Houston.

You dont have to be afraid or skeptical about agents because your original creditor has researched collections agency near me, before hiring them. We at Nelson Cooper & Ortiz have great payment plans and options for all debtors so that paying us is not a hassle. Visit our website or to know more about our services and quotes.

Recommended Reading: How To Bounce Back From Bankruptcy

What Debt Collectors Can And Can’t Do

- A debt collector should only contact a debtor for a reasonable purpose and only when necessary.

- Certain behaviour by debt collectors is illegal, including physical force, coercion or harassment.

What the ACCC does

- We accept reports and enquiries about debt collectors.

- We review reports from the public and take action if we identify concerning behaviour.

- We educate consumers and businesses on their rights and responsibilities.

What the ACCC cant do

- We dont get involved in individual debt disputes.

How Debt Collectors Get Your Information

When you havent paid a debt to a creditor , they may sell it to a agency or hire an agency to collect the debt on their behalf. The responsibility of collecting the debt then falls to the collection agency.

The creditor will likely pass along some of your personal information like your address and phone number so that the collection agency can contact you. If this information is incorrect, they may also try an internet search to find your current contact information.

If a debt collector got your information from the original creditor, theyll have your personal details, such as where you live, the amount owed and the company you originally owed money to. If youre dealing with legitimate debt collectors, they should have no problem sharing information related to your debt.

Read Also: How Often Can You File Bankruptcy In Ga

Pros And Cons Of Collection Agencies

There are several reasons why businesses turn to a collection agency for help. Many business owners are strapped for time. They barely have a moment to bill customers, let alone chase down late ones. A collection agency takes that off your hands. Sure, theres a fee, but its better than getting nothing if you dont collect it on your own.

You also get legal protection when you work with a collection agency. The last thing you want is to face legal action because of the way you attempted to collect debt. A reputable collection agency knows the rules and regulations. You have less chance of being sued if you hire an accredited and highly rated collection agency.

The collections success rate tends to be higher when you work with a collection agency than if you try to collect the debt yourself.

The biggest downside of working with a collection agency is that there is a fee for doing so. You dont get all of the money you are owed, because the collection agency takes a percentage for their efforts. However, it is often better to get some of what you are owed, rather than none at all.

Key takeaway: The benefits of hiring a collection agency are that you dont have to chase down clients, nor do you have to worry about being sued if youre collection tactics are too aggressive.

Will Collection Agency Settle For Less Hospital Bills

Negotiating medical debt settlement on your own means working with the collections agency to lower the amount of your debt you have to pay back. Offer to pay a percentage of your debt and enter into a settlement agreement. You may be able to make monthly payments on this settled amount until it’s paid off.

Don’t Miss: What Happens When You File Bankruptcy For Credit Card Debt

What Should I Do If A Debt Collection Agency Calls Me

Its always distressing to get a call out of the blue, from someone who knows your business and is demanding something. Sometimes collection agency calls are exactly what they seem attempts by debt collectors to receive money you are delinquent on repaying but sometimes, you may be talking to a scammer.Try not to be upset about the call. If you cant talk just then, or want to think about the situation, ask the collector to call back another time. Or, ask them questions about the situation so that you have more information. Read on to check out various reasons you may be receiving this call.

Don’t Give A Collector Your Personal Financial Information

While some collectors might say they want information about your income to qualify you for a lower payment amount, you should never provide your personal financial information, including your:

- bank account numbers

- your Social Security number, or

- the amount or value of property that you own.

This information might be used to collect from you through a wage garnishment, bank levy, or property lien if the creditor or collector gets a judgment against you.

You can, however, provide basic information about your financial troubles.

Also Check: Does A Bankruptcy Trustee Check Records

Be Aware Of Debt Collection Scams

Debt collection scams are real, and scammers may use anxieties about debt in order to pressure you into paying. Watch out for supposed debt collectors withholding information, calling you late at night, threatening jail time or asking you to pay with a prepaid card.

Confirming both your debt and the collection agencys right to your payments goes a long way in protecting you against potential fraud. Never give anyone access to your bank account. Instead, pay with certified checks and keep detailed records of your payments along with your original agreement.

If you think a debt collector has broken the law, report them to the CFPB. You can also sue them in federal court within one year of when they broke the law.

What Happens To Your Credit Score

Unpaid debts on your credit report can hurt your credit score for months until you pay the debt, or up to seven years before it falls off of your report. This can impact your ability to get loans and definitely you ability to get loans with a low interest rate. It can also impact your ability to get a job, especially ones that are in upper management or are finance oriented. Furthermore it can also impact your ability to pass a credit check when renting a house or apartment, as property management companies, as well as some landlords conduct credit checks when deciding which applicant to rent to.

Read Also: How Often Can You File Bankruptcy In Ny

Tell The Collector You Can’t Afford To Pay

A collector doesn’t have to stop trying to collect just because you can’t pay. But telling collectors that you can’t pay, and giving them a short explanation of your financial difficulties, might lead them to move on to other consumers. It might also prevent your file from being referred to litigation.

But be sure not to admit that you owe the debt or say anything that might restart an expired statute of limitations. Depending on your state, you might restart the statute of limitations if you make a partial payment on a debt or otherwise acknowledge that you owe a debt that you haven’t been paying. A new promise to pay a debt might also revive the statute of limitations in some circumstances.

How Do You Get Medical Debt Forgiven

Contact your provider, hospital, or health care institution to ask for a discount or to arrange for a payment plan. Many hospitals offer financial assistance programs. Find out if you qualify for help, such as debt forgiveness. You may be eligible for assistance through local, state, and federal government programs.

Also Check: Auction Pallets For Sale

If A Debt Collector’s Behaviour Is Unacceptable

If a debt collector threatens you with violence or physical force, contact the police immediately.

If they’re harassing or intimidating you, ask them in writing to stop it. The Financial Rights Legal Centre has a letter template you can use.

If the behaviour doesn’t stop, contact the Australian Financial Complaints Authority to make a complaint and get free, independent dispute resolution.

What To Expect In 2021

A lot has changed for collection agencies since January. Heading into 2020, the industry was focused on new rules and regulations regarding debt collections, increased competition, and declining commission rates. But then the COVID-19 pandemic occurred, and everything changed.

Like other industries, collection agencies across the country were required to shut down in-person operations, shifting to remote workforces or halting operations altogether.

At the same time, states aiming to protect struggling consumers during the pandemic, limited the work collection agencies can do. Massachusetts, for example, banned debt collectors from making collection calls, filing new collection lawsuits, garnishing wages or earnings, or repossessing property and vehicles. In Illinois, debt collectors must work with consumers to create payment plans that meet clients financial situations or delay collection for 60 days.

The federal government is also taking steps to limit what debt collection agencies can do during these unprecedented times. A bill has been introduced in the U.S. Senate that, if passed, would only allow debt collectors to communicate with consumers in writing during a major disaster, such as the current coronavirus pandemic. The limitations on collection agencies would last for 120 days from when the president declares a major disaster.

Read Also: Will Filing Bankruptcy Stop Irs Debt

Make A Settlement Offer

If you have a single old debt and want to stop the calls, consider negotiating a settlement with the collection agency. You can offer to pay the collection agency a percentage of what you owe and ask that the unpaid debt be written off. Depending on what you can afford and how old the debt is, start at 20 cents on the dollar and see what they are willing to accept.

Be aware that your settlement payment will update the last activity date meaning the debt will remain for another six years on your report. To avoid this, as part of your settlement arrangement, ask the collection agency to purge the debt from your credit report right away.

Should You Pay A Debt Collection Agency For Old Debts

Its a common myth that old debts go away after a specific time. However, the truth is that old debt can come back to haunt you whether you pay them or not. Heres how:

If you dont pay an old debt, it will likely appear on your as unpaid. This can damage your credit score and make it harder to get loans or other lines of credit in the future.

Additionally, the original creditor may sell your debt to a collection agency, which will then try to collect the debt from you. This can be stressful and may lead to wage garnishment or legal action.

On the other hand, if you pay an old debt, you may inadvertently revive the debt and reset the statute of limitations. This means that the creditor can now sue you for the debt, and if they win, they can garnish your wages or take other legal action to collect the debt.

Recommended Reading: Does Filing Bankruptcy Affect Spouses Credit

Go To Small Claims Court

If the above steps havent resulted in payment, you can take your client to small claims court if the debt youre owed is smaller than your states small claims maximum. You dont need a lawyer to appear with you in small claims court, and if your client doesnt appear, you automatically win the case.

How Does Debt End Up With A Debt Collection Agency To Begin With

Say you end up not paying a medical bill or your mortgage. Usually after around 60 days of nonpayment your bill will go to a debt collection company, which has been hired by the company that you owe money to. If and when you pay the debt collector, usually the money will largely go to the entity that you originally owed money to but the debt collector will also take a cutbetween 25 and 45% usually. The debt collector might also have bought the debt from whomever you owed initially, and will collect the entire amount.

Also Check: Filing Bankruptcy In Tennessee

What To Do After You Make Your Last Payment

When you finish your payment plan or complete the lump sum, ask the collection agency for a letter of completion from a company signatory. Then check your credit reports to make sure that the account has been accurately updated but note that changes may not be reflected for 30 days. Even after everything is updated correctly, keep your records in a safe place in case any issues arise later.

What Happens If You Dont Pay A Collection Agency

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Filing for bankruptcy relief does not mean that you have to give up everything you own. The purpose of filing a bankruptcy case is to get debt relief. The fresh start provided by filing a Chapter 7 bankruptcy would not be a real fresh start if the filer ends up losing all of their belongings. That’s where the bankruptcy exemptions come in.

Written byAttorney John Coble.

What will happen if you don’t pay a debt collector? The answer to that question depends on many different factors. The debt collector may go away. Usually, the debt collector will continue the phone calls to hound you until it has made progress on the debt collection. This article will discuss whether you should pay a debt collector or consider other options. In some situations, it makes sense not to pay the debt collection agencies.

Don’t Miss: How To File Bankruptcy While Married