Definition And Examples Of Qualifying Ratios

A qualifying ratio is a percentage lenders use to determine whether or not a borrower can reasonably repay their loan. The exact requirements can vary depending on the lender, and this ratio is usually considered alongside a borrowers and other factors to determine eligibility.

For instance, the debt-to-income ratio is one metric mortgage lenders use to qualify a borrower for a home loan. A debt-to-income ratio looks at the percentage of a borrowers income that goes toward monthly debt payments.

Fannie Mae, which buys conventional mortgages, allows for a maximum debt-to-income ratio of 45%, although up to 50% is permitted with additional compensating factors.

Fha Debt To Income Ratio Requirements Versus Conventional Loans

FHA Debt To Income Ratio Requirements applies for both home purchase, refinance loans, and Cash-Out Refinance Mortgage Loans.

Just because borrowers meet all the HUD Agency Mortgage Guidelineson FHA loans does not mean that all lenders will approve borrowers meeting just the minimum agency mortgage guidelines. Lenders will require all borrowers to meet the minimum HUD agency mortgage guidelines on FHA loans. Most Lenders will have Lender Overlays on debt to income ratios, which we will discuss on this blog. Lender overlays are additional lending requirements that are above and beyond the minimum HUD Agency Guidelines. Lenders are allowed to have tougher lending requirements that are above and beyond the minimum HUD Agency Guidelines. There are lenders like Gustan Cho Associateswith no lender overlays on government and conventional loans. Gustan Cho Associates has no lender overlays on FHA loans. We just go off the automated underwriting system and have zero lender overlays.

In this article

Dont Miss: Does Loan Modification Stop Foreclosure

Can A Second Mortgage Eliminate Pmi

A loan option that is rising in popularity is the piggyback mortgage, also called the 80-10-10 or 80-5-15 mortgage.

This loan structure uses a conventional loan as the first mortgage , a simultaneous second mortgage , and a 10% homebuyer down payment. The combination of both loans can help you avoid PMI, because the lender considers the second loan as part of your down payment. A piggyback loan can make homeownership accessible for those who may not yet have saved a down payment.

For an in-depth look at these loans, see our piggyback loan blog post.

Don’t Miss: Can Medical Debt Be Discharged In Bankruptcy

Stated Income To Avoid Debt

- For those who have trouble meeting DTI ratio requirements

- A stated income loan could come in handy

- But expect a higher interest rate as a result

- And be prepared to document a significant amount of assets

Its also possible to go the stated income route if you feel you wont qualify for the loan based on your gross income alone. But unlike the liars loans of the early 2000s, todays stated loans rely on a healthy stable of assets to offset any income shortcomings.

One such example is a bank statement loan, which calculates income by using bank deposit history over a certain period of time. So you still need to have lots of money in the bank to get a mortgage.

If you find yourself in this situation, mortgage brokers can be helpful because they work with a variety of banks and lenders, including specialty lenders. The big retail banks may not be able to accommodate you.

Before the crisis, pretty much every bank and lender offer reduced documentation loans such as SIVA loans and No Ratio loans , and very few borrowers actually documented their income. Those days have come and gone.

Many people think reduced-doc loans are just stretching the truth, but they can also come in handy for borrowers who have increased their gross income recently, or those with complicated tax schedules, usually self-employed borrowers.

Conventional Loan Vs Government Loans

Home buyers have dozens of mortgage loan options today.

In general, though, mortgages can be divided into two broad categories government-backed loans and conventional loans.

The rule of thumb is that if you have good credit and a large down payment , a conventional loan is often best. If you have lower credit and/or a smaller down payment, a government-loan can help.

But those are not universal rules. The best type of mortgage for you will depend on your budget, your credit, and your home buying goals.

To help guide you in the right direction, heres a broad overview of conventional vs. government loans, and who theyre best for:

If youre not sure which type of loan is best for you, read up on your options or chat with a loan officer about what you might qualify for.

Read Also: Can Bankruptcy Affect My Job Uk

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Who Benefits From The Higher Dti Ratio Limit

Borrowers who have strong credit scores and a steady income but live in expensive housing markets are likely to benefit the most from the DTI change, says Michael Fratantoni, chief economist with the Mortgage Bankers Association.

Thats because they otherwise wouldnt qualify for a conventional loan, and theyd have to take out a jumbo loan, he adds.

Jumbo loans are also called nonconforming loans because the loan amount exceeds the limits established by Fannie Mae and Freddie Mac.

While most properties in the U.S. have a loan limit of $548,250, some in higher-cost areas have a higher limit of $822,375, according to the Federal Housing Finance Agency.

That said, the average borrower wont suddenly have more access to mortgage credit because of a higher DTI ratio limit, Fratantoni says.

After all, he notes, lenders may also look at your credit payment history, FICO score, income and credit utilization to determine if you can repay your loan.

Don’t Miss: How To Get A Credit Card With Bankruptcy

Conventional Conforming Loans Vs Non

Straightforward, common sense conventional loan requirements combined with low interest rates and minimal fees are considered the signature qualities of conforming loans. In contrast, non-conforming conventional loans have often encompassed nearly every risky lending practice known to man until recently. Conforming vs. non-conforming conventional loan requirements related to an applicants and history, debt-to-income ratio and loan-to-value ratio are explained here

Who Qualifies For A Conventional Loan

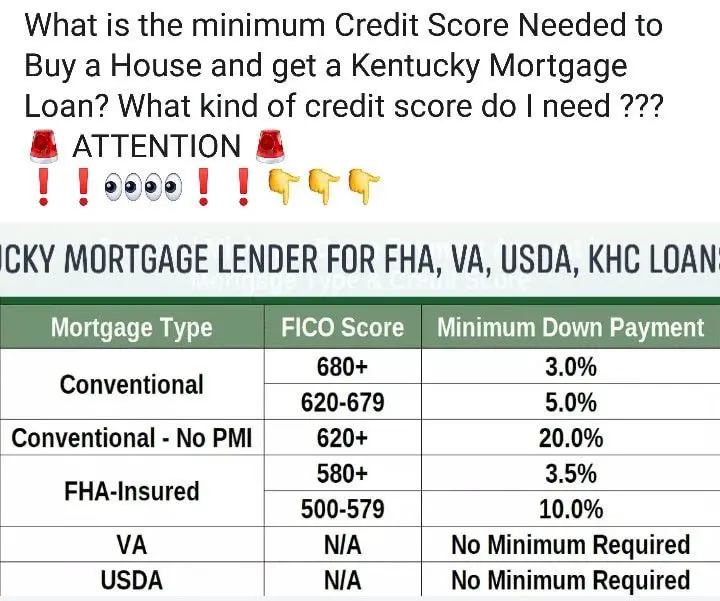

Conventional loan requirements arent as tough as many home buyers expect. Borrowers can often qualify for a conventional loan with a credit score of 620 or higher, reliable income, and at least 3% down. In addition, lenders usually want to see a two-year history of steady income and employment. And youll need to provide financial documents like bank statements and tax forms to verify your financial information.

Home buyers no longer need 20% down or perfect credit to get a conventional mortgage. So dont let those traditional standards get in your way if youre ready to buy a home now.

In this article

Note on mortgage terminology: A conventional loan” is any mortgage not backed by the federal government. Most conventional loans are also conforming loans, meaning they follow lending guidelines set by Fannie Mae and Freddie Mac. The terms are often used interchangeably, although not all conventional loans are conforming loans. In this article, we use the term conventional loans to refer to conforming loans that meet Fannie Mas and Freddie Mac requirements.

You May Like: California Bankruptcy Exemptions 2021

What Are Conventional Conforming Loan Requirements

To decide if you qualify for a conventional mortgage, various aspects of your financial history will be looked at. How does that happen? Fannie Mae provides a powerful application called Desktop Underwriter that helps conventional loan lenders quickly evaluate mortgage applicants. DU software instantly analyzes the borrowers finances, assets, employment history, and credit profile. Freddie Mac also provides a similar program called Loan Prospector.

These helpful Automated Underwriting System programs speed up the mortgage approval process by leaps and bounds. Modern AUS software follows strict guidelines that are important to understand before loan submission. These requirements will be evaluated.

What Do You Need For A Conventional Loan

In order to get a conventional loan, you need to meet basic lending requirements set by Fannie Mae, Freddie Mac, and your individual lender.

Typical conventional loan requirements include:

- Minimum credit score of 620

- Minimum down payment of 3-5%

- Debt-to-income ratio below 43%

- Proof of stable employment and income

- Clean credit history

Although Fannie Mae and Freddie Mac set the minimum conventional loan requirements, lenders can set their own stricter rules, too. For instance, you can technically get a conventional loan with just 3% down according to Fannie and Freddies guidelines. But some lenders require 5 percent. Lenders might also have higher standards for credit score or debt-to-income ratio.

Since requirements vary by lender, it can be helpful to shop around when youre on the borderline of qualifying for a conventional mortgage. If you get denied at first, try with a few other lenders to see whether one will approve your mortgage application.

Also Check: Can I File Bankruptcy Online

What Will My Interest Rate Be

Conventional loan rates are determined by the program you qualify for and your credit score. You might be asking yourself what is the formula to calculate interest rates? Interest rates are driven off of Mortgage Backed Securities which are commonly referred to mortgage bonds. These value of these bonds determine whether the interest rates rise or fall. Your final rate will determine your payment using the standard calculate mortgage payment formula.

How Much Income Do You Need To Get A Usda Loan

To get a USDA loan, you must have a DTI of less than 41%. USDA loans have a couple of unique requirements. First, you canât get a USDA loan if your household income exceeds 115% of the median income for your area. Second, your lender must consider the income of everyone in the household when evaluating your eligibility for a USDA loan.

Read Also: Tv Pallets For Sale

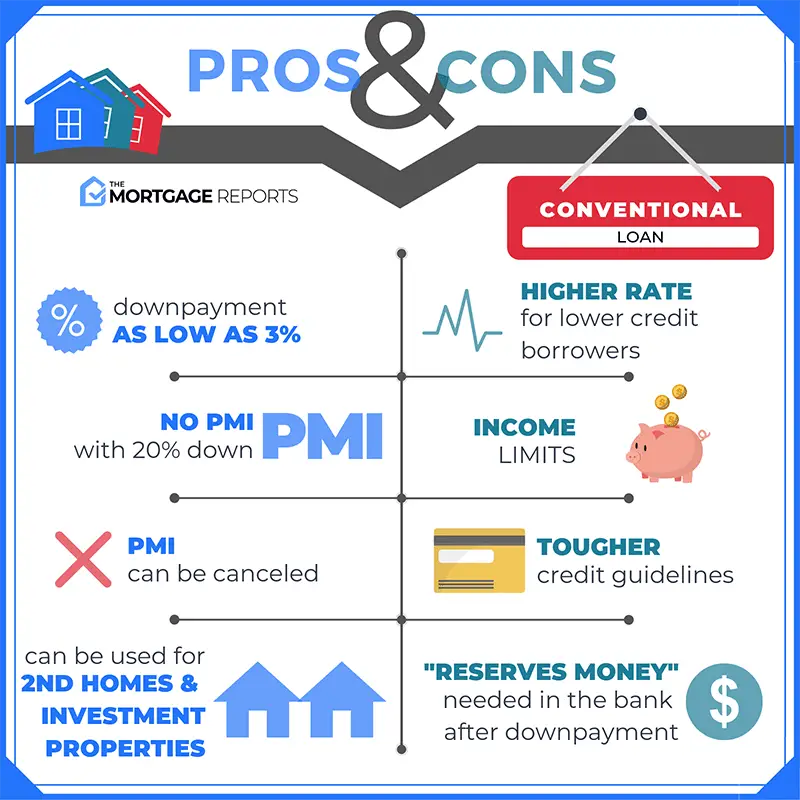

Does Pmi Increase Monthly Mortgage Payments

Probably from shoppers who want to avoid paying private mortgage insurance premiums. When you put less than 20% down on a conventional loan, your lender will require private mortgage insurance . This coverage helps protect the lender if you default on the loan. PMI does increase monthly mortgage payments.

How To Calculate The Qualifying Ratio For A Home Loan

Debt-to-income ratio dictates how large of a mortgage payment you can afford.

Digital Vision./Digital Vision/Getty Images

One of the main factors in qualifying for a mortgage loan is the debt-to-income ratio. All lenders have slightly different guidelines. Different loan programs also recommend higher or lower debt-to-income guidelines. If you are in the market to buy a home or are considering refinancing, it will be helpful to know how to calculate the ratio yourself. It also will be useful to have a general idea of what number lenders are looking for.

You May Like: What Cannot Be Discharged In Chapter 7 Bankruptcy

Looking At Your Mortgage To Income Ratio Logically

Above, weve talked about the mortgage to income ratio guidelines according to the lenders. Now its time to talk about the mortgage to income ratio logically. What can you afford? Thats what you need to figure out. Just because you can have a 31% housing ratio for an FHA loan, for example, doesnt mean that you need to borrow that much. If you arent comfortable with a mortgage payment of that size, choose one that you are comfortable with so that you can decrease your chances of foreclosure.

We suggest that you get pre-approved for a loan amount and find out the full payment. Then compare that to your actual budget. Put the numbers in your budget and see how it works. Is it close to the amount you pay now for rent/housing? If its much higher, is it a number that fits within your budget? Do you have enough disposable income after paying the mortgage to cover the cost of everyday living? Consider these factors before deciding on a mortgage.

Conventional Dti Calculator For Fannie Mae Dti Guidelines

Fannie Mae DTI Guidelines on Conventional Loans: Borrowers can calculate their debt-to-income ratio using the Conventional Loan DTI Mortgage Calculator powered by Gustan Cho Associates. Conventional loans are the most popular loan program for first-time homebuyers due to the low 3% down payment program. Fannie Mae DTI Guidelines cap the DTI at 50%. However, to get an approve/eligible with lower credit scores, the debt-to-income ratio may be capped at 45%. Fannie Mae DTI Guidelines have a maximum debt to income ratio cap of 50% DTI on conventional loans. Conventional loan debt-to-income ratio guidelines are different than any other mortgage loan program. There is no maximum front-end debt to income ratio on conventional loans. There is only one debt to income ratio on conforming loans which is the back end.

You May Like: Can You File Bankruptcy On Income Taxes Owed

What Is The Debt To Income Ratio

There are two debt-to-income ratios utilized for most mortgage programs. The first ratio is known as your top ratio, and that uses your new housing payment as a percentage of your gross monthly income. The second ratio, known as your âbottom ratioâ, factors all your monthly debt, including new housing expenses, …

How Do I Get Rid Of Private Mortgage Insurance

Once your equity reaches 20% of the homeâs value , you can ask the lender to remove the PMI from your monthly payments. Once your equity rises to 22% of the original purchase price, the Homeowners ProtectionAct requires the lender to remove the PMI automatically â even if the homeâs fair market value has fallen.

» MORE:Learn how to get rid of PMI here

You May Like: Bank Of America Foreclosed Homes

Pros And Cons Of Conventional Loans

Pros: Why you should consider a conventional mortgage

- You have more choices in mortgages Conventional mortgages either come with fixed-interest rates for the full term of the loan, or Adjustable-rate mortgages which have an initial low fixed-interest rate and once the initial period is over, the interest rate will adjust every 6 months. Fixed-interest rate mortgages commonly come with 15-, 20-, and 30-year loan terms. This means your interest rate will remain the same for the length of the mortgage, and youll have to pay off the mortgage over the agreed-upon time. Adjustable-rate mortgages have an initial low fixed-interest rate during the introductory period of the loan. Once this introductory period is over, the interest rate will adjust every 6 months.

Fund fact: Your credit score impacts the interest rate lenders will offer you.

Cons: Why a conventional mortgage may not be right for you

Fund Fact: Homebuyers with DTIs up to 50% may also be eligible for a conventional loan with Better Mortgage.

- You have had past bankruptcies and foreclosures. The eligibility criteria for government-backed mortgages are more relaxed. As a result, past bankruptcies and foreclosures are forgiven much faster. Homebuyers with recent bankruptcies or foreclosures which would otherwise be approved may need to wait longer before a lender approves them for a conventional loan. And in some cases, the homebuyer’s loan may not be approved at all.

Max Dti Ratio For Va Loans

- VA states 41% is max acceptable DTI

- And 41% max without compensating factors is likely the limit

- Possible to get approved with DTI between 41-50% with compensating factors

- Or even higher in certain cases with exception

For VA loans, the same automated/manual UW rules apply. If you get an AUS approval, the maximum DTI ratio can be quite high.

However, if its manually underwritten then the maximum debt-to-income ratio is 41% . There is no front-end debt ratio requirement for VA loans.

Again, as with FHA loans, if you have compensating factors and the lender allows it, you can exceed the 41% threshold and enjoy higher DTI limits.

Specifically, if your residual income is 120% of the acceptable limit for your geography, the 41% DTI limit can be exceeded, so long as the lender gives you the go-ahead.

In other words, most of these limits arent set in stone, assuming youre a sound borrower otherwise.

You May Like: Do It Yourself Bankruptcy Chapter 13

Explore Conventional Loan Rates From Better Mortgage

Interest rates from all lenders are affected by the economy. The type of property youre buying, where its located, and your unique financial situation also impact the rates lenders offer. This is why you might notice a difference in the rate youre offered compared to the rate provided to a friend. Often its an individuals credit score that makes the difference. Lenders are more likely to offer a lower interest rate to homebuyers with good credit who want to borrow more money. Another thing lenders take into account is how likely and how soon a borrower will refinance their mortgage.

The most accurate way to know your personalized conventional loan rates is to do a mortgage pre-approval. With Better Mortgage, a pre-approval takes just 3-minutes and wont impact your credit score.