What Is A Debt

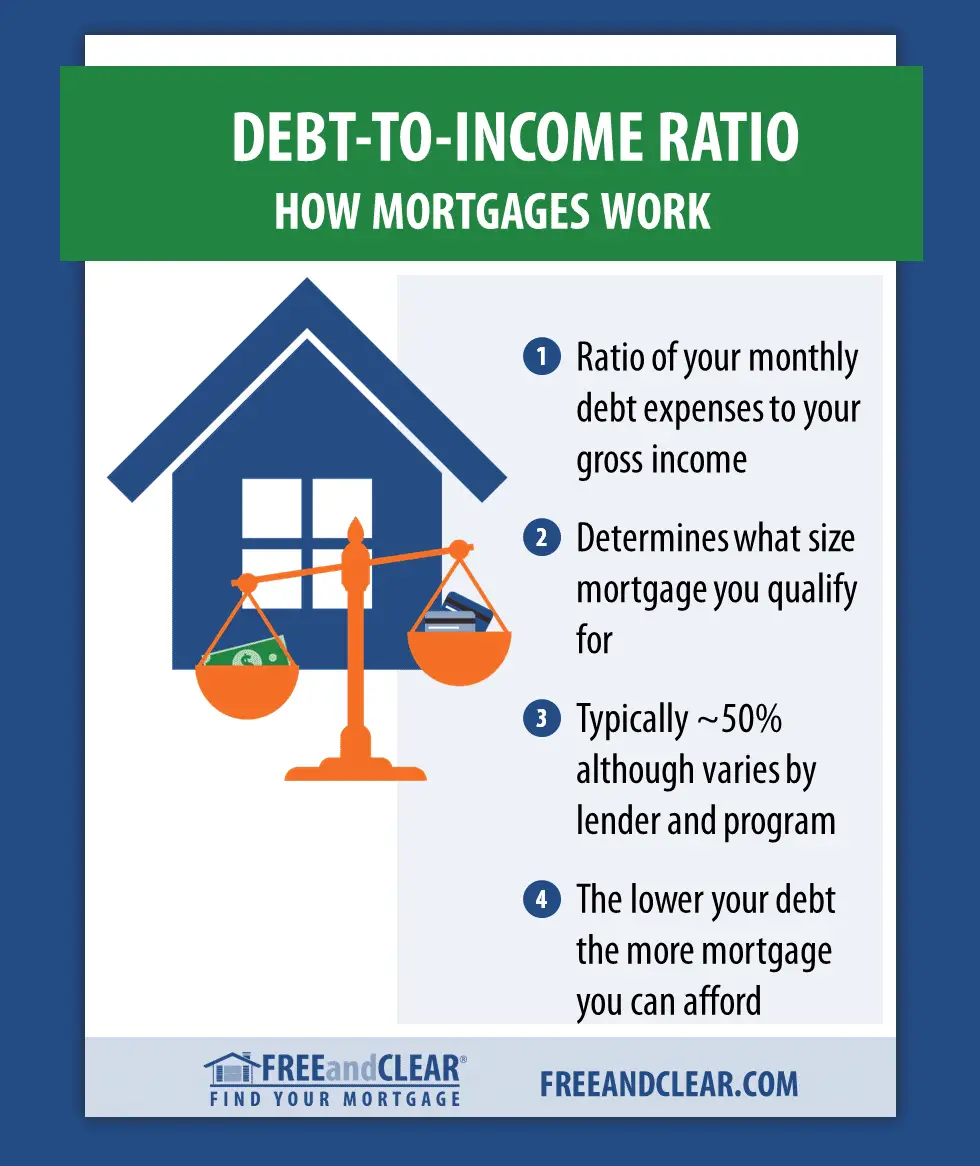

Your debt-to-income ratio tells you how affordable your debt repayment is. It can help you decide if you have too much debt or if you can manage your debt payments comfortably.

To calculate your debt-to-income ratio, add up all your monthly debt payments, and divide this by your monthly gross income. To express your ratio in percentage form, multiply it by 100.

As a formula: DTI = monthly debt payments ÷ monthly gross income x 100

Lets use the 2018 average Canadian total income of $4,000 a month as an example. Lets also say that your overall total monthly debt commitment is $1,800.

Doing the math, that would be $1,800 divided by $4,000, with the result being 0.45. Now, multiply that 0.45 by 100 . The final answer, which is 45%, is your debt-to-income ratio.

To calculate the share of your income consumed by debt repayment, try our easy-to-use debt-to-income ratio calculator.

What Percentage Of Income Do I Need For A Mortgage

A conservative approach is the 28% rule, which suggests you shouldn’t spend more than 28% of your gross monthly income on your monthly mortgage payment.

Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage. Outside of credit score, lenders typically look at your debt-to-income ratio, which compares your monthly debts, including the prospective mortgage payment, to your expenses. With lenders looking at income and expenses, our mortgage calculator provides a great option when determining what you can potentially afford.

Update On Minimum Down Payment And Debt To Income Ratio For Conventional Loan

Fannie Mae and Freddie Mac have brought back the 3% down payment conventional loan home purchase program for first-time homebuyers. Fannie Mae and Freddie Mac offer the 3% down payment conventional home purchase loan program to first-time home buyers. First-time homebuyers are defined as home buyers who had not owned a property in the past three years. Seasoned home buyers who had ownership of a home in the past 3 years require a 5% down payment on conventional loans. Private mortgage insurance is required on all conventional loans with higher than 80% loan to value.

Read Also: Why Did Detroit File For Bankruptcy

Tips To Lower Your Dti

If you arent happy with your current DTI, remember it isnt a fixed number, and you can lower it by either increasing your monthly income or decreasing your existing debt. Whether youre having trouble getting approved for a loan or are facing high interest rates, trying out these tips to reduce your DTI may help.

- Compare your credit card interest rates and pay down ones with the highest rates first.

- Use the 50/30/20 rules to create a budget you can stick to, that will help you manage your spending.

- Pay all bills on time to avoid piling on late fees.

- Get a side hustle like ridesharing, tutoring online, selling clothes in the resale market, or a part-time restaurant or retail position.

What Are Conventional Loans

In order for lenders to be able to sell conventional loans they fund on the secondary market, the loans they originate and fund need to meet Fannie Mae and/or Freddie Mac Guidelines:

- A conventional loan is also known as a conforming loan

- Conventional Loans are also called conforming loans because they need to conform to Fannie Mae and/or Freddie Mac Mortgage Guidelines

- Conforms to the standards, lending guidelines and loan limits set by Fannie Mae and Freddie Mac

- Fannie Mae and Freddie Mac are GSE, which stands for a Government Sponsored Enterprise

- Fannie Mae and Freddie Mac are the two Government Sponsored Enterprises, GSE

Conventional loans that do not meet Fannie Mae and/or Freddie Mac mortgage lending guidelines are known as non-conforming loans.

Recommended Reading: Chase Mortgage Recast Fee

Don’t Miss: Single Family Foreclosed Homes

What Is The Average American Debt

Average American debt payments in 2020: 8.69% of income Louis Federal Reserve tracks the nation’s household debt payments as a percentage of household income. The most recent number, from the second quarter of 2020, is 8.69%. That means the average American spends less than 9% of their monthly income on debt payments.

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

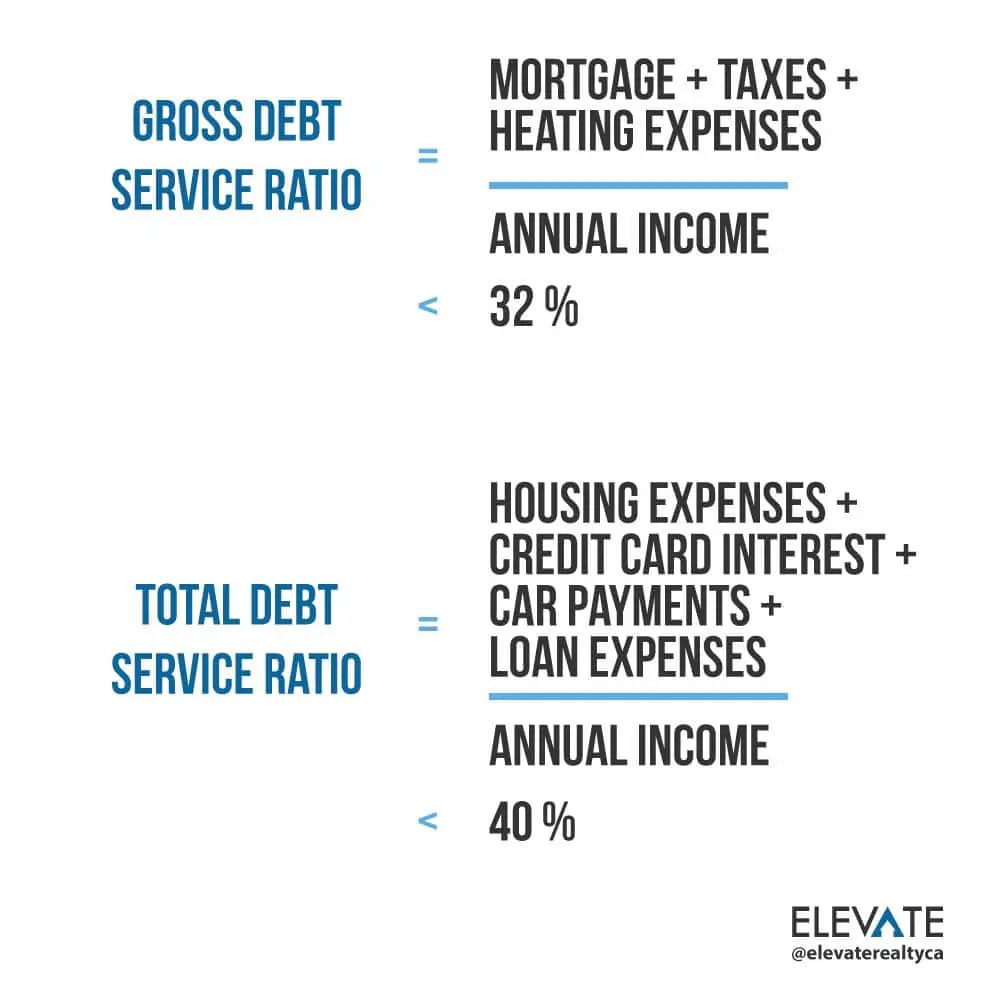

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

You May Like: Foreclosured Homes For Sale

Benefits Of A Conventional Home Loan

Conventional loans are the most popular type of mortgage. After that come government-backed mortgages, including FHA, VA, and USDA loans.

Government-backed mortgages have some unique benefits, including small down payments and flexible credit guidelines. First-time home buyers often need this kind of leeway.

But conventional loans can outshine government-backed loans in several ways.

Dont Miss: How To Not Pay Student Loan Debt

Have A Low Amount Of Debt

Your debt-to-income ratio is the amount you owe on monthly debt payments compared to your monthly income. Considering your DTI ratio helps lenders determine if you can reasonably manage taking on more debt. This ratio is key to whether you qualify for a loan.

To qualify for a HELOC, youll typically need a DTI ratio no higher than 43% to 50%though some lenders might require lower ratios than this.

Read Also: Do Employees Get Paid In Bankruptcy

Recommended Reading: Debt To Income Ratio Definition

How To Improve Debt

If youre denied a loan, or if you know your DTI is too high, there are steps you can take to lower it. Your DTI is just a snapshot in time of your current monthly debt in relation to your income and can improve with a little work. Consider these options:

How To Calculate Your Debt

To calculate your debt-to-income ratio, add up your recurring monthly debt obligations, such as your minimum credit card payments, student loan payments, car payments, housing payments , child support, alimony and personal loan payments. Divide this number by your monthly pre-tax income. When a lender calculates your debt-to-income ratio, it will look at your present debt and your future debt that includes your potential mortgage debt burden.

The debt-to-income ratio gives lenders an idea of how youre managing your debt. It also allows them to predict whether youll be able to pay your mortgage bills. Typically, no single monthly debt should be greater than 28% of your monthly income. And when all of your debt payments are combined, they should not be greater than 36%. However, as we stated earlier, you could get a mortgage with a higher debt-to-income ratio .

Its important to note that debt-to-income ratios dont include your living expenses. So things like car insurance payments, entertainment expenses and the cost of groceries are not included in the ratio. If your living expenses combined with new mortgage payments exceed your take-home pay, youll need to cut or trim the living costs that arent fixed, e.g., restaurants and vacations.

You May Like: Homes For Sale Foreclosures

Buyer Bewareof How Much You Can Afford

Because debt-to-income ratios are calculated using gross income, which is the pre-tax amount, its a good idea to be conservative when you feel comfortable taking on. You may qualify for a $300,000 mortgage, but that amount may mean living paycheck-to-paycheck rather than being able to save some of your income each month. Also remember, if youre in a higher income bracket, the percentage of your net income that goes to taxes may be higher.

While your debt-to-income ratio is calculated using your gross income, consider basing your own calculations on your net income for a more realistic view of your finances and what amount youd be comfortable spending on a home.

Divide That Total By Your Gross Monthly Income

Once you have an idea of what your monthly debt total is, divide it by your gross monthly income to determine your DTI ratio. Your gross monthly income is the amount of money you make each month before taxes. You can usually find your gross income on your paystubs or you can calculate it.

If you are a salaried employee, you can divide your yearly salary by 12 to find your gross monthly income. If you are paid hourly, multiply your hourly rate by the number of hours you work in a week and then multiply that number by 52 to get your yearly income, which you can divide by 12 to get your monthly gross income.

Once you know your monthly gross income, you should be able to use it to find your DTI. If you make $4,000 a month as your gross income and your total debts amount to $1,200, the formula to calculate your DTI would look like this:

= 0.3, or 30%

Also Check: Can You Refinance A Mortgage More Than Once

You May Like: What Is Included In Debt To Income Ratio

What Is A Home Equity Loan

A home equity loan is secured by the equity in your primary residence. Your equity is the difference between your home’s current market value and how much you owe on it. With every mortgage payment you make, you build some equity in your home. Home improvements or a rising housing market can also increase your equity.

Once you have at least 20% equity in your home, many lenders will consider you for a home equity loan. If you’re approved, you’ll typically get payment in the form of a lump sum that you will then repay over an agreed-upon period of anywhere from five to 30 years.

Home equity interest rates, typically slightly above primary mortgage rates, are often an attractive alternative to high-interest personal loans or credit cards. The downside is that if you can’t make your loan payments, you risk losing your home.

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

Read Also: What Is The Chapter 11 Bankruptcy

Which Option Is Best For You

The right option will depend on your timeline for achieving your homeownership goals, the amount of available spare cash, and your potential lenders willingness to work with you. Your homeownership dream doesnt necessarily have to come to an end if a lender says you have too much debt to get approved for a loan. The important thing is to explore all the possible solutions.

Dont Miss: How Many Bankruptcies Has Donald Trump Have

Can You Have More Than One Home Equity Product At A Time

Yes. As long as you have enough equity to borrow against and you meet the qualifications for each product, you can have multiple home equity loans, or a home equity loan and a HELOC. To account for all your loans, prospective lenders will look at your combined loan-to-value ratio to determine how much more you can borrow.

Don’t Miss: Best Place To Buy Liquidation Stock

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

You May Like: Can You Get Extra Money On Your Mortgage For Furniture

Fha Debt To Income Ratio Requirements Versus Conventional Loans

FHA Debt To Income Ratio Requirements applies for both home purchase, refinance loans, and Cash-Out Refinance Mortgage Loans.

Just because borrowers meet all the HUD Agency Mortgage Guidelineson FHA loans does not mean that all lenders will approve borrowers meeting just the minimum agency mortgage guidelines. Lenders will require all borrowers to meet the minimum HUD agency mortgage guidelines on FHA loans. Most Lenders will have Lender Overlays on debt to income ratios, which we will discuss on this blog. Lender overlays are additional lending requirements that are above and beyond the minimum HUD Agency Guidelines. Lenders are allowed to have tougher lending requirements that are above and beyond the minimum HUD Agency Guidelines. There are lenders like Gustan Cho Associateswith no lender overlays on government and conventional loans. Gustan Cho Associates has no lender overlays on FHA loans. We just go off the automated underwriting system and have zero lender overlays.

In this article

Dont Miss: Does Loan Modification Stop Foreclosure

Don’t Miss: Wholesale Liquidation Pallets For Sale

What Else Is Included In Dti

Your debt-to-income ratio also considers auto loans, minimum credit card payments, installment loans, student loans, alimony, child support, and any other expenses you must make each month. It doesn’t typically include recurring monthly charges for utilities, internet service, cable or satellite TV, mobile phone subscription or other charges for ongoing services or other things where the cost is newly incurred each month.

To calculate if you have the required income for a mortgage, the lender takes your projected monthly mortgage payment, adds your expenses for credit cards and any other loans, plus legal obligations like child support or alimony, and compares it to your monthly income. If your debt payments are less than 36 percent of your pre-tax income, you’re typically in good shape.

What if your income varies from month to month? In that case, your lender will likely use your average monthly income over the past two years. But if you earned significantly more in one year than the other, the lender may opt for the year’s average with lower earnings.

Note: Your required income doesn’t just depend on the size of the loan and the debts you have but will vary depending on your mortgage rate and the length of your loan. Those affect your monthly mortgage payment, so the mortgage income calculator allows you to take those into account as well.

Why Your Dti Is So Important

First of all, its desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

Read Also:

You May Like: Who Gets Paid First In Bankruptcy

If Your Dti Is Over 50%

A DTI ratio of over 50% is considered financially unsustainable, and you will likely have trouble qualifying for a conventional loan if the total of your debts consumes more than half of your monthly income.

If you are in this situation, you may want to consider contacting a reputable credit counselor to explore the options available to you. Many small businesses and people who are self-employed live with high debt levels as they build their businesses, so it doesnt necessarily mean you can never qualify for a loan with a DTI this high. Lenders do consider high DTI ratios to be a risk, however, so it may be in your best interest to attempt to pay down what you can before attempting to get a loan.

Create the bathroom youve always wanted.