Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

What Is Included In Your Debt

Your DTI ratio should include all revolving and installment debts car loans, personal loans, student loans, mortgage loans, , and any other debt that shows up on a credit report. Certain financial obligations like child support and alimony should also be included.

Monthly expenses like rent, health insurance premiums, transportation costs, 401k or IRA contributions, and bills for utilities and services are generally not included. However, if you have long-overdue bills for these types of accounts, they might eventually be passed on to a collection agency. The debt may be included in the calculation if that is the case.

There are two types of DTI ratios that lenders look at when considering a mortgage application: front-end and back-end.

What is your front-end ratio?

The front-end-DTI ratio, also called the housing ratio, only looks at how much of an applicants gross income is spent on housing costs, including principal, interest, taxes and insurance.

What is your back-end ratio?

The back-end-DTI ratio considers what portion of your income is needed to cover your monthly debt obligations, including future mortgage payments and housing expenses. This is the number most lenders focus on, as it gives a broad picture of an applicants monthly spending and the relationship between income and overall debt.

A general rule would be to work towards a back-end ratio of 36% or lower, with a front-end ratio that does not exceed 28%.

Also Check: How To Qualify For Home Loan After Bankruptcy

How Is Debt Consolidation Loan For High Debt To Income Ratio

Debt Consolidation Loans for High Debt-to-Income Ratios A debt consolidation loan allows you to scoop up some or all of your current loans and put them into one basket. This way, you only have to remember one loan payment per month, and your new monthly payment may be less than the sum of your current monthly payments.

What happens if you have too much debt to get a mortgage?

When you apply for a mortgage, the lender will make sure you can afford it. Doing so involves evaluating the relationship between your debts and your income formally called your debt-to-income ratio, or DTI. If your DTI is too high, you could have a hard time getting approved for a mortgage.

Also Check: Debt To Income Ratio To Buy House

Monitor Your Dti And Your Credit For Better Access To Credit

Even if you don’t anticipate needing to apply for credit anytime soon, it’s a good idea to keep an eye on your DTI and your credit score to make sure you’re ready when you need it. To monitor your DTI, keep a running list of your debt payments and calculate your DTI whenever you pay off a loan or credit card or take on new credit.

For your credit score, you can use Experian’s free credit monitoring service, which provides access to your Experian credit report and FICO® Score. You’ll also get real-time alerts whenever changes are made to your credit report, so you can track your progress and spot potential issues before they wreak havoc on your credit health.

Also Check: Can You Declare Bankruptcy And Keep Your Home

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johnâs income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

How To Lower Your Dti Ratio

There are several strategies to lower your DTI. The goal is not only to reduce overall debt but also how much youll pay on a monthly basis.

You May Like: Amazon Pallets For Sale Denver

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Reduce Your Monthly Debts

The fastest way to lower your DTI is to pay down your existing loan and credit card balances.

One strategy is to pay off your smallest loans first, which will free up cash to put toward larger debts like car payments and student loans.

Another option for reducing your credit balances is to refinance your high interest and high balance loans. Rather than let a high interest rate inflate what you owe, try shopping around for a lower rate.

Don’t Miss: Can File Bankruptcy On Student Loans

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Should You Worry About Your Dti

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you’re treading on the slippery slope to fiscal collapse. It says you’re making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it’s easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that’s still a goal worth setting. Use the following tips to put your best foot forward for lenders.

Recommended Reading: How Long After Bankruptcy For Fha Loan

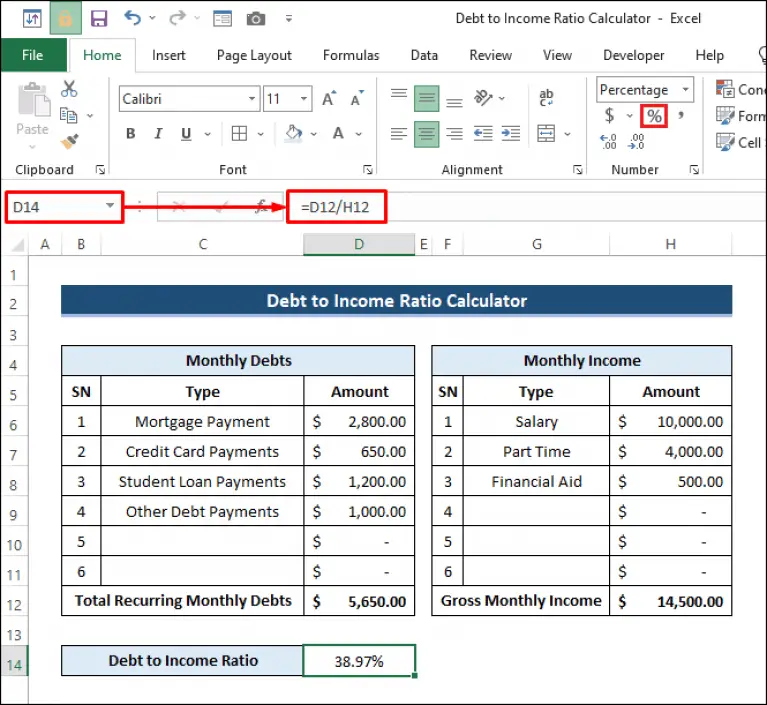

How To Calculate Debt

The debt-to-income formula is simple: Total monthly debt payments divided by total monthly gross income . Then, multiply that number by 100. That final number represents the percentage of your monthly income used towards paying your debts.

Say you make $3,000 a month before taxes and household expenses. Your monthly debts include $1,200 for rent, $200 in student loan payments, and $100 in car payments, for a total of $1,500. Divide your total monthly debt payments by the total monthly income, $3,000, and the result is 0.5 or 50%. This means that 50% of your monthly income goes towards paying back your debts.

How To Lower Your Debt

To improve yourDTI ratio, the best thing you can do is either pay down existing debt or increase your income.

While paying down debt, avoid taking on any additional debt or applying for new credit cards. If planning to make a large purchase, consider waiting until after you’ve bought a home. Try putting as much as you can intosaving for a down payment. A larger down payment means you’ll need to borrow less on a mortgage. Use aDTI calculator to monitor your progress each month, and consider speaking with a lender toget pre-qualifiedfor a mortgage.

Don’t Miss: Will Credit Score Increase After Bankruptcy Falls Off

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

How To Calculate Your Debt To Income Ratio

To calculate the share of your income consumed by debt repayment, fill in the numbers in our easy-to-use debt-to-income ratio calculator.

Step 1: Total your gross monthly income

Include all income sources, including employment income, pension, support payments, and government assistance. If you are self-employed, include your gross business income net of operating expenses but before taxes and personal benefits.

My paycheque

Bank or other loan paymentsInstallment loans, rent-to-ownOther debt paymentsTOTAL MONTHLY DEBT PAYMENTS

We include both rent and mortgage payments in this calculation. Why? Because a mortgage is a critical component of many peoples debt problems, and to make the ratio comparable, those without a mortgage should substitute their monthly rent payment.

You may also want to add in monthly spousal support payments if these obligations take up a significant portion of your income.

Step 3: Now run this formula or click calculate

DTI = TOTAL MONTHLY DEBT PAYMENTS divided by TOTAL MONTHLY INCOME

For example, if your total monthly income was $2,800 and your debt payments totaled $1,200 then your debt-to-income ratio is:

$1,200 / $2,800 = 42%

Also Check: Cheap Pallets For Sale

What Your Debt To Income Ratio Means

Your final result will fall into one of these categories.

- 36% or less is the healthiest debt load for the majority of people. If your debt-to-income ratio falls within this range, avoid incurring more debt to maintain a good ratio. You may have trouble getting approved for a mortgage with a ratio above this amount.

- 37% to 42% isnt a bad ratio to have, but it could be better. If your ratio falls in this range, you should start reducing your debts.

- 43% to 49% is a ratio that indicates likely financial trouble. You should start aggressively paying your debts to prevent an overloaded debt situation.

- 50% or more is an extremely dangerous ratio. This means that more than half of your income goes toward debt payments each month. You should be aggressively paying off your debts. Dont hesitate to seek professional help.

Is Car Insurance Included In Debt

Lenders consider as debt any mortgages you have or are applying for, rent payments, car loans, student loans, any other loans you may have and credit card debt. For the purposes of calculating your debt-to-income ratio, insurance premiums for life insurance, health insurance and car insurance are not included.

Read Also: When To Buy A Car After Bankruptcy

Don’t Miss: Are Bankruptcy Courts Affected By Government Shutdown

Dti Formula And Calculation

The debt-to-income ratio is a personal finance measure that compares an individualâs monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individualâs ability to manage monthly payments and repay debts.

Add Up Your Monthly Debt Payments

Once youve determined your monthly gross income, you can focus on your monthly debt payments. This is the money thats taken out of your paycheck each month. Expenses like groceries and utilities generally are not included. Once youve figured out all of your monthly debts, take the sum of each value.

Example: You owe $1,000 in rent, $300 in student loans and $100 for a credit card payment. You would then add 1,000, 300 and 100. This would result in monthly debt payments of $1,400.

$1,000 + $300 + $100 = $1,400

Read Also: What Happens When House Foreclosed

Recommended Reading: Can You File Bankruptcy Just For Credit Cards

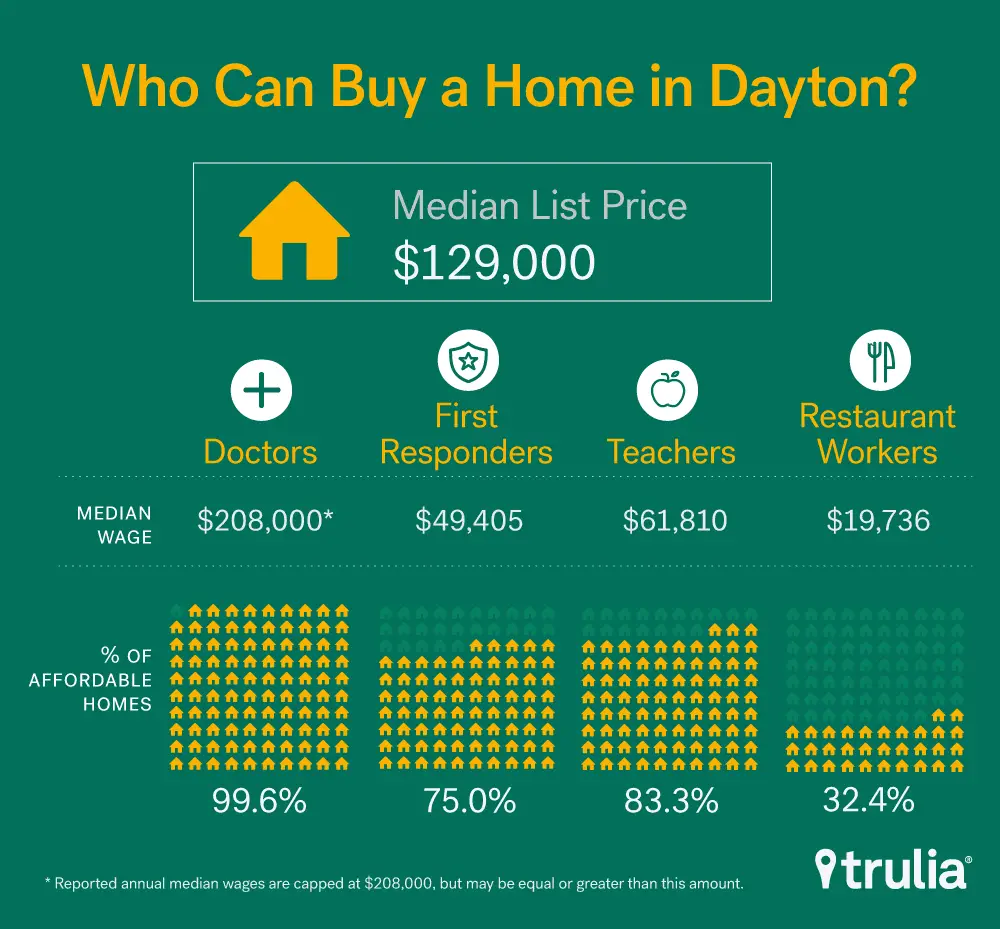

Mortgage Approval: Whats Behind The Numbers In Our Dti Calculator

Your debt-to-income ratio matters when buying a house. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. DTI is calculated by dividing your monthly debt obligations by your pretax, or gross, income.

In most cases, lenders want total debts to account for 36% of your monthly income or less. Nonconventional mortgages, like FHA loans, may accept higher a DTI ratio, but conventional mortgages may not be as flexible.

Lenders consider low DTI as important as having a stable job and a good credit score. When evaluating your mortgage application, DTI tells lenders how much of your income is already spoken for by other debts. If the percentage is too large, its a clue you may have trouble paying your monthly mortgage payments, and lenders will be reluctant to approve your loan.

Hate surprises? Estimating your DTI with the NerdWallet calculator before submitting your mortgage application can help you understand how much house you can afford.

How To Improve Your Debt

The goal is usually 43% or less, and lenders often recommend taking remedial steps if your ratio exceeds 35%. There are two options to improving your debt-to-income ratio:

Neither one is easy for many people, but there are strategies to consider that might work for you.

Don’t Miss: Can You Cancel A Chapter 13 Bankruptcy