How Chapter 7 Works

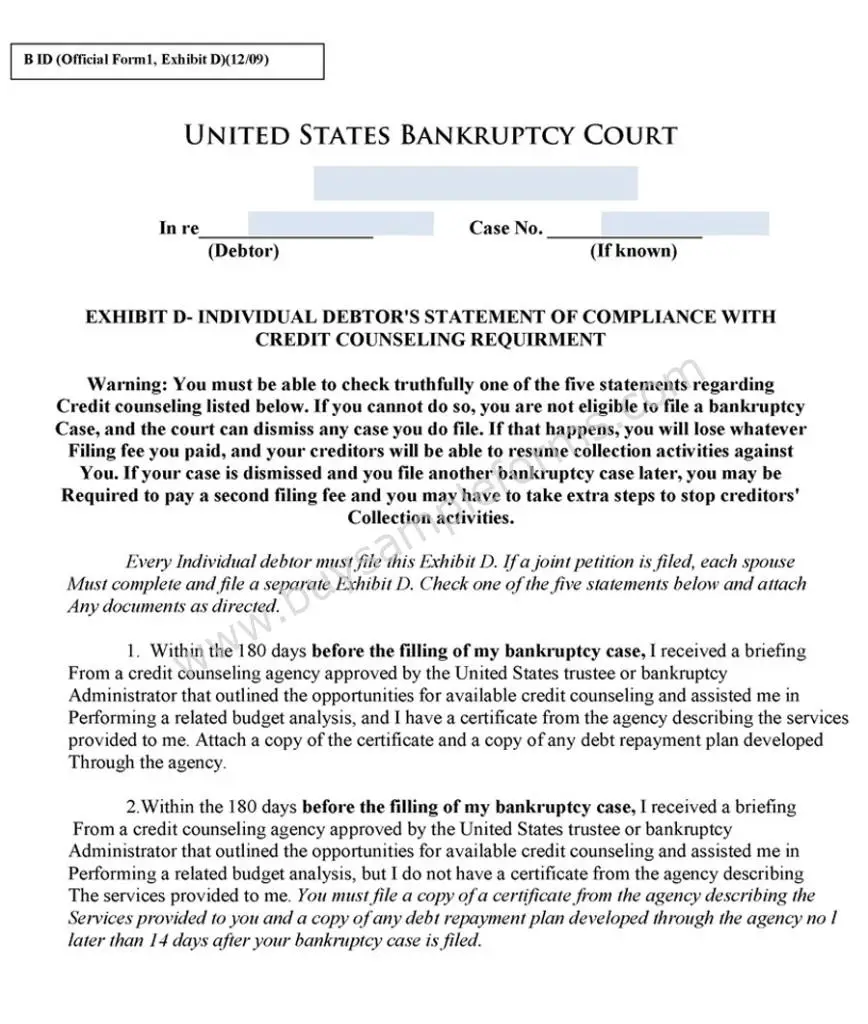

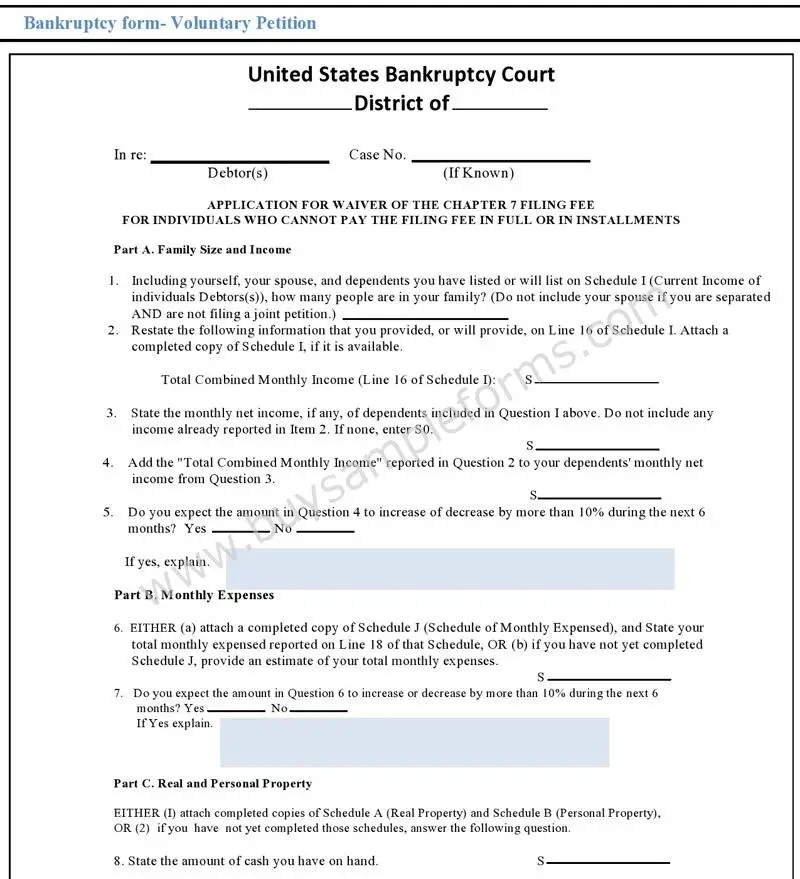

A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets. In addition to the petition, the debtor must also file with the court: schedules of assets and liabilities a schedule of current income and expenditures a statement of financial affairs and a schedule of executory contracts and unexpired leases. Fed. R. Bankr. P. 1007. Debtors must also provide the assigned case trustee with a copy of the tax return or transcripts for the most recent tax year as well as tax returns filed during the case . 11 U.S.C. § 521. Individual debtors with primarily consumer debts have additional document filing requirements. They must file: a certificate of credit counseling and a copy of any debt repayment plan developed through credit counseling evidence of payment from employers, if any, received 60 days before filing a statement of monthly net income and any anticipated increase in income or expenses after filing and a record of any interest the debtor has in federal or state qualified education or tuition accounts. Id. A husband and wife may file a joint petition or individual petitions. 11 U.S.C. § 302. Even if filing jointly, a husband and wife are subject to all the document filing requirements of individual debtors.

Kansas City Attorney Explains When To File These Claims Yourself

When you file Chapter 13 bankruptcy, you must provide a list of your creditors and debts. You can use the Chapter 13 repayment plan to get current with your secured debts , and your unsecured debts will be discharged at the end of the bankruptcy process. However, each of your creditors must file a proof of claim within a certain time to prove how much you owe. If a creditor fails to do so, then the bankruptcy trustee will not make any payments to that creditor. In some cases, lack of a proof of claim may benefit you. On the other hand, if you owe secured and/or nondischargeable debts, it may be in your best interest to file a proof of claim on your creditors behalf.

Chapter 13 bankruptcy allows you to stop paying many overwhelming debts and manage the rest of what you owe. However, if your creditors do not file proofs of claim, you could still owe certain debts and be behind on payments at the end of the bankruptcy process. A Chapter 13 bankruptcy attorney can help make sure this does not happen. We can explain when you should file a proof of claim on behalf of creditors and answer other questions you may have throughout your case.

How To Fill Out A Bankruptcy Proof Of Claim Form

To preserve your legal rights to payment, it is important that you submit to the Bankruptcy Court a completed proof of claim form that memorializes how much the Debtor owes you, and why. This is not a legal pleading that must be completed by an attorney . Your proof of claim will be kept by the Clerk of the Bankruptcy Court , but will not appear on the docket of the bankruptcy case. Make sure to submit your proof of claim form as soon as possible, and in any event well in advance of any deadline to submit proofs of claim, known as the Claims Bar Date.

Recommended Reading: Can You Get A Credit Card After Bankruptcy

Information For Filing Your Proof Of Claim Form Electronically

A CM/ECF login is not required to docket claims electronically. All claims in any case where there is no Claims Agent assigned are accepted through the Court’s website.

Using the ePOC system, a Proof of Claim may now be filed and amended electronically. ePOC will generate the official Bankruptcy Proof of Claim form based upon the information entered.

Please have access to the following information before you begin:

- Address where notices from the Court and payments from the Trustee should be sent

- Documentation supporting your rights to the claim amount in PDF format with personal identifiers properly redacted

Penalty for filing fraudulent claim: Fine of up to $500,000 or imprisonment for up to 5 years, or both. 11 U.S.C. §§ 152 and 3571.

The Chapter 7 Discharge

A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor. Because a chapter 7 discharge is subject to many exceptions, debtors should consult competent legal counsel before filing to discuss the scope of the discharge. Generally, excluding cases that are dismissed or converted, individual debtors receive a discharge in more than 99 percent of chapter 7 cases. In most cases, unless a party in interest files a complaint objecting to the discharge or a motion to extend the time to object, the bankruptcy court will issue a discharge order relatively early in the case generally, 60 to 90 days after the date first set for the meeting of creditors. Fed. R. Bankr. P. 4004.

The grounds for denying an individual debtor a discharge in a chapter 7 case are narrow and are construed against the moving party. Among other reasons, the court may deny the debtor a discharge if it finds that the debtor: failed to keep or produce adequate books or financial records failed to explain satisfactorily any loss of assets committed a bankruptcy crime such as perjury failed to obey a lawful order of the bankruptcy court fraudulently transferred, concealed, or destroyed property that would have become property of the estate or failed to complete an approved instructional course concerning financial management. 11 U.S.C. § 727 Fed. R. Bankr. P. 4005.

Also Check: How In Debt Is America

Keep Your Assets / Rebuild Credit

You may be able to keep your car, house and other personal belongings when filing for Chapter 7 or Chapter 13 personal bankruptcy. When you work with our bankruptcy law firm, our personal bankruptcy attorneys will help you retain your assets and show you what steps to take following your bankruptcy so that you can quickly get back on your feet. You may also begin to rebuild your credit immediately after.

Formal Proof Of Claim

A proof of claim must conform substantially with the official bankruptcy form, Proof of Claim . You can download official bankruptcy forms from the U.S. Courts Bankruptcy Forms page, including Form 410. The information a creditor will need to include is as follows:

- the debtor’s name and the bankruptcy case number

- the creditor’s information, including a mailing address

- the amount owed as of the petition date

- the basis for the claim , and

- the type of claim .

The creditor should attach supporting documentation, such as the contract, as evidence of the claim. Official attachment forms are available. Also, the creditor or an authorized representative must sign the proof of claim.

Read Also: Will Filing Bankruptcy Stop My Student Loans

Role Of The Case Trustee

When a chapter 7 petition is filed, the U.S. trustee appoints an impartial case trustee to administer the case and liquidate the debtor’s nonexempt assets. 11 U.S.C. §§ 701, 704. If all the debtor’s assets are exempt or subject to valid liens, the trustee will normally file a “no asset” report with the court, and there will be no distribution to unsecured creditors. Most chapter 7 cases involving individual debtors are no asset cases. But if the case appears to be an “asset” case at the outset, unsecured creditors must file their claims with the court within 90 days after the first date set for the meeting of creditors. Fed. R. Bankr. P. 3002. A governmental unit, however, has 180 days from the date the case is filed to file a claim. 11 U.S.C. § 502. In the typical no asset chapter 7 case, there is no need for creditors to file proofs of claim because there will be no distribution. If the trustee later recovers assets for distribution to unsecured creditors, the Bankruptcy Court will provide notice to creditors and will allow additional time to file proofs of claim. Although a secured creditor does not need to file a proof of claim in a chapter 7 case to preserve its security interest or lien, there may be other reasons to file a claim. A creditor in a chapter 7 case who has a lien on the debtor’s property should consult an attorney for advice.

What Is An Example Of A Poc

Proof of concept is evidence obtained from a pilot project, which is executed to demonstrate that a product idea, business plan, or project plan is feasible. For example, in drug development, clinical trials are used to gather proof of concept for a final product. But that’s not all a proof of concept does.

You May Like: How Long Bankruptcies On Credit Report

Sign And Send Your Proof Of Claim Form And Supporting Documents

You likely received a notice of bankruptcy that will tell you where to submit a proof of claim form. If you did not, you should contact the Debtor, the bankruptcy court, and/or the claims agent to find out where to send your proof of claim. Make sure to keep a copy of your proof of claim form and all supporting information and proof of delivery of your proof of claim form.

Proof Of Claim Requirements For Chapter 11 Bankruptcy

Chapter 11 is solely for companies that plan to reorganize and continue business at the conclusion of the bankruptcy.

Chapter 11 creditors are not required to file a Proof of Claim because the debtor is required to file a Schedule of Assets and Liabilities. If the customers Schedule of Liabilities lists the creditors claim in the correct amount and does not designate the claim as disputed, unliquidated or contingent, the creditor will be able to participate in any distributions for its category .

If the creditors claim is listed incorrectly , or designated as disputed, unliquidated or contingent, a Proof of Claim should be filed. If it is not filed, the Bankruptcy Court will consider the customers Schedule of Liabilities as accurate and make any distributions accordingly.

Read Also: How Do You Rebuild Credit After Bankruptcy

What Information Do I Need To Fill Out A Proof Of Claim Form

The following is a list of the important details a creditor will need to have ready in order to complete a Proof of Claim form in a bankruptcy case.

- Debtorâs Information: Debtorâs Name and the relevant Bankruptcy Case Number

- Classification Section of the claim: select either Secured, General Unsecured, or Priority Unsecured

- Amount owed as of the Petition Date

- Basis of the claim

- Attach documentation that shows an itemization of charges to demonstrate the claim amount owed

- Signature of the Creditor or an Authorized Representative

Give Information About The Claim As Of The Date The Case Was Filed

In part 2 of the proof of claim form, describe your claim in a way that will allow the Bankruptcy Judge to understand what you are owed and why.

- Question 7: If possible, identify the precise dollar amount of your claim. Include interest, penalties, and fees.

- If you do not know the precise amount the Debtor owes you, then describe your claim and why you cannot determine the exact amount. This will be the case if you have a lawsuit against the Debtor or have guaranteed an obligation of the Debtors that has not matured. If necessary or helpful, attach additional information that describes a pending lawsuit, legal claims, indemnity claims, guaranty claims, or any other legal theory under which the debtor owes you money.

- Be accurate, and do not exclude any legal theory that gives rise to your right to payment from the Debtor. If you do not include it in your proof of claim, you may or may not be able to amend your claim at a later date.

Don’t Miss: Why Did Pg& e File For Bankruptcy

Proof Of Claim Requirements For Chapter 7 And 13 Bankruptcies

Chapter 7 is typically a liquidation of assets and the resultant closing of the company.

Chapter 13 is a form of debt reorganization generally available only to individuals. However, if the individual is self-employed or operating an unincorporated business and has business-related debts for which they are personally liable, Chapter 13 can be filed subject to secured and unsecured dollar limits.

If creditors wish to participate in any possible distribution of assets, they are required, by both Chapter 7 and 13, to file Proof of Claim forms within 90 days after the first scheduled creditors meeting.

Top Mistakes To Avoid When Filing A Proof Of Claim

As mentioned above, it is recommended to hire an experienced bankruptcy attorney to best represent your bankruptcy claim and help you file a Proof of Claim accurately, to completion, and in a timely manner. This is especially true for complex claims and when a Creditor is seeking substantial restitution in monetary value. The utmost care and attention to detail should be taken when filling out a Proof of Claim form and submitting it within the bankruptcy claims timeframe. In fact, fraudulent claims are subject to a fine of up to $500,000, imprisonment for up to 5 years, or both.

The most common mistake made is incorrectly confusing the Debtor and creditor fields on the form. The Debtor is the corporation or entity that has filed for Chapter 11 bankruptcy, while the creditor is the person or business entity that is entitled to a payment or equitable remedy arising from events that occurred before the Petition date.

It is also critical that the individual completing the Proof of Claim signs and dates the Official Form B410. An original signature is mandatory for Proofs of Claim that are mailed physically. For filing an electronic Proof of Claim, courts are authorized to consider electronic signatures as valid. A creditorâs signature declares under penalty of perjury that the details provided on the Proof of Claim form are true, and accurate to the best of their knowledge and belief.

Also Check: How To Find Bankruptcy Discharge Papers

How To File A Form 410 Proof Of Claim

Typically, a creditor will receive a blank bankruptcy chapter 11 proof of claim form after the debtor files bankruptcy, along with the notice of bankruptcy. The notice will provide information on how to file the proof of claim and where you must submit it. It will also include a deadline or bar date representing the last date you can file it. The process of filing the claim can be time-consuming and complex, so we recommend consulting with an experienced bankruptcy lawyer if you receive notice of a bankruptcy petition that affects you.

What Happens If I Miss The Bar Date

In the event that a creditor fails to file the Proof of Claim form by the Bar Date, the creditor will need to convince the Bankruptcy Court that there is a legitimate reason for filing late and missing the bankruptcy claims timeframe. For creditors who have a good standing relationship with the Debtor, it is possible to request that the Debtor file the Proof of Claim on the creditorâs behalf. However, it will be up to the creditor to prove the reasoning with the court. Ignorance of the law or to use the excuse that the Bankruptcy Notice was never received are insufficient reasons that the court will not accept.

The following is a list of the four considerations that a Court will evaluate in determining whether to excuse a late Proof of Claim filing, according to a Supreme Court decision made in 1993.

Under extenuating circumstances, there is the possibility for a creditor to file a late Proof of Claim to be accepted by the court. However, the stringent criteria and subsequent dealings with the court to excuse the failure to meet the Bar Date can make it a burdensome process.

Read Also: National Debt Relief Credit Impact

Objections To A Creditors Claim

Anyone who has a financial stake in the outcome of the proceeding can make an objection to a claim. This is usually the bankruptcy trustee, but sometimes the debtor or another party will object as well. They must make their objection in writing and file it with the bankruptcy court. The objection and a notice of hearing must be served to the creditor, the debtor, and the trustee 30 days before the hearing.

An objection to a proof of claim may be filed by any person with an interest in the case, but this is usually filed by the trustee, another creditor, or the bankruptcy filer.

An objection to a claim might arise if the trustee or the debtor believes that the amount of the debt is excessive, the creditor has classified a claim as secured when it is unsecured, the claim lacks supporting documentation, or the creditor is improperly seeking interest or penalty fees. The objecting party has the initial burden of production, which means that they need to provide evidence to support disallowing the creditors claim. If they meet this burden, the eventual burden of proof lies on the creditor.