What Does My Debt To Credit Ratio Mean

Knowing how to calculate your debt to credit ratio is excellent, but its useless if you dont know what to do with this information.

Using the formula, youll get your debt to credit ratio in the form of a percentage. But what does this percentage mean?

Well, simply enough, this percentage is the portion of your available credit that you use. So, for example, if your debt to credit ratio is 40%, that means you utilize 40% of your credit limit.

Like I mentioned earlier, a good rule of thumb is to aim for a credit utilization rate of 30% or lower. When your ratio is higher than this, it not only lowers your credit score, but it can give lenders the impression that you are an irresponsible or high-risk borrower.

For business owners, this can hurt your chances of being approved for the financing you need to help grow your business.

If your debt to credit ratio is too high, you may need to work on lowering it before you apply for a business loan or choose a lender with more lenient requirements, like Camino Financial.

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay. For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI. Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Any homeowners association fees that are paid monthly

- Auto loan payments

- Student loan minimum payment: $125

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Don’t Miss: How To Declare Bankruptcy With No Money

How To Improve Your Dti

If the calculator shows a DTI over 36%, dont be too discouraged: you may still have options. And knowing where you stand before filling out a mortgage application can save you a lot of time, money and heartache.

Achieve a lower debt-to-income ratio by:

-

Avoiding new debt

-

Increasing your income with a side hustle

-

Reducing expenses and using the extra cash to pay off debts

Debt-to-income ratio is different than , which measures how much credit youre using versus how much is available to you. But reducing credit utilization will typically improve your DTI.

How Is Debt Consolidation Loan For High Debt To Income Ratio

Debt Consolidation Loans for High Debt-to-Income Ratios A debt consolidation loan allows you to scoop up some or all of your current loans and put them into one basket. This way, you only have to remember one loan payment per month, and your new monthly payment may be less than the sum of your current monthly payments.

What happens if you have too much debt to get a mortgage?

When you apply for a mortgage, the lender will make sure you can afford it. Doing so involves evaluating the relationship between your debts and your income formally called your debt-to-income ratio, or DTI. If your DTI is too high, you could have a hard time getting approved for a mortgage.

Also Check: Debt To Income Ratio To Buy House

Why Does Your Debt

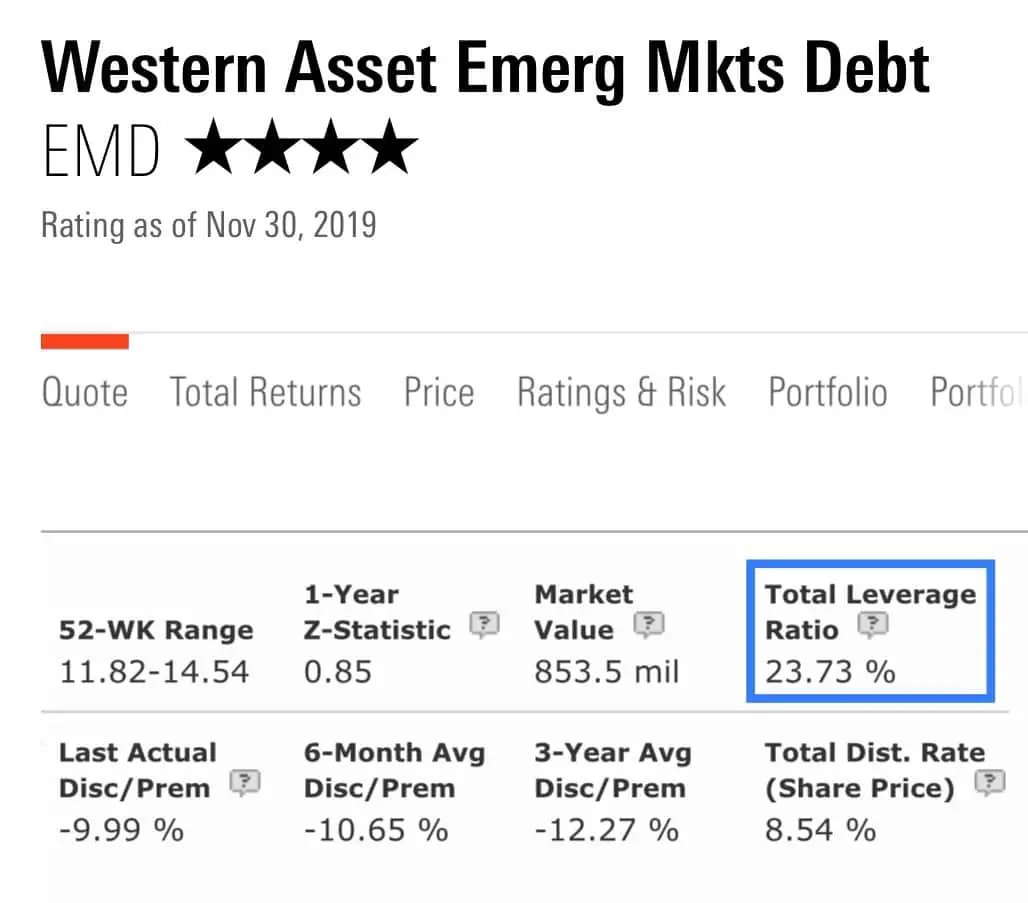

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

Can You Afford That Big Purchase

If you are considering a major acquisition, you should take into account the new purchase as you work out your debt-to-income ratio. You can be sure that any lender considering your application will do so.

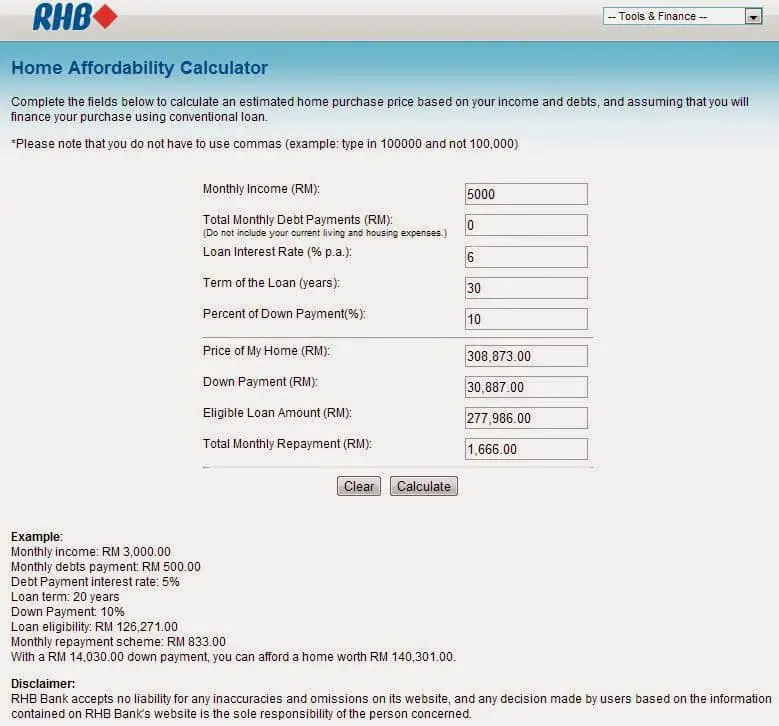

You can use an online calculator, for example, to estimate the amount of the monthly mortgage payment or new car loan that you are considering.

Comparing your “before” and “after” debt-to-income ratio is a good way to help you determine whether you can handle that home purchase or new car right now.

When you pay off debta student loan or a credit cardrecalculating your debt-to-income ratio shows how much you have improved your financial status.

For example, in most cases, lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. To get a qualified mortgage, your maximum debt-to-income ratio should be no higher than 43%. Let’s see how that could translate into a real-life situation.

Also Check: Debt Forgiveness Credit Card

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over two decades of experience in the industry.

How To Calculate Dti Ratio

Calculating your debt-to-income ratio will help you and potential lenders determine your financial standing. To perform this calculation, you need to know your gross income and how many monthly debt payments you’re making. For example, your rent, student loan payments or child support payments would fall into this category. Use these to calculate your DTI ratio with the following steps:

Read Also: Does Bankruptcy Ruin Your Credit Forever

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Lower Your Dti Ratio

If you have a high DTI ratio, you’re probably putting a large chunk of your monthly income toward debt payments. Lowering your DTI ratio can help you shift your focus to building wealth for the future.

Here are a few steps you can take to help lower your DTI ratio:

- Increase the amount you pay each month toward your existing debt. You can do this by paying more than the minimum monthly payments for your credit card accounts, for example. This can help lower your overall debt quickly and effectively.

- Avoid increasing your overall debt. If you feel it’s necessary to apply for additional loans, first aim to reduce the amount of your existing debt.

- Postpone large purchases. Prioritize lowering your DTI ratio before making significant purchases that could lead to additional debt.

- Track your DTI ratio. Monitoring your DTI ratio and seeing the percentage fall as a direct result of your efforts may motivate you to continue reducing your DTI ratio, which can help you better manage your debt in the long run.

Don’t Miss: Does A Married Couple Have To File Bankruptcy Together

What Factors Make Up A Dti Ratio

- Front-end ratio: also called the housing ratio, shows what percentage of your monthly gross income would go toward your housing expenses, including your monthly mortgage payment, property taxes, homeowners insurance and homeowners association dues.

- Back-end ratio: shows what portion of your income is needed to cover all of your monthly debt obligations, plus your mortgage payments and housing expenses. This includes credit card bills, car loans, child support, student loans and any other revolving debt that shows on your credit report.

How Is Your Debt

You can determine your debt-to-credit ratio by dividing the total amount of credit available to you, across all your revolving accounts, by the total amount of debt on those accounts.

For example, say you have two credit cards with a combined credit limit of $10,000. If you owe $4,000 on one card and $1,000 on the other for a combined total of $5,000, your debt-to-credit ratio is 50 percent.

You May Like: How Long Does A Bankruptcy Stay On Your U4

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Add Up Your Monthly Debt Payments

Once you’ve determined your monthly gross income, you can focus on your monthly debt payments. This is the money that’s taken out of your paycheck each month. Expenses like groceries and utilities generally are not included. Once you’ve figured out all of your monthly debts, take the sum of each value.

Example: You owe $1,000 in rent, $300 in student loans and $100 for a credit card payment. You would then add 1,000, 300 and 100. This would result in monthly debt payments of $1,400.

$1,000 + $300 + $100 = $1,400

Read Also: What Happens When House Foreclosed

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

How To Improve Your Debt

Improving your DTI comes down to doing one of two things : Increasing your income or reducing your debt.

On the income side, there are some things you can do try to raise your gross pay. The options include:

- Negotiating a raise at work

- Taking a second job or part-time job

- Starting one or more side hustles

You can also generate income through investments. For example, investing in dividend-paying stocks could help you to create a passive income stream. Real estate can also provide passive income if youre earning dividends from a real estate investment trust . Investing in rental property can also provide monthly income but it can be more hands-on than owning REITs or real estate ETFs in your portfolio.

If youre interested in reducing debt, you could start by making it more affordable. Refinancing a mortgage or student loans or consolidating high-interest credit card debt, for example, could allow you to pay more toward the principal each month and less in interest. That could help you to pay back what you owe at a faster pace.

A positive side effect of reducing your debt is that it may also raise your credit score. That can be a win-win if youre hoping to get approved for a mortgage or another loan and youre angling for the best interest rates.

Also Check: Does Chapter 7 Bankruptcy Stop Garnishment

Personal Loans And Auto Loans

With personal loans and car loans, you might be able to qualify for financing with a DTI ratio higher than the typical 43% cap for a qualified mortgage. But you should pay close attention to your interest rate and monthly payment to make sure its affordable for you.

Wells Fargo, for example, says that if you have a DTI of 35% or less, youre probably in pretty good shape.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Don’t Miss: The Us Debt Clock

What Your Debt To Income Ratio Means

Your final result will fall into one of these categories.

- 36% or less is the healthiest debt load for the majority of people. If your debt-to-income ratio falls within this range, avoid incurring more debt to maintain a good ratio. You may have trouble getting approved for a mortgage with a ratio above this amount.

- 37% to 42% isn’t a bad ratio to have, but it could be better. If your ratio falls in this range, you should start reducing your debts.

- 43% to 49% is a ratio that indicates likely financial trouble. You should start aggressively paying your debts to prevent an overloaded debt situation.

- 50% or more is an extremely dangerous ratio. This means that more than half of your income goes toward debt payments each month. You should be aggressively paying off your debts. Don’t hesitate to seek professional help.

Is Car Insurance Included In Debt

Lenders consider as debt any mortgages you have or are applying for, rent payments, car loans, student loans, any other loans you may have and credit card debt. For the purposes of calculating your debt-to-income ratio, insurance premiums for life insurance, health insurance and car insurance are not included.

Read Also: When To Buy A Car After Bankruptcy

Its Important To Have A Healthy Debt To Credit Ratio

Debt to credit ratio is one of the most critical factors used to determine your credit score. By using the formula provided in this article, you can quickly and easily calculate your credit utilization rate and use this information to adjust your spending practices as needed.

At Camino Financial, we operate on the motto, No Business Left Behind. Thats why we offer small business loans with lenient requirements, competitive rates, and excellent terms. Our loans will help you reach success.

Want to learn more?

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Read Also: Us National Debt Gdp

Example Of A Dti Calculation

Here’s a look at an example of a debt-to-income ratio calculation.

- $1,000 mortgage

- $200 minimum credit card payments

- $400 other monthly debt obligations

She has the following gross monthly income:

- $4,000 salary from her primary job

- $2,000 from her secondary job

Debt-to-income ratio = $2,300 / $6,000 = 0.38

Now multiply by 100 to express it as a percentage:

0.38 X 100 = 38%

Less debt or a higher income would give Mary a lower, and therefore better, debt-to-income ratio. Say she manages to pay off her student and auto loans, but her income stays the same. In that case the calculation would be:

Total recurring monthly debt = $1,600

Gross monthly income = $6,000

Consumer Financial Protection Bureau. “Debt-to-Income Calculator,” Pages 1-3.